Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Andreessen Horowitz invests in its first DeSci project, Circle releases a new compliance focused tool.

Institutional Corner: PayPal allows businesses to buy, sell and hold crypto, Robinhood and Revolut may enter the stablecoin market, VARA amends its marketing guidelines for virtual assets, Visa has introduced a new platform to assist banks in issuing and testing fiat-backed tokens and Hong Kong regulators to adopt ESMA regulation.

Charts of the Week: Altcoin liquidity concentrated on offshore exchanges, Bitcoin has its best September performance since 2012, Base active addresses remain high.

Top Jobs in Crypto: Featuring Cumberland DRW, Hivemind, Revolut, SmartCo Consulting and LSEG.

Macro Update

This is where we connect the dots between macro and crypto.

The Big Bazooka

If the previous newsletter was all about the Fed, this one is all about China!

We stated last week that “the bigger 50bp rate cut from the Fed provides cover for China to bring out its big bazooka” and that’s exactly what we got this week, propelling Chinese equity markets higher and driving the S&P 500 to yet more record highs. With the massive stimulus and liquidity measures announced, Bitcoin gained to momentum to reach its highest levels since July above the 65k resistance level🔥

The moves began on Monday when China lowered the 14 day repo rate 10bps to 1.85% whilst injecting 234.6bn Yuan ($33.3bn) into the banking system to maintain adequate liquidity into quarter end. However, on Tuesday, central bank governor Pan Gongsheng convened an ad-hoc press-conference with several economic officials to announce a raft of measures designed to re-ignite the Chinese economy. These measures included:

🇨🇳PBOC to cut the Reserve Requirement Ratio (RRR) by 50bps to provide an estimated 1 trillion in Yuan liquidity ($140mio.)

🇨🇳Reduced 7 day reverse repo rate (a key short term policy rate) by 20bps to 1.5%.

🇨🇳Rates on existing home mortgage loans to be reduced 50bps.

🇨🇳Down payment requirement for second home buyers to be lowered to 15% from 25%, in line with that for first time buyers.

🇨🇳800bn Yuan ($114mio) support for stocks, allowing brokerages to borrow directly from the central bank to fund purchases of equities.

This shock-and-awe approach from China was the most aggressive economic stimulus package since Covid. These measures however were further reinforced on Thursday with President Xi calling to ramp up fiscal spending to shore up the property sector and for “forceful” rate cuts to reverse the slow down.

To fund the stimulus, China plans to issue special sovereign bonds worth about 2 trillion yuan ($284.43 billion) this year. 1 trillion yuan of special sovereign debt primarily to stimulate consumption amid growing concerns about a stuttering post-COVID economic recovery. This includes the provision of a monthly child allowance of 800 yuan ($114) per child for families with 2 or more children. China also aims to raise another 1 trillion yuan via a separate special sovereign debt issuance and plans to use the proceeds to help local governments tackle their debt problems. China is also considering an injection of $142bn of capital into top banks to increase their capacity to support the economy.

Whatever it takes…

The open ended measures had a “whatever it takes” feel to them. China has drawn a line in the sand and as we frequently say in terms of our longer term bullish bias, central banks have removed the “left tail” risk from markets which will continue to frustrate the bears that look to position for the big blow up scenarios.

Indeed, fiat, credit based economies need ever larger amounts of debt for the economy to grow. As the debt intensity of growth falls (for each unit of debt, we get less units of GDP) then we require exponentially increasing levels of debt to sustain growth.

Assets form the collateral which allows fiat economies to borrow and underpins that debt. So they need to artificially inflate the value of assets in perpetuity to maintain the expansion of credit to maintain growth.

China has now reached the point, after piecemeal stimulus measures and marginal rate cuts, where to hit growth targets, they need to artificially inflate the assets (property and stocks) for a re-leveraging and reflation cycle to take hold. The escape valve in all of this is fiat currency and fiat economies are essentially defaulting via the stealth debasement of fiat currency.

That’s why we have 100% conviction in the long term prediction of Bitcoin being multiples higher in fiat terms.

It’s just maths, it’s just a function of fiat, debt driven economies. Overlaid with a secular trend in a world moving towards ever more digitization, Bitcoin will continue to rise and outperform every other macro asset on the planet.

Data supports global rate cuts…

Elsewhere, the European composite PMI fell back into contraction territory at 48.9 from 51.0, driven largely by the services sector which plunged 2.4pts to 50.5. Manufacturing also remained deep in contraction territory at 44.8, down from 45.8.

