Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: VanEck to invest in businesses building on Avalanche, Kraken launching tokenised US equity trading, TwoPrime expands its partnership with MARA, FIFA to migrate its NFTs to Avalanche.

Institutional Corner: Perps trading in the US could be approved very soon, US banks exploring the launch of a stablecoin, Hong Kong passes a stablecoin bill, Texas passes legislation seeking to establish a Bitcoin reserve.

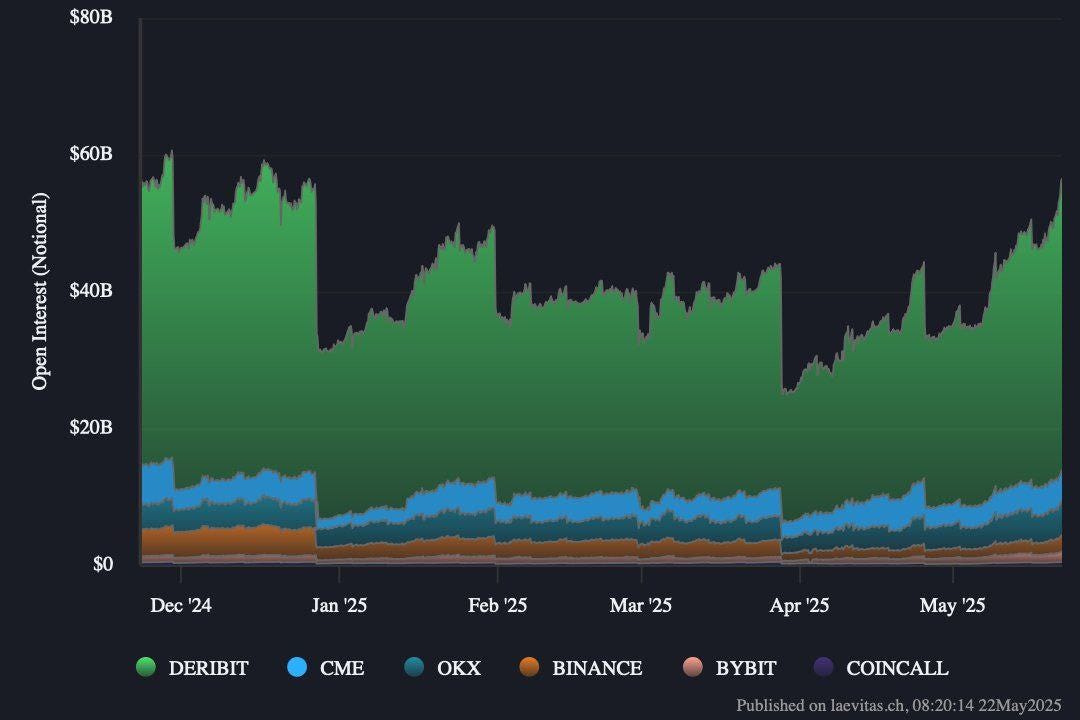

Charts of the Week: Global crypto options open interest the highest since December, top 5 DEX’s by trading volume.

Top Jobs in Crypto: Featuring CoinMarketCap, Crypto.com, ChainLink Labs, Coinbase, Kraken and OKX.

Macro Update

This is where we connect the dots between macro and crypto.

Fiat Fairy Dust

Global bond markets were sharply in focus this week. The US downgrade, in and of itself, was the non-event we suggested for broader risk. Yet spiralling debt dynamics particularly in the US and Japan, two of the three largest bond markets in the world, provided for a nervous overtone which saw equities trade lower on the week as global yields spiked higher.

Bitcoin however, hit new record highs, performing its role as a hedge against the failure of the fiat system and increasingly being viewed as “pristine collateral” 💪

Not helping the risk mood, Trump’s recent conciliatory tone in regard to tariffs gave way to frustration at the lack of progress made in negotiations with Europe, leading to Trump announcing 50% tariffs on the EU starting from 1st of June. In a striking escalation, he also threatened a 25% tariff on iPhones unless Apple onshores production. Markets are however becoming less sensitive to such headlines as it’s become clear that this is just part of Trump’s negotiation tactics to focus minds and agree a deal.

Bond troubles…

Back to the bond market however, weak 20yr auctions both in Japan and the US saw global yields punch higher. Japan’s 20yr auction on Tuesday saw the weakest demand since 1987 and helped drive 30yr yields to a record high of 3.185% and 40yr yields hit an all time peak of 3.635%. In the US, Wednesday's weak 20yr auction saw 30yr yields trade above 3.1% while 10yr yields briefly traded above 4.60%.

