Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “The most succinct, easy to digest macro summary I have read in all crypto newsletters!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Watching the currencies in Japan and China aswell as Powell and Yellen this week. What does it all mean for bitcoin?

Crypto Native News: MicroStrategy could qualify for inclusion in the S&P500, Talos acquires Cloudwall.

Institutional News: Franklin Templeton tokenises treasuries, UK authorities given power to seize crypto and the EU votes on a new package of laws.

Charts of the Week: IBIT ETF setting records, stablecoin purchases growing, bitcoin ETF trading volume grown since February.

Top Jobs in Crypto: Featuring Onchain Bureau, Revolut, Blockovate, Kraken, DRW Cumberland and First Digital.

Macro Update

This is where we connect the dots between macro and crypto.

Slowly, Then All at Once

Major US indices managed to break a 3 week losing streak last week, with Geopolitical tensions fading and solid earnings from Google and Microsoft helping drive the Nasdaq close to 4% higher. Bitcoin however struggled to find traction after failing an early week attempt to break and hold above 67k, ending the week flattish, chopping a 63k-65k range.

On the data front, headline releases in the US painted a somewhat stagflationary picture of the US economy. Q1 real GDP came in at a much weaker annualized rate of 1.6%, down from 3.4% and much weaker than the 2.5% consensus forecast. This is the slowest pace of growth in 2 years and comes despite the US running crisis level deficits north of 6% 🤯

This actually speaks to our long term bullish thesis for Bitcoin. The debt intensity of growth in already highly indebted economies, continues to rise. That is, it requires increasingly more units of debt to produce just one unit of growth. There is no other way the US can grow other than increasing debt and yet with growth struggling to keep pace with the interest cost on that debt, yields will necessarily need to be kept artificially low and this act of financial repression will continually erode the value of the dollar against hard assets, especially the hardest asset, Bitcoin 🚀

On the inflation side, core PCE rose at an annualized pace of 3.7% in Q1, well above Q4’s 2% and expectations of 3.4%. Despite the weaker growth, markets continued pricing out the chance of the Fed being able to cut this year and 10yr yields spiked to highs around 4.73%. Relieving some pressure however, the more current monthly PCE numbers for March, released on Friday, showed core inflation moderating ever so slightly, falling to 2.82% YoY Vs 2.84% in Feb. Nonetheless, the sticky inflation data is not going to provide the confidence the Fed requires to begin this rate cut cycle, despite Yellen’s assertions this week that we remain “on a downward path for inflation.”

Breaking: Yen

The biggest macro story this week however was the continued weakness of the Japanese Yen, which sold off sharply again on Friday post a relatively dovish Bank of Japan meeting. The BoJ held rates at 0-0.1% as expected and committed to continue to buy government bonds to guard against sharp rises in borrowing costs, although they did drop a previous footnote on how much it would buy each month. Despite some expectations that the BoJ might take a more hawkish line to help defend the currency, they instead stated that “currency rates are not a target of monetary policy to directly control.” Intervention then perhaps being left to the Ministry of Finance, although it appears it's more the speed of the depreciation than the absolute level of the JPY which is causing concern. That acts like a red rag to a bull for speculators shorting the JPY, as they know that currency interventions will have a short lived impact, unable to reverse the dynamics driving the JPY lower.

Despite the macro bears wanting the BoJ to be the big blow up story which would drive a massive global unwind of the JPY funded carry trade, as we’ve continuously expressed, the BoJ is simply tweaking round the edges and are still effectively doing QE, with rates at zero. With Tokyo CPI falling sharply too, to 1.8% YoY from 2.6%, it looks like the disinflationary trend endured for decades is returning and policy “normalization” may well be at its limit already.

This is not sufficient to reverse portfolio flows and force the world’s biggest creditor to repatriate funds back home, causing a global bond and equity sell off. Indeed, the relative divergence to US policy continues to keep the currency under pressure and attempts to intervene to strengthen the JPY will be futile. Ultimately, it will require another dovish pivot from JPow and for the US to begin the rate cutting process to more sustainably reverse the pressure on JPY.

Yuan devaluation…

That same pressure also continues to build on the Chinese Yuan. USDCNH has mostly drifted sideways in April as no doubt, the PBOC will be intervening to prevent excessive CNH weakness. Yet the pressure is building and the odds are growing for a Yuan devaluation, especially as they will need to keep pace with their biggest export competitor, Japan.

The last time China devalued in 2015, Bitcoin prices shortly tripled as money flooded out of China. In the short term however, the resulting broad dollar strength acts as a headwind to Bitcoin and we also continue to believe that China is keeping a lid on Bitcoin to maintain the “veil of stability” and discourage capital flight into Bitcoin.

