Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

If you find this newsletter useful, we’d like to ask a favour.

Could you share it with just 1 person you think might learn something from it. Thank you !

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Conflict in the Middle East still dominates and the de-risking continues, Fed continue their co-ordinated dovish messaging, the risk reward remains to the upside for bitcoin.

Crypto Native News: Tether promoted its CTO to CEO, the FTX estate staked over 5.5m SOL coins ($122m) this weekend.

Institutional News: Mastercard participates in the RBA CBDC pilot project, ARK invest submits an amended spot Bitcoin ETF application, JPMorgan debuts its in-house blockchain-based tokenisation application and ESMA releases a paper on DeFi.

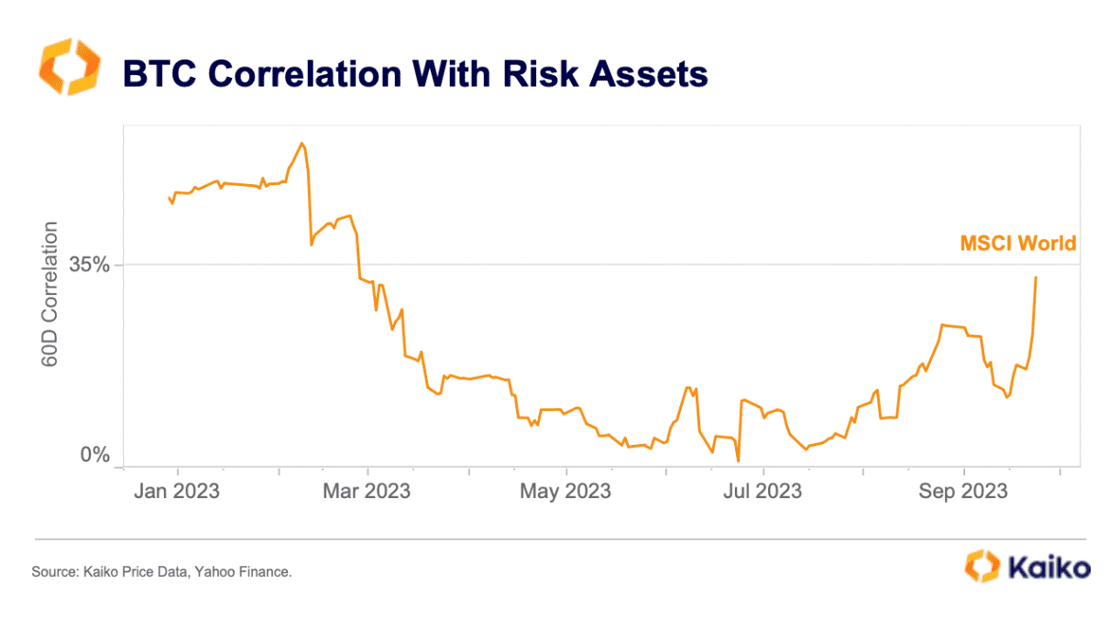

Chart of the Week: Bitcoins correlation to risk assets has risen considerably since the summer.

Top Jobs in Crypto: Featuring Paysafe, Marex, Fionics, Revolut, Bullish and the FCA.

Macro Update

This is where we connect the dots between macro and crypto.

Did the Fed Just Pivot ?

Conflict in the Middle East dominated markets this week, driving oil prices 6% higher, with similar gains for gold and US treasuries rallying on a flight to safety.

Equities ended the week mixed but generally benefitting from a broad de-risking which has seen an unwinding of the vaunted short positioning.

Bitcoin and the wider crypto space generally trading heavy as long positions are reduced and perhaps a reminder that, whilst many of us view Bitcoin as “digital gold” it’s still very much a high beta risk asset. This, despite legendary macro investor Paul Tudor Jones recommending increasing allocations to both bitcoin and gold amidst geopolitical uncertainty and spiralling US debt.

Still, Bitcoin generally remains range bound and options markets show little signs of “fear” with most of the directional trades still positioning for a move higher into year end and beyond. Underpinning that positive sentiment, are expectations that the Fed is done hiking rates.

Indeed, there’s been a notable change in Fed communication this past week, with a seemingly coordinated, dovish messaging that the run higher in longer term yields warrants some concern and is doing much of the tightening work, reducing the need for further hikes. Atlanta Fed President Raphael Bostic was even more explicit in saying “I actually don’t think we need to increase rates anymore” and this chimed with the FOMC minutes with officials agreeing that the “Fed should shift communications from how high to raise rates to how long to hold rates.”

This Fed hike cycle is done 🎉

Inflation data however continues to remain “sticky” with inflation readings coming in a touch stronger than expected. Headline CPI inflation for Sep was unchanged at 3.7% YoY although core at 4.1% is at its lowest in 2 years. Producer Price Inputs also showing signs of picking up, with core PPI rising to 2.7% from 2.5% and along with oil prices rising, will keep the Fed feeling a little uncomfortable. Nonetheless, markets have all but priced out a Fed hike in November, with odds dropping to just 5.7% Vs 27% a week ago. The Fed’s dovish message has been well received 🫡

Where does this leave us?

Short term, it feels difficult to break out of this range bound lethargy. With the VIX and MOVE index rising, the broad risk environment, understandably given the conflict in Israel, remains fragile and high beta risk assets like Bitcoin will remain under some pressure.

Yet this shift in Fed messaging is important. We were correctly bullish into this year on this changing macro regime from the sharpest Fed hike cycle in history to the eventual pause, followed by the cutting cycle. Bitcoin remains the best performing macro asset in 2023, but has been leaning into the strong macro headwinds of a rising dollar and higher yields as resilient US data has kept us in this “macro purgatory” and the Fed forced to maintain a hawkish stance.

The rise in term premia on US debt sustainability concerns reinforces the longer term bull case for Bitcoin as the hedge against the failure of a fiat system unable to handle higher real rates. Even the Fed are expressing concern on that now and will be hoping inflation and growth slows sufficiently to allow them to lower front end rates, otherwise yield curve control will be an inevitable consequence.

Regional banks also remain a concern and continue to suffer deposit outflows, whilst their equity price trades heavy. Credit will consequently be constrained, reinforcing a slow down, especially with those covid excess savings having now been depleted. We’re edging closer to the liquidity hose being turned back on to these markets.

Friday’s news that the SEC won’t appeal the loss in the Grayscale case all but ensures spot BTC ETF approval. With the macro cycle set to ease into the halvening alongside the big institutions able to buy BTC via the ETF structure, the risk reward continues to be, in our view, asymmetric for Bitcoin to break to the upside. Steady lads!

Want to know what the politicians think about Crypto ?

Last week I watched Lisa Cameron MP speak at the Zebu Live Conference.

Check out what she had to say HERE.

Native News

Key news from the crypto native space this week.

Stablecoin issuer Tether has promoted its long-standing Chief Technology Office Paolo Ardoino to CEO. Ardoino will take over the role in December and said that he envisions Tether becoming a “tech centric organisation, reshaping the future of finance”, instead of just being a stablecoin issuer. Tether’s current CEO, Jean-Louis van der Velde, will move to an advisory role. Velde will retain his position as CEO for Bitfinex, a crypto exchange and sister company of Tether. A statement said "Paolo will begin his tenure by focusing on technological advancements, supporting peer-to-peer projects, and participating in bitcoin mining initiatives," "This broader technological and industry advancement strategy may also include collaboration with regulators to establish clearer guidelines and foster greater compliance within the cryptocurrency space."

Yesterday, the FTX estate staked over 5.5 million Solana (SOL) coins, valued at $122 million. According to on chain data from SolanaFM, the SOL was moved from one of its principal wallets on the Solana blockchain. A substantial amount of SOL earmarked to the FTX estate unlocks every month according to the vesting schedule, offering the possibility for the estate to sell them off if they want. There have been previous concerns that the estate might liquidate its substantial Solana holdings, as the coins become unlocked. However, the latest action by the FTX estate eases those concerns.

Institutional Corner

Top stories from the big institutions

This week, Mastercard highlighted that they had participated in the Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Centres central bank digital currency (CBDC) pilot project which explored potential use cases for CBDC in Australia. Mastercard said that it has successfully demonstrated capabilities of a new solution that enables CBDCs to be tokenised (or “wrapped”) onto different blockchains, providing consumers with a new option to participate in commerce across multiple blockchains with increased security and ease. Mastercard’s Division President for Australasia said “As the digital economy continues to mature, Mastercard has seen demand from consumers to participate in commerce across multiple blockchains, including public blockchains. This technology not only has the potential to drive more consumer choice, but it also unlocks new opportunities for collaboration between the public and private networks to drive genuine impact in the digital currency space”. Read the full release from Mastercard HERE.

In the ETF space, Cathie Woods ARK Invest filed a second amended application for a spot Bitcoin ETF this week. The latest version, filed on Wednesday, introduces additional risk warnings associated with the Bitcoin network that could negatively affect the price of an ETF. Other minor adjustments include issues related to energy consumption, a community driven upgrade to Bitcoin source code and competition within the industry. It also provides more clarity on the custodian, Coinbase. Coinbase will hold the assets backing the ETF in segregated addresses on the Bitcoin blockchain and will not be “comingled with corporate of other customer assets”. See the full filing HERE.

JPMorgan debuted its in-house blockchain-based tokenisation application, the Tokenized Collateral Network (TCN), on Wednesday. TCN settled its first trade for asset manager BlackRock. The Tokenised Collateral Network is an application that allows investors to utilise assets as collateral. Using blockchain technology, investors can transfer collateral ownership without moving assets in underlying ledgers. In its first public collateralised trade between JPMorgan and BlackRock, the TCN turned shares of one money market fund into digital tokens, which were then transferred to Barclays bank as security for an over-the-counter derivatives exchange between the two companies. The first internal test of the TCN was conducted by JPMorgan in May 2022, with a pipeline of other clients and transactions now that TCN is live. The TCN was launched to streamline and scale the process of traditional settlements on a blockchain. According to Tyrone Lobban, head of Onyx Digital Assets at JPMorgan, the new TCN platform unlocks capital and allows it to be used as collateral in ongoing transactions, boosting efficiency at scale. The platform enables the creation, transfer and settling of tokenised traditional assets. It also allows for the movement of collateral nearly instantly, unlike earlier methods.

The European Securities and Markets Authority released a paper "Decentralisation Finance: A Categorisation of Smart Contracts" and noted that although MiCA does not directly supervise DeFi, regulators need to understand and monitor the complexity, fragility and contagion of smart contracts that depend on each other. Read the full report from ESMA HERE.

Chart of the Week

Because charts are just as important as macro.

Bitcoins correlation with risk assets has risen considerably since the summer lows. The 60 day correlation to the MSCI World Index has risen to nearly 35%.

Hat tip to Kaiko Data for the chart

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Account Manager for Crypto at Paysafe

Crypto Options Market Maker via Fionics

Product Owner Crypto at Revolut

Technical Specialist in Cryptoasset Business Models at the FCA

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.