Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Guest Writer Noelle Acheson gives her views on this weeks macro.

Crypto Native News: Riot Platforms acquires Block Mining, Bitstamp repaying Mt Gox creditors, Hex Trust acquires Singapore license.

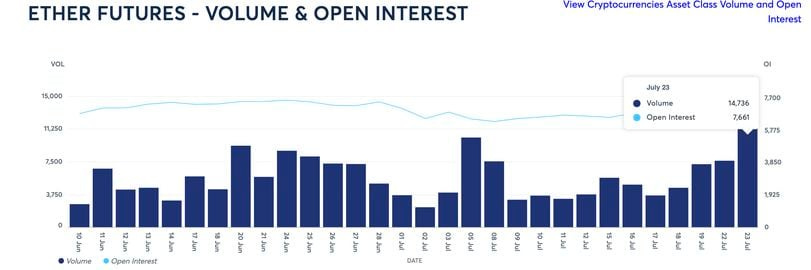

Institutional Corner: Record open interest for CME ether futures, U.S. Senator Roger Marshall withdraws from a proposed crypto anti-money laundering bill, Revolut receives UK banking license.

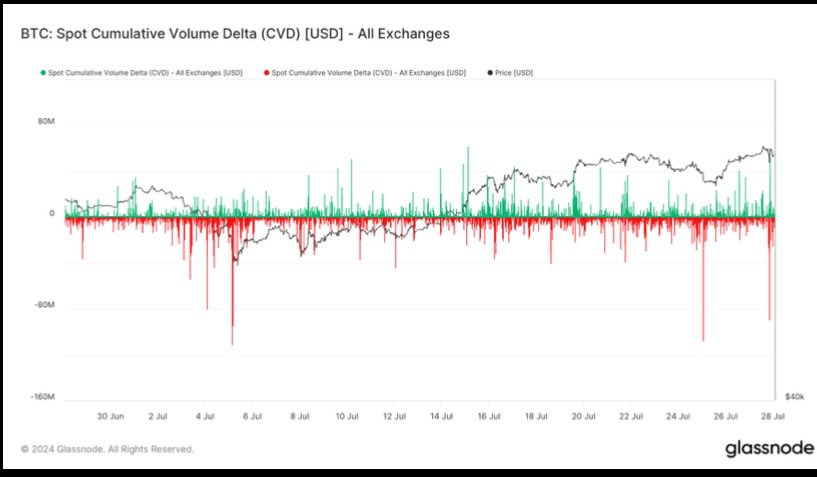

Charts of the Week: Strong ETH buying on crypto native exchanges, large increase in volumes during Trumps speech.

Top Jobs in Crypto: Featuring Cleo, Harris and Trotter, Quantstamp, Hakflow, Consensys, Kraken and Ripple.

Macro Chart of the Week - China unexpectedly cut their key one-year policy rate (median-term lending rate) by the most since April 2020. Hat tip to Jeroen Blokland for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

While we take a 2 week summer break, we have a guest writer for the macro section, our good friend Noelle Acheson. All views in the following section are those of Noelle’s.

Those lazy, hazy days

So much for enjoying a nice, quiet, sultry week in the middle of summer. The past few days have not only delivered quite a few macro market jolts; they have also seen BTC reassert its narrative dominance despite a big step forward for ETH. A strange week indeed.

Starting with the macro jolts: the three that most stand out are, not in order of importance, 1) data releases casting doubt on the consensus narrative of an economic slowdown, 2) the sharp steepening of the yield curve, and 3) the continued rotation out of big tech.

Macro misdirection

1) The consensus, at least from the macro podcasts and X chatter in my feed, is that the US economic slowdown is now undeniable. This is strange.

There are signs it is slowing, sure – the housing market, a key driver of consumption, is showing weakness, and consumer sentiment is dropping. But the S&P Composite PMI index flash reading for June came in this week stronger than forecast, reaching its highest level since May 2022. US Q2 GDP came in at 2.8%, notably higher than the expected 2.0% and higher still than Q1’s 1.4%. And the month-on-month growth of the US personal consumption expenditure index (PCE), the Fed’s preferred inflation gauge, accelerated slightly in June, at both the headline and core level.

Where, exactly, is that slowdown?

Ah, yes, the labour market. Only, jobless claims released on Friday were lower both on a weekly and a four-week average basis. Next Friday’s official jobs data for July is expected to deliver a steady increase of 0.3% month-on-month in average hourly earnings, and a steady unemployment rate at 4.1%. That is still lower than the non-recession average for the US so far this century – not exactly a panic signal.

Then again, we know that when unemployment starts to move, it moves fast, so there just might be a negative surprise next Friday.