How the Fed responds to this on Wednesday will be paramount. Fed rates are simply too high for the global fiat system to handle. Yet the US economy remains “resilient” as Joe Biden prints insane deficits in an attempt to keep him in the Oval office this November. The Fed therefore is currently not getting the data they need to start getting rates lower. Meanwhile, as the US deficit runs amok, higher US rates are reinforcing the parabolic debt spiral. The rest of the world is also at breakpoint, squeezed by US rates and a strong dollar. What a mess!

Bitcoin a Call and Put Option…

Something will have to give and as we always say, fiat currency will be the escape valve. Don’t be surprised if JPow takes a more dovish line on Wednesday under the watchful eye of Yellen. Yellen is also herself in the spotlight with the Quarterly Refinancing Announcement (which lays out how the Treasury plan to fund their debt requirements over the next quarter) and suspect she will continue to weight issuance to short dated treasury bills in an attempt to keep long end yields artificially low.

Bitcoin may continue to struggle to break out higher short term, buffeted by this headwind of a stronger dollar and higher US rates. Yet this unsustainable dynamic is rapidly approaching its natural end point. Either JPow and the Fed flip dovish and sacrifice the dollar, or China and Japan get pushed to breakpoint. Bitcoin as both a risk-on asset and a flight to safety captures both tails of the risk distribution. Depending on the Fed, it feels like we’re going to get pushed to one of those tail end scenarios. Bitcoin is both the call and put option to hedge against this inevitable fiat system failure. Slowly….then all at once!

Native News

Key news from the crypto native space this week.

According to an investment note by Benchmark, if MicroStrategy adopted new accounting rules, the impact on its earnings per share would be huge. The noted added that adopting the latest accounting standards means MicroStrategy could qualify for inclusion in the S&P 500. Benchmark estimates that if MicroStrategy elects for early adoption of the Financial Accounting Standards Board's (FASB) new ASU 2023-08 standard, it could report a gain of more than $300 per share during 1Q24. The new accounting rules would increase its 2024 beginning retained earnings balance by around $3.1 billion. A company must report positive earnings in its most recent quarter to be considered for inclusion in the S&P 500 by the committee that runs the index. Benchmark observed that while MicroStrategy has reported losses in 10 of the past 14 quarters, early adoption of the new accounting standards could enable the software company to meet this final criterion.

Talos, a crypto trading software provider, has fully acquired Cloudwall, a crypto risk management platform. The size of the deal wasn't disclosed, but Talos said Cloudwall will improve its existing crypto portfolio management system to help its institutional clients manage risks and optimize their portfolios. Talos co-founder and CEO Anton Katz said "Cloudwall's focus has been very much rooted in building the tools that institutions need to manage a portfolio of digital assets, while Talos has focused on trading technology as well as complementary pillars of a PMS, namely portfolio engineering tools for portfolio construction and tools for P&L, treasury, and position management," "Therefore, the acquisition was a natural step forward in Talos' mission to deliver a comprehensive institutional-grade PMS." Founded in 2021, Cloudwall's cloud-based platform allows users to run various risk models and have a clear view of their risks, enabling them to decide which risks they want to gain exposure to and which ones to hedge, Katz added. "Given the growing relevance of risk tracking and management in the evolving digital assets landscape, these tools are becoming a crucial component in our clients' toolkit.”

Institutional Corner

Top stories from the big institutions

Franklin Templeton has tokenised a $380 million treasuries fund on the Polygon and Stellar blockchains to enable peer-to-peer (P2P) transfers without intermediaries. The company has launched the Franklin OnChain United States Government Money Fund (FOBXX), offering shares as BENJI tokens. Each token represents a share of the FOBXX and is tradable on the public Polygon and Stellar blockchains. The innovation aims to simplify transactions and expand access, allowing investors to manage their assets more flexibly through direct exchanges. This development from FT positions the firm to compete directly with BlackRock’s tokenisation efforts. The asset manager recently introduced its BUIDL fund on Ethereum in partnership with Securitize.

According to a press release from the UK Government this week, the UK National Crime Agency (NCA) and police have been granted greater powers to “seize, freeze and destroy” crypto used by criminals. The new powers which came into force this week mean that police will no longer be required to make an arrest before seizing crypto from a suspect. Police will also be able to seize items such as memory sticks and written passwords that “could be used to give information to help an investigation.” Police officers will be able to transfer illicit crypto into wallets controlled by law enforcement. Read the full release from the government HERE.