Whilst inflation in both the US and Japan remains stubbornly high (annual headline inflation in Japan for April remained unchanged at 3.6% whilst core inflation accelerated to 3.5%, the highest level in 2 years) it’s the fiscal dynamic which is giving investors cause for concern and pressuring the respective bond markets.

Trump’s “Big beautiful” tax bill passed the House of Representatives this week and whilst it likely meets resistance in the Senate, estimates that it is set to add circa $5trn to national debt is in complete juxtaposition to the administration's early promise to reduce deficits. Bessent notably now leaning on the flimsy promise to “grow our way out of the national debt crisis” instead of taking the required actions to actually cut the deficit.

Meanwhile, in Japan, concerns are swirling about new fiscal stimulus ahead of a Japanese Upper House election slated for July, with several political parties calling for consumption tax cuts. Above-target inflation alongside suggestions of more fiscal stimulus for a country carrying north of 260% debt/GDP is a toxic combination and leaves the Bank of Japan facing an impossible choice. Next week’s 30yr and 40yr bond auctions will be another key test for global bond markets.

Fairy dust…

In the fiat world, the whole ponzi is held together by the magic fairy dust of confidence. Belief in responsible government and the credibility of currency.

2008 was the end game for the fiat system but the adjustment and deleveraging required was simply too painful, so governments and central banks artificially inflated the assets which were the collateral underpinning the system.

Today, the BoJ owns circa 50% of their domestic bond market. The ECB circa 30% and the Fed circa 20%. Those percentages over time will necessarily rise as they monetise the debt and the default comes via the stealth debasement of currency which has, to date, been subtle enough to maintain the magic fairy dust of confidence.

Boomers who didn’t/don’t understand Bitcoin more worryingly didn’t understand the mechanics of debt driven fiat economies. Their equity and property portfolios that made them rich they assumed was a result of their genius and skill.

They scoffed at the volatility of Bitcoin whilst still thinking government bonds were the “safe haven” benchmark investment because governments who are true sovereigns can never nominally default. Yet they overlooked the fact that the currency value of bond holdings has been in persistent decline.

That awareness and perception is starting to shift and is a seminal moment for Bitcoin.

This isn’t however a “doomer” proclamation of an impending collapse of bond and equity markets. Bond yields will be capped via huge liquidity injections and the financial repression tricks and magic performed by treasuries and central banks (Bessent suggesting this week they could change the Supplementary Ratio over the summer, a case in point.)

Yet as the tricks are increasingly understood, flows will rotate out of fiat currency bonds into harder assets, including stocks, gold and crypto.

Bitcoin as the hardest asset will outperform everything.

These big shifts in macro regimes and flows often come with a lot of volatility as they induce uncertainty and challenge conventional investment wisdom. Yet we are witnessing a paradigm shift in the macro dynamic which will be an “aha moment” for investors in relation to Bitcoin

We started London Crypto Club to educate on the investment potential of Bitcoin as a result of this inevitable end game for the fiat system. We are rapidly reaching that end point as debt dynamics in major economies hit the exponential phase. Things are about to get crazy.

Native News

Key news from the crypto native space this week.

Asset Manager VanEck this week announced the upcoming launch of the VanEck Purpose Built Fund, a private digital assets fund that will invest in businesses building on Avalanche and launching tokens designed to create long-term value and utility. The Fund is expected to launch in June 2025 and will invest in liquid tokens and venture-backed projects—spanning industries that include gaming, financial services, payments and AI. It will typically invest around or after a Token Generation Event, with a fundamentals-first strategy focused on long-term outcomes. Idle capital will be deployed onchain through Avalanche-native real-world asset (RWA) products, including tokenised money market funds, to maintain liquidity while reinforcing the broader onchain economy.

Crypto exchange Kraken said on Thursday it is launching tokens of U.S. equities that will trade around the clock, giving non-U.S. investors exposure to high-profile companies such as Apple, Tesla and Nvidia. Tokenisation refers to the process of issuing digital representations of publicly-traded securities. Instead of holding the securities directly, investors hold tokens that represent ownership of the securities. The tokens called “xStocks” will enable customers in regions such as Europe, Latin America, Africa, and Asia to trade these tokenised assets 24/7, even when traditional markets are closed. This development is set to roll out in the coming weeks. Kraken’s xStocks tokens will be issued on the Solana blockchain and each xStock will represent a tokenised version of a real-world stock or ETF. Read more details from Kraken HERE.

Two Prime, an SEC-registered bitcoin investment advisor, announced that it has expanded its partnership with MARA Holdings, Inc., a leading energy technology company. MARA will allocate an initial 500 BTC to the firm's managed yield strategies as part of the deepened relationship. This builds on an existing partnership in which Two Prime provides BTC-backed loans to MARA. Alexander Blume, CEO of Two Prime said "MARA has one of the largest bitcoin corporate treasuries in the world, and they're setting the standard for how institutional holders can responsibly unlock its value. This expanded partnership is about more than just yield – it's about building a model for capital efficiency, transparency, and risk-aware innovation in digital asset management."

