Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Cantor Fitzgerald and partners create a multibillion-dollar bitcoin acquisition vehicle, World Liberty Financial signs a Letter of Intent with the Pakistan Crypto Council, six entities are responsible for 88% of all tokenised US Treasuries.

Institutional Corner: The Fed withdraws its guidance on crypto and stablecoin activities, new SEC Chair Paul Atkins pledges to bring clarity to cryptocurrency regulation, CME to launch XRP futures, the Swiss National Bank rejects holding bitcoin reserves.

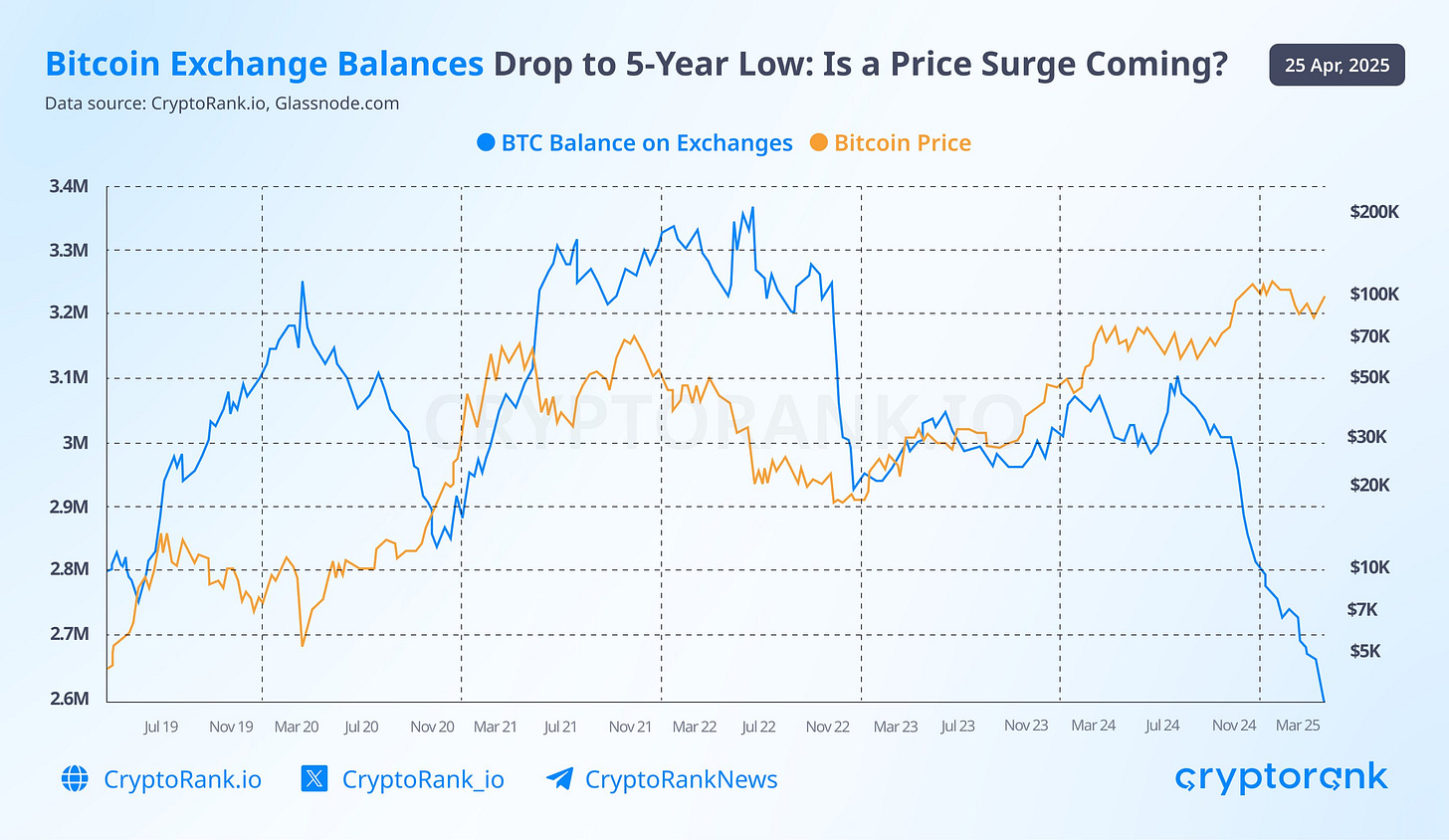

Charts of the Week: Bitcoin balance on exchanges has dropped to its lowest level since 2019, Tokenised treasury funds market cap over time graph.

Top Jobs in Crypto: Featuring UK Ministry of Defence, Crypto.com, Gemini, DRW, KuCoin and DV Trading.