The European Parliament voted to adopt a new package of laws tightening money laundering and terrorist financing measures across the EU. The laws target large cash payments, crypto firms and football clubs, among others. In addition to creating a single rulebook for the 27 nations that make up the European Union, the package approved on Thursday sets up an anti-money laundering authority based in Frankfurt to oversee the implementation of the relevant frameworks – particularly those the bloc deems as the "riskiest entities." A press statement on the vote said "The new laws include enhanced due diligence measures and checks on customers’ identity, after which so-called obliged entities (e.g. banks, assets and crypto assets managers or real and virtual estate agents) have to report suspicious activities to [Financial Intelligence Units] and other competent authorities."

Charts of the Week

Because charts are just as important as macro.

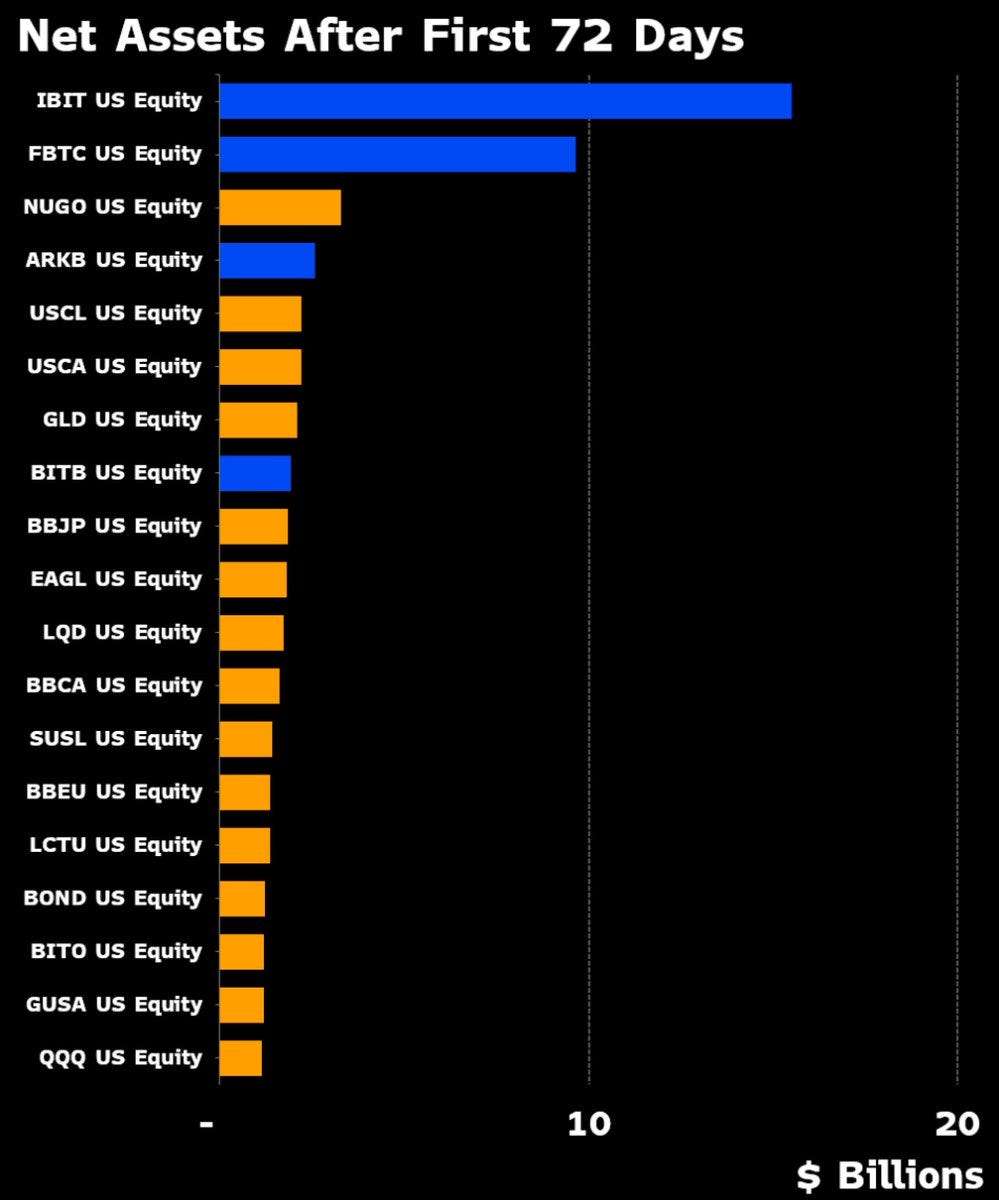

Despite IBIT’s daily inflow streak stalling at 72 days, its still setting records, having the largest net assets. Hat tip to Eric Balchunas for the chart.

