Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

If you think someone will benefit from reading this newsletter, we’d be really grateful if you could share it with them. Thanks!

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: NVIDIA leads the AI driven tech rally, Bitcoin ETF inflows continue, China still an important component and we continue to expect a rise in “hard assets.”

Crypto Native News: Stablecoin volume on centralised exchanges increases, 360T launched crypto NDF’s.

Institutional News: The ECB releases a report on bitcoin, the CME announces euro-denominated BTC and ETH micro futures, Mastercard offers cryptocurrency rewards and the Economic Secretary to the Treasury expects legislation around stablecoins and staking.

Charts of the Week: Record total open interest on Deribit, bitcoin ETF inflows vs gold ETF outflows, bitcoin network demand vs supply.

Top Jobs in Crypto: Featuring Foreign, Commonwealth and Development Office, Elliptic, Revolut, Uphold, Circle and Goldman Sachs.

Macro Update

This is where we connect the dots between macro and crypto.

Welcome to the Exponential Age

Markets were dominated this week by what Goldman Sachs described as “the most important stock on planet earth” - NVIDIA. NVIDIA has been the poster child for the AI driven tech rally and once again, continued to beat expectations on earnings, with Q4 revenue more than tripling from a year earlier to $22.1bn and profits increasing ninefold to $12.3bn. Further, as demand continues to outpace supply, future revenue projections were also revised higher. Welcome to the exponential age!

The results saw NVIDIA share price surge taking its market cap above the $2 trillion mark and dragging the Nasdaq and S&P to new intra day highs. We’ve repeatedly said that this market is under positioned and desperate for a sell off given the levels we’re at. Yet with liquidity ample, major central banks done hiking, cash on the sidelines and a transformative technology adding an explosive growth dynamic, tech is TINA (“there is no alternative”) and crypto is a fundamental cornerstone of a tech based, digital economy. This is not a mean reversion market, rather the start of a secular, parabolic move 🚀.

Crypto majors meanwhile continue to etch out new highs, although both BTC and ETH ran into strong resistance into respective 53k and 3k levels. Consolidation here looks healthy before making a push to what we expect will be new record highs for both. Spot BTC ETF inflows continue apace (despite one day of net outflows) and in a holiday shortened week saw a net inflow of $584bn. ETF’s combined have now taken in a net $5.5bn and with the likes of Carson group, a $30bn RIA platform greenlighting 4 of the spot BTC ETF’s, these inflows are likely just getting started.

One potential headwind for Bitcoin remains China. Chinese Premier Li Qiang called for “pragmatic and forceful action” to boost confidence in the economy at a State Council meeting last Sunday, underscoring concerns on the economy and an on-going stock market rout driving capital flight. This was followed by a 25bp cut to the 5yr loan prime rate - the peg for most mortgages - and is the biggest cut on record as China looks to contain a sprawling property crisis. Despite the rate divergence with the US however, suspected currency intervention kept a lid on USDCNH and as China seeks to maintain the “veil of stability,” we continue to suspect they are also trying to keep a lid on Bitcoin to discourage digital assets as the capital outflow channel. The recent measures taken saw Chinese stocks up broadly around 4% on the week and continued stability there, we believe, will be an important prerequisite for Bitcoin to face less resistance on its move higher. So far, so good.

Elsewhere, little new to add to the macro outlook. Fed minutes re-emphasized the lack of urgency to deliver the first cut, with markets now pricing June as the start of the cutting cycle. Importantly, as we have been highlighting since last year, the QT taper looks set to begin in Q2 and the Fed are linking the need to taper to the run down of the RRP facility. With still 500bn to run down, there’s a continuous supply of liquidity to our markets which will continue to frustrate the bears. Once this approaches zero, this is when we foresee a more material correction for equities and possibly crypto, all things equal. The QT taper will be a necessary, but not sufficient action as once the RRP hits zero, front end yields will spike and we likely will see a funding rate blow up, a la the 2019 repo crisis. The Fed of course, as things start to break, will be the liquidity providers of last resort and the return of liquidity will trigger the next explosive move higher.

Underpinning this need for continued Fed liquidity is of course the spiralling US debt, with no end insight for the profligacy of the lunatics running government. In the past month, $260bn was added to the deficit which now sits at $34.33trn 🤯. Ultimately, this will all find itself sitting on the Fed’s balance sheet. Meanwhile, the fiat world, caught in a debt driven trap, continues to debase their respective currencies.

FX is a relative game and given all major economies are trapped in the same debt spiral, on the surface, the dollar looks quite stable, strong even. Yet the debasement is ever more evident with the continued rise in “hard assets.” Hence the Nasdaq, with tech companies that offer real value, will continue, in dollar terms, to re-rate ever higher. Likewise, Bitcoin, as the hardest asset on the planet with an increasing network of adoption and digital scarcity, will continue an inevitable move higher, punctuated with intermittent liquidity driven corrections. Until those liquidity corrections arrive, buy tech and crypto, wear diamonds 💎

London Crypto Club recommends….FINK ! After seeing the dire state of commentary and research after leaving broking, David thought retail could benefit from institutional research made bitesize with actionable ideas coming from it… so that’s what he did — he created Macrodesiac which is now Fink. Check it out HERE.

