Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “The most succinct, easy to digest macro summary I have read in all crypto newsletters!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Important update this week. The game is being played as global leaders manage the trade off between unsustainable debt levels and growth, whilst also trying to maintain monetary credibility and confidence in their respective currencies. The mirage is fading.

Crypto Native News: Buterin issues a call-to-action for Ethereum developers, Base setting record DEX volumes.

Institutional News: The UK's Treasury Technology Working Group published a new report on the potential use cases of fund tokenisation, Taiwan close to regulating crypto, Insurance broker Marsh provides digital asset custody insurance,

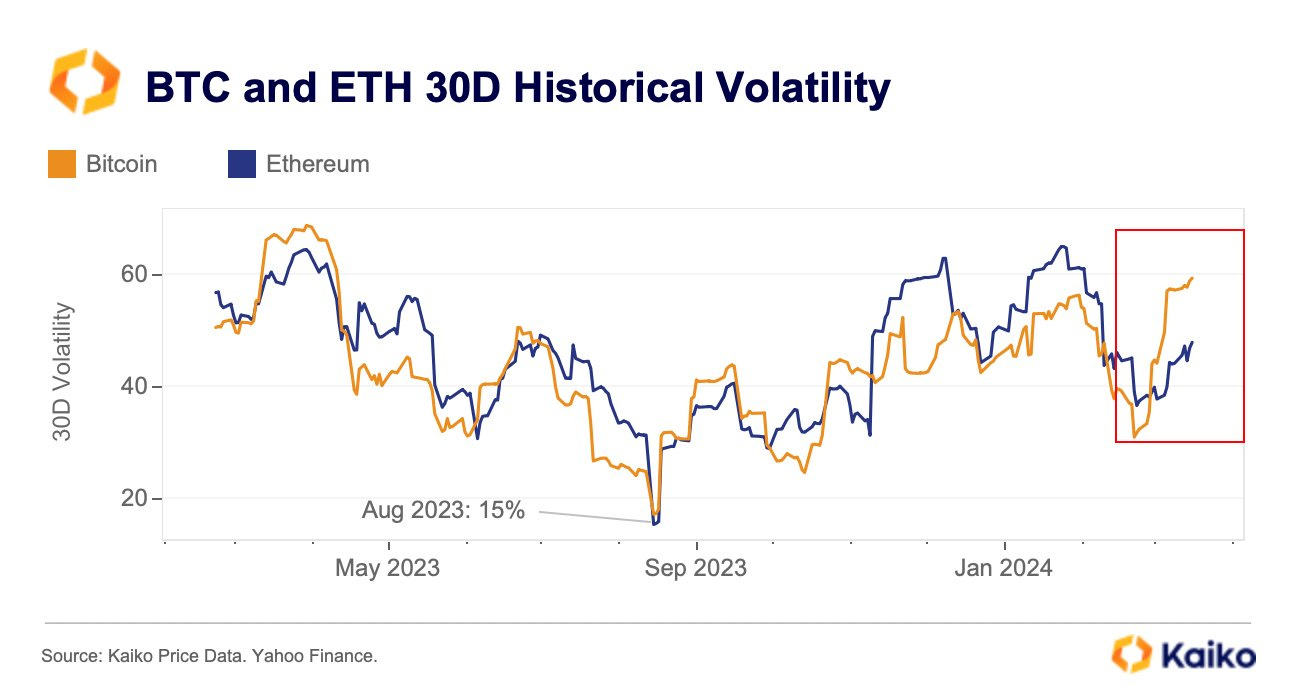

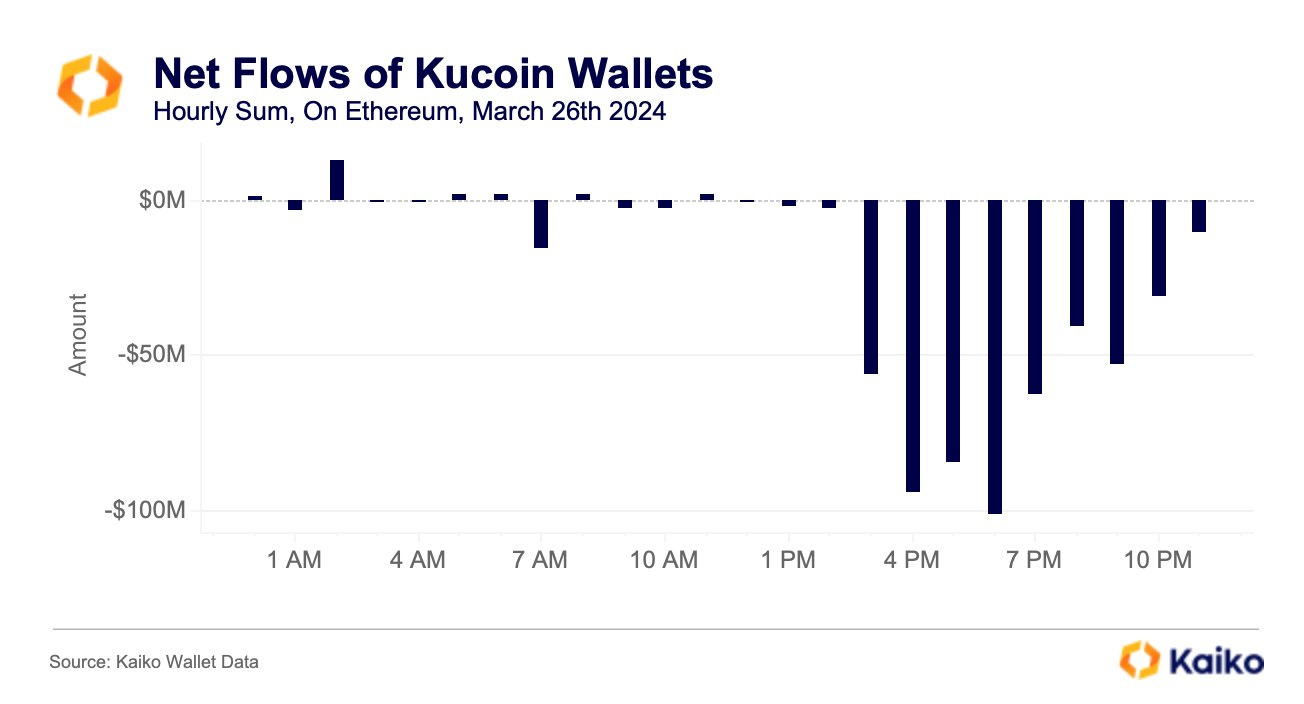

