Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “The most succinct, easy to digest macro summary I have read in all crypto newsletters!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: The macro provided somewhat mixed signals for markets, although we continued to make progress towards the broader global “peak rates” narrative. The path of US yields appears to be a short term, important determinant of whether Bitcoin can finally break the resistance levels that are layered ahead of new record highs.

Crypto Native News: Coinbase launches a smart wallet, Ripple partners with Clear Junction, the ether ETF could attract between $3.1 billion and $4.8 billion net inflows and Binance reaches 200m users.

Institutional Corner: Robinhood to buy Bitstamp, State of Wisconsin just “dipping their toe in the water” with bitcoin.

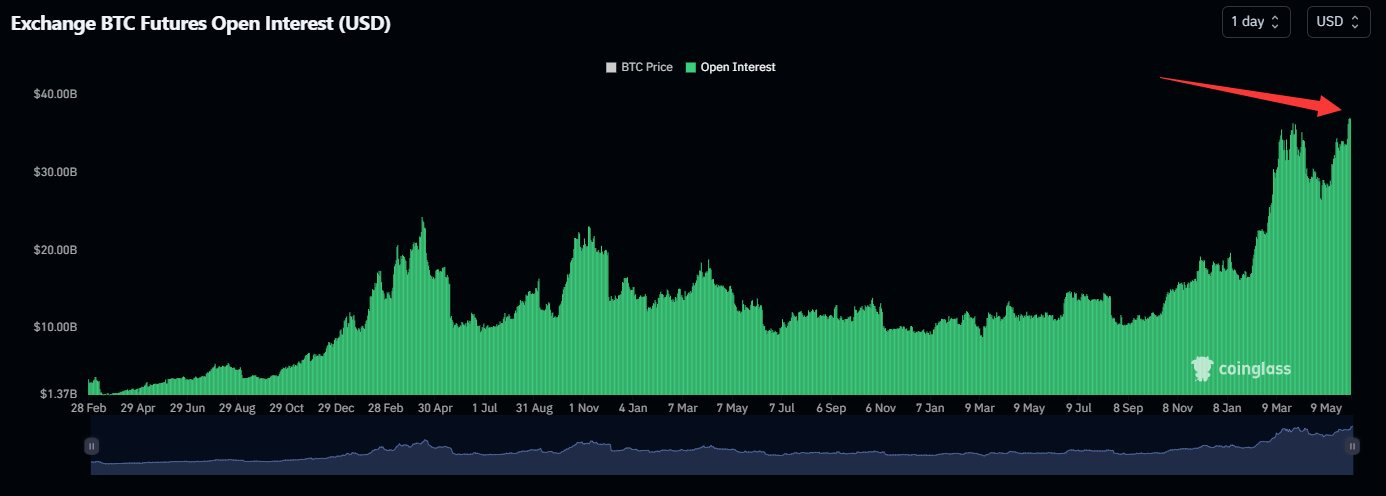

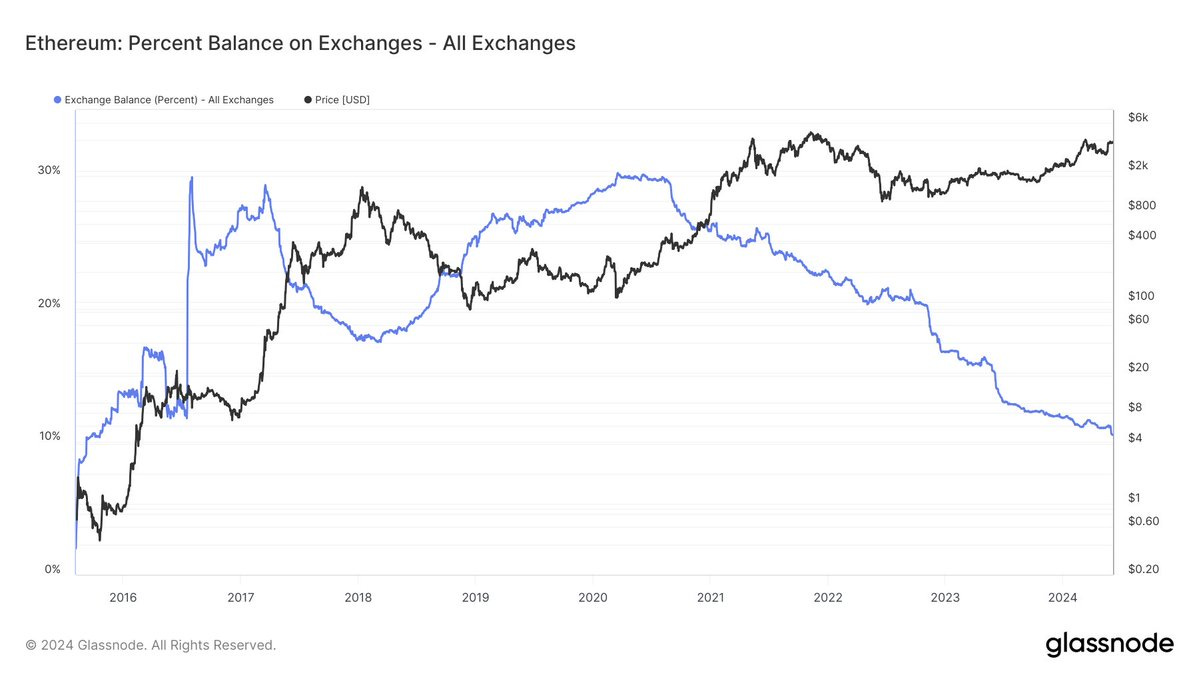

Charts of the Week: BTC futures open interest reaches a record, ETH on exchanges at lowest since 2015.

Top Jobs in Crypto: Featuring DRW, Paysafe, Crypto.com, Ripple Kraken and Talos.

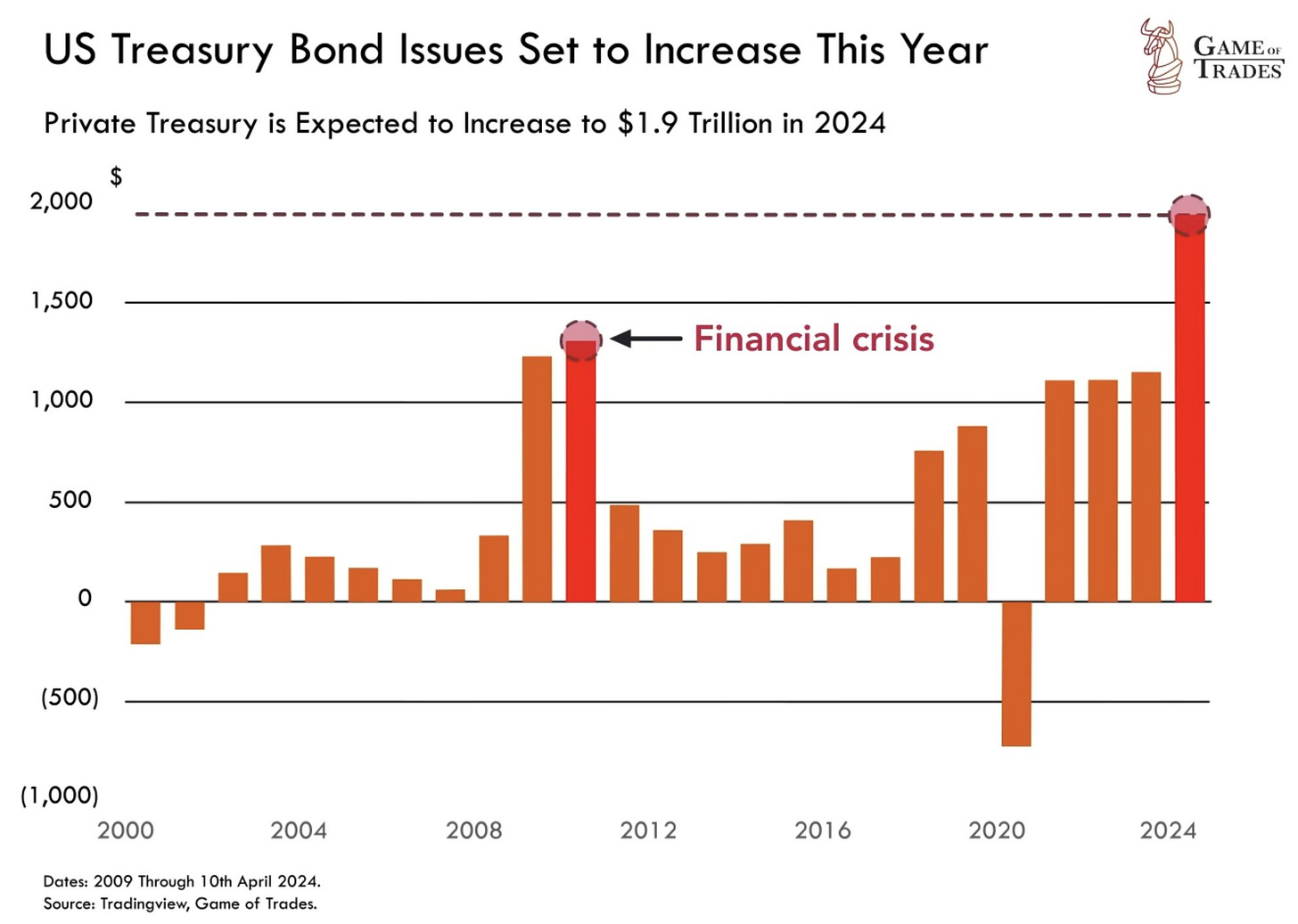

Macro Chart of the Week - Treasury bond issuance this year is expected to increase to $1.9 Trillion, surpassing even the 2008 peak of the financial crisis. Hat tip to Game of Trades for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

