Firstly, apologies that this is a good few days late, have been bed ridden with the flu for some of this week! Anyway, here goes…

Last week was a busy week in the macro crypto world!

After the short gamma squeeze crypto pump which we outlined in last week’s Connecting the Dots, early focus last week was on the Bank of Japan.

Expectations had grown for a further widening of their Yield Curve Control (YCC) bands or even a complete removal of YCC which would have sent shivers across global bond markets and ultimately dented the positive start to 2023.

In the event, the BoJ left policy unchanged and markets breathed a sigh of relief. Japan is the largest foreign holder of US treasuries and largest creditor nation in the world. So changes to domestic policy that would encourage capital to return home would potentially lead to large portfolio flows, selling foreign bonds and equities to seek higher domestic yields. Expectations remain that the YCC control policy will be abandoned at some stage this year (last Friday’s inflation data came in at 4%, double the target) although the BoJ remains of the view that inflation will come lower from Feb and see inflation potentially below 2% by year end.

Peak rates…

We came into this year bullish US Treasuries and “long duration” as the market transitions away from inflation fears, towards growth concerns. The BoJ posed a risk to that view on the potential flow dynamic, but with that averted for now, we can focus back on the macro data flow which continues to fit with the peak inflation, slowing growth macro dynamic we’ve outlined.

US data last week delivered a one two punch 🥊 with Producer Price Inflation coming in -0.5% (Vs +0.2% prior) and weak retail sales falling 1.1% on the month questioning the strength of the US consumer.

Both 2yr and 10yr US yields broke the respective 4.10% and 3.40% support levels we had been looking to break, with recession fears initially denting risk. Somewhat disappointingly, yields recovered on Friday as risk recovered, with better jobless claims cooling the jets on the deep recession narrative. However, with those supports now removed, US yields will have less support as they continue the down trend in this peak inflation, peak Fed world which ultimately feeds our bullish crypto view. We continue to watch this chart 👀

2yr US yields testing lower as markets price a dovish pivot #peakinflation #peakrates

Fed speakers however continue to push back on market pricing for rate cuts, fearful of an “unwarranted easing of financial conditions.” Interesting that markets are becoming less sensitive to the somewhat dated Fed speak. More interesting perhaps were comments from the Fed’s influential Brainard this week who highlighted the now two sided risks to policy and also suggested the recent cooling in inflation raises questions over the extent to which the Fed needs to cool the labour market to bring down inflation. To wit:

“Wages do not appear to be driving inflation and there is no wage-price spiral akin to the 1970’s”

We’ve strongly pushed back on the 1970’s comparisons. Post war 1940’s perhaps the better reference period, but post Covid, analysing this market through these periodic comparisons is likely to be misleading. We stick to our macro framework, focusing on rates, dollar, liquidity and flows.

Dollar breakdown…

Speaking of the dollar, we’ve written before about the importance of this macro factor for crypto and broad risk. The “dollar wrecking ball” has strangled global growth and squeezed liquidity and financial markets over the past year. With policy “convergence” as other central banks play catch up with the Fed, alongside a more positive growth trajectory for the rest of world post China re-opening, the dollar continues its grind lower. FX is the best asset class for sniffing out regime change and the importance of the dollar selling off should not be taken lightly. This continued move lower in the dollar is another important sign post in our macro framework that we could be at the start of a new bull market in crypto. Having broken the big 2022 uptrend, we’re approaching the May lows. A break through there will spark another leg higher for risk…

Dollar breakdown continues…

Liquidity easing…

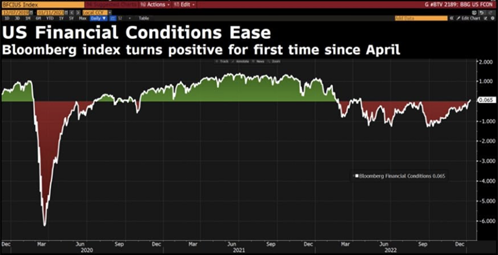

We also spoke about markets being at “max liquidity tightness” in our year end episode “Crypto is Dead, Long Live Crypto” and as we suggested, liquidity is starting to improve. On the Fed balance sheet side, off-setting Quantitative Tightening has been the drawing down of the Reserve Repo Facility (RRP) balances which are slowly reducing. More importantly, with the US hitting the debt ceiling and unable to issue more debt, the US treasury will have to continue to run down its cash balances held at the Fed (the so-called Treasury General Account, TGA) which, short term, will provide a liquidity boost to our markets. Indeed, as liquidity eases, financial conditions are easing, with Bloomberg's financial conditions index turning positive for the first time since April 👇

