Apologies for the short delay in posting this. Flew back from Dubai last night was met not by storms but London Underground delays!

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “The most succinct, easy to digest macro summary I have read in all crypto newsletters!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Lots to watch in the macro. We watch for a simmering in bond market volatility and easing of the dollar.

Crypto Native News: PV01 completes its first tokenised bond sale, Adidas teams up with Solana based fitness app Stepn.

Institutional News: UK government to put forward legislation for stablecoins, Hong Kong based Victory Securities discloses its BTC and ETH ETF fees., 4 millions digital yuan transactions taken place.

Charts of the Week: BTC correlation with the dollar drops, Bitcoin ETFs hold 851k BTC, 4.3% of circulating Bitcoin.

Top Jobs in Crypto: Featuring mids.capital, find.co, Priority Crypto, Zenith Asset Management, Kraken, Digital Asset and Copper.

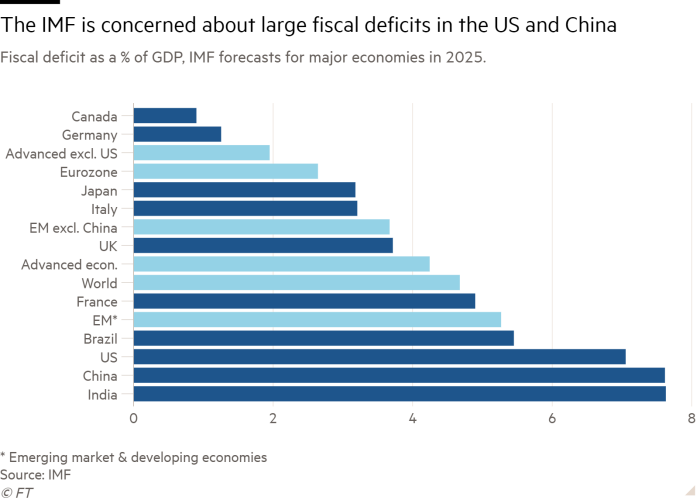

Macro Chart of the Week - The US deficit as a percent of GDP is expected to rank right next to China and India by 2025, bigger than countries like Brazil. Hat tip to Lisa Abramowicz for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

Bond Villain

Geopolitical uncertainty and hawkish central bank rhetoric saw US equities record their 3rd straight week of losses. With markets broadly de-risking, Bitcoin was also trading heavy, although encouragingly, flushes below 60k proved short lived and Bitcoin found some strength heading into the weekend and the much vaunted halving!

On the halving, whilst we continue to celebrate the transparent, predictable, deflationary policy of this global monetary network - which stands in contrast to the whimsical profligacy of the overlords destroying fiat currency - we don’t expect any immediate, significant impact. Rather, as with the ETF’s, the forces of this powerful demand/supply dynamic will impact over time, with previous post halving bull markets lasting anything from a year to 18 months. Bitcoin is currently up circa 550% since the last halving in May 2020 (h/t to the team at FRNT Financial) - we are still very early in this bull market 🚀

Moooar Government Spending…

As we suggested last week, knee jerk sell offs from Geopolitical unrest are typically short lived and are actually a positive risk factor given it leads to more government spending, increased liquidity and financial repression. Indeed, right on queue, with the increased tensions in the Middle East, the US this weekend passed a $95bn national security bill, predominantly to provide military aid to Ukraine and Israel. With those tensions now de-escalating in what seems an almost polite, face saving, tit-for-tat, the geopolitics looks set to play a lesser role in the week ahead.

Macro however is front and centre. A strong US retail sales print continued to point to a resilient economy and there was certainly a more coordinated line of messaging from the plethora of Fed speakers this past week, keen to push back on the timing for rate cuts. Encapsulated best by JPow himself when he said “recent data have clearly not given us greater confidence and instead indicate that it’s likely going to take longer to achieve that confidence.” Along with the ever increasing deficit, this continues to push up yields, with 10yr reaching highs of 4.69%.

