Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: AllUnity to issue Germany’s first regulated, euro-denominated stablecoin, Amber raises £25.5m.

Institutional Corner: The US SEC Crypto Task Force meets with Securities Industry and Financial Markets Association, South Korea CBDC pauses its CBDC project, Kazakhstan to establish a state bitcoin reserve, Chinese tech giants lobbying China's central bank to approve offshore yuan-based stablecoins.

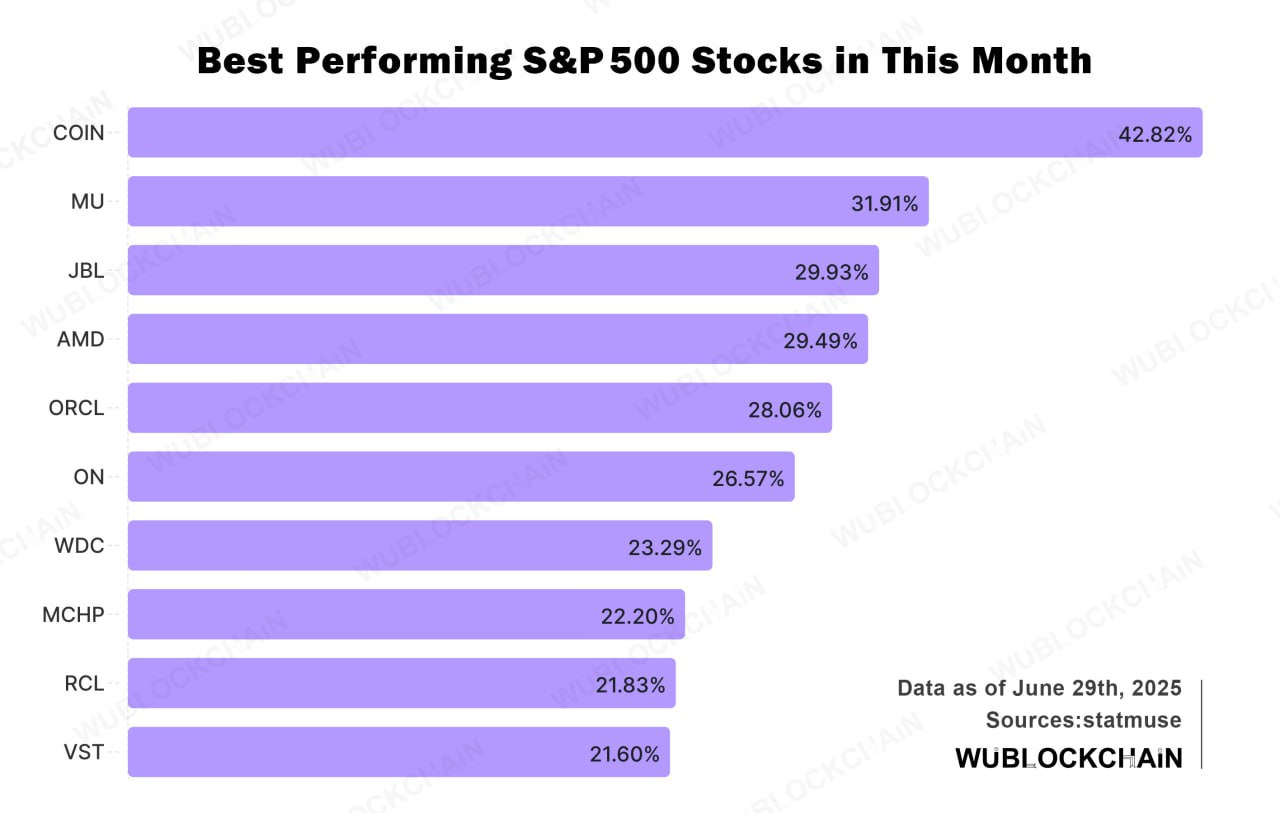

Charts of the Week: Coinbase the best performing S&P500 stock in June, Base has accounted for 67% of L2 fees in 2025, SOL CME futures hits volume record.

Top Jobs in Crypto: Featuring Kraken, DRW, Bitget, Citi, R3 and Coinbase.

Macro Update

This is where we connect the dots between macro and crypto.

