Welcome to the new subscribers that have joined us over the last week.

The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week, across both macro and crypto.

As always, our only ask is that you share this with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: Banking pressures persists, feels like we’re knocking at the door for the next leg lower in yields.

Crypto Native News: Coinbase launches its International Exchange, and release their Q1,23 Financials, CEX volume falls in April, Stripe launches fiat-to-crypto on ramp and Ethereum is already looking ahead to its next network upgrade.

Institutional News: The White House CEA looking to tax crypto mining, Joe Bidens administration also releases a strategy document focusing on setting standards for “critical and emerging” technologies, A16z provides a response to the UK Treasury Crypto consultation paper and investment manager Hamilton Lane offers tokenised access to one of its funds.

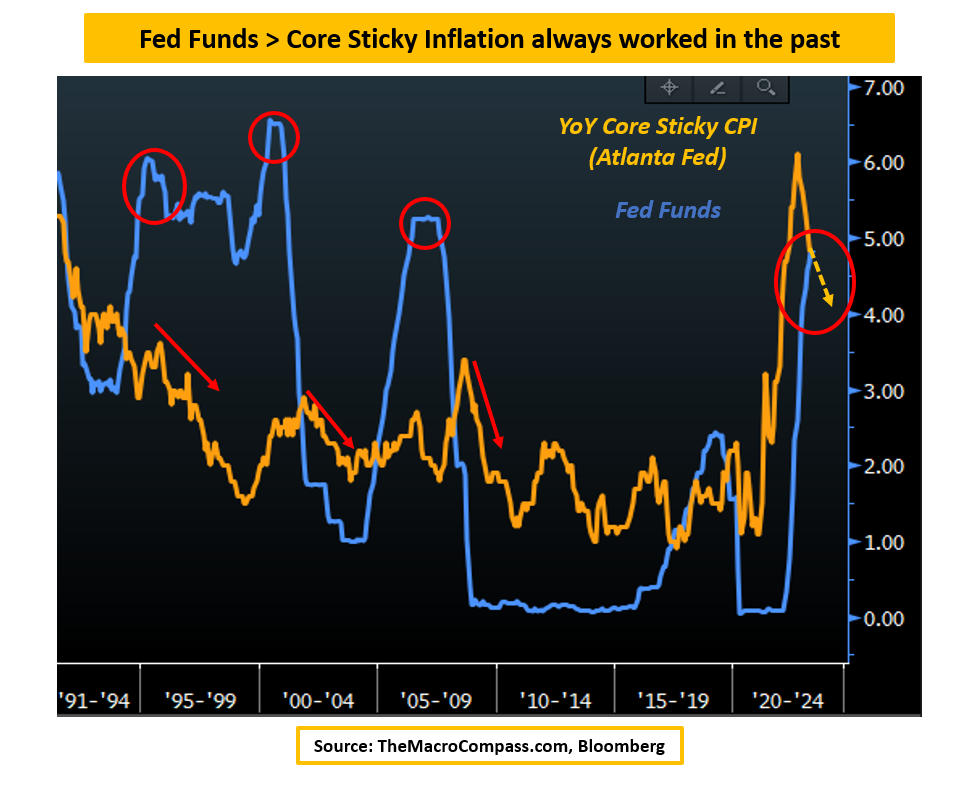

Chart of the Week: Every time Fed Funds were raised above the levels of core sticky inflation, policy turned out to be restrictive enough to cool inflationary pressures.

Top Jobs in Crypto: Featuring Hivemind, Elwood, Ripple, Aaro Capital, the FCA and Coinbase.

Macro Update

Were macro at heart, this where we connect the dots between macro and crypto.

A week packed with macro data was once again dominated by focus on the banking sector as First Republic Bank (FRC) became the second largest bank failure in history. Having been taken into FDIC receivership, JP Morgan assumed the bank's $173bn customer loans and $92bn of deposits, whilst FRC’s equity and bond holders were wiped out.