Easy Now

A big week for macro provided somewhat mixed signals for markets, although we continued to make progress towards the broader global “peak rates” narrative, with the Bank of Canada and ECB both kicking off respective rate cutting cycles. Contradictory data out of the US however spoiled the party, despite the Nasdaq and S&P 500 clocking new record highs 🎉.

The Bank of Canada was the first G7 central bank to cut rates, cutting 25bps as expected to 4.75% and leaving the door open to further cuts. BoC governor Tiff Macklem said:

“We’ve come a long way in the fight against inflation. And our confidence that inflation will continue to move closer to the 2 per cent target has increased over recent months.”

Less confident were the ECB who also cut rates 25bps, despite raising inflation forecasts for 2024 and 2025, but maintained data dependence on further cuts as “domestic price pressures remain strong” with inflation forecast to be above target into next year. Markets are pricing 2 more cuts for 2024.

Major central banks appear increasingly comfortable with the pace of disinflation and with the degree of policy restrictiveness, the risks to growth and employment are becoming a greater focus. Whilst the timing and depth of the rate cutting cycle remain unclear, the direction is clear and the easier rate outlook will continue to provide a tailwind to Bitcoin and broader risk assets.

Frustratingly, just as we appeared to hit a pivot point for US rates, the US data has fallen back into a familiar pattern with manufacturing mired in recession (ISM Manufacturing falling to 48.7), the service sector resilient (ISM services bouncing to 53.8) alongside a resilient labour market (NFP added a stronger 272k jobs in May.) This is complicating the policy path for JPow who is under mounting pressure to get the rate cutting cycle under way, with US rates having adverse impacts on Asia as well as reinforcing the unsustainable debt spiral that his predecessor Janet Yellen is in no mood to address ahead of the election.

Into Non Farm Payrolls on Friday, the softer pulse of data flow alongside declining oil prices saw 10yr US yields sub 4.30% with 2yr yields threatening 4.70%. These bounced strongly post data to close 4.43% and 4.89% respectively and took the wind out of Bitcoin’s sails that had been creeping towards the 72k resistance, but saw a late wash of levered longs to take us back sub 70k.

So where does this leave us?

Firstly, it’s worth noting under the hood, the headline NFP figure was less strong. Full time employment declined a huge 625k and the establishment survey figure of +272k jobs diverged wildly to the household survey which had the number of jobs falling by a massive 408K (this is in part due to the double counting of the establishment survey which counts 1 person working 2 jobs twice.)

Second, the unemployment rate also increased to 4%, the highest level since Jan 2022, something that Bloomberg noted the Fed will read as a sign of further labour market slackening. Also a sign of slackening and a normalisation of the labour market, was Tuesday’s JOLTs data for job openings which fell from 8.36mio to 8.06mio, back to pre-pandemic levels.

Put in context then, the markets reaction to the headline NFP looks overdone and we suspect, after a weekend to digest we will see yields continue the path lower (it’s worth noting too, US yields were still lower on the week, across the curve, despite Friday’s sharp bounce). Whilst this report will do little to rush the Fed to cut rates, there’s enough to suggest the Fed, who view policy as restrictive, can consider following their G7 counterparts in lowering rates this year.

In fact, the higher for longer mantra from the Fed at a time where growth concerns are re-emerging may actually work to bring long end yields lower and a subsequent rally in duration will continue to fuel the long duration proxies of Nasdaq and of course, Bitcoin!

Next week, US inflation, the Fed and Bank of Japan, who are expected to trim their monthly bond buying, will be important drivers of yields. There’s also a 10yr and 30yr bond auction to monitor on the 11th June and 13th June respectively. The path of US yields appears to be a short term, important determinant of whether Bitcoin can finally break the resistance levels that are layered ahead of new record highs.

Yet with net inflows into the ETF’s remaining strong (there were 1.82bn net inflows last week 😳) G7 central banks firing the starting gun on the rate cutting cycle, the US running emergency level deficits amidst an improving liquidity dynamic, there is a super constructive backdrop which we believe will limit the extent of any pullbacks and we remain on course for making new record highs. HODL 💪

Native News

Key news from the crypto native space this week.