Big Beautiful Debasement Games

A holiday shortened week saw the S&P 500 and Nasdaq close at record highs for the second week in a row as the “goldilocks” macro and easing geopolitical tensions maintained a positive tailwind for risk.

The data flow continued to support our sanguine view of the world. Mixed labour market signals, with ADP showing private payrolls in June contracting 33k (first negative print since March 2023) yet the official Labour Department NFP report showed that the US added 147K jobs, beating expectations for 110K and up from 144K prior. Average hourly earnings cooled from 3.8% to 3.7%.

TLDR: the US labour market, whilst showing signs of softness, is resilient and not signalling an urgent need for Fed rate cuts.

Meanwhile, US manufacturing remained in contraction territory with the ISM PMI inching up to 49% from May’s 48.5% whilst the services ISM moved back into expansion territory (just about) at 50.8%. A slowing, not collapsing US economy with little sign of re-accelerating inflation remains a good backdrop for risk 💪

Big Beautiful Bill…

The big news of the week however, was the passing of Trump’s “One Big Beautiful Bill” which narrowly passed through the Senate and House and was signed into law by Trump on 4th July.

The Bill immediately raises the debt ceiling by $5trn and makes permanent the 2017 tax cuts, with individual rates capped at 37%. Without going into the details here, the Committee for a Responsible Federal Budget (CRFB), suggests the bill could add between $5 trillion and $7 trillion to the national debt over the next decade. This will drive the US debt/GDP ratio significantly higher from its already lofty 124% 🤯

Nothing stops the train!

Risk on, but watch the bond market…

Immediately for markets, we see the passing of this bill as stimulative, with a positive demand shock coming from the pro-growth tax policies and the boost to sentiment from the “certainty” it now provides to US businesses.

For markets that are underweight and still fretting over recession risks, we suspect there will be more forced chasing of performance and equity markets push to ever new record highs 📈

One potential risk here could however be the bond market due to the continued deterioration in debt dynamics for the US. A particular concern of ours lies in the potential liquidity drain from the US Treasury now being able to issue new debt in markets. Much will depend on how that debt is raised, with recent comments from Trump and Bessent pointing to more “treasury QE” by extending front end T-bill issuance rather than longer dated coupon issuance. This does however risk causing a spike in front end rates and a September 2019 style repo crisis where front end funding rates spiked sharply, which would blow back negatively on risk.

We’re consequently watching the bond and rates markets closely over the coming weeks and expect there could be some volatility. However, ultimately, any rise in front end rates inconsistent with where the Fed Funds rate is set will necessarily require the Fed to intervene with some form of “not QE QE” monetary operation to keep a lid on yields. It will also likely be the bigger determinant of monetary policy, more than what inflation and employment is doing.

As we’ve said repeatedly, none of this is self-sustainable and ultimately results in financial repression and currency debasement as the debt gets financed by the Fed.

For Bitcoin, another raising of the debt ceiling and another spending bill which ultimately worsens the debt dynamics of the US, reinforces our long term, inevitable bullish macro thesis for Bitcoin and all hard assets. Debt based, fiat systems rely on increasingly more debt and the monetisation of that debt to sustain growth and keep the fiat ponzi alive.

The bond market may cause some short term volatility over the coming weeks, yet with the sanguine macro backdrop, the US running insane deficits, all with the stimulative impact of a weaker dollar amidst rising global liquidity, we continue to expect Bitcoin to break out into new range highs. The currency debasement games just stepped up another level…

Native News

Key news from the crypto native space this week.

AllUnity, a joint venture between Deutsche Bank’s (DBK) asset management subsidiary DWS, Flow Traders and Galaxy (GLXY) said it will issue Germany’s first regulated, euro-denominated stablecoin after receiving an e-money institution (EMI) license from the Federal Financial Supervisory Authority (BaFin) this week. The AllUnity EURAU stablecoin, which will comply with Europe’s Markets in Crypto Assets (MiCA) framework. According to the press release, EURAU will be 100% collateralised and deliver institutional-grade transparency through proof of reserves and regulatory reporting. The token can be used for 24/7 instant cross-border settlements, seamless integration for regulated financial institutions, fintechs, Treasuries (ERP) and enterprise clients across Europe and beyond. Speaking about securing an EMI license from BaFin, Alexander Höptner, CEO of AllUnity said in a statement: "This license is not just a regulatory hurdle cleared, it’s a foundational step towards building a truly secure, transparent and compliant digital cross-border payment ecosystem for Europe and global markets."

