Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Binance to launch a new yield bearing product, OpenSea sends a letter to the SEC, the Central Bank of Bahrain grants BPay Global a PSP license.

Institutional Corner: Paul Atkins voted in as SEC Chair, Ethereum ETF options trading approved, Pakistan to allocate part of its surplus electricity to Bitcoin mining and AI data centres.

Charts of the Week: Bitcoin reserve on Binance increased, bitcoin market depth remains resilient, Arbitrum hits $300bn volume on Uniswap.

Top Jobs in Crypto: Featuring Crypto .com, Koinly, Coinbase, Nickle Digital Asset Management, Re7 Capital and Chainlink Labs.

Macro Update

This is where we connect the dots between macro and crypto.

Blinking Trump

Another volatile week dominated by tariff related uncertainty eventually saw US equities record strong weekly gains, with the S&P 500 up 5.7% and the Nasdaq up 7.3%, despite opening the week with sharp losses. Bitcoin similarly ended the week once again flat, recovering sharply after making new year lows sub 75k.

Wednesday’s announcement from Trump of a 90 day pause on the higher reciprocal tariffs for countries ex-China sent broad risk surging, although the enthusiasm was soon tempered with the tit-for-tat with China seeing the US impose up to 145% tariffs on China and China responding with levies of up to 125% on US imports 😬

Nonetheless, for those that doubted if a “Trump Put” existed, then this was the administration blinking. As I write, headlines are also breaking that Trump will exempt smartphones, computers and other electronics from reciprocal tariffs. This is huge as it relates to technology stocks and the Nasdaq 🚀

The biggest focus however for the market has been the dislocations we are witnessing in the rates market.

This week, the U.S. Treasury market experienced significant turbulence as heavy selling drove 10-year bond yields to their largest weekly increase in over a decade, peaking at 4.51% before settling to close the week at 4.49%. This surge marked a sharp reversal from an initial decline triggered by Trump's tariff announcement, which raised recession fears and expectations of rate cuts. Even a very soft inflation report with headline inflation falling from 2.8% to 2.4% and core inflation at 2.8% the softest since March 2021, provided little relief as macro data takes a back seat to the forward looking implications of tariffs and trade disruption.

Things are starting to break…

Typically in these “risk-off” environments, Treasuries act as the ultimate safe haven and the sell off this week, especially in the long end (30yr yields on the week rising from 4.41% to highs of 5.02% at one stage) which began even when equities were getting hit hard, has raised some concerns that the US credibility is being called into question and is driving a sharp rotation of investment flows out of the US.

Particularly unusual is to see the dollar selling off when US yields are spiking higher, adding credence to the theories that investors and sovereigns are dumping US treasuries and repatriating back home as confidence is lost in the US. The fact that US breakevens are sharply lower (market based measures of inflation) further suggests this isn’t tariff driven inflation fears, but term premium being priced in as US credibility is called into question.

Also creating concern is the talk that this move in treasuries is causing a mass unwinding of a popular leveraged basis trade (where hedge funds buy treasuries and sell treasury futures to capture small differentials) which is estimated to be leverage up to a circa $800bn trade. Sharp, disorderly moves such as what we’ve experienced this week quickly cause things to break and funds to blow up. It’s quite likely, in our view, that this has been a greater cause of the treasury sell off than the fears of a mass exodus of investors leaving the US. Indeed, we suspect that as global markets de-risk, US assets are being sold and repatriated simply as that de-risking process rather than the start of a longer term shift away from the US. As those more mechanical flows dry up, then the dollar likely comes back stronger as continued stress will then see a global demand rush for dollars to service the huge amount of dollar debt issued outside of the US (estimated to be to the tune of $17trn 🤯) - so no, this is not the start of the dollar demise and a sustained rotation out of the US, in our view. The US remains the cleanest shirt in the laundry and this is more just a mechanical de-risking driving these correlation breakdowns.

Central Banks priming the liquidity pump…

Nonetheless, US treasuries are the ultimate collateral that underpin the global financial system and when the quality of that collateral is called into question and its volatility is high, markets freeze up quickly and can set off a negative chain reaction, and we’ve seen signs of stress this week that draw parallels with Covid era dislocations.

Central bank vigilance is consequently stepping up. The ECB this week calling on banks to check on deposits and other forms of funding more frequently, whilst the BoE asked lenders for information about market liquidity whilst also amending its schedule for bond sales in the second quarter, delaying the issuance of longer dated gilts.

Meanwhile, and perhaps most importantly, the Fed’s Collins late on Friday re-iterated that the “Fed is absolutely ready to help stabilize the market if needed.”

