We’re 20 episodes of the newsletter in and pushing towards 1,000 subscribers, thanks for the support so far !

This seems like a good time to reflect, so if you have any feedback, I’d love you to reply to this email and tell us what’s going well and what could be better. (FWIW - I’m thinking of adding a Week Ahead section).

For the new subscribers this week, welcome. The aim of this newsletter is to help you navigate the world of crypto.

There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

As always, our only ask is that you share this with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: The positive macro tailwinds for risk and crypto faded somewhat this week, the Fed Beige book suggested the expected credit crunch is underway and US tax repayments muddy the waters.

Crypto Native News: Deutsche Digital Assets release a report on Cryptoasset Adoption and Volatility, Coinbase CEO says he may consider relocating due to US regulatory environment.

Institutional News: CME to offer shorter term options contracts in BTC and ETH, EU votes in favour of MiCA regulations, Soc Gen launches a EUR-pegged stablecoin, the Digital Economy Initiative releases a proposal for stablecoins, central bank of Isreal still insure whether to issue a CBDC and A Hong Kong court declares that cryptocurrencies are property and capable of being held on trust

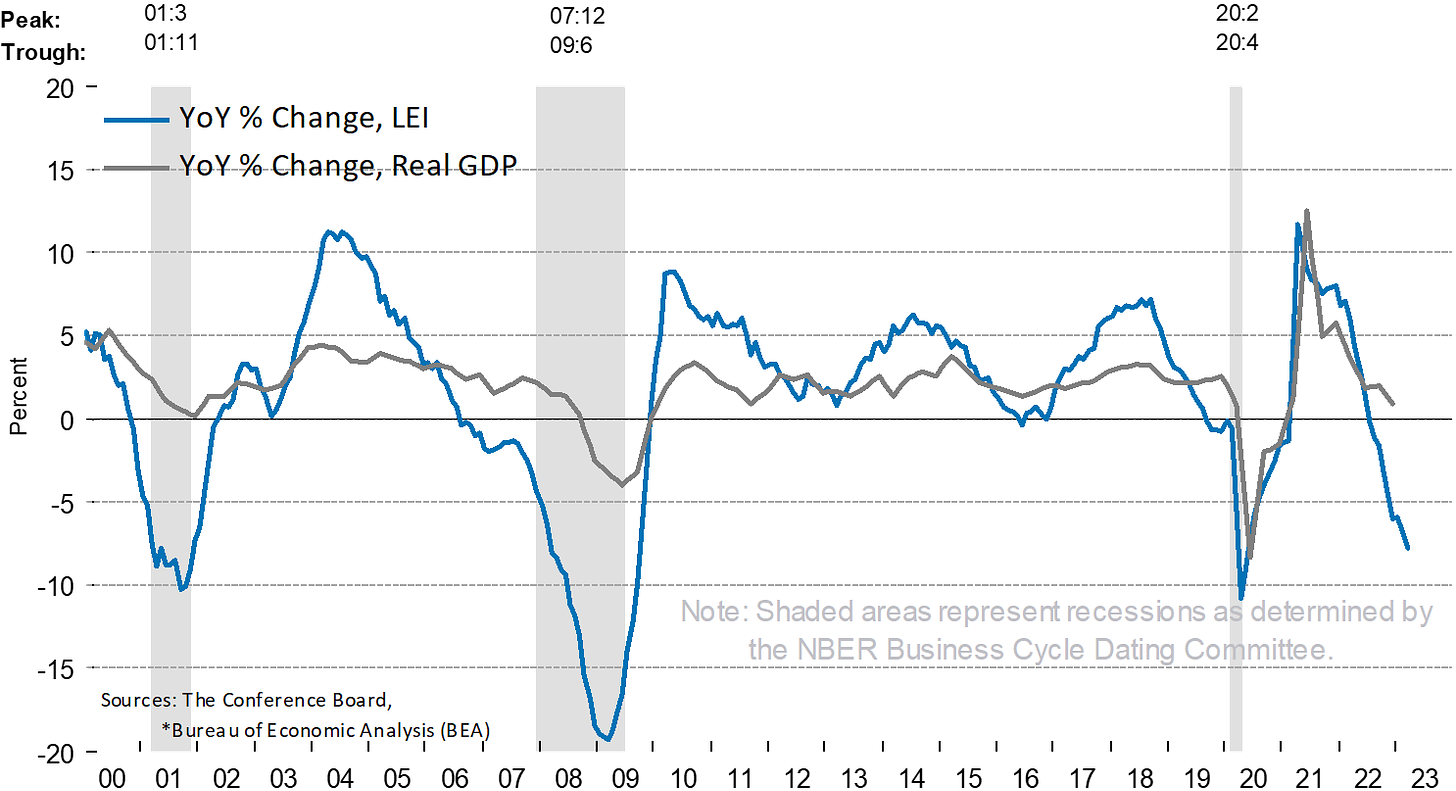

Chart of the Week: US Leading Economic Indicator pointing to a sharp growth slowdown.