Germany's economic woes are leading the broader weakness in the periphery. Employment numbers also continued to exhibit weakness, with employment contracting for the second month in a row whilst cost pressures and prices charged were seen declining amidst a soft demand environment. Despite relatively hawkish rhetoric from ECB policymakers, markets are now pricing another 25bp cut in October.

In the US, the Fed’s preferred inflation measure, the personal consumption expenditures (PCE) price index came in at a benign 2.2% YoY down from 2.5%, whilst MoM core inflation came in a tick below expectations at 0.1%. Personal spending and incomes also surprised on the downside in August, reinforcing the disinflationary forces that will provide the space for the Fed to aggressively cut rates back towards more neutral levels.

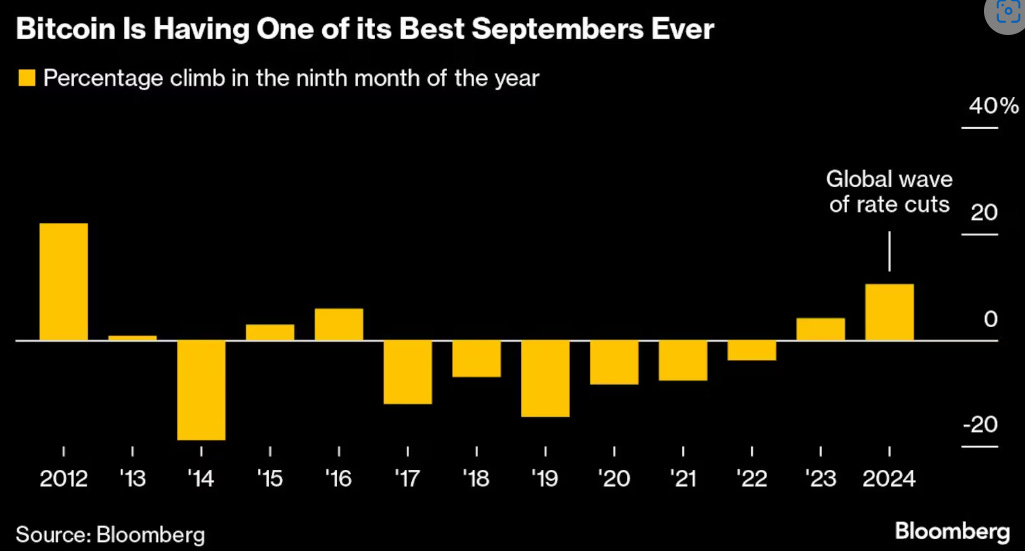

Stocks and Bitcoin have had a strong September, confounding the seasonal weakness with a one-two liquidity punch from the Fed and China. Keep in mind, this week's China bazooka has come at month/quarter end.

As we’ve said before, quarter/month end is negative for market liquidity. Banks “window dress” the balance sheet to hold more high quality liquid assets (HQLA’s) to reduce the capital requirements and balance sheet costs of holding riskier assets (the balance sheet risk assessment is literally made on that month end snapshot.)

One area you see this is rising use of the Fed’s RRP facility (banks sell riskier assets and place the cash at the Fed) The RRP has risen 97bn this past week - that’s literally cash taken out of the market.

Expect fireworks…

All this to say, the steps taken from China this week will unleash a tsunami of liquidity 🌊 Alongside the Fed more aggressively cutting and a global easing cycle, we’re pumping in anticipation of that, but against this short term liquidity drain. Next week when this liquidity is returned to the market, expect fireworks. We anticipate we could hit record highs for Bitcoin this coming week.

They say don’t fight the Fed. Also don’t fight China. Definitely don’t fight the Fed and China together 🚀

Native News

Key news from the crypto native space this week.

