We’re hosting our first meet up in the city of London this week to celebrate our collaboration with Blue Coast Capital. If you’re around on Thursday night and want to meet some of your peers in institutional crypto trading, come along !

You can sign up at this link ——> PARTY

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

If you find this newsletter useful, we’d like to ask a favour. Could you share it with just 1 person you think might learn something from it. Thank you !

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: The slowing global growth backdrop continues to reinforce our view that the major central banks are done hiking, instability in the Middle East is potentially negative for oil supply and oil prices have bounced, yet war typically provides the cover for the US to pursue more expansionary fiscal and monetary policy.

Crypto Native News: Ripple obtains its a digital asset license from MAS, Deribit announces the launch of new currencies for crypto options trading and JP Morgan releases a report on Ethereum.

Institutional News: Think tank Policy Exchange publishes a report on Web3 with 10 proposals for the UK government, ESMA releases a consultative paper on MiCA, UBS Asset Management launches a pilot of a tokenised money market fund and Bank of Korea launches a CBDC test with the BIS.

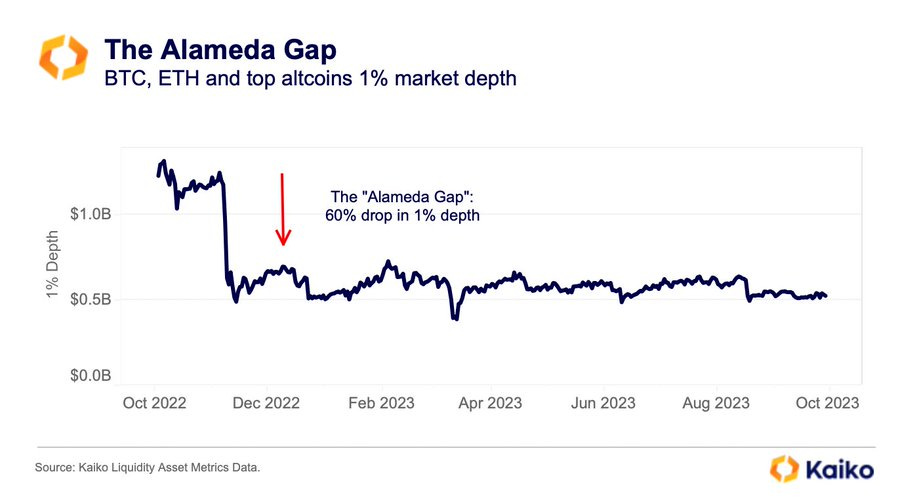

Chart of the Week: Post FTX liquidity still impaired.

Top Jobs in Crypto: Featuring Crypto.com, Ripple, Fireblocks, Unlimit, DWS Group and Galaxy.

Macro Update

This is where we connect the dots between macro and crypto.

Risky Business

The bond bloodbath continued to dominate market attention last week, with 10yr yields hitting highs of 4.89% and the 30yr yield above 5% post non farm payrolls, before sharply reversing.

Non farm payrolls showed the US added a huge 336k jobs last month and the headline print drove a spike to new year highs in yields. However under the hood, the picture was more nuanced with softer earnings at 4.2% and unemployment flat at 3.8%. Divergence with the household survey which pointed to just 86K jobs also added some doubt to the headline print and yields and the dollar reversed lower, providing relief to a market that has felt suffocated.

Also providing relief, oil fell nearly 10% on the week with data showing a sharp decline in US gasoline demand to the lowest seasonal level in 25 years. Signs that the US service sector is slowing, with the ISM at at 53.6 (down from 54.5) and new orders falling, also helping to allay fears of a reflationary rebound. Composite PMI’s in Europe meanwhile, were firmly in contraction territory.

This slowing global growth backdrop continues to reinforce our view that the major central banks are done hiking. The bond sell off continues to be driven in large part by the rising term premia (the extra yield demanded by investors to hold longer dated debt) in the US amidst heavy supply. Bitcoins resilience is coinciding with question marks over the sustainability of US debt. The run up in US yields is also doing a lot of the tightening, so the Fed doesn’t have to and they appear to be growing increasingly concerned by the bond market moves (yield curve control anyone?)

With the reversal in the US dollar and yields, a goldilocks backdrop looked to be forming for Bitcoin heading in the weekend, until the devastating news of the Hamas attacks on Israel.

The situation in Israel remains fluid and we won’t speculate here on outcomes. Much of what it means for markets will depend on the extent of escalations and which countries get directly involved.

Clearly, instability in the Middle East is potentially negative for oil supply and oil prices have bounced some 4% as a knee jerk response. US treasuries will receive a safe haven bid to help yields lower, but that’s off-set by higher oil (inflationary) and the prospect of the US involvement in another war, blowing out an already spiralling US deficit.

General uncertainty is bad for risk taking and the first response is to reduce risk positions, especially high beta risk like Bitcoin (and especially your alt bags crypto bros!). However, typically we fade geo-political uncertainty from a risk point of view. The S&P500 was trading circa 4% higher a week after Russia invaded Ukraine, Bitcoin was almost 20% higher.