Top Jobs in Crypto: Featuring the FCA, Ripple, Hudson River Trading, Finixio, Blockdaemon and DRW

Macro Update

We’re macro at heart, this is where we try to connect the dots between the macro and crypto.

Crunch Time

The positive macro tailwinds for risk and crypto faded somewhat this week, with persistent hawkish rhetoric from Fed officials alongside a seemingly becalmed banking sector seeing markets price out some of the aggressive rate cuts for 2023. A 25bp hike for May is now pricing at 90% probability and markets are pricing in a 25% probability for an additional hike in June, challenging our expectations for “one and done.”

The Fed balance sheet also contracted $17.6bn this past week and China reported strong GDP at 4.5% YOY on the quarter, up from 2.9% prior, dampening expectations for continued credit pumping.

Interesting to note, the Fed emergency loans to banks rose for the first time in 5 weeks, with the discount lending facility up at $69.9bn Vs $67.7bn and the Bank Term Funding Programme (BTFP) up to $74bn Vs $71.8bn the week prior. US bank deposits also resumed outflows, falling $69bn to the lowest levels since April 2021. Underlying financial stress remains and the longer that Fed rates stay up here, it’s a matter of when, not if we have another bank failure.

Underscoring the real economy impacts of these banking strains, the Fed Beige book suggested the expected credit crunch is underway, as lending standards tightened “notably” with “several depository institutions opting to reduce loan volumes.”

JPow has alluded to the possibility that a tightening in credit conditions would work in the same way as rate hikes and that tightening looks to be well under way and this slow moving credit crunch keeps us comfortable that May’s hike will be the last of this cycle.

Whilst the broad data has thrown up some mixed signals, the general pulse is weak, encapsulated by the latest Conference Board Lead Economic Indicators which fell by 1.2% in March and the lowest levels since mid 2020. The weaknesses in the index were widespread and point towards a recession starting mid 2023.

Muddying the waters this past week has also been the US tax repayment deadline which may, in and of itself, have weighed on broad assets as they get sold to raise the cash to make payment. Tax receipts were also disappointingly low and have brought forward expectations that the “X-date” (when the US government runs out of money) will be reached by June. This has driven a large move in 1 month yields down to 3.35%, Vs 3 month at 5.11% as investors seek to avoid the risks of a potential stalemate in the debt ceiling negotiations and subsequent default.

Of course, the US will not nominally default and the debt ceiling will get lifted at the eleventh hour (they default by stealth through inflation and currency debasement.) The raising of the debt ceiling will however provide a challenge to risk as the US Treasury will be able to once again issue debt and subsequently drain liquidity from our markets. Perhaps the sell off in BTC this past week is in anxious anticipation of that moment coming close.

Ironically, in the bigger picture, this debacle only once more highlights the value proposition for Bitcoin as the US can only survive on yet more debt, which eventually finds its way back onto the Fed balance sheet and will continue to debase the value of fiat.

Healthy consolidation then, but the long term bull case for crypto continues to strengthen.

Native News

Key news from the crypto native space this week.

Deutsche Digital Assets released a report on Cryptoasset Adoption and Volatility. It examines the global adoption rates of cryptoassets, highlighting key trends and factors that contribute to their growth. Some of the key takeaways from the report include: Developing countries lead the way in adoption rates, with male millennials around the age of 35 being the most likely cryptoasset owners. Factors such as inflation and money supply growth have an impact on adoption rates, with institutional investors like high-net-worth individuals and financial advisors being the most likely to invest. Retail adoption rates vary between 5% and 24%, while institutional adoption rates range from 28% to 57%. Switzerland and the Netherlands exhibit the highest adoption rates in Europe, while France and the United Kingdom have the lowest. The pace of adoption has accelerated post-Covid, with the growth rate of retail cryptoasset users averaging around 87% per year since 2017. They conclude that conclusion, the global adoption of cryptoassets is evolving rapidly, with a clear shift towards digital and decentralised currencies. While certain demographic groups and countries are more likely to adopt these assets, the growth rate of adoption tends to cycle and is typically highest around market cycle tops. You can read the full report HERE.

