After a short Christmas break, we’re back! We wish you all the best for 2024.

Welcome to the new subscribers that have joined us over the Christmas period. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

If you think someone will benefit from reading this newsletter, we’d be really grateful if you could share it with them. Thanks!

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Positive macro dynamic growing stronger in 2024, slow growth, disinflation to trigger global rate cutting cycle and global liquidity to accelerate higher and Fed balance sheer reduction set to end.

Crypto Native News: Bitcoin Miner Marathon Digital releases its 2023 review, Celcius to unstake its Ethereum and digital asset ETP’s see their 3rd highest net inflows dating back to 2017.

Institutional News: Goldmans to be an AP for bitcoin ETF’s, Central Bank of Spain names its CBDC test partners.

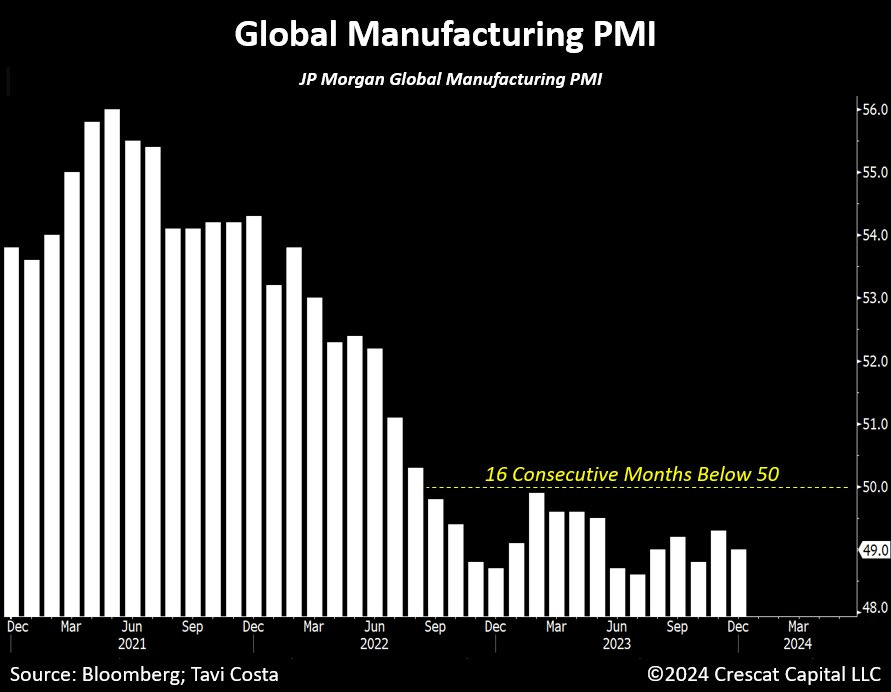

Charts of the Week: CME open interest grows again, Crypto exchange volumes hit $1tn and global manufacturing PMI remains low.

Top Jobs in Crypto: Featuring Paypal, Uphold, Austin Andrew Recruitment, Ripple and BCB Group.

Macro Update

This is where we connect the dots between macro and crypto.

Spring into Summer

Markets began 2024 unwinding some of the euphoric, Fed driven moves into year end. However, there was nothing in the week's data to materially change the macro dynamic which has underpinned our bullish risk view throughout much of 2023, a dynamic which we expect to grow more powerful in 2024.

Namely, in a market which post 2008 is simply a function of rates and liquidity, major central banks are set to embark on a rate cutting cycle this year, whilst liquidity conditions continue to improve and we expect to accelerate.

Perhaps markets got a little ahead of themselves in the sharp, early pricing of rate cuts and March odds of a cut this week fell from what was essentially a full gone conclusion to now 50/50. The key data release came in the form of non farm payrolls, which again on the headline showed a resilient labour market, beating expectations with 216k jobs added, whilst average hourly earnings and the unemployment rate remained steady at 0.4% and 3.7% respectively. However, details under the hood were less impressive, with downward revisions to past data (Oct and Nov revised a combined 71k lower) off-setting the headline beat, whilst private sector hiring is at its lowest levels in over a year.