Another crisis averted…or merely postponed. Perhaps ironically, whilst all uninsured deposits were taken into the “too big to fail” safety of JP Morgan, it leaves unanswered the question of the safety of uninsured deposits at other regional banks, for which there is still no explicit guarantee. The “deposit walk” continues in the meantime, with unadjusted deposit outflows of over $360bn in the 3 weeks leading into May. Money market fund inflows accelerated $47bn this past week suggesting the drain continues.

Regional bank stocks were hit hard as markets looked for the next shoe to drop. PacWest and Western Alliance under significant pressure, with PacWest said to be weighing strategic options, including a sale. These banking issues are not going away when the driver is simply that Fed rates are too high for the banking system to handle. Either Fed rates will need to be aggressively cut, or the Fed’s balance sheet is going to explode as they ultimately become the lenders of last resort.

Back to the data and despite the Fed induced bank stress, the Fed hiked 25bps on Wednesday as expected, although signalled a pause in dropping the phrase “some additional policy firming may be warranted.” In the press conference, JPow firmed up expectations for a pause in highlighting the extent to which they’ve already tightened, bringing them “closer, or maybe even there” to the terminal rate.

The ECB was the other major Central Bank in action and slowed its pace of hikes to 25bps, lifting the refi rate to 3.25%, despite some calls for another 50bps. In a slightly more hawkish twist however, they also announced an end to re-investments of the proceeds of bonds bought during QE, which will shrink the bond portfolio at a pace of EUR 25bn a month, up from 15bn. Lagarde was at pains to stress the plan to keep hiking - “we are not pausing, that is very clear” - although it remains significant that the pace of hikes is slowing which ultimately leads us to the pause.

US Non Farm Payrolls was the other big release of the week and once again came in stronger than expected, rising 253k Vs the 185k consensus. The unemployment rate fell to 3.4% from 3.5% and average hourly earnings ticked up to 4.4% from 4.3%. Sizeable downward revisions however muddying the waters, with the March estimate revised down from 236k to 165k and Feb also lower from 326k to 248k. We know that employment is the most lagging of indicators on the economy and also, during downturns, are systematically over-stated given the assumptions made when making adjustments.

How has this left markets?

With banking stress and the expected credit driven slowdown, markets are still pricing 75bps of cuts from current levels by year end. 2yr US yields, ending the week 8bps lower (although at one point were 35bps lower as regional banks hit their lows) The peak rates dynamic then continues to provide a supportive tailwind and with the on-going bank stress, feels like we’re knocking at the door for the next leg lower in yields. The dollar also sits precariously near the year lows. Gold touched new all time highs on Thursday and the Nasdaq is threatening a break to new year highs. Cross-asset correlations aligning, but just need a catalyst to finally break us into new ranges and out of this range bound lethargy for crypto majors. The on-going banking stress looks set to be the trigger. The pressure is building.

Native News

Key news from the crypto native space this week.

This week, Coinbase announced the launch of Coinbase International Exchange. The new venture follows regulatory approval from the Bermuda Monetary Authority (BMA), and the new exchange will initially offer Bitcoin and Ethereum perpetual futures. Coinbase said “Our international expansion drive will focus on high-bar regulatory jurisdictions” Coinbase said it is committed to the U.S., but observed that countries worldwide are increasingly moving forward with responsible, crypto-forward regulatory frameworks as they attempt to position themselves as crypto hubs. “We would like to see the U.S. take a similar approach instead of regulation by enforcement, which has led to a disappointing trend for crypto development in the U.S. Coinbase said trades on the Coinbase International Exchange will be settled in USD Coin (USDC), and that the new exchange will have several security features, including real-time 24/7 risk management, dynamic margin requirements, and rigorous compliance standards.

Staying with Coinbase, they released their Q1 2023 financials this week. reported Q1 revenue of $773 million, exceeding analyst estimates of $655 million and up from Q4 revenue of $629 million. The company reported an adjusted loss of $0.34 per share, compared to an analyst estimate for a loss of $1.45 per share and a narrowing from Q4’s loss of $2.45 per share. Trading volume came in at $145 billion versus analyst estimates of $147.7 million for the quarter. Trading volume was roughly $146 billion in the fourth quarter. Coinbase shares rose around 8% in the hours after the release on Thursday, to $53 per share. See the full release from Coinbase HERE.