A looming yield event

2) After two years of inversion, the 10y2y yield differential at one point during the past week was nine basis points away from reaching zero, without any clear economic catalyst or shift in outlook. The curve had been steepening since early June on expectations that rate cuts will bring short-term rates down faster – this accelerated after President Biden’s decision on Sunday to exit the race as, for a brief window, a Trump victory looked even more likely. This would, according to Trump’s proposed platform, rekindle inflationary pressures, pushing longer term rates up.

It didn’t take long, however, for the market to realize that it may have underestimated Vice President Harris’ chances, and the “political” trade in the yield curve steepening eased a bit. But the 10y2y differential is still close to zero, and the FOMC meeting this coming week – at which Fed Chair Powell is expected to drop heavy hints that the first cut is coming in September – could further shrink the gap.

This matters because, in the past, a de-inversion of the yield curve has signalled that a recession is around the corner. It has also signalled a stock market correction.

Deflation… of narratives

3) It could be that this has already started. It’s not just the recent almost 5% drop in the S&P 500 over the span of nine days that suggests a sentiment shift. It’s how this is happening.

The concentration of stock market gains in large caps had reached extreme levels. A couple of weeks ago, the ratio of the S&P 500 to its equivalent equal-weighted index reached the highest level since late 2003. This turned fast – on July 11, the Russell 2000 small cap index outperformed the large-cap Nasdaq 100 by 5.8 percentage points, the most since November 2020. The S&P 500 dropped nearly 1% although all but 100 names went up.

The trigger was two-fold: that day’s positive surprise on June’s US CPI brought rate cut expectations forward, moving the spotlight to more rates-sensitive smaller caps. And doubts about AI’s impact started to creep in, fuelled by last month’s sceptical Goldman Sachs report which has since been followed by similar articles in The Economist, the Financial Times and others. This past Wednesday, the S&P 500 and Nasdaq dropped by 2.3 and 3.7% respectively – the most since late 2022.

The risk is more in the slipperiness of the slope, as sentiment and fear kick in. Even if you are convinced the market is wrong and this is a tech stock buy-the-dip opportunity, you’re probably focusing now on what other people are thinking. Investors tend to move in packs which accelerates trend shifts, and in this case, there is career risk in being on the wrong side of this trade.

The crypto effect

The jitters, of course, spilled over into the crypto market. For most of this past week, the majors were heading down despite strong anyone-but-Biden tailwinds, offering a reminder that, in times of market nerves, crypto will get hit as short-term investors exit any risk asset they can.

And ETH was further hit as a successful day one for the spot ETFs on Tuesday was offset by net outflows the rest of the week.

Things started turning as the weekend approached, however, along with mounting excitement about Trump’s appearance at the Bitcoin conference in Nashville. BTC climbed almost 8% between Thursday’s low and the time he took the stage on Saturday afternoon – ETH, however, barely managed 4%.

Trump’s promise of love and support and his vow that the US would not sell its BTC did not impress traders, and BTC dropped sharply. This swiftly turned as Trump ceded the stage to Senator Cynthia Lummis (R-WY) who triumphantly brandished a proposed bill to create a Bitcoin Strategic Reserve. The drift down since then shows that there’s more convincing to do.

What does this mean for next week’s set-up? On the one hand, we could have a disappointment dump if Trump shows signs of forgetting what he said yesterday. There may still be some pent-up outflow from Grayscale’s ETHE fund, which stuck to its 2.5% fee. And macro data could cast doubt on just how many cuts the Fed will deliver this year.

Or, we could get some rousing language at the Powell press conference on Wednesday combined with possible surprises at the Bank of Japan and Bank of England meetings this coming week; we could see unemployment moves gain momentum; and there might be some startling figures in next week’s Treasury refunding announcement for August.

Plus, the ETHE outflows will ease at some stage. BTC spot ETF inflows are still strong. And apparently VP Harris’ team has reached out to crypto industry representatives in an attempt to improve the relationship – this could perhaps lead to some short-term Administration changes.

There are short-term risks on the horizon, and summer tends to be lazy, hazy, crazy and range-bound. But the tailwinds are strong, and getting stronger.

Noelle Acheson, partner at Triple Crown Digital and author of the Crypto is Macro Now newsletter on Substack. Check it out here…

Native News

Key news from the crypto native space this week.

Bitcoin mining firm Riot Platforms this week acquired Block Mining, a Kentucky-based bitcoin miner, in a $92.5 million deal to expand its mining operations. In a statement released on Tuesday, Riot said that the acquisition could immediately add 60 megawatts of current operational capacity. “Riot intends to further expand Block Mining's two sites, targeting 110 MW for self-mining operations by the end of 2024.” That would bring Riot’s total potential power capacity to 2 gigawatts. “This transaction allows us to diversify our operations nationally and accelerate Block Mining's expansion in Kentucky,” Jason Les, CEO of Riot, said in the statement. “With a combined 60 MW of existing developed capacity, and a pipeline to rapidly scale to over 300 MW, this acquisition expands our operations and further enhances our path towards our growth target of 100 EH/s.” Riot paid the purchase deal with $18.5 million in cash and $74 million worth of Riot common stock.

