A quick favour before we start. If you like what you read, could you share this newsletter with just one person. We’d really appreciate the support.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Major central banks remain on course to begin, or have begun the rate cutting cycle thought a re-strengthening dollar has become a headwind.

Crypto Native News: The SEC closes its investigation into Ethereum, Bitwise updates its S-1 registration form for its spot Ethereum ETF, stablecoin issuers now the 18th largest holder of US debt, Tether creates a new synthetic dollar backed by gold.

Institutional Corner: Zodia Custody gets investment from NAB, The US Chamber of Digital Commerce provides feedback to the IRS on digital asset transaction reporting.

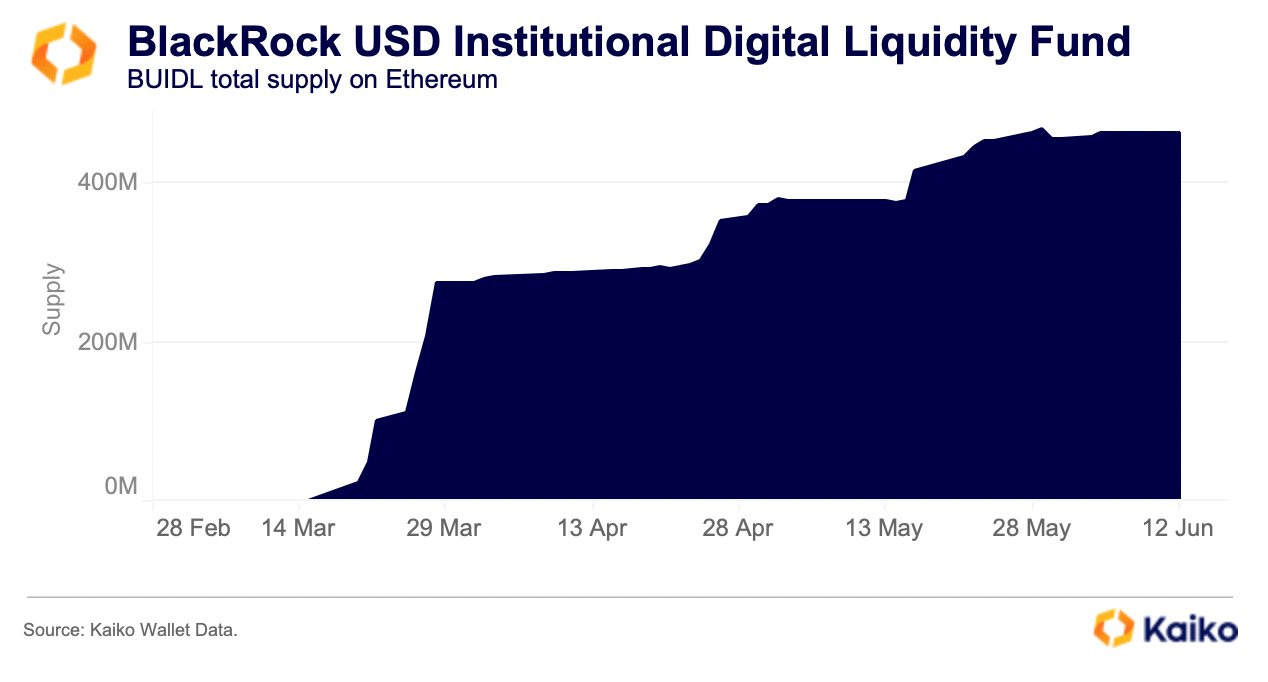

Charts of the Week: Stablecoin transfer volumes 10x’d in 4 years, