Welcome to the new subscribers that have joined us over the last week.

The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

If you want daily market colour and opinion, check out our Twitter HERE.

Here’s a snippet of what you can expect:

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: China’s data looking interesting, bank stress continues to bubble under the surface and with the Fed pause and pivot to come, the medium term path remains higher.

Crypto Native News: Tether published its assurance opinion for Q1,23, the IRS files claims against FTX and Marathon Digital partners with UAE firm Zero Two.

Institutional News: Goldman Sachs releases its family office insights report, the Central Bank of Ireland Governor’s blog post on crypto and the world biggest firms partner to launch the Canton Network blockchain.

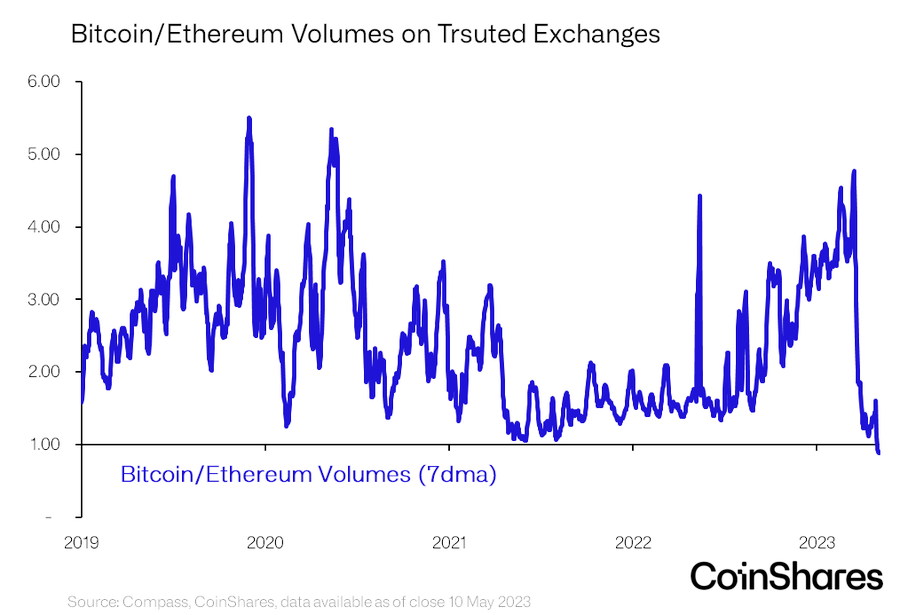

Chart of the Week: Ethereum volumes surpass Bitcoin this week.

Top Jobs in Crypto: Featuring Quant Street, Hivemind, Paratus Capital, Coinshares, Old Street Digital and Keyrock.

Macro Update

Here’s where we connect the dots between macro and crypto.

Have a Little Patience

A difficult week for crypto majors, with Bitcoin breaking below the low end of this broad 27k/30k range we’ve been stuck in throughout May and diverging from an otherwise stable risk backdrop, with the Nasdaq pushing to new year highs.

This week’s data highlight came in the form of US CPI. Although with the Fed leaning on an expected credit tightening to halt the hikes, early focus was on the Senior Loan Officer Opinion Survey (SLOOS) which confirmed that banks have “tightened standards across all loan categories” and perhaps more interesting, loan demand fell to its lowest levels since 2009. The credit crunch is already starting to bite.

US CPI came in at a weaker 4.9% Vs 5% exp and having peaked at 9.1% last year, is the lowest print in 2 years. Core a more elevated 5.5%, down from 5.6% but the “super core” (core less rent and shelter - JPow’s preferred measure) came in a cooler 5.1% YoY, 0.1% MoM as the lagging shelter/rent inflation finally starts to turn lower. PPI reinforcing the softer inflation narrative, with the headline coming in at 2.3%, down from 2.7%. Peak inflation narrative remains, albeit coming down slowly, yet enough here for a Fed pause in June.

China also saw its weakest CPI print since Feb 2021, coming in at just 0.1% YoY and PPI coming in at a deflationary -3.6%. Imports also fell 7.9% YoY in April. No signs of the feared inflationary impulse from China’s reopening. China PPI, as the world’s largest goods exporter, is also typically a lead on US CPI and like many other leading indicators suggests US CPI should start to accelerate lower into the second half of the year.

Adding to China slowdown fears was softer credit and loans data. China’s credit impulse correlates positively with Bitcoin so a tentative slowing here adds to another negative liquidity story on top of a likely lifting of the US debt ceiling in a few weeks time. Meanwhile, slowing global growth is a dollar positive in a world scrambling to service dollar debt and the dollar bounce, failing to break new lows, adds another macro headwind to Bitcoin.

Bank stress also continues to bubble under the surface, with unadjusted deposit outflows continuing and Money Market Funds receiving $18.3bn of inflows just this week. The KRE regional banks index down 5%, reversing last Friday’s dead cat bounce. It’s a case of when, not if we get another banking failure. This isn’t going away.

Competing forces then with fading liquidity and a dollar bounce creating headwinds, US yields failing to break lower. Still, we’re in consolidation mode and we look for 25k in BTC to hold. The medium term path remains higher in our view as the US financial system continues to stumble and the Fed pause and pivot. Patience required as we navigate the debt ceiling finale. Or as the crypto bro’s say. HODL.