Further adding doubt to the payroll numbers, the ISM services employment number unexpectedly fell sharply into contraction territory at 43.3. The headline ISM Services PMI a much weaker 50.6, just avoiding falling into contraction territory. With manufacturing still in contraction, services are “catching down” and the US economy continues to slow. Just as “soft landing” appears to be consensus, 2024 may be the recession year many incorrectly called in 2023.

Nonetheless, little to change anything in a now dovish Fed’s thinking. Nothing either to justify what appears to be a bearish bond view emerging once more across many macro commentators. We here at London Crypto Club continue to like the long duration trade and see 10yr yields heading substantially lower as the Fed gets the rate cutting cycle under way amidst a continued disinflationary environment which we expect to see undershoot the 2% target this year. China also continues to emanate a global deflationary pulse. Combined with the lags of monetary policy still to feed through, deflation is an underpriced risk in 2024.

What was interesting this past week, was the FOMC minutes and comments on QT, with participants suggesting it would be appropriate to begin discussing technical factors that would guide a decision on the balance sheet run off, well before a decision was reached. Translated: They’re thinking about thinking about ending QT, which in central bank parlance means it’s likely quite an active conversation! Supporting that view, the Fed’s Logan this weekend suggested the Fed should slow the asset run off (i.e QT) as the Reserve Repo (RRP) dwindles.

Recall, we’ve frequently written that we expect QT to end once the RRP falls to zero. This was sat above $2trn in June last year and is now sat just under 700bn, as money has been teased out in search of higher T-bill yields as the US treasury fund the spiralling deficit by issuing shorter dated bonds. This effectively has been a huge injection of cash liquidity into our markets and one of the reasons high beta risk has performed so well, as it has off-set the negative impact of the Fed’s balance sheet reduction via QT. Logan noted that whilst ample liquidity in the financial system for now, individual banks may start to face constraints. Let’s not forget too, last years “bank bailout” in the form of the BTFP is set to end in March, yet continues to see record take-up. Another temporary measure that likely becomes necessarily permanent.

All of this feeds our long term bullish view on Bitcoin and the wider crypto complex. Debt driven fiat systems depend on low rates and liquidity. There’s consequently a limit to how much the Fed can “normalise” policy and reduce the balance sheet before things start to break. Risks continue to lurk beneath the surface, from regional banking sector fragilities to spiralling government debt and a looming commercial real estate (CRE) crisis as loans need to roll over at higher rates. Meanwhile, as the global reserve currency, the Fed is essentially the Central Banker to the global economy and the global, disinflationary slowdown is something the Fed has to take into consideration. Those who don’t understand the Fed’s dovish pivot in December are looking narrowly through a US economic lens. Yet the Fed’s role is much more broad than that and they need to maintain ample system liquidity.

The Fed’s balance sheet will therefore necessarily expand in perpetuity, interrupted by these brief periods of normalisation. The USD price of Bitcoin will consequently rise in perpetuity. Whilst we’re not yet in balance sheet expansion mode, 2024 will mark the year certainly that balance sheet contraction stops. Expansion may well come as the RRP falls to zero and at the risk of a funding crisis, the Fed are forced to do some form of “not QE-QE.”

In the meantime, broader measures of liquidity are set to rise. The PBOC continues to inject record amounts of liquidity as they seek to arrest a deflationary slowdown and housing market crisis. The lagged impacts of Western Bank policy are also set to hit full on in 2024. The ECB already look way behind the curve and will be forced into extraordinary policy to atone for another policy over-shoot.

We were bullish into 2023 on a “peak rates” narrative as the Fed slowed the pace of hikes, towards an eventual pause, followed by cuts. Liquidity also bottomed in October 2022. However, despite our bullish view on long duration proxies, Bitcoin, Nasdaq and 10yr US bonds, US data resilience kept the Fed engaged for longer than expected. Even though 10yr yields finished the year flat, we were clearly wrong on the path given the levels they first reached before correcting.