Charts of the Week: Bitcoin realised vol surpasses Ethereum, Kucoin sees significant outflows.

Top Jobs in Crypto: Featuring CryptoRecruit, Ledger, The FCA, Bruin, Fireblock and CryptPro.

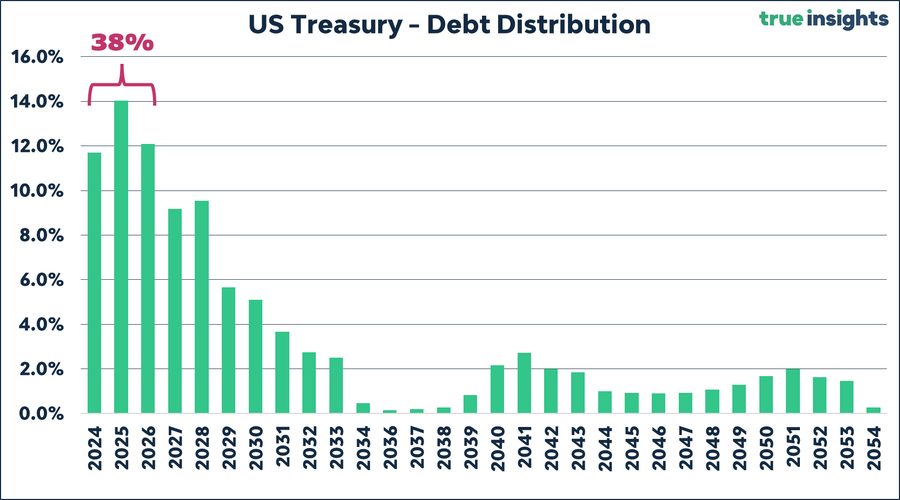

Macro Chart of the Week - The US Treasury has to refinance 38% of all of its outstanding debt within three years, with (net) interest payments already heading to 5% of GDP. Hat tip to Jeroen Blokland for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

The Global Monetary Debasement Game

A relatively subdued, holiday shortened week of trading to close out a strong Q1 for both crypto and equities. Our bullish thesis that ran throughout 2023, which we expected to grow stronger in 2024 continues to unfold nicely and we anticipate stronger gains for both crypto and equities throughout the rest of the year.

