Welcome to the new subscribers that have joined us over the last week.

The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

As always, our only ask is that you share this with your colleagues, friends and family to help us, help them.

One half of London Crypto Club (Chris) will be attending Paris Blockchain Week on Wednesday and Thursday, drop me a message if you’re around for a catch up.

Onto the newsletter. Here’s what you’re getting this week:

Macro: Fed rates are simply too high for the banking system to handle so they now face the impossible choice between inflation of the financial system.

Crypto Native News: Fidelity opens trading services for retail investors, Arbitrum gets its own token and Circle clears its backlog of USDC minting and redemption requests.

Institutional News: The US Fed announces its long awaited real time payment system called FedNow and CME goes live with event contracts.

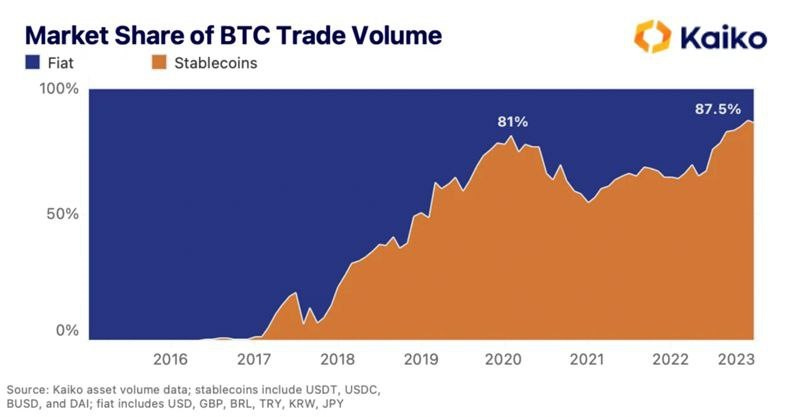

Chart of the Week: Bitcoin market share of trade volume for stablecoins reaches an all-time high.

Top Jobs in Crypto: Featuring BCB Group, Binance, DRW, HireChain, Circle and Brevan Howard.

Macro Update

We’re macro at heart, this is where we try to connect the dots between the macro and crypto.

Whack-a-mole

Macro data has taken a back seat this week to the unfolding of events within the banking sector following the announced failure of Silicon Valley Bank, the second largest US bank failure in history, alongside the failure of Signature Bank. This also followed the earlier announcement of the voluntary liquidation of crypto focused Silvergate.

It’s been said that the Fed will hike until something breaks. Things are now breaking and it’s the banking system.

At the heart of the issue at Silicon Valley Bank (risk management practices aside) was a de-facto bank run, with deposits leaving the bank in search of higher money market yields. Liquidity issues quickly morphed into solvency issues as SVB needed to sell their US treasury assets which were under water given the Fed’s sharp rate hikes.

Calm was restored to markets on the Monday open after the US Regulators and the Fed guaranteed deposits at SVB and Signature and launched the Bank Term Funding Program (BTFP) to provide up to 1yr liquidity, in return for “eligible collateral” (largely UST’s) at par value.

As is always the case when confidence starts to drain from markets however, there’s never just one cockroach.

The next “domino” was Credit Suisse which saw its share price plunge and CDS spike as its major shareholder, the Saudi National Bank, ruled out further investment, culminating in the Swiss National Bank providing a SFr 50bn liquidity backstop. Regulators are still scrambling this weekend to seal a UBS takeover deal, which looks to be complete at time of writing.

The game of whack-a-mole then reverted back to the US, with First Republic Bank shares down 70% over the week after again suffering deposit outflows. On Thursday, Wall Street giants including Bank of America, Goldman and JP Morgan, amongst others, committed to depositing $30bn to shore up the bank’s liquidity position.

The reason money and deposits are flooding out of banks is because deposit rates are too low relative to money market rates. Banks are unable to hike deposit rates given inverted yield curves which would make them unprofitable if they were to do so. Put another way, Fed rates are simply too high for the banking system to handle.

The BTFP short term can help prevent a liquidity crisis. The ability for banks to exchange that collateral at par also helps stave off a solvency crisis.