Into 2024 however, with the lags of previous tightening set to more fully impact, broad rates are set to head lower and provide a more supportive tailwind to the improved liquidity backdrop. Combined with the halvening and likely powerful demand flow dynamic post spot ETF approval, last years crypto spring is set to move straight into summer. The Nasdaq reclaimed record highs late 2023 which we correctly called for. The backdrop looks set to see Bitcoin follow suit and accelerate through. 2024 looks set to be a transformative year 🚀

Native News

Key news from the crypto native space this week.

The largest publicly traded Bitcoin miner Marathon Digital published a review of 2023. The report highlighted that Marathon had record BTC production in December, mining 1,853 BTC and 12,852 for 2023 as a whole. They say the increase in production comes from higher transaction fees on the Bitcoin network. Their BTC holdings as of end December is 15,174 bitcoins. The report also highlights and increased average operational hash rate of 18% M/M to 22.4 EH/s. Marathon CEO says that they are targeting 30% growth in energised hash rate in 2024 with the acquisition of 2 new mining sites. Read the full report HERE.

Bankrupt crypto lender Celsius said it will unstake its holdings of Ethereum. In a statement, Celsius said "Celsius will unstake existing ETH holdings, which have provided valuable staking rewards income to the estate, to offset certain costs incurred throughout the restructuring process," the firm said in an X post. "The significant unstaking activity in the next few days will unlock ETH to ensure timely distributions to creditors." Data from analysis tool Arkham show crypto wallets linked to Celsius have staked over $151 million worth of ether, a position on which it likely earns over 4%-5% in annualised yields. Data shows Celsius sent over 30,000 ETH to custodian Fireblocks in the past week, some of which was deposited at crypto exchange Coinbase, where it may have been likely exchanged for stablecoins.

According top Coinshares crypto report, investors poured over $2 billion into digital-asset investment exchange-traded products (ETPs) in 2023, making it the third-largest year for net inflows dating back to 2017. At $2.2 billion, the inflows were more than double those of 2022 and most of the money came in the final quarter of 2023. The final week of the year alone saw $243m of net inflows into digital asset ETP’s. Read the full report from Coinshares HERE.

Institutional Corner

Top stories from the big institutions

Goldman Sachs is reportedly in talks to become an Authorised Participant (AP) for proposed Bitcoin spot ETFs by BlackRock and Grayscale. The AP role involves creating and redeeming ETF shares to ensure the product trades in sync with its underlying assets. Last week, JPMorgan, Jane Street, and Cantor Fitzgerald announced they would act as APs for several firms seeking SEC approval to offer Bitcoin ETFs in the United States. Some suggest that each Bitcoin ETF to eventually have 5 to 10 APs.

The Central Bank of Spain (Banco de Espana) has published the names of the 3 partners that will take part in their central bank digital currency (CBDC) tests. Cecabank, Abanca and Adhara Blockchain were the 3 firms named to take part in the pilot tests in the next 6 months. The tests will feature the simulation of the processing and settlement of interbank payments with a single tokenised wholesale CBDC and by exchanging several wholesale CBDCs issued by different central banks. In another part of the experiment conducted with the help of the Cecabank-Abanca consortium, the wholesale CBDC will be used to settle a simulated tokenised bond.

Charts of the Week

Because charts are just as important as macro.

CME Bitcoin Open Interest Dominance hit 32% this week, a new high. Binance fell to 25%, the lowest dominance since Jan 2022. Hat tip Glassnode for the chart.

Cryptocurrency monthly exchange volumes hit the $1tn mark in December, the last time it reached that level was September 2022. Hat tip to The Block for the chart.

Global Manufacturing PMI is now below 50 for 16 consecutive months. Hat tip to Tavi Costa for the chart

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Copywriter, Crypto Marketing at Uphold

Head of Operations at a Crypto Fund via Austin Andrew Recruitment

Software Engineer Intern, Crypto Compliance and Finance at Ripple

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.