Source: Bloomberg

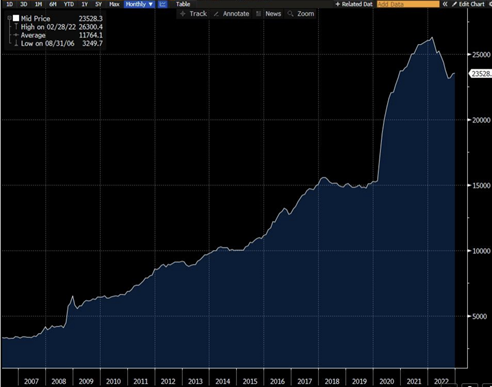

Further, adding to looser liquidity conditions, the Big 4 Central Bank balance sheets are once again expanding, as the PBOC and BoJ off-set the contraction of the Fed and ECB balance sheets. Don’t fight the Fed? Don’t fight the Fed, ECB, BoJ, PBOC 👇

G4 Central Bank Balance Sheets turning higher

Source: Bloomberg

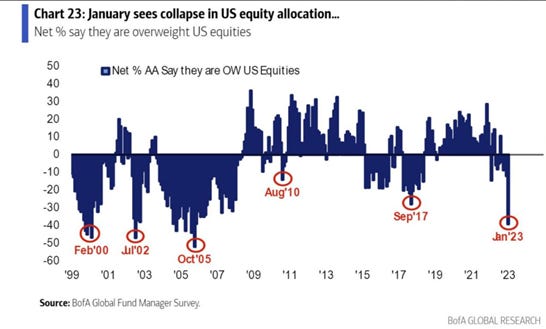

As the macro regime shifts, investors have been caught out trading the 2022 playbook and remain, in our view, under-positioned for the topside. Already, particularly in crypto, those under positioned are going to have to chase performance. The Bank of America Fund Manager survey perhaps supporting our view on the level of under-weight positioning in risk generally 👇

Most fund manager underweight US equities since 2005

I’ll have a latte and a Bitzlato to go…

Back in crypto land, just as the party was getting in full swing, the Department of Justice made everyone spill their drinks, by announcing a pending announcement on a major crypto enforcement action. Rumors circulated that it was to do with Binance and both BTC and ETH were hit sharply, just as they were scaling new recent highs. In the event, the announcement centered on little known Russian crypto exchange Bitzlato, with the founders arrested for allegedly processing over $700mio in illicit funds. Queue the meme’s for the ridiculed reaction. Bitzlato sounds more like something you’d order in a coffee shop than a major trigger to dent crypto’s positive start to 2023!

More significant perhaps was the announcement that Genesis had filed for Chapter 11 Bankruptcy protection. Markets took the anticipated announcement in stride, with subsidiary businesses such as the derivatives trading and custody businesses unaffected and able to continue operation. The contagion then, somewhat limited. Details still to be resolved, but this cloud that has been hanging over crypto is perhaps dissipating.

Fund flows positioning for higher crypto prices…

With the macro supportive and some “progress” on the Genesis situation, crypto was grinding back towards its highs, triggering some key levels in time for a weekend pump. Short liquidations and negative gamma chasing (which we described last week) helping fuel a sharp rally late Friday.

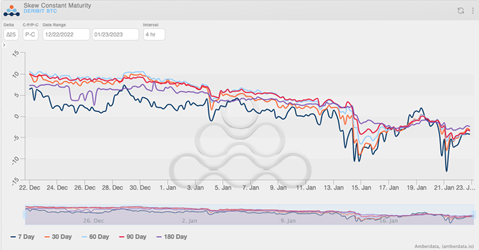

In the derivatives space, flows continue to position for the topside and this has seen “skew” turn positive for calls over puts across maturities. See below chart courtesy of Amberdata.io 👇

What this tells is, is demand for calls (higher BTC prices) is in higher than the demand for puts (lower BTC prices)

Crypto funds are getting more bullish for crypto to break higher…and so are we.

In summary

The macro data then continues to support the peak inflation, peak rates narrative that we believe will underpin a positive backdrop for crypto in 2023.

Rates are coming lower and making new lows ✅

The dollar looks set to break new lows ✅

Liquidity is improving ✅

Fund flows are positioning for the topside ✅

For all the talk of simply a bear market rally, there looks to be a more fundamental driver for these higher crypto prices. So long as the macro continues to unfold this way, this looks like the start of a new bull cycle, rather than a correction to the bear.

Our newsletter might look different in the coming weeks. Don’t worry, the macro will still be covered, but there will be a few editions including news, charts and education.

Thanks for sticking with us.

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.