Ultimately, the Macro regime shift from the sharpest tightening cycle in recorded history, towards a global rate cutting cycle and rising liquidity will act as a persistent tailwind to keep risk assets moving higher. Meanwhile, with the AI boom set to accelerate the secular growth story in tech, a market so accustomed to mean reversion has been left dumbfounded, slow to adjust to an exponential trend. No more is that exponential trend apparent than in Bitcoin, where many keep trying to call the top, yet we’re still very early in the bull cycle. Things get a lot crazier from here 🚀

The push back we receive to our view that a heavily indebted fiat system is unable to handle this level of real rates, is the apparent resilience of the US economy. Yet the period of monetary dominance has been quietly replaced by fiscal dominance. The US is effectively printing $1trn of deficits every 90 days. This is insane 🤯. Currently this has been financed via the reverse repo drawdown, as the US Treasury pivoted to issuing debt via shorter dated T-bills to tease that excess cash parked at the Fed back into the system.

Financial repression…

As that runs down, the Fed plan to simultaneously taper QT and plans are being made to incentivise banks to use their huge reserve holdings to start buying treasuries, making them exempt from the supplementary leverage ratio calculation (in short, banks won’t have to hold capital against their treasury holdings.) The Fed also appears to have pivoted to a higher, inflation range target, allowing them to keep real rates artificially low. Eventually of course, once QT ends, we will once again see the return of Fed balance sheet expansion.

All of this is a form of financial repression and ultimately, we are witnessing default by the stealth debasement of fiat currency. Increasingly, Bitcoin is being viewed as the hardest asset which protects savers from this erosion of wealth. It’s quite significant to now have titans of finance such as Blackrock’s Larry Fink also highlighting the need to protect ourselves against an unsustainable fiat system. We’re still so early on the Bitcoin adoption path and as the US debt spiral continues uncontrollably, with the ETF’s making it easier to now own Bitcoin, that adoption is set to accelerate.

China QE…

These problems aren’t unique to the US. Indeed, the other 2 of the 3 largest economies in the world, China and Japan, are also struggling to keep their failing fiat systems afloat. This week, after the markets saw through Japan’s feeble attempts to “tighten” policy, the JPY hit new 34 year lows, sparking fevered verbal intervention to try and strengthen the currency.

China meanwhile uncomfortably needs to let their currency slide to maintain competitiveness with Japan at a time when the Chinese economy is in a deflationary spiral and trying to manage a sprawling property crisis.

Indeed, perhaps the biggest news this week was an article that circulated in the Chinese press that President Xi has instructed the Central Bank to “enrich the monetary toolbox” and start buying China Treasury bonds in its open market operations, something they have not done in 2 decades. The comments from Xi were actually made in October and no bonds have been purchased in the 5 months since, but the fact the story is circulating in a tightly controlled media, suggests that China is now readying their own form of QE to unleash a new liquidity wave onto markets. Gold certainly seemed to get the memo on Thursday!

Several big banks have been quick to dismiss this as being QE, much like we saw in the semantic discussions over Fed interventions during last year's regional bank crisis. Yet it’s all a form of liquidity injection and financial suppression to keep assets artificially inflated, yields artificially low. Fiat currency will of course be the escape valve. Bitcoin the escape route.

The global monetary game…

It will be interesting to monitor the outcome of Yellen’s April visit to China. In a December speech, Yellen said her priorities in 2024 included greater transparency on China’s “foreign exchange practices” and planning on joint management of any future possible global banking crisis. We fully expect the message Yellen will return with is that Fed rates are making life difficult across Asia and if the US wants their two biggest foreign buyers of treasuries to keep helping fund the US debt spiral, they need to lower rates and help keep the dollar weaker.