Native News

Key news from the crypto native space this week.

Tether Holdings Limited, the issuer of stablecoin USDT, published its assurance opinion for Q1 of 2023 completed by BDO Italia, an independent public accounting firm. The attestation re-affirms the accuracy of Tether’s Consolidated Reserves Report (CRR), which breaks down the assets held by the group as of 31 March 2023. Some of the key takeaways from the report include a net profit for Q1,23 of $1.48bn and an increase in the tokens in circulation of 20%. Tether closed the first quarter 2023 with $81.8bn in consolidated total assets. The majority of its reserves are invested in US Treasury Bills. It has also been working to take steps to reduce its reliance on pure bank deposits as a source of liquidity and instead leverage the Repo market as an additional measure to ensure higher standards of protection for its users by maintaining the required liquidity. Tether says their reserves remain extremely liquid, with the majority of its investments being held in cash, cash equivalents, and other short-term deposits (approximately 85%). Tether says their latest report demonstrates their commitment to transparency and highlights a 25% reduction in secured loans from 8.7% to 6.5% of this asset class within the overall reserves and the highest percentage to date of assets allocated in US Treasury Bills. Gold and Bitcoin represent circa 4% and 2% of the total reserves, respectively. Read the full release from Tether HERE.

The United States IRS, this week filed claims worth nearly $44bn against the estate of bankrupt crypto exchange FTX and its affiliated entities. According the bankruptcy filings, the IRS put in 45 claims against FTX companies including Ledger Holdings and Blockfolio. The largest claims include a $20.4bn and $7.9bn claim against Alameda Research and two claims totalling $9.5bn against Alameda Research Holdings. You can find more information HERE.

BTC Miner Marathon Digital announced a partnership with UAE crypto investment firm Zero Two aimed at developing mining operations in the country. The planned mining operations will aim to increase the base load & sustainability of the Abu Dhabi power grid. Read the full release HERE.

Institutional Corner

Top stories from the big institutions.

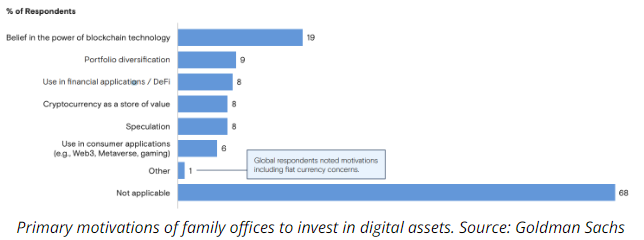

According to a report by Goldman Sachs titled “Eyes on the Horizon: Family Office Investment Insights,” 32% of family offices currently hold investments in digital assets. This category includes cryptocurrencies, nonfungible tokens (NFTs), decentralised finance (DeFi) and blockchain-focused funds. The proportion that are invested in cryptocurrencies has risen from 16% in 2021 to 23% in 2023. Explaining their motivations for investing in digital assets, most (19%) cited a belief in the power of blockchain technology, with only 8% and 9% citing speculation and portfolio diversification, respectively. (See chart below). You can read the full report HERE.

The Central Bank of Ireland Governor released a blog post on Crypto this week. In the post he said there is an urgent need for policy action and MiCA was an important first step in that. The Governor says he is open towards the potential of ‘backed crypto’ – such as Electronic Money Tokens (EMTs) and Asset Reference Tokens (ARTs) under MiCA – where appropriate reserves and controls are in place. Though consumers should know these are not risk free. On the other hand, he says ‘unbacked crypto’ (including poorly or unreliably-backed crypto) is a very different proposition and that the claimed benefits of ‘unbacked crypto’ should be treated with a large dose of scepticism. Read the full report HERE.

This week leading market participants across both technology and finance announce their plans to launch the Canton Network, the industry’s first privacy-enabled interoperable blockchain network, designed for institutional assets and built to responsibly unlock the potential of synchronized financial markets. The Canton Network will provide a decentralised infrastructure that connects independent applications built with Daml, Digital Asset’s smart-contract language. It creates a ‘network of networks’, allowing previously siloed systems in financial markets to interoperate with the appropriate governance, privacy, permissioning and controls required for highly regulated industries. Some of the network participants include Network participants include 3Homes, ASX, BNP Paribas, Broadridge, Capgemini, Cboe Global Markets, Cumberland, Deloitte, Deutsche Börse Group, Digital Asset, The Digital Dollar Project, DRW, Eleox, EquiLend, FinClear, Gambyl, Goldman Sachs, IntellectEU, Liberty City Ventures, Microsoft, Moody’s, Paxos, Right Pedal LendOS, S&P Global, SBI Digital Asset Holdings, Umbrage, Versana, VERT Capital, Xpansiv, and Zinnia.

Chart of the Week

Because charts are just as important as macro.

This week, Ethereum volumes surpassed Bitcoin volumes on exchanges. Chart from Coinshares.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Quant Trader at Quant Street

Senior Crypto Operations Analyst at Hivemind

Senior Quant Trader – Crypto at Paratus Capital

Sales Analyst/Associate at Old Street Digital

Options Trader Digital Assets at Keyrock

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.

Great write-up, LCC! Keep the updates coming!