Venture capital firm Andreessen Horowitz has invested in its first "DeSci" (as in "decentralised science") project — AminoChain. As a reminder, Decentralised science, or DeSci, refers to the use of blockchain to make various aspects of scientific research and collaboration more open, incentivized and community-driven. A16z led the $5 million seed round into AminoChain announced on Wednesday. The project is looking to bring “ownership, transparency, and consent” into the field of medical data collection using blockchain technology. AminoChain is building a “decentralised biobank” and Layer 2 network that will connect enterprise medical institutions looking to share medical data while preserving patient privacy. According to AminoChain’s website, medical institutions can install “Amino Node” software and integrate it with its existing tech stack. “While data stays self-custodial on the given institutions' servers, the Node software harmonises and standardises the data into a common format, making it interoperable with a network of collaborators. AminoChain added “The Node software thereby sources data from all providers and brings credible neutrality to the network; from this basis, developers can source data from a multitude of medical bodies and build any number of patient-centric applications”

Circle, the issuer of the second-largest stablecoin, has unveiled a new compliance-focused tool for programmable wallets. The tool is called the Compliance Engine an will help “companies build onchain while meeting rigorous demands for compliance” according to Circle’s CEO. The system provides ways to program customisable and automatically enforced regulatory checks into different decentralised applications. The service will feature a transaction screening tool “to detect risky and suspect” transfers as well as a monitoring tool “to help identify potential high-risk behaviors.” A “Travel Rule” service is designed to meet the Financial Action Task Force’s surveillance and data validation requirements for virtual asset service providers. Circle’s website notes the Compliance Engine will feature a one-stop “consol” where users can integrate APIs and analyse data, flag transactions in real-time, perform long-running investigations, set up blocklists for wallets connected to suspicious or known bad actors and report transactions to authorities. The tool will support any blockchain connected to Circle’s existing Programmable Wallets tool, including Avalanche, Ethereum, Polygon and Solana, among others. Developers will be charged on a “pay-as-you-grow” model every month. Read the more detail from Circles website HERE.

Institutional Corner

Top stories from the big institutions

This week, PayPal announced plans to enable U.S. business customers to buy, sell, hold, and transfer cryptocurrencies. PayPal said "Today's announcement is PayPal's latest step to increase cryptocurrency's utility by making increased functionality available to millions of merchants in the U.S.” Though they noted that when the service launches, it will not be available to business accounts based in New York State. PayPal Senior Vice President Jose Fernandez da Ponte said "Since we launched the ability for PayPal and Venmo consumers to buy, sell, and hold cryptocurrency in their wallets, we have learned a lot about how they want to use their cryptocurrency. Business owners have increasingly expressed a desire for the same cryptocurrency capabilities available to consumers. We're excited to meet that demand by delivering this new offering, empowering them to engage with digital currencies effortlessly." PayPal also said it would allow U.S. merchants to transfer cryptocurrency to "third-party eligible wallets" and receive "supported" tokens from external addresses.

Robinhood Markets and Revolut are reportedly seeking to enter the stablecoin market Both companies are said to be considering issuing their own stablecoins but haven’t confirmed the move. Although sources note that both fintech giants Robinhood and Revolut might explore stablecoins, a Robinhood spokesperson said it has “no imminent plans to launch this offering.” On the other hand, a Revolut executive said that the firm is planning to “further grow” its crypto product suite. The fintech firm is reportedly evaluating options to release a stablecoin but has yet to make any announcements.

Dubai’s crypto regulator updated its marketing guidelines for virtual assets this week. Dubai’s Virtual Asset Regulatory Authority (VARA) will require firms marketing digital assets to include a noticeable disclaimer warning potential investors about the volatility risks involved. The new rules set to come into force on 1 October mandate that any entity that advertises digital asset investments must do so while stating that virtual assets “may lose their value in full or in part and are subject to extreme volatility.” In addition to the mandatory disclaimer, VARA has implemented further requirements for companies offering incentives related to digital assets. Firms must now receive regulatory compliance confirmation before offering bonuses or promotions.

Visa has introduced a new platform to assist banks in issuing and testing fiat-backed tokens. The Visa Tokenized Asset Platform (VTAP) aims to create global standards for interactions between financial institutions exploring blockchain technology. Speaking on the project, Cuy Sheffield Visa’s head of crypto said “We think that creates a significant opportunity for banks to issue their own fiat-backed tokens on blockchains, do it in a regulated way and enable their customers to access and participate in these on-chain capital markets”

Two top-level Hong Kong financial regulators have co-announced their intent to adopt reporting requirements set by the European Securities and Markets Authority (ESMA) for crypto over-the-counter (OTC) derivatives. On 26 September the Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC) shared a plan to bring their OTC reporting requirements up to global standards after studying responses to a consultation paper from March 2024. According to Hong Kong stakeholders and investors, crypto OTC derivatives investments cannot be classified under the existing traditional five asset classes: interest rates, foreign exchange, credit, commodities and equities. Read the full report from the regulators HERE.

Charts of the Week

Because charts are just as important as macro.