Ultimately, the Fed will need to pause and eventually get rates lower. Liquidity provisions such as the BTFP and the Fed’s discount window can provide a short term solution to plaster over the cracks. However, bank deposits will continue to flood out and banks will become increasingly dependent on Fed liquidity.

Just this past week, the Fed balance sheet increased a MASSIVE $300bn as banks tapped the various liquidity facilities at the Fed (albeit only 11bn of the BTFP was used) This unwinds most of the Quantitative Tightening since October.

The idea then that the Fed can hike rates on the one hand to address inflation, whilst providing liquidity to help the banking sector suffering outflows on the other looks improbable. The Fed’s balance sheet will explode!

The Fed faces an impossible choice between inflation or the financial system. Now they pause and pray that inflation comes lower. Hike cycle is done. Liquidity is returning. The fiat system once again failing. The original narrative which gave birth to crypto has come full circle and it’s never looked stronger.

Native News

Key news from the crypto native space this week.

Fidelity Investments opened its crypto trading services to retail participants. Individual investors can now buy and sell bitcoin and ether and use custodial and trading services provided by Fidelity Digital Assets. However, clients are not yet able to transfer cryptocurrency to or from their Fidelity accounts. The company said it would be exploring cryptocurrency transfers, that would be researched later this year. Trading is open only to U.S. citizens over the age of 18 who reside in one of the 36 states where Fidelity Digital Assets offers services.

In Ethereum news, Arbitrum, currently the biggest layer 2 solution is getting its own token. The Arbitrum Foundation said on Thursday that ARB, Arbritrum’s new token, will be airdropped to community members next Thursday 23 March. Growth of Layer 2 solutions which bundle up and settle transactions on Ethereum continues to grow. Unlike sidechains like Polygon, which also bundle up transactions and settle them on Ethereum, rollups (also called layer 2 platforms) take advantage of Ethereum’s existing security apparatus. According to data from Blockworks, transaction fees on Ethereum average around 75 cents vs Arbitrum at 14 cents.

Looking at the stablecoin space, Circle, the operator of USDC, said in a blog post that it had cleared “substantially all” of the backlog of minting and redemption requests relating to USDC through Monday and Tuesday. A total of $3.8bn of tokens were redeemed by investors since the weekend, and it had minted $0.8bn of new coins. The USDC mark cap has fallen around $6bn this week to just below $37bn at close Friday. The USDT market cap has risen around $3bn to $72bn. The overall Crypto market cap has risen $196bn to $1.13tn at close Friday.

Institutional Corner

Top stories from the big institutions.

On Wednesday, the U.S. Federal Reserve announced that it will be activating its long-awaited real-time payments system called FedNow, in July. The FedNow Service, meant to solve the existing delays for clearing financial transactions between institutions. The Fed will begin certifying the first participants in FedNow from the start of next month. Ken Montgomery, the chief operating officer at the Federal Reserve Bank of Boston, who has been working on the new system said, “We urge financial institutions and their industry partners to move full steam ahead with preparations to join the FedNow Service,” and added the service will offer a “modern instant payment solution.” The official description of the FedNow Service taken from the official website is as follows: “The FedNow Service will be available to depository institutions in the United States and will enable individuals and businesses to send instant payments through their depository institution accounts. The service is intended to be a flexible, neutral platform that supports a broad variety of instant payments. At the most fundamental level, the service will provide interbank clearing and settlement that enables funds to be transferred from the account of a sender to the account of a receiver in near real-time and at any time, any day of the year”. Read more on the official website HERE.

CME Group opened ‘event contracts’ on Bitcoin futures on Monday. These types of contracts offer payouts based on specific events and are also called prediction contracts or information contracts. They are short-term, meaning they expire daily, and are settled in cash. CME said the new product will give customers “a limited-risk, highly transparent way for a wide range of investors to access the bitcoin market via a fully regulated exchange.” CME Bitcoin options volumes reached a high of $1.1bn in January, chart below.

CME Bitcoin Volumes - highest volume of $1.1bn in Jan 2023.

Chart from The Block. Source of data Coinglass.

Chart of the Week

Because charts are just as important as macro

This week saw Bitcoin market share of trade volume for stablecoins reach an all-time high at 87.5%.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Macro Research Analyst at Binance

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.