Coinbase is launching a smart wallet, aiming to provide users with greater convenience through simplified onboarding, the elimination of gas fees, and the removal of recovery phrases. The new Coinbase Wallet is designed to overcome the complexity often associated with traditional crypto wallets. The smart wallet will enable users to create a new wallet and onboard onto a blockchain without the need to download a new app or generate a new recovery phrase. Instead, the smart wallet will integrate with major apps and use biometric methods like Face ID, users’ Google Chrome profile, fingerprint ID, or Yubikey to onboard through a passkey stored on users’ devices.

Ripple has partnered with payment solution firm Clear Junction, to enhance cross-border payments, enabling instant and secure GBP and EUR payouts. Ripple Payments provides faster, cheaper cross-border payment infrastructure, serving customers in over 55 countries. Clear Junction, established in 2016, offers multi-currency payment accounts and virtual IBANs, facilitating client access to new markets and technologies. Dima Kats, Founder and CEO of Clear Junction, stated, “Blockchain technology and cryptocurrencies will definitely be at the core of the evolution of correspondent banking and we are happy to partner with Ripple to be a part of this process.”

According to a research report by K33 Research the spot Ethereum ETFs in the U.S. could attract between $3.1 billion and $4.8 billion in net inflows in their first five months after trading begins. At current ether prices, this represents a supply absorption of 800,000 ETH to 1.26 million ETH, equivalent to between 0.7% and 1.05% of the circulating supply, the analysts said. The company based its forecast by comparing the assets under management in existing ETH-based exchange-traded products around the globe to similar bitcoin products and the amount of open interest in futures contracts on the Chicago Mercantile Exchange (CME).

Binance, the world’s biggest crypto exchange, said this week that it had reached 200 million global users, despite a leadership change, paying a record fine to US regulators. At the end of 2023, the exchange said it had added 40 million users to bring its total to 170 million, which means that it has gained about 30 million in the first half of this year.

Institutional Corner

Top stories from the big institutions

The big news of the week was that trading platform Robinhood agreed to acquire crypto exchange Bitstamp as it looks to expand its crypto presence globally and attract institutional clients through new product offerings. According to the press release, the $200 million all-cash deal is expected to close in the first half of 2025. Barclays Capital and Galaxy Digital advised Robinhood and Bitstamp on the sale. Johann Kerbrat, general manager of Robinhood Crypto said “The acquisition of Bitstamp is a major step in growing our crypto business,” "Bitstamp’s highly trusted and long standing global exchange has shown resilience through market cycles … Through this strategic combination, we are better positioned to expand our footprint outside of the U.S. and welcome institutional customers to Robinhood.” As a reminder, Bitstamp is a U.K.-based crypto exchange that was founded in 2011. It currently offers spot trading of over 85 cryptocurrencies as well as other crypto products including institutional lending and staking, among others. It is one of the most regulated on the market, holding more than 50 licenses and registrations globally.

David Krause, a professor of finance at Marquette University, said the initial investment into bitcoin by the State of Wisconsin Investment Board is just "a toe in the water" to test the public’s reaction. The State of Wisconsin Investment Board added two spot bitcoin ETF’s to the portfolio of Wisconsin's pension plan. The SWIB purchased shares of BlackRock’s iShares Bitcoin Trust (IBIT) and Grayscale’s Bitcoin Trust (GBTC) valued at $164 million as of March 31, a filing with the U.S. Securities and Exchange Commission revealed in May. As of the end of 2023, the SWIB managed roughly $156 billion in assets, according to its website, meaning its holdings in the bitcoin ETFs were a negligible roughly 0.1% of its portfolio. “Wisconsin’s investment board has always been innovative,” he said. “This is a fully funded pension fund so in a way, they have the luxury of being able to invest for the long term. They don’t need to worry as much about liquidity as, say, the pension fund for the state of Illinois, which is only funded at 50% of its level”

Charts of the Week

Because charts are just as important as macro.

Bitcoin futures open interest reached a record of $37.66bn this week. Hat tip to Coinglass for the chart.

The amount of ETH on exchanges is at its lowest since 2015, with 3.9 million ETH (or 3.2% of total circ. supply) being withdrawn from exchanges the past week. Hat tip to Pluid for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Wallet Operations at DRW

Senior Sales Manager for Crypto at Paysafe

Senior Flow Trader - Quant Trading Team at Crypto.com

Director Corporate Development at Ripple

Head of International Compliance at Kraken

Client Services Engineer at Talos

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.