Oil will be the key asset to keep an eye on as a continued move higher will spark stagflationary fears, reinforcing the “higher for longer” funk that has kept us range bound in Bitcoin for months.

Yet war typically provides the cover for the US to pursue more expansionary fiscal and monetary policy whilst a further straining at the fabric of international relations continues to undermine confidence in global institutions. Caution is warranted, yet the underlying bullish macro story for crypto into Q4 is unfolding nicely.

Want to know what the politicians think about Crypto ?

This week I watched Lisa Cameron MP speak at the Zebu Live Conference.

Check out what she had to say HERE.

Native News

Key news from the crypto native space this week.

This week, Ripple obtained a digital asset license from the Monetary Authority of Singapore. Ripple received the Major Payments Institution (MPI) license allows the firm to offer regulated digital asset token services in the country. Ripples CEO Brad Garlinghouse said “Since establishing Singapore as our Asia Pacific headquarters in 2017, the country has been pivotal to Ripple’s global business. We have hired exceptional talent and local leadership, doubling headcount over the past year and plan to continue growing our presence in a progressive jurisdiction like Singapore,” “Under MAS’ leadership, Singapore has developed into one of the leading fintech and digital asset hubs striking the balance between innovation, consumer protection and responsible growth.”

As part of its expansion in Europe, crypto options exchange Deribit will offer crypto options on more coins. From January 2024, Deribit will offer options on Solana’s SOL, Ripples XRP and Polygons MATIC. Deribit is also applying for brokerage licenses in Europe.

According to a report this week from JP Morgan, the rise of Ethereum staking since major network upgrades, the Merge and Shanghai, has come at the cost of higher centralisation and lower staking yields. The top five liquid staking providers: Lido, Coinbase, Figment, Binance and Kraken, control over 50% of staking on the Ethereum network, JPMorgan analysts noted in the report, adding that Lido alone accounts for almost one-third. The report says that the crypto community has seen the decentralised liquid staking platform Lido as a better alternative to centralised staking platforms associated with centralised exchanges like Coinbase or Binance. However, in practice, “even decentralised liquid staking platforms involve a high degree of centralisation”. Lido’s node operators get selected by Lido’s decentralized autonomous organization (DAO), which is controlled by a few wallet addresses, “making Lido’s platform rather centralized in its decision making autonomous organisation (DAO), which is controlled by a few wallet addresses, “making Lido’s platform rather centralised in its decision making.

Institutional Corner

Top stories from the big institutions

This week, Policy Exchange, an independent think tank, published a report on Web3 with 10 proposals for the U.K. government, which it claims would help the country improve Web3 regulation. The United Kingdom has an opportunity to capitalise on the departure of Web3 firms leaving the United States due to regulatory uncertainty. But to achieve that, the U.K. will need to follow its own regulatory path. The report also suggests the principal U.K. financial regulator, the Financial Conduct Authority (FCA), loosens its current Know Your Customer (KYC) approach, allowing for the use of “alternative and innovative techniques,” such as digital identities and blockchain analytics tools. Read the full report HERE.

This week the European Securities and Markets Authority (ESMA), the European Union’s markets regulator, released a second consultative paper on Markets in Crypto-Assets (MiCA) regulation. ESMA is seeking stakeholders’ input on five areas of MiCA, including sustainability indicators for distributed ledgers, disclosures of inside information, technical requirements for white papers, trade transparency measures, and record-keeping for crypto-asset service providers (CASPs). Read the full detail from ESMA HERE.

UBS Asset Management, one of the world's largest funds, has launched its first "live pilot" of a tokenised money market fund on the Ethereum blockchain. The pilot allows UBS Asset Management to test various fund activities on-chain, including subscriptions and redemptions. UBS has utilized its in-house tokenization service, UBS Tokenize, to launch the pilot of the fund. Thomas Kaegi, head of UBS Asset Management in Singapore and Southeast Asia, said in a statement "This is a key milestone in understanding the tokenization of funds, building on UBS's expertise in tokenizing bonds and structured products," "Through this exploratory initiative, we will work with traditional financial institutions and fintech providers to help understand how to improve market liquidity and market access for clients." Read the full release from UBS HERE.

On Wednesday, the Bank of Korea announced that it plans to begin a wholesale central bank digital currency test in partnership with the Bank for International Settlements (BIS) and other institutions. The pilot will test whether a wholesale CBDC can be used as a settlement asset for commercial bank tokenized deposits. The scheme will also experiment with the programmability of tokenized deposits. The initiative will involve BIS researchers partnering with South Korea's central bank, with oversight provided by South Korean financial regulators, the Financial Services Commission (FSC), and the Financial Supervisory Service (FSS). The BoK has already conducted retail CBDC trials but determined that a retail CBDC is not currently necessary due to the efficiency of the Korean payment landscape. See the full release HERE.

Chart of the Week

Because charts are just as important as macro.

Liquidity still impaired.

A week after FTX collapsed, liquidity in the major pairs more than halved. Market depth in the majors is still half of what it was pre-collapse.

Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

OTC Sales Trader at Crypto.com

Business Development Representative at Fireblocks

Risk Manager Digital Assets at DWS Group

Regulatory Compliance Specialist at Galaxy

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.