According to Blockchain data provider Kaiko, trading volume on centralised exchanges have fallen in April after 3 consecutive months of gains. April volumes were almost half of those in March at around $500bn. It’s the lowest volume month so far this year. Some suggest the majority of the decrease is due to Binance adding back fees on BTC pairs, though Binance remains the market leader with a dominance of 71.6%. Binance average 24 hour trading volume is around $10bn, larger than its nearest rival Coinbase at $1.1bn.

Stripe, one of the largest financial infrastructure platforms for business, announced the launch of Stripe-hosted fiat-to-crypto onramp making it easier for Web3 companies to help US based customers purchase crypto. Stripe is opening up the on ramp to users that joined the waitlist over the last few months. Read full details HERE.

Despite Ethereum’s Shapella upgrade going live just three weeks ago, the Ethereum Foundation is already looking ahead to the network’s next upgrade, known as Dencun. According to a blog post from Ethereum Foundation community manager Tim Beiko this week, Ethereum’s core developers are already in “the final stages of planning” for Dencun. The primary update included in Dencun is EIP-4844, also known as “Proto-Danksharding” or “The Surge.” Researchers anticipate the update will significantly reduce the costs associated with transacting on Ethereum Layer 2.

Institutional Corner

Top stories from the big institutions.

According to an online post by the White House’s Council of Economic Advisers (CEA), US President Joe Biden is looking to impose a punitive tax on crypto mining operations for the “harms they impose on society”. They make the case for a US tax equal to 30% of a mining firms energy cost. According to the CEA’s description of the tax it calls the Digital Assets Mining Energy Tax, they say “Currently, crypto mining firms do not have to pay for the full cost they impose on others, in the form of local environmental pollution, higher energy prices, and the impacts of increased greenhouse gas emissions on the climate. Read the full post from the White House HERE.

The Biden administration has released a strategy document focusing on setting standards for “critical and emerging” technologies such as blockchain and digital ID. The administration of United States President Joe Biden released a national standards strategy for critical and emerging technologies on 4 May. The strategy stated that the U.S. would prioritize standards development in eight areas. Among the prioritized areas are “digital identity infrastructure and distributed ledger technologies, which increasingly affect a range of key economic sectors.” Read the full report HERE.

As we highlighted a few weeks back, the UK Treasury launched a consultation paper which introduced a new crypto regulatory framework. A16z Crypto provided a response to the paper and urged the UK to take a “more nuanced” approach to the regulation of crypto assets. The VC firm said in a letter to the Treasury that "A 'one-size-fits-all' approach to the regulation of cryptoasset transactions would not be consistent with the Treasury’s core design principle of 'same risk, same regulatory outcome” The venture firm argued that regulatory frameworks should include a "principles-based analysis" that considers whether or not the very structure of a given platform or protocol has already mitigated possible risks. More specifically, a16z crypto said that regulations should not unnecessarily hinder a project from decentralising.

Hamilton Lane, the investment-management firm with $832 billion in assets under management, is offering tokenised access to a second fund. The access is provided through a feeder fund from Securitize on the Polygon blockchain. The firm is making a portion of the Senior Credit Opportunities (SCOPE) Fund, launched in October, available through the Securitize feeder fund. The feeder is the second of three tokenised funds Hamilton Lane announced last year. Tokenized access was opened for the Hamilton Lane Equity Opportunities Securitise Fund V in January.

Chart of the Week

Because charts are just as important as macro.

Hat tip to Alfonso Peccatiello for this great chart. Over the last 30+ years, every time Fed Funds (blue) were raised above the levels of core sticky inflation (orange), policy turned out to be restrictive enough to cool inflationary pressures back to 2% or below.

See more from Alf HERE

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Senior Crypto Operations Analyst at Hivemind

Treasury Operations Digital Assets at Elwood

Senior Manager, Quant Trader at Ripple

Sales Support Coordinator at Aaro Capital

Lead Associate in Crypto Asset Policy at the FCA

International Derivative Exchange Lead at Coinbase

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.