Macro Update

This is where we connect the dots between macro and crypto.

US Exceptionalism is Dead, Long Live US Exceptionalism

U.S. equities saw broad gains over the past week, buoyed by encouraging signs of easing trade tensions between the U.S. and China, along with prospects for improved relations with other trading partners.

Positive sentiment was further supported by President Trump softening his stance on Federal Reserve Chair Jerome Powell. The Trump put, certainly as it relates to the bond market, remains alive and kicking.

Whilst China/US headlines remain uncertain, the thawing and underlying move towards discussions is a positive development which we think can further accelerate the unwind of the “Liberation day” sell off. We remain steadfast in our view that equities will end the year substantially higher, driven by the positive liquidity and stimulus pulse alongside the ever fading headwinds of a Trump administration that front-loaded the bad news in terms of tariff threats and tensions.

Indeed, it will make uncomfortable reading for the perma-macro bears to see the Nasdaq trading in positive territory in the month of April. With equity positioning having hit record lows and a market pricing extreme, covid levels of risk and uncertainty, there’s a lot more risk premium to unwind over the coming weeks and months.

US Exceptionalism…

We’ve also been sceptical of the recent narratives applied to the unusual combination of equities, bonds and the dollar all selling off in tandem, reflecting a mass exodus and flight away from US assets and the end of “American exceptionalism.”

Mostly, we attribute the dynamic to a global de-risking sparked by trade uncertainty and as the US runs a net negative foreign investment position (foreigners own more US assets than US own foreign assets) initially we see the dollar selling off alongside equities and treasuries. Eventually, given the large amount of US dollar denominated debt issued outside of the US (some estimates put this at around $17trn) falling asset values which are the collateral underpinning this debt sees a scramble for dollars to repay the debt and make margin calls. The dollar remains the cleanest shirt in the fiat laundry.

In the short term, the trade wars and the resulting negative impact to global growth is also set to hurt everyone else more than the US. Typically, when markets start to price a global recession, currency weakness in the rest of the world Vs the USD provides a counter-cyclical stabilisation for those economies. This time, the US is getting the growth stabilisation through a weaker dollar which will drive growth outperformance over the coming months and US exceptionalism and the associated equity outperformance will re-assert itself.

Of course, this dollar weakness we are seeing will reflexively ease financial conditions broadly for a dollar based system of finance and trade. It’s also allowing everyone else to pursue looser monetary and fiscal policy in attempts to weaken and offset domestic currency strength and this will continue to drive an explosion in global M2, which is exactly what we’re starting to see.

In case you need reminding of what the explosion in M2 means for Bitcoin, see below the chart from the team at Real Vision👇

Slow down…

US economic data is taking a back seat to the tariff uncertainty but continues to paint a mixed picture of current conditions. While the manufacturing sector showed a slight uptick in activity, the services sector experienced a sharp slowdown, dragging overall business activity to a 16-month low, as per S&P Global's PMI data. Inflationary pressures increased due to tariffs, and optimism among businesses waned, though manufacturers held onto some hope for supportive government policies.

Durable goods orders jumped, largely driven by a spike in commercial aircraft purchases, but excluding transportation, overall business investment appeared flat. Consumer sentiment also declined for a fourth straight month, with fears of inflation and trade policy uncertainty dragging expectations to lows not seen since the early '90s.