Whilst macro bears continue to be frustrated by the Fed’s dovishness in the face of sticky inflation and resilient growth (Friday’s Core PCE inflation ticked down to 2.8%, JPow described that as “in line with what we want to see” to begin rate cuts) there’s a much bigger more important game being played as global leaders manage the trade off between unsustainable debt levels and growth, whilst also trying to maintain monetary credibility and confidence in their respective currencies. The mirage is starting to fade.

With these global financial strains percolating, new capital flowing into Bitcoin via the ETF’s and the Bitcoin halving ahead, this is no time to mid-curve this bull market. Now month and quarter end positioning adjustments are out of the way, we expect an explosive April to see Bitcoin take the next leg higher, beginning its ascent to 100k. We’re just warming up here 🚀.

Native News

Key news from the crypto native space this week.

In a blog post this week, Ethereum chief scientist and founder Vitalik Buterin issued a call-to-action to Ethereum developers, urging them to begin building applications aspiring to support “millions” of users. Buterin said that the massive fee savings that Dencun unlocked on Layer 2 scaling networks, means mainstream dApps targeting non-financial use cases are now possible. Buterin described Dencun as the most significant Ethereum upgrade since The Merge, which transitioned the network to Proof of Stake consensus in September 2022. He said “As of two weeks ago, the two largest changes to the Ethereum blockchain — the switch to Proof of Stake, and the re-architecting to blobs — are behind us.”

Coinbase Ethereum layer-2 network Base continues to set new trading volume records on decentralised exchanges. On March 30, Base recorded $1.21 billion in DEX trading volume, up 25% from the previous day’s $959.63 million. Most of the trading activity occurred on Uniswap, which accounted for 64.3% of the volume, followed by Aerodrome Finance at 9.7% and SharkSwap at 7.8%. Daily active users continue to climb and are pushing towards 200,000. Over the past six weeks, there has been an average of 667,765 weekly active users.

Institutional Corner

Top stories from the big institutions

The Technology Working Group of the UK's Treasury, the government's economic and finance ministry, has published a new report on the potential use cases of fund tokenisation. The report explored the use of tokens as collateral for money market funds and the role tokenised funds could play in the onchain investment market. The report outlined how the UK funds industry can effectively leverage tokenisation's potential for the asset management sector and detailed how firms operating within the UK can adopt a foundational tokenisation model. Furthermore, it explained various use cases demonstrating how this model could enhance firms' business operations, such as optimising money market fund collateral management. Read the full report HERE.

Taiwan is coming closer to regulating crypto. Taiwan’s Ministry of the Interior has approved the application from the local cryptocurrency industry to form an industry association. The local crypto industry working group, formed last year in preparation for establishing an industry association, said in a notice on Friday that it received the go ahead from the government for the application. Requirements from the government means the working group needs to finish all preparation work and officially establish the crypto industry association by the end of June. The working group currently comprises 22 crypto firms, including major exchanges in Taiwan such as MaiCoin and BitoPro.

HSBC launched tokenised gold products for retail clients in Hong Kong this week. In its statement HSBC said retail customers can access the HSBC Gold Token via online banking and the bank’s mobile app. “The launch marks the first time HSBC's private distributed ledger is being used to tokenise a retail investment product.” The bank built the HSBC Gold Token with its digital assets platform, HSBC Orion, and has previously launched digital bonds in Hong Kong and Luxembourg.

Insurance broker Marsh has introduced a digital asset custody insurance product providing capacity up to $825 million, the largest facility of its kind. Marsh said its new insurance product will support organizations with digital assets held offline in cold storage, as well other custody solutions such as Multi-Party Computation (MPC), where cryptographic keys are split into shards. Jacqueline Quintal, Global Digital Asset Leader said “Marsh’s facility provides custodians with protection for the key operational risks they face in the management of digital assets; we look forward to supporting clients globally in aligning their risk financing and evolving commercial strategies, as they focus on building their operational resilience and market presence in this fast-growing sector.”

Charts of the Week

Because charts are just as important as macro.

Bitcoins 30-day realised volatility hit 60% last week and has been surpassing Ethereum’s since February.

Kucoin saw significant outflows in after the US Department of Justice's indictment on March 26.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Quantitative Trader via CryptoRecruit recruiters

Senior Manager Product Marketing at Ledger

Payments Policy Development Manager at the FCA

Legal Counsel Digital Assets at Bruin

VP Product Marketing at Fireblocks

Quantitative Trader at CryptPro

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.