Native News

Key news from the crypto native space this week.

Data from CCData shows that stablecoin trading volume on centralised exchanges rose 4.5% to over $1 trillion in January — hitting its highest point since the tail end of the previous bull market, in December 2021. CCData said “Volumes are on track to record a higher total in February,” noting that $440 billion in stablecoins had traded on centralised exchanges as of 16 February. Read the full report from CCData HERE.

360T launched a crypto NDF offering this week, with Wintermute Asia and Crypto Finance pioneering the first trade on the platform. 360T said “We are very pleased to have supported the first bitcoin NDF trade on our platform, offering a proven, reliable and safe platform to facilitate Crypto NDF products alongside OTC and listed FX, Short-Term Money Market products, and Commodities,” “By launching our crypto offering with non-deliverable derivatives products, we are allowing our diverse, global client base to engage with the crypto market without the need to build or invest in Distributed Ledger Technology (DLT) infrastructure. Looking ahead, we will continue to work with our industry partners to expand 360T’s crypto offering in-line with their needs.” Wintermute CEO Evgeny Gaevoy said “Being one of the counterparties pioneering this trade underlines our commitment to supporting innovative solutions and products that respond to evolving market needs. Traditional financial institutions increasingly seek exposure to cryptocurrencies, and NDFs offer a safe gateway to crypto for these entities. We’re pleased to see an experienced and established technology provider like 360T addressing institutional investor demands and look forward to increasing our participation on the platform.”

Institutional Corner

Top stories from the big institutions

The European Central Bank (ECB) released a damming report on Bitcoin titled “ETF approval for bitcoin – the naked emperors new clothes”. The summary says that “Bitcoin has failed on the promise to be a global decentralised digital currency and is still hardly used for legitimate transfers. The latest approval of an ETF doesn’t change the fact that Bitcoin is not suitable as means of payment or as an investment.” The report goes on to say that on 10 January, the US Securities and Exchange Commission (SEC) approved spot exchange-traded funds (ETFs) for Bitcoin. For disciples, the formal approval confirms that Bitcoin investments are safe and the preceding rally is proof of an unstoppable triumph. We disagree with both claims and reiterate that the fair value of Bitcoin is still zero. For society, a renewed boom-bust cycle of Bitcoin is a dire perspective. And the collateral damage will be massive, including the environmental damage and the ultimate redistribution of wealth at the expense of the less sophisticated. Read the full report HERE.

The Chicago Mercantile Exchange (CME) announced this week that it plans to launch euro-denominated micro bitcoin and ether futures on 18 March. Pending regulatory review, the expansion of its cryptocurrency derivatives offering is set to follow the launch of its U.S. dollar-denominated micro bitcoin futures contracts in May 2021 and micro ether futures in December 2021. CME previously announced the launch of regular euro-denominated bitcoin and ether futures contracts in August 2022. It also offers bitcoin and ether options products. Similar to their U.S. dollar-denominated counterparts, the micro bitcoin euro and micro ether euro futures contracts will be one-tenth the size of the respective underlying assets — aimed at providing a cost-effective way to gain bitcoin and ether exposure. CME Group Global Head of Cryptocurrency Products Giovanni Vicioso said in the statement. "Global investors have sought more precise tools to manage their risk as interest for bitcoin and ether grows. As such, we have seen a four-fold increase in volume in our USD-denominated micro bitcoin and micro ether futures.” Read full details from CME HERE.

Payments company Mastercard is working with Swoo Pay, an emerging markets-focused mobile payments app, to offer loyalty rewards in cryptocurrency. With the new partnership, Mastercard and Swoo will target emerging regions like Africa and Southeast Asia, specifically the parts untouched by Google Pay. “This also includes connecting users in countries with a high concentration of affordable Huawei smartphones,” said Swoo co-founder Filipp Shubin. Shubin added “In many emerging countries like Nigeria, Kenya, Philippines and Indonesia, there are billions of users who have MasterCard and Visa cards, but don’t have access to Google Pay.”

Economic Secretary to the Treasury Bim Afolami said that the U.K. government was "pushing very hard” to bring legislation around stablecoins and crypto staking services within the next six months. Speaking at a Coinbase event this week Afolami said “We’re very clear that we want to get these things done as soon as possible. And I think over the next six months, those things are doable.”

Charts of the Week

Because charts are just as important as macro.

Total open interest on Deribit exchange exceeded $25bn this week. Hat tip to Deribit for the chart.