Amber International Holding Ltd., a subsidiary of Singapore-based crypto financial services firm Amber Group, has raised $25.5 million through a private placement to support its $100 million crypto reserve strategy. In a statement, Amber said that the funding drew participation from institutional investors including CMAG Funds, Mile Green, Pantera Capital, Choco Up and Kingkey Financial International. The American Depository Shares (ADS) for Amber were priced at $10.45 each, reflecting a 5% discount to the three-day volume-weighted average price of its stock. The company said "Proceeds from the private placement will be strategically used to enhance Amber International's $100 million Crypto Reserve initiative, which is designed to support long-term ecosystem alignment and product innovation." See the full statement HERE.

Institutional Corner

Top stories from the big institutions

This week, the US SEC Crypto Task Force met with representatives from the Securities Industry and Financial Markets Association (SIFMA), a major industry group for financial firms. The SEC wrote in a memo on Thursday that the meeting focused on cryptocurrency regulatory issues, specifically addressing digital asset issuance, digital commodities and tokenised securities. According to the agenda submitted before the meeting, SIFMA highlighted the need for a consistent regulatory approach for new services and platforms involving digital assets, but with updates to match technological advancements. The industry group proposed expanding and adapting existing disclosure regulations to cover new types of securities, particularly those involving digital assets. Regarding digital commodities and tokenised securities, SIFMA stated that the SEC should ensure that different functions — such as exchange and broker-dealer, or trading and custody — are kept separate, while promoting competition and interoperability among service providers. Meanwhile, it said direct retail participation in trading digital securities and commodities should be limited. The industry group noted that a new framework for the issuance and trading of digital securities should be developed openly and transparently, with careful construction of the "foundational" definition of securities and digital commodities. SIFMA also suggested that digital assets legislation should take a holistic approach, incorporating technological updates to statutory texts and including provisions for cross-border applicability. Read the full memo from the SEC HERE.

South Korea's central bank has decided to temporarily pause its CBDC project as local currency-based stablecoins gain momentum under endorsement by the country's president. The Bank of Korea (BOK) recently notified banks participating in the Hangang CBDC project that it is postponing discussions of a second stage of digital currency trials. The suspension comes less than three months after the central bank launched the Hangang CBDC pilot, which allowed 100,000 citizen participants to use the CBDC at local vendors in partnership with major local banking institutions. The BOK told banks that it will monitor how the legislation around stablecoin goes, as it is unclear how CBDCs, stablecoins and bank deposit tokens would coexist.

The country of Kazakhstan announced this week that it will establish a state cryptocurrency reserve under a National Bank affiliate. It will finance the plan with assets seized in criminal cases and coins mined by state-owned operations, the country's central bank governor, Timur Suleimenov said. The move extends Kazakhstan’s push into the crypto sector. The country controls about 13% of global Bitcoin hashrate and has imposed licensing rules on miners after officials seized nearly $200 million in illegal rigs following power shortages in 2022.

According to a report by Reuters, Chinese tech giants JD.com and Ant Group are lobbying China's central bank to approve offshore yuan-based stablecoins. The report says that the two tech firms have urged the People's Bank of China to authorise the launch of yuan-pegged stablecoins in Hong Kong. Last month, PBOC Governor Pan Gongsheng acknowledged that stablecoins and central bank digital currencies are reshaping global payment infrastructure. Pan also announced plans to establish an e-CNY international operation centre in Shanghai to expand the Chinese yuan's global influence. According to sources who spoke to Reuters, JD.com has made the case to the PBOC during closed-door meetings that offshore yuan-backed stablecoins are critically important for advancing the internationalisation of the yuan, especially when the Hong Kong dollar is pegged to the U.S. dollar.

Charts of the Week

Because charts are just as important as macro.

As of 29 June, Coinbase was the best performing stock of the S&P500 for the month.

Base has accounted for 67% of L2 fees in 2025

SOL CME Futures volume hit an all-time high of 1.75M contracts - the highest on record. Hat tip to Glassnode for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Staff Product Manager, Kraken Prime

Business Development Manager, Cryptoassets at DRW

Business Development Manager at Bitget

Digital Assets Product Manager at Citi

Senior DeFi Product Lead at R3

Prime Financing Trading Analyst at Coinbase

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.