We frequently say that the Fed and other central banks have removed the “left tail risk” from our markets. Ultimately, all of this leads to an explosion of liquidity as the Fed is forced to perform its primary role as the “treasury buyer of last resort” and ensure sufficient liquidity to enable “normal” market functioning.

Financial repression and currency debasement is the end game. As Jamie Dimon said this week, the Fed will step in “when they start to panic a bit” and this week has likely brought that moment closer.

Bitcoin is showing signs of sniffing this liquidity which will add to its recent strength as a borderless, non-sovereign asset. Meanwhile Trump has shown the market where the strike is on his equity market “put” and having front loaded the bad news, expect the headlines to start to flow a little softer from here.

This week likely marked the turning point for equity markets in our view. With global fiscal and monetary support ramping up, global M2 exploding higher alongside the dollar selling off and US credibility getting called into question, this is the moment that Bitcoin was made for. Get ready.

Native News

Key news from the crypto native space this week.

Binance Futures will this month debut a new yield-bearing product, LDUSDT, allowing traders to earn rewards that can be used for futures trading. Binance said that LDUSDT is not a stablecoin or swappable token but users will be able to trade Tether (USDT) for LDUSDT via the company’s Simple Earn Flexible Products to use as collateral for speculating in futures. Binance VP of product Jeff Li said in a statement “LDUSDT increases capital efficiency for users and lets users put their assets to work for them as both a reward-earning and liquid trading margin asset, all while retaining flexibility to redeploy their capital at any time.”

This week, NFT marketplace OpenSea send a letter to the US SEC asking them to clarify that it and platforms like it should not be treated as securities exchanges or brokers. OpenSea’s general counsel, Adele Faure, and deputy general counsel Laura Brookover urged SEC Commissioner Hester Peirce to issue informal guidance affirming that NFT marketplaces fall outside the scope of broker-dealer and exchange rules saying “Classifying OpenSea and similar NFT marketplaces as securities exchanges or brokers would be regulatory overreach.” OpenSea describes itself more as a digital bazaar than a trading floor, “allowing people to discover NFTs and connect with buyers and sellers” rather than facilitating trades in the traditional sense. See the full letter from OpenSea HERE.

The Central Bank of Bahrain (CBB) has granted BPay Global a Payment Service Provider (PSP) license to operate in the Kingdom of Bahrain. BPay Global is a payment services company in the Binance Group. The PSP license will allow the company to provide fiat services to Binance customers globally, including fiat top ups and withdrawals, custody and other payment services. This will enable Binance customers to open an e-wallet and make fiat top ups on the Binance platform through bank transfers and debit/credit card payments. The license will also allow BPay Global to custody fiat on behalf of customers. Commenting on this announcement, Mr. Abdulla Haji, Director of Licensing Directorate at CBB, said “We are pleased to announce the issuance of a license to a new payment service provider in Bahrain. This license represents a positive step in enhancing Bahrain’s digital payments ecosystem, particularly in its support for crypto-related sector as well as fiat payment solutions. The CBB remains committed to enabling a dynamic and progressive payment landscape that aligns with global advancements in financial technology.”

Institutional Corner

Top stories from the big institutions

This week, the U.S. Senate voted to confirm Paul Atkins, President Donald Trump's pick for Securities and Exchange Commission Chair. Atkins is expected to embark on creating a regulatory framework for digital assets. Atkins founded the consulting firm Patomak Global Partners in 2009 and the firm has clients including banks, crypto exchanges and DeFi platforms, according to its website. He was also appointed by former President George W. Bush as an SEC commissioner from 2002 to 2008. In prepared testimony during a Senate Banking Committee hearing last month, Atkins said he would make creating a regulatory framework for digital assets a "top priority."

The U.S. Securities and Exchange Commission has approved options trading on Ethereum exchange-traded funds. The filings released on Wednesday show that the regulator approved trading options for BlackRock's iShares Ethereum Trust, along with the Bitwise Ethereum ETF and Grayscale's Ethereum Trust and Ethereum Mini Trust. As a reminder the Ethereum ETFs allow investors to gain exposure to digital assets without the need to buy and store the virtual coin themselves. Options give investors the right to buy or sell an asset at a predetermined price by a set date. Read the filing for the BlackRock ETF HERE.