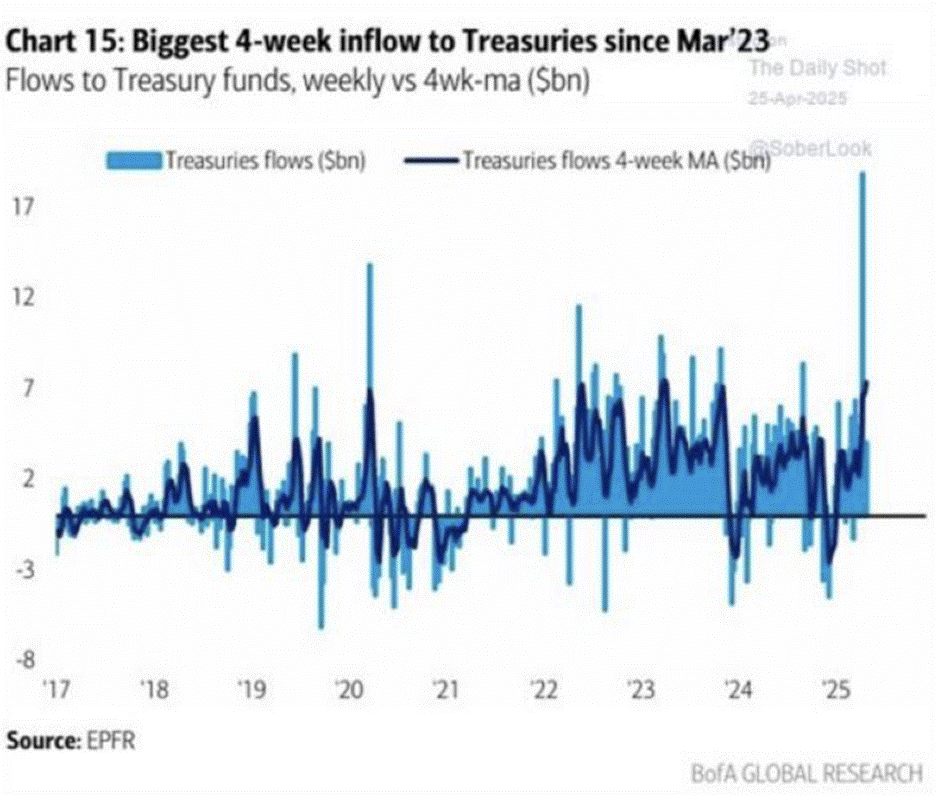

Given the disinflationary trend we’ve witnessed over recent weeks, if tariffs settle substantially below the levels initially announced, it’s very likely we see the negative growth impacts, which are reinforced short term by the uncertainty, outweigh inflationary impacts of the tariffs themselves and the Fed will get the cover to cut rates more aggressively than priced and pull yields across the curve substantially lower. Indeed, for all the talk of investors dumping treasuries, this week saw the biggest 4 week inflows to Treasuries since March ‘23 according to Bank of America 👇

Whilst macro bears will point to a coming slow down as reason to maintain a negative view on stocks, and recession fears provide for short term volatility, we remain a function of rates and liquidity. We think therefore the weaker dollar alongside the potential for an easier Fed in addition to rising global liquidity and stimulus, with the likes of the EU and China both stepping up the fiscal injections, is setting this market up for a face ripping rally over the coming weeks and months.

From left tail to right tail…

Flows are returning to treasuries, but they’re also returning to crypto, with Bitcoin ETF’s receiving the largest weekly inflows since mid December with just over $3bn of inflows this week.

Bitcoin has received a huge boost to its credibility, proving its safe haven credentials as a borderless, non sovereign asset in the face of US credibility being questioned. Its relative outperformance over recent weeks will no doubt provide confidence to treasury managers and investors about the downside risks and volatility of Bitcoin in broadly risk off environments.

As we have said, Bitcoin captures both the far left and far right of the risk distribution. Acting as the ultimate hedge against the failure of existing economic and political structures (the far left tail) but also as the ultimate, high beta, risk on-asset (the right tail.)

With risk premia starting to leak out of the market, risk positioning low and global M2 and liquidity rising, Bitcoin is starting to move back towards the right tail…and that’s where all the fun really begins again.

Native News

Key news from the crypto native space this week.

As reported in the Financial Times this week, Brandon Lutnick, son of U.S. Commerce Secretary Howard Lutnick and chair of brokerage Cantor Fitzgerald, is partnering with SoftBank, Tether and Bitfinex to create a multibillion-dollar bitcoin acquisition vehicle. The vehicle, Cantor Equity Partners, will use the cash to create a new firm, called 21 Capital. It will receive $3 billion in bitcoin from the other cryptocurrency investors and trading firms. Tether would contribute $1.5 billion of bitcoin, while SoftBank and Bitfinex would contribute $900 million and $600 million, respectively.

World Liberty Financial (WLF), the decentralised finance (DeFi) platform backed by U.S. President Donald Trump, has signed a Letter of Intent (LOI) with the Pakistan Crypto Council (PCC) to accelerate blockchain innovation, stablecoin adoption, and decentralized finance (DeFi) integration across Pakistan. The WLF delegation, which included Zachary Folkman, Zachary Witkoff (the son of Steve Witkoff, the United States Special Envoy to the Middle East), and Chase Herro, met with Pakistan’s leadership. This group included the Prime Minister, Chief of Army Staff, Deputy Prime Minister, Minister of Information, and Minister of Défense. The purpose of the meeting was to formalise cooperation, marking a significant step toward establishing Pakistan as a global leader in the digital finance revolution. The Scope of Cooperation between Pakistan Crypto Council and World Liberty Financial outlines collaboration in key areas including, Launching regulatory sandboxes for blockchain financial product testing, facilitating the responsible growth of DeFi protocols, exploring tokenisation of real-world assets like real estate and commodities, expanding stablecoin applications for remittances and trade, and providing strategic advisory on blockchain infrastructure and global regulatory trends

New data from RWA.xyz, a platform tracking tokenised real-world assets, shows that six entities are responsible for 88% of all tokenised US Treasuries. The largest issuer of tokenised treasures continues to be BlackRock. The company's tokenised US treasury fund, called BUIDL, has a market capitalisation of $2.5 billion, 360% higher than its nearest competitor. BlackRock disclosed a total of $11.6 trillion in assets under management in the first quarter of 2025. Completing the top six are Franklin Templeton’s BENJI, with a market capitalisation of $707 million, Superstate’s USTB at $661 million, Ondo’s USDY at $586 million, Circle’s USYC at $487 million, and Ondo’s OUSG fund holding assets worth $424 million. Together, those six funds account for 88% of all tokenised treasuries issued.