FIFA, the governing body of international soccer, is planning to migrate its FIFA Collect NFT collectibles platform to its own Avalanche Layer-1 blockchain. FIFA Collect, which allows users to purchase and trade NFT-based soccer highlights, was previously launched on Algorand and also issued some collectibles on the Ethereum scaling network Polygon. In April, the platform said it would leave Algorand and migrate assets to a new FIFA-centric blockchain, which is now confirmed to be powered by Avalanche. Francesco Abbate, CEO of Modex and FIFA Collect, said in a statement “This move enhances our ability to deliver unique digital collectibles and immersive fan experiences, powered by the speed, scalability, and EVM compatibility. That means seamless integration with popular wallets, easier access, and a future-proof foundation for growth."

Institutional Corner

Top stories from the big institutions

The outgoing US CFTC Commissioner Summer Mersinger said in an interview this week that perpetual futures trading in the US could receive regulatory approval “very soon.” She added “We’re seeing some applications, and I believe we’ll see some of those products trading live very soon” adding it would be “great to get that trading back onshore in the United States.” At the end of May, Mersinger will leave the CFTC to work at the Blockchain Association, a trade group with over 100 members that represents the crypto industry and economy. As reminder Crypto perpetuals are not currently permitted in the US and are traded on large offshore centralised exchanges, such as Binance, OKX, and Bybit. Binance is the largest with almost $95 billion in perpetual trading volume per day, according to CoinGecko. It offers over 500 crypto perpetual pairs with up to 125x leverage.

According to a report in the Wall Street Journal this week, some of the biggest US banks are exploring a team up to launch a crypto stablecoin. Companies owned by JPMorgan, Bank of America, Citigroup and Wells Fargo have discussed the possibility of jointly issuing a stablecoin. Those entities are Early Warning Services (EWS), which operates the peer-to-peer payment network Zelle, and The Clearing House (TCH), which handles real-time payments between banks. EWS is jointly owned by seven major US banks, including JPMorgan Chase, Bank of America, and Wells Fargo. TCH, meanwhile, is owned by two dozen of the world’s largest banks, also including those three. The future of the joint stablecoin project rests on regulatory clarity and market appetite. As of now, the most remarkable legislative effort in this space is the GENIUS Act, which aims to establish a framework for stablecoin issuance by both banks and nonbanks. The Act, short for the Guiding and Establishing National Innovation for US Stablecoins Act, just passed a critical procedural vote earlier this week and is currently in the Senate amendment phase. A full floor vote for the proposed legislation is expected to arrive in the coming weeks.

Hong Kong's Legislative Council passed the long-anticipated stablecoin bill this week, establishing a licensing regime for stablecoin issuers. In a council meeting Wednesday, lawmakers passed the "Stablecoins Bill" in its third reading, which mandates licensing from the Hong Kong Monetary Authority for issuers of fiat-referenced stablecoins. The Hong Kong government said in a statement that the Stablecoins Ordinance is set to come into effect this year, to "allow sufficient time for the industry to understand the requirements under the licensing regime." The HKMA said it plans to hold additional consultations on the detailed regulatory framework. Under the new regime, stablecoin issuers must meet requirements in key areas such as reserve asset management, redemption mechanisms, and client asset segregation. They are expected to maintain robust systems to stabilise token value and comply with anti-money laundering standards, counter-terrorist financing, risk management, and other regulatory requirements. Read the full announcement from the HK government HERE.

On Wednesday the Texas House of Representatives passed landmark legislation seeking to establish a Bitcoin reserve on its third and final reading, moving the state closer to officially adopting crypto as part of its treasury management. Senate Bill 21, a bipartisan-backed bill, garnered strong support across party lines. It now awaits a concurrence vote on House amendments before heading to Governor Greg Abbott's desk to be signed into law.

Charts of the Week

Because charts are just as important as macro.

Global options open interest has climbed to $56.5 billion notional, the highest since December 2024. BTC leads with 83.95% of total OI.

Among the top 5 chains by DEX trading volume, Solana, BNB Chain, and Ethereum command ~85% market share. Base and Arbitrum One have ~7-8% market share each.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Macro Researcher at CoinMarketCap

Director, Organic Growth at Crypto.com

Blockchain and Product Partnerships Manager at ChainLink Labs

Prime Financing Trading Analyst at Coinbase

Product Manager - B2B - Payments & Blockchain at Kraken

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.