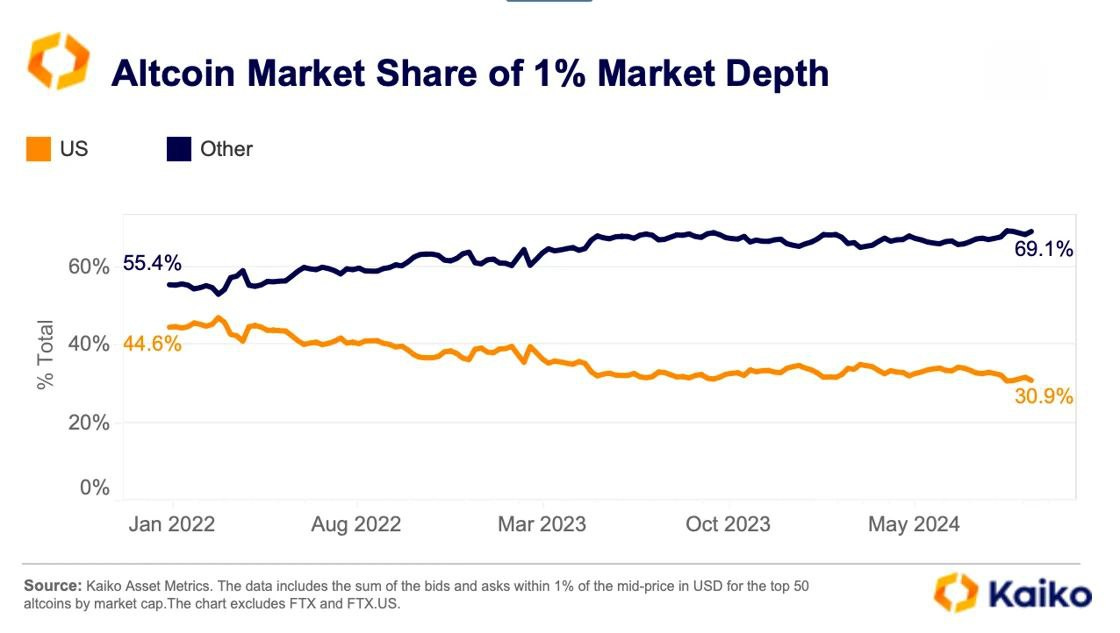

Altcoin liquidity is more concentrated on offshore exchanges. Their share of the total altcoin depth has increased to 69% from 55% in early 2022. The trend has been driven by large and mid-cap altcoins.

Bitcoin had its best September performance since 2012.

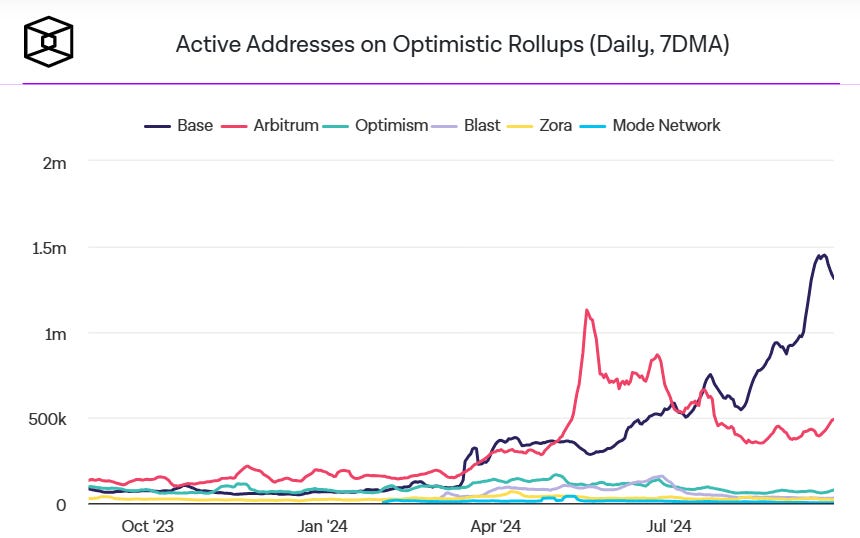

Base remains in the lead for active addresses on optimistic rollups, ahead of Arbitrum.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Business Development Manager Cryptoassets at Cumberland DRW

Product Owner Crypto Exchange at Revolut

Digital Asset Practice Lead at SmartCo Consulting

Manager Digital Asset Operations at LSEG (London Stock Exchange Group

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.