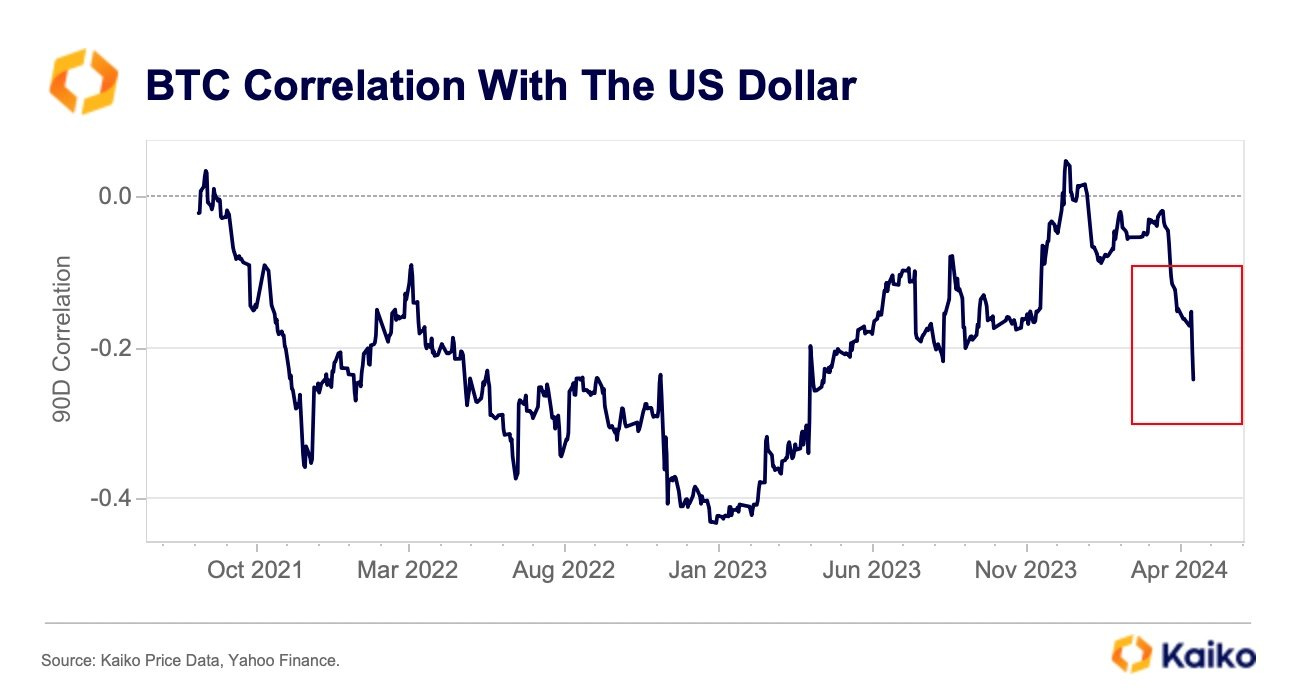

The dollar also continued to strengthen, reaching its highest levels since late October. Combined with the climb in yields, this is a big headwind for Bitcoin, particularly as it relates to liquidity. The dollar, as the global reserve currency, dominating most global transactions is like a lubricant for the global economy. A stronger dollar, all things equal, represents a tightening in global liquidity.

Bond volatility and liquidity…

Perhaps a bigger impact on liquidity however is interest rate volatility. Whilst we don’t think the absolute level of nominal rates is a large problem for Bitcoin and broader risk (especially when it comes in response to higher inflation) interest rate volatility as reflected by the MOVE Index (a measure of US treasury interest rate volatility) is.

The MOVE index spiked higher last week, peaking as US treasury yields peaked on Tuesday. This is important as treasuries are often the collateral that are used by markets to borrow and gain leverage to trade in stocks and other riskier investments. When bond volatility spikes, then a greater haircut is applied to that collateral, meaning less leverage is able to be taken against it, which means reduced liquidity in the system. Alongside the strengthening dollar, this has been a squeeze on stocks and also on Bitcoin.

The question then, is will this dynamic continue? We think not, given the international backdrop and central role the US plays in the global fiat economy. As we’ve previously described, the global economy is struggling under the weight of high US rates. In particular, Asia is feeling the full effects of the dollar wrecking ball. With China and Japan battling severe currency weakness, they need the US to help contain rates and keep a lid on the dollar. Without that, to defend their currencies, they are forced to sell their USD reserve assets (namely Treasuries) to raise the dollars to sell and purchase their domestic currency. This creates a vicious circle, driving US yields higher, reinforcing the stronger dollar.