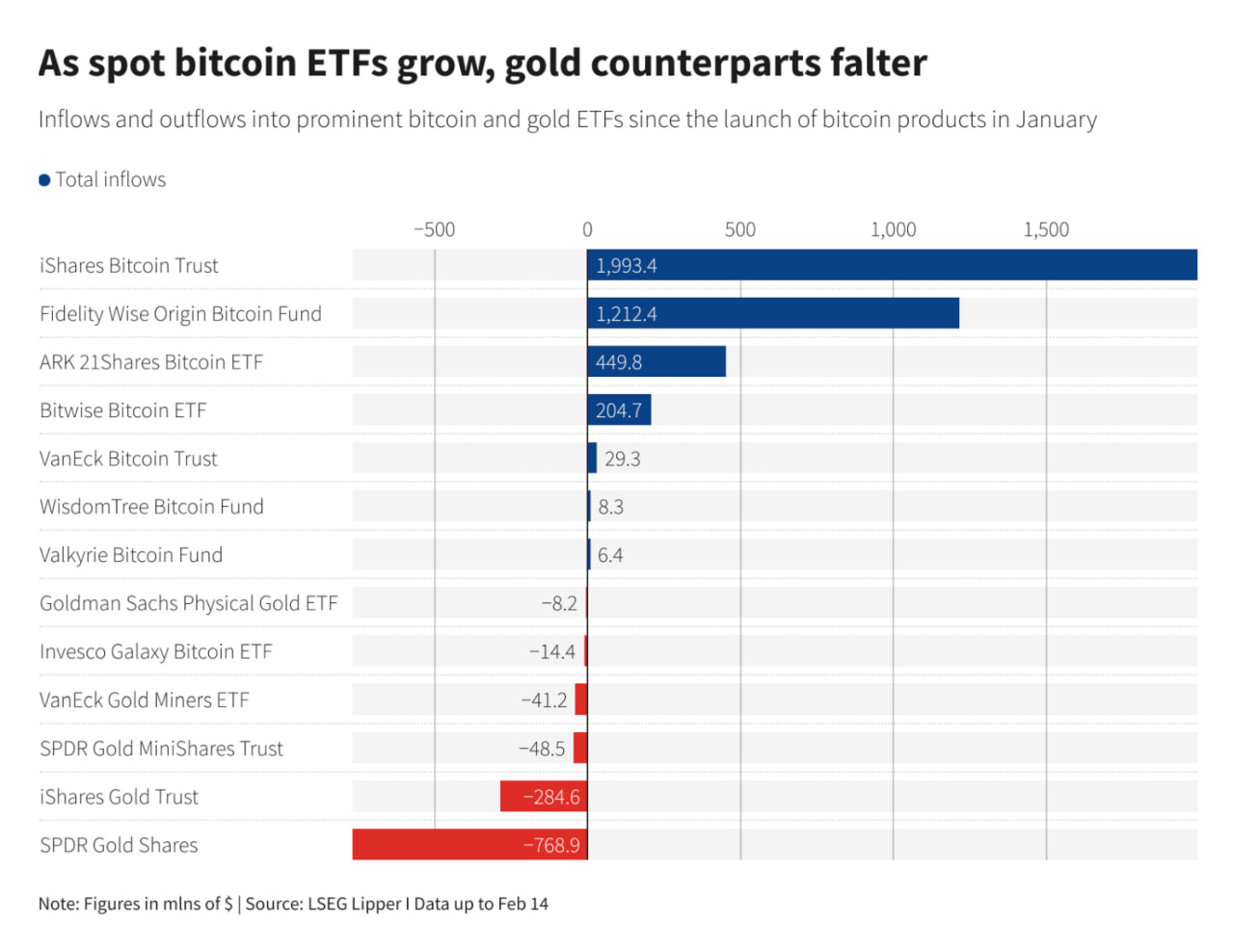

Since the Jan. 10 U.S. approval, two of the biggest new spot bitcoin ETFs, iShares Bitcoin Trust and Fidelity Wise Origin Bitcoin Fund, had accumulated $5.45 billion and $4.13 billion in assets respectively as of Feb. 14. Meanwhile, the largest gold-backed ETF, New York's SPDR Gold Trust, saw outflows of $768.9 million over the same period, while the iShares Gold Trust had outflows of $284.6 million.

The Bitcoin network is receiving an average of $607m per day of new investor demand while this is being met by $46m per day of new supply in the form of new coins being mined. Hat tip to Willy Woo for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Management Lead at Foreign, Commonwealth and Development Office

Senior Crypto Thread Analyst at Elliptic

Legal Counsel Regulatory Crypto at Revolut

Copywriter, Crypto Marketing at Uphold

Business Development Director, Wholesale Liquidity at Circle

Financial Crime Compliance for Digital Assets at Goldman Sachs

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.

Grateful for this information london ❤