Institutional Corner

Top stories from the big institutions

The Board of Governors of The U.S. Federal Reserve announced on Thursday that it is withdrawing its guidance on crypto and stablecoin activities that previously discouraged banks from participating. This includes rescinding its 2022 supervisory letter that required banks to provide notification of crypto-related activities ahead of time, along with supervisory requirements for stablecoin activities issued in 2023. The statement said "As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process." The Federal Reserve has also joined the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency to reverse two previous statements regarding banks' exposure to crypto. The statement specifically expressed concern about potential risks of fraud and scams among crypto asset participants. Read the full statement HERE.

At the SEC’s latest crypto roundtable discussion on Friday, new SEC Chair Paul Atkins pledged to bring clarity to cryptocurrency regulation. He criticised past efforts and promising a “fit-for-purpose” framework for digital assets. “I expect huge benefits from this market innovation in terms of efficiency, cost reduction, transparency, and risk mitigation,” Atkins said. “Innovation, unfortunately, has been stifled for the last several years due to market and regulatory uncertainty that the SEC has fostered.” Commissioner Hester Peirce who now leads the SECs internal crypto task force also spoke in at the roundtable, using a vivid metaphor to describe the agency’s previous approach to crypto custody rules. She likened navigating SEC regulations to playing “the floor is lava” — but in the dark, without clear guidance. “If investment advisers do not know which crypto assets are securities, or what entities are qualified custodians, they may not be able to serve their clients’ best interests,” Peirce said. “We need to turn on the lights and build some walkways over the lava pit.”

CME Group has announced plans to launch XRP futures on May 19, pending regulatory review. The contracts will be available in two sizes: a micro contract representing 2,500 XRP and a larger contract sized at 50,000 XRP. The futures will be cash-settled, priced against the CME CF XRP-Dollar Reference Rate, calculated daily at 4:00 p.m. London time. The new product adds to CME Group’s existing crypto derivatives suite, which includes futures and options on Bitcoin, Ether, and Solana. Giovanni Vicioso, Global Head of Cryptocurrency Products at CME Group, commented, “As innovation in the digital asset landscape continues to evolve, market participants continue to look to regulated derivatives products to manage risks across a wider range of tokens. Interest in XRP and its underlying ledger (XRPL) has steadily increased as institutional and retail adoption for the network grows, and we are pleased to launch these new futures contracts to provide a capital-efficient toolset to support clients’ investment and hedging strategies.”

The Swiss National Bank has rejected holding bitcoin reserves, citing concerns over cryptocurrency market liquidity and volatility. "For cryptocurrencies, market liquidity, even if it may seem ok at times, is especially during crises naturally called into question,” said SNB President Martin Schlegel at the bank’s General Assembly meeting Friday. “Cryptocurrencies also are known for their high volatility, which is a risk for long term value preservation. In short, one can say that cryptocurrencies for the moment do not fulfil the high requirements for our currency reserves.” Schlegel’s comments were prompted by the Bitcoin Initiative, a bitcoin advocacy group whose research demonstrates that adding bitcoin to Switzerland’s treasury would complement its overall portfolio and yield substantial return with minimal volatility. Without bitcoin, the Swiss National Bank's investments grew by about 10% since 2015. A 1% bitcoin allocation to the central bank’s portfolio would have nearly doubled returns over the same period, according to a Bitcoin Initiative portfolio simulation (see below). Annualised volatility would have increased only slightly.

Charts of the Week

Because charts are just as important as macro.

Bitcoin balance on exchanges has dropped to its lowest level since 2019. Hat tip to Cryptorank for the chart.

Tokenised treasury funds market cap over time graph. Hat tip to rwa.xyz for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Accountant at the UK Ministry of Defence

Senior Flow Trader - Quant Team at Crypto.com

Associate, Institutional Sales at Gemini

Business Development Manager, Cryptoassets at DRW Cumberland

Institutional Sales Manager at KuCoin Exchange

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.

One of the best macro econmics and crypto blogs from somebody that really understands from within, the financial markets