This wouldn’t be such a problem if the US, battling a spiralling deficit, weren't also concerned about the level of domestic yields and the problems caused by Treasury market instability. It was noteworthy then, that last week, during the IMF/World Bank meetings in Washington, Janet Yellen joined with the Japanese and South Korean finance ministers to jointly express their concern over recent dollar strength against the JPY and KRW, saying they would “consult closely on foreign exchange developments.” Typically, when Yellen expresses concern on the dollar and US treasury market, it marks a turning point in both the dollar and yields.

Heading into this week then, a simmering in bond market volatility and easing of the dollar will be important pre-conditions for Bitcoin to regain momentum and challenge new highs.

As the US continues to run unchecked fiscal deficits, it remains hard to be too bearish on broad risk and certainly Bitcoin. Currently however, with key moving averages rolling over, CTA, momentum based funds are “mechanically” triggered to sell and we see these indiscriminate waves of selling periodically in the US trading session. Stability will require “real buyers” to step in and off-set those flows, turning the market and broad risk, including Bitcoin, positive. A softer dollar and becalmed bond market volatility will play a key role, but it looks like this correction may well be done. Bears, be warned!

Native News

Key news from the crypto native space this week.

Tokenisation company PV01, helmed by founders of crypto market maker B2C2, has completed its first tokenised bond sale under English law. The asset was a tokenised version on the Ethereum blockchain of a single U.S. Treasury bill worth $5 million issued on April 8 and redeemed a week later, with market makers B2C2, BlockTower Capital and Keyrock investing in PV01's "proof-of-concept" issuance. The company "hopes" to facilitate a tokenised corporate bond sale of a crypto firm "in the next few months.”

Shoe and sports apparel giant Adidas announced on Monday that it is teaming up with the Solana-based fitness app Stepn. The partnership will start with a batch of 1,000 NFTs called the Stepn x Adidas Genesis Sneakers collection. It's based on some of Adidas's "most iconic running silhouettes." Stepn said in its statement "This genesis collection is the first of a series of co-branded activities between Stepn and Adidas over a one-year partnership that will see further NFT drops and physical, wearable items on the roadmap."

Institutional Corner

Top stories from the big institutions

Speaking at the Innovate Finance Global Summit, Economic Secretary Bim Afolami said the U.K. government is set to put forward legislation for stablecoins as well as for crypto staking, exchange and custody by June or July. Afolami said "We are now working at pace to deliver the legislation to put our final proposals for our regime in place," "Once it goes live, a whole host of crypto asset activities, including operating an exchange, taking custody of customers’ assets and other things, will come within the regulatory perimeter for the first time."

Hong Kong-based investment firm Victory Securities has reportedly disclosed its proposed fees to investors for Bitcoin and Ethereum exchange-traded funds (ETFs) following the recent approval of cryptocurrency ETF products within the region. It’s worth noting however, that the Hong Kong Securities and Futures Commission (SFC) has not yet published the list of approved ETF issuers. If approved by the SFC, Victory Securities' customers will face proposed fees for Ethereum and Bitcoin ETF shares in the primary market, set at 0.5% to 1% of the total transaction, with a minimum fee of $850, according to an extract of a translated report.

Yi Gang, governor of the People’s Bank of China, said this week that over 4 million transactions totalling more than 2 billion yuan ($299 million) have been conducted using China’s digital yuan. Speaking at the Hong Kong Fintech Week conference on Monday, Yi said the COVID-19 crisis has also accelerated the need for contactless banking, creating challenges for central banks looking to balance consumer needs and safety. That said, the central banker also played down the prospect of an imminent launch, saying the digital yuan project is still in the early stages.

Charts of the Week

Because charts are just as important as macro.

Last week $BTC's 90-day correlation with the Dollar Index dropped to a negative 0.24, its lowest level in over a year. Hat tip to Kaiko Data for the chart.

