Cheers to our 25th newsletter anniversary !

Really proud to say that we’ve been writing for 25 weeks. We started this newsletter with the aim of producing content on macro and crypto built on 2 pillars, experience and integrity. We hope you continue to find value in the content that we produce. Thanks for your support so far !

For the new subscribers that have joined us this week, welcome ! The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

If you want daily market colour and opinion, check out our Twitter HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: Debt ceiling deal reached, what does that mean for crypto markets? US yields and DXY also being closely watched.

Crypto Native News: Binance back in Japan, Ripple buys shares in Bitstamp and Tether announces Bitcoin mining operations in Uruguay.

Institutional News: China releases a whitepaper on Web3 policy, Hong Kong licensing regime for retail investors goes live this week and Brazil releases details on its CBDC pilot.

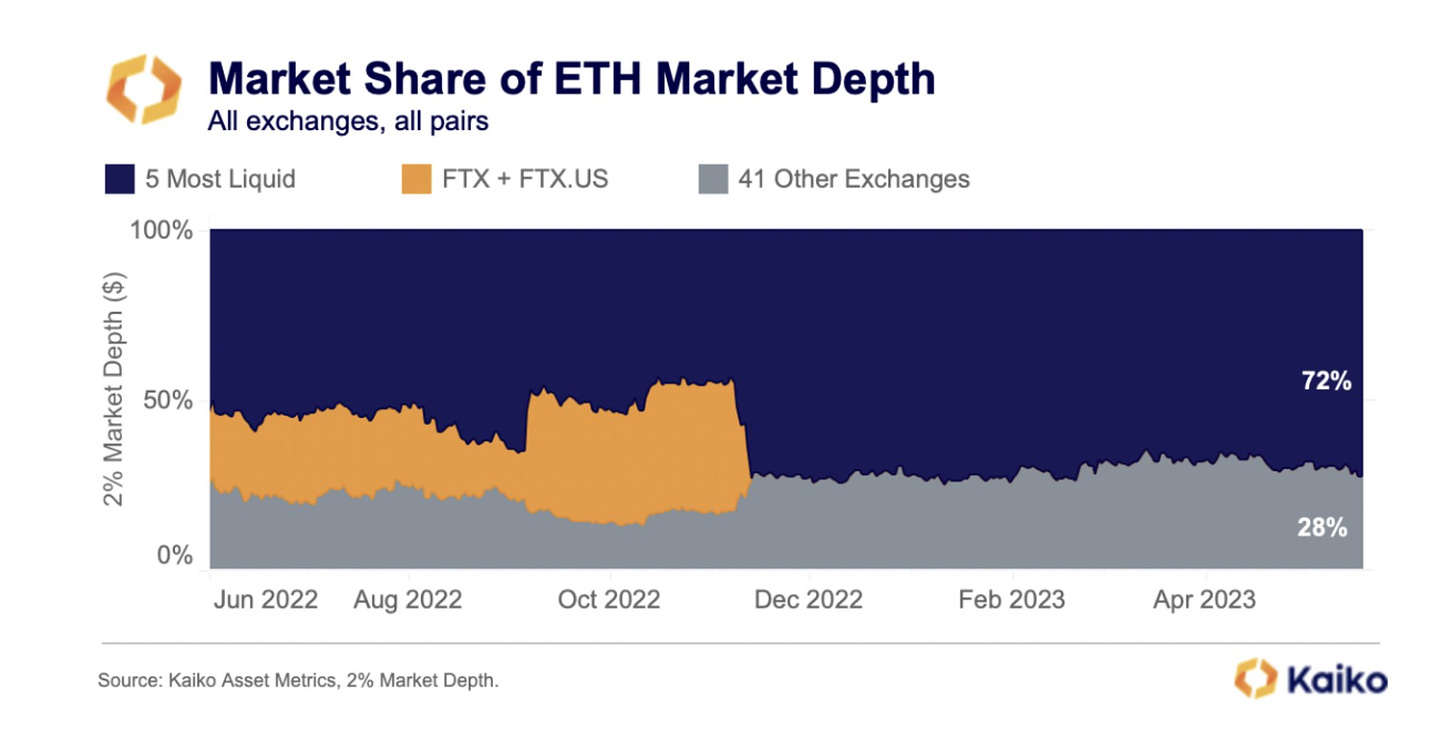

Chart of the Week: ETH market depth concentrated in 5 exchanges.

Top Jobs in Crypto: Featuring Coinbase, Matrixport, Ripple, Bitpanda and Finixio.

Macro Update

This is where we connect the dots between macro and crypto.

Champagne On Ice

Breaking news that the White House and Republican leaders have reached a deal to lift the debt ceiling and avoid default has dominated the long holiday weekend newsflow. The deal will suspend the $31.4trn debt ceiling until Jan 2025 (after the next election.) Details of the deal indicate that non-defense spending will be kept flat next year although defense spending will be allowed to rise by 3%. Elsewhere, some tinkering around social welfare but no major overhaul. Estimates suggest spending cuts will total a paltry 0.2% of GDP and total debt over that time frame to increase by over $4trn. The deal will pass to the house to be voted on Wednesday, with a rush to pass the legislation before the estimated 5th June X-date (when the US Treasury run out of money and risk default).

The knee-jerk response has seen crypto majors pop higher. Immediately, the world’s largest economy and global reserve currency avoiding default can reasonably be deemed “risk positive” even if the chances of actual default remained close to zero. Of course, this was always just about politics.

This also continues to support the big picture bull narrative for Bitcoin. Namely, our fiat-based credit systems cannot survive and grow without ever more debt. The unsustainability of this debt means eventually, it gets “printed” away and will find itself sitting on the Fed balance sheet, which ultimately leads to the continued debasement of fiat currency.