Coinbase CEO Brian Armstrong spoke at a conference in London with former UK Chancellor of the Exchequer George Osborne this week. Armstrong said the company would consider relocating if the US regulatory environment made it necessary. Armstrong added that the US is not seeing the required regulatory clarity despite its potential to be an important market for crypto. This came in a week where Coinbase said it plans to push into countries like Brazil, Singapore and Canada. The company also said it had received a license in Bermuda and was “doubling down” in Europe.

Institutional Corner

Top stories from the big institutions.

The CME announced this week that they will offer shorter term cryptocurrency options contracts from 22 May. They will offer 10 new weekly options on Bitcoin and Ether futures and 4 on Bitcoin and Ether micro contracts. For both Bitcoin and Ether futures, they will offer weekly options for Monday, Tuesday, Wednesday, Thursday and Friday. And for micro futures they will offer Tuesday and Thursday weekly options. CME say the change is intended to give market players greater precision and variety in managing short-term price risk, given the options will expire daily. You can read full details from the CME HERE.

Lawmakers in the European Union on Thursday voted 517-38 in favour of a new crypto licensing regime, Markets in Crypto Assets, also known as MiCA. It is the first major jurisdiction in the world to introduce a comprehensive crypto law. The European Parliament also voted 529-29 in favour of a separate law known as the Transfer of Funds regulation, which requires crypto operators to identify their customers in a bid to halt money laundering, with 14 abstentions. The votes follow a Wednesday debate in which lawmakers largely supported plans to make crypto wallet providers and exchanges seek a license to operate across the bloc and require issuers of stablecoins tied to the value of other assets to maintain sufficient reserves. European Commission's Mairead McGuinness said "We’re protecting consumers and safeguarding financial stability and market integrity," "The rules will start applying from next year." Read the official release HERE.

Societe Generale-Forge (SG-Forge), a regulated subsidiary of the French banking firm Societe Generale, has launched EUR CoinVertible, a euro-pegged stablecoin for qualified institutional clients. SG-Forge said that the new stablecoin is based on the Ethereum blockchain and will be traded under the ticker symbol EURCV. The new digital asset will be only available to investors onboarded by Societe Generale through its existing Know Your Customer and Anti-Money Laundering procedures. SG-Forge decided to launch the digital asset in response to the growing demand for a new settlement asset for on-chain transactions. The EUR CoinVertible stablecoin complies with major market standards, including the open-source interoperability and securitization framework known as Compliant Architecture for Security Token, or CAST, SG-Forge noted. The firm stressed that it will ensure “complete segregation” of the collateral assets backing the value of the stablecoins from the issuer and will provide daily transparency reports and collateral positions. You can read more details about the launch HERE.

This week the Digital Economy Initiative, an independent think tank dedicated to promoting effective public policy for cryptocurrencies and other digital economy applications, released a proposal for Stablecoins. The paper is titled “A Proposal for a UK Capital and Liquidity Framework for Stablecoin Issuers” and looks at how Stablecoins can be classified. It proposes frameworks for capital and liquidity for Stablecoins from a UK perspective and also talks to Basel standards, EU provisions and opportunities for the UK. You can read the full 15 page document HERE.

Israel’s Central bank said at the start of the week that its steering committee hasn’t yet decided whether to issue a CBDC or not. There are a number of variables that will affect the steering committees recommendation including whether other developed economies (like the US or EU) decide to issue one and the decline in the legitimate use of cash. Israel will also monitor the technological developments in the payments systems including the competition in the domestic payment system environment. The central bank will also monitor how stablecoins or other private means of payment evolve. At this current point there are no signs of stablecoins as means of payment in Israel. You can read the full report from Bank of Israel HERE.

A Hong Kong court has for the first time declared that cryptocurrencies are property and capable of being held on trust. In a report published by the law firm Hogan Lovells, Justice Linda Chan said that crypto has the attributes of a property. The court deemed that it was appropriate to follow reasoning applied by other jurisdictions that crypto was property and was able to form the subject matter of trust. According to Hogan Lovells, the new ruling can potentially give insolvency practitioners in Hong Kong greater clarity in terms of digital assets. Confirming that crypto constitutes property that's similar to other assets like stocks aligns Hong Kong with other jurisdictions. In the United States Internal Revenue Service (IRS), cryptocurrencies are recognised as property for federal tax purposes. This means that principles that are applicable to property transactions apply to transactions using crypto. Read the full report HERE.

Chart of the Week

Because charts are just as important as macro.

US Leading Economic Indicator (LEI) pointing to a sharp growth slowdown.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Lead Associate Financial Promotions & Enforcement Taskforce Crypto at the FCA.

Senior Product Manager for Crypto Settlement at Ripple

Crypto Trading Support Engineer at Hudson River Trading

Chief News Editor for Fintech and Crypto at Finixio

Junior Sales Executive at Blockdaemon

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.