Bitstamp has begun repaying Mt. Gox creditors after receiving all the funds owed to them from the trustee. The cryptocurrency exchange received all the Bitcoin, Bitcoin Cash and Ether and started repaying creditors on July 25. According to the announcement, the recipients can expect to have full control of their assets within a week after the completion of the necessary security controls. Over $9.4 billion worth of Bitcoin is owed to approximately 127,000 Mt. Gox creditors who have been waiting for over 10 years to recover their fund. The announcement marks a positive sign for Mt. Gox creditors, but Bitstamp users based in the United Kingdom may have to wait a few more months before finally receiving their assets. Bitstamp’s announcement added that UK customers will be informed in “due course”: “While UK customers will not be included in the first tranche of distributions, UK customers can expect to receive their restored within the next few months and will receive more information in due course.”

Hex Trust, an institutional crypto custodian, has obtained in-principle approval for a Major Payment Institution (MPI) license in Singapore. The Monetary Authority of Singapore has granted it the preliminary approval for the MPI license, which would allow the firm to offer “digital payment token services” in Singapore, “namely the custody and OTC trading of DPTs.” Alessio Quaglini, co-founder and CEO of Hex Trust said “We are thrilled to strengthen our presence in Singapore — a vibrant hub for fintech innovation, renowned for its outstanding regulatory framework” The latest compliance update in Singapore follows the company obtaining a full Virtual Asset Service Provider license in Dubai in November 2023.

Institutional Corner

Top stories from the big institutions

CME Ether futures reached record open interest on Tuesday following the launch of the ETH ETF a day before. The so-called open interest or the number of active bets in standard ether futures rose to a record of 7,661 contracts, equalling 383,650 ETH and $1.4 billion in notional terms, the exchange said in an email to CoinDesk. The previous peak of 7,550 contracts was set one month ago. Speaking of trading volumes, the derivatives giant witnessed 14,736 contracts change hands on Tuesday, which is three times higher than the average daily volume of 5,010 contracts seen throughout July. Tuesday was also one of the top 10 volume days for ether futures.

U.S. Senator Roger Marshall has withdrawn from a proposed crypto anti-money laundering bill he originally introduced with Sen. Elizabeth Warren. Marshall pulled his support for the controversial Digital Asset Anti-Money Laundering Act of 2023 (DAAMLA) this week, becoming the first co-sponsor to do so, according to Congress legislative records. The bipartisan bill still has support from 18 co-sponsoring senators, however. The bill aims to expand know-your-customer and anti-money laundering verification responsibilities to digital asset service providers, miners, validators and other participants in efforts to close existing security loopholes in crypto. A section of the anti-money laundering bill also proposes that the Treasury, Securities and Exchange Commission and Commodity Futures Trading Commission establish a new AML review process to enforce Bank Secrecy Act compliance on digital asset entities. Read more on the bill HERE.

Revolut announced on Thursday that it has received a banking license from UK financial regulators. The approval of a preliminary banking license from the UK's Prudential Regulation Authority (PRA) marks the culmination of a rigorous three-year application process for the fintech firm. Revolut CEO Nik Storonsky in a statement said "We are incredibly proud to reach this important milestone in the journey of the company and we will ensure we deliver on making Revolut the bank of choice for UK customers." Revolut said it had received the license from the PRA with restrictions, as it now enters a "mobilisation" stage before obtaining a full licence. During this "mobilization" period, banks face a range of restrictions, such as a £50,000 limit ($64,000) on total customer deposits. On Thursday, the bank sent a notice to its UK-based customers, stating, "We are now entering a 'mobilization' period, a common regulatory stage for many new banks. During this period, we will complete the setup of our banking processes before beginning operations as a bank in the UK." Once it fully enters the market, the fintech will be able to offer products such as mortgages and credit cards in addition to its existing e-money services.

Charts of the Week

Because charts are just as important as macro.

Since the launch of spot Ethereum ETFs, ETH has seen strong net buying on Coinbase and Binance. Selling outweighed buying on OKX, indicating some traders are taking profit. Hat tip to Kaiko Data for the chart.

Large volume increase on centralised exchanges during Trumps speech. Hat tip to James Van Straten for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Lead Product Manager Crypto/Trading at Cleo

Business Development Manager at Harris and Trotter

Applied Cryptographer at Quantstamp

Smart Contract Auditor at Hakflow

Staff Software Engineer - Metamask at Consensys

Senior Sales Manager at Ripple

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.