The U.S. consistently accounts for the biggest share of stablecoin purchases, but global demand is increasing, with a diverse representation of nations and regions contributing to over $40 billion in purchases in March 2024 alone.

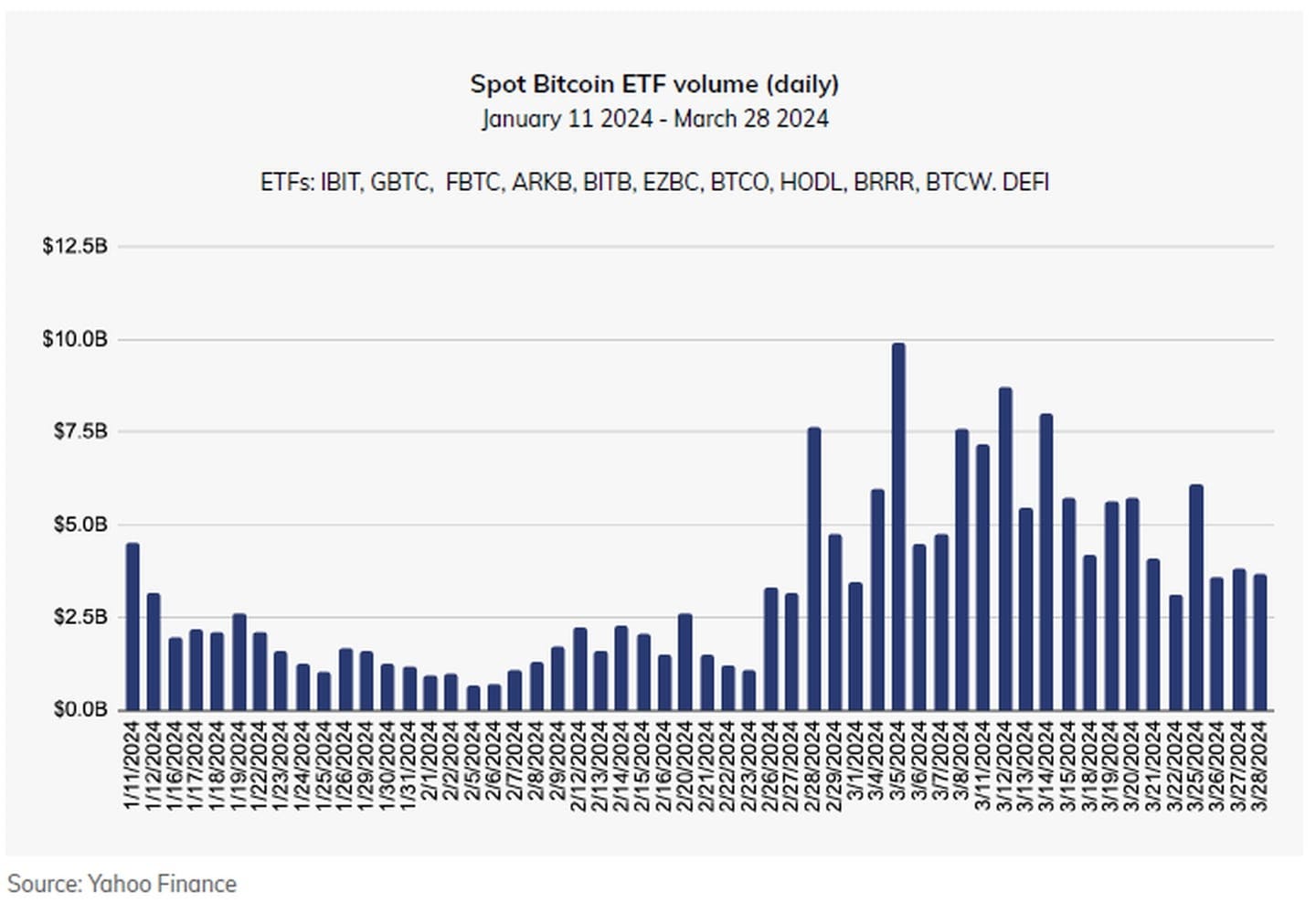

Bitcoin ETF trading volume has been strong but has gained momentum since February.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Memecoin Market Maker Sales Crypto at Onchain Bureau

Product Marketing Manager for Crypto at Revolut

Crypto Community Manager at Blockovate

Senior Product Marketing Manager, Institutional for Kraken

Digital Assets Compliance Officer at DRW Cumberland

Operations Manager at First Digital

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.