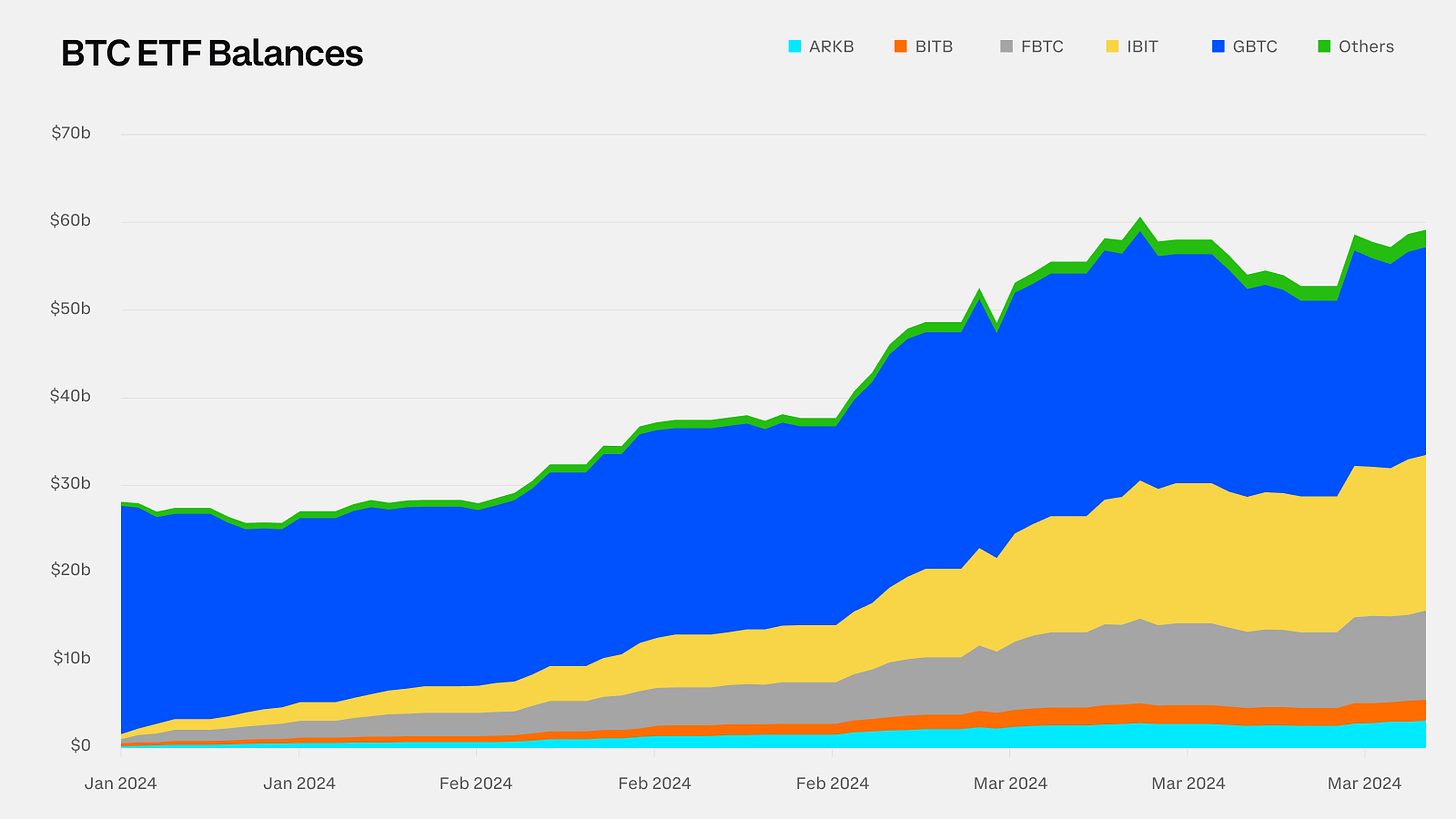

Bitcoin ETFs hold 851k BTC, 4.3% of circulating Bitcoin. After strong starts with inflows up to $2.5B, there's a slowdown since March. Hat tip to Glassnode for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Business Development Manager at mids.capital

Director of Business Development - Crypto at find.co

Social Media Manager at Priority Crypto

Crypto Product Specialist at Zenith Asset Management

Deal Lead, Business Development at Kraken

Product Design Manager at Digital Asset

Middle Office Associate at Copper

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.