Pakistan's Head of Crypto Council and adviser to the finance minister said on Wednesday that the country plans to allocate part of its surplus electricity to Bitcoin mining and AI data centres. Bilal Bin Saqib, chief executive officer of the council, told Reuters the location of the mining centre will be finalised based on the availability of excess power in specific regions. Changpeng Zhao, founder of Binance, who will serve as a strategic adviser to the Pakistan Crypto Council. His role on the Pakistan council will include supporting blockchain infrastructure, advising on regulatory frameworks, and assisting with national initiatives, such as digital currency, mining, and youth education in blockchain technologies.

Charts of the Week

Because charts are just as important as macro.

Bitcoin reserve on Binance has increased by 22,106 BTC. This shows a strong acceleration in BTC inflows to Binance. Hat tip to CryptoQuant for the chart.

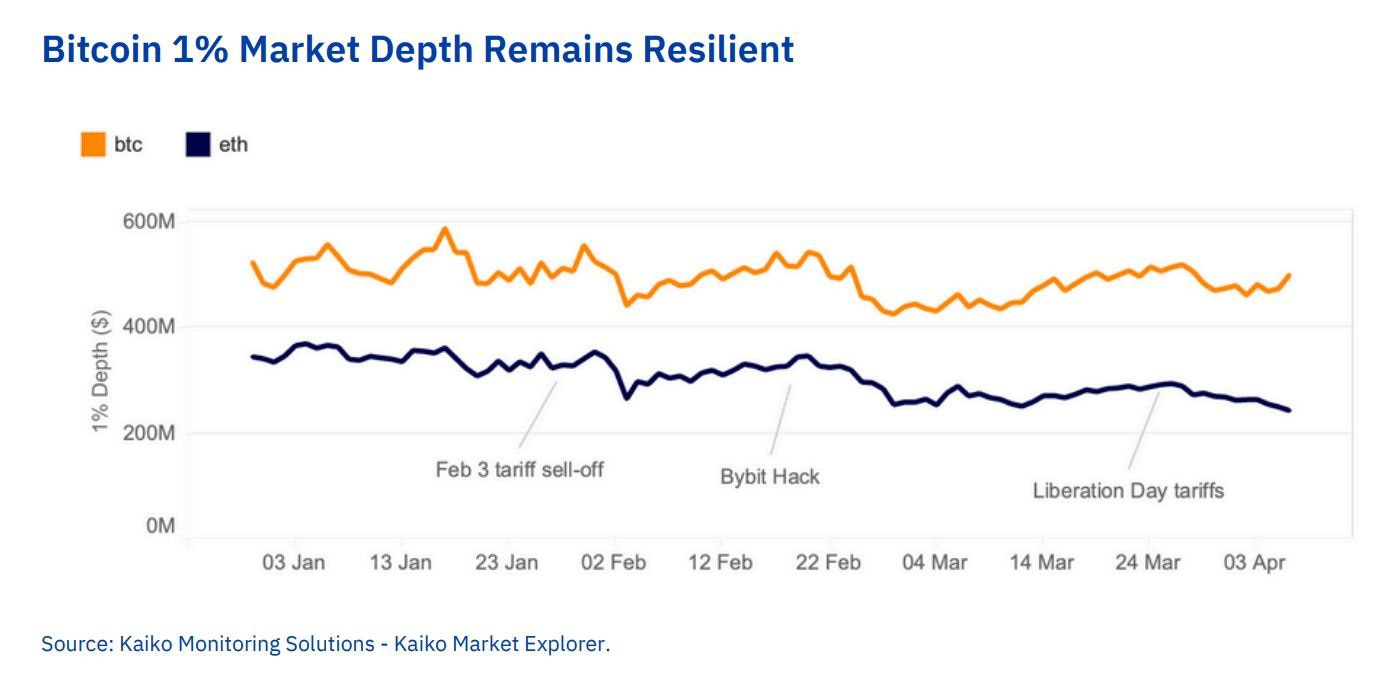

Despite rising volatility, Bitcoin 1% market depth remains resilient. While liquidity decreased following the February 3 tariff selloff, market makers kept stable BTC exposure through March and increased it in early April, despite the global selloff on Liberation Day.

Conversely, ETH liquidity continued its decline, dropping 27% from January 1 to April 6, reaching $243 million amid ongoing underperformance. Hat tip to Kaiko Data for the chart.

Arbitrum has become the first Layer 2 to hit $300B in volume on Uniswap. Hat tip to CryptoRand for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Director, Organic Growth at Crypto .com

Product Analyst for Crypto at Koinly

Prime Financing Trade Analyst at Coinbase

Middle Office Analyst at Nickel Digital Asset Management

DeFi Program Manager at Re7 Capital

Strategic Account Manager for DeFi at Chainlink Labs

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.

Nice summary, I appreciate your work!