The shorter term however, caution remains of the negative liquidity impact this will have on our markets. With the debt ceiling lift allowing the US Treasury to return to the debt markets, the issuance of this debt will be a significant liquidity drain, with the treasury looking to build the TGA back to 500bn by the end of June! There is, of course, nuance with this. Issuing via T-bills will be more easily absorbed given the lower duration profile. It could also be off-set if the money parked at the Fed’s overnight Reverse Repo facility (RRP), which currently sits in excess of $2trn is teased out to earn higher yielding T-bills.

How US yields and the dollar react in the days/weeks ahead will also be significant. Both have moved decently higher in the past couple of weeks and formed this negative dynamic that has kept a lid on Bitcoin. Whilst markets have re-priced expectations for the Fed (65% odds for a June hike now priced in), concerns surrounding a potential debt default have been significant drivers of those moves. If those moves prove to be a “buy the rumour, sell the fact” redux, then some easing of the dollar and move lower in yields should offset the expected liquidity tightening.

AI and tech are partying hard. For the crypto liquidity junkies, the champagne needs to be put on ice.

Native News

Key news from the crypto native space this week.

After five years out of the Japanese market, crypto exchange Binance has begun the process of establishing a new and fully regulated subsidiary in the country. The move follows the acquisition of the regulated crypto exchange Sakura Exchange Bitcoin (SEBC) in November 2022. As part of the deal, SEBC will cease its current services by 31 May and reopen as Binance Japan in the coming weeks. Users of the exchange's global platform in the country will have to register with the new entity. The migration will be available after 1 August 2023, and will include a new identity verification process (KYC) to comply with local requirements.

As part of its continued expansion route outside of the US, Ripple Labs purchased shares in European crypto exchange Bitstamp. Ripple bought the shares previously owned by American investment firm Pantera Capital.

Tether the blockchain-enabled platform powering the world's first and most widely used stablecoin, announced today that it is investing resources into energy production and the launch of sustainable Bitcoin mining operations in Uruguay, in collaboration with a local licensed company. The press release from Tether says that with this move, it has expanded its reach from finance and communications to include the energy sector. Its goal is to become a global tech leader, and this latest initiative showcases Tether's commitment to energy innovation and the future of cryptocurrency. As part of the new venture, Tether is investing in renewable energy sources to support and promote sustainable Bitcoin mining—an essential component in upholding the world's most robust and secure monetary network. To accomplish this ambitious objective, Tether is actively seeking to augment its team by recruiting experts in the energy sector. This project represents a noteworthy milestone, where the realms of energy and cryptocurrency converge harmoniously. Paolo Ardoino, CTO of Tether said "By harnessing the power of Bitcoin and Uruguay's renewable energy capabilities, Tether is leading the way in sustainable and responsible Bitcoin mining," "Our unwavering commitment to renewable energy ensures that every Bitcoin we mine leaves a minimal ecological footprint while upholding the security and integrity of the Bitcoin network. Tether is proud to spearhead a movement that combines cutting-edge technology, sustainable practices, and financial innovation." Read the full release from Tether HERE.

Institutional Corner

Top stories from the big institutions.

Over the weekend, authorities at the Beijing Municipal Science & Technology Commission, which oversees the Zhongguancun Chaoyang Park – a cluster of China’s top tech companies and academic institutions – released a whitepaper outlining suggestions for China’s web3 policy. However Web3, in China, means an internet enhanced by artificial intelligence, blockchain, faster computing chips and more resilient networks, its not a whitepaper related to crypto. The whitepaper is more interested in defining – and enhancing – the layers of infrastructure behind the internet, which it identifies as the infrastructure layer, interactive terminal layer, platform tool layer and application layer. We think this is pretty significant and continue to watch for any softening of language from China towards crypto.

Don’t forget that from 1 June, Hong Kong's securities regulator will have a licensing regime to protect retail investors. The new regime requires all trading platforms and exchanges to apply for a licence, failing which would result in fines and jail terms. Other measures include requiring companies to set an exposure limit for retail investors as well as only allowing retail trading in highly liquid tokens that have been issued for at least one year. The new system also covers the marketing of services from unlicensed platforms.

The Central Bank of Brazil selected 14 institutions to participate in the pilot of the country’s central bank digital currency (CBDC), the digital real. The central bank published the list of institutions taking part which includes major local private banks such as Bradesco, Nubank, and Itaú Unibanco, as well as the largest public Brazilian bank, Banco do Brasil, and the local stock exchange B3. Multinational companies such as Visa and Microsoft were also chosen to participate. The central bank will begin incorporating participants into the Real Digital Pilot platform in mid-June 2023. In total, the bank received 36 interest proposals from over 100 institutions from several different financial sectors, including payment institutions, cooperatives, public banks, crypto companies, financial market infrastructure operators, and payment settlement institutes.

Chart of the Week

Because charts are just as important as macro

72% of ETH market depth exists on just 5 exchanges: Binance, Bitfinex, OKX, Coinbase and Kraken. All other exchanges (41) account for just 28% of market depth. Before FTX collapsed, the exchange and U.S. counterpart accounted for a high of nearly 40%. Market share on the 5 most liquid exchanges has increased to 72%.

Hat tip to Kaiko Data for the chart. See their full analysis HERE.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

International Derivative Exchange Lead at Coinbase

Institutional Sales Crypto/Digital Assets at Matrixport

Lead Product Manager, Crypto Settlement at Ripple

Money Laundering Reporting Officer at Bitpanda

Crypto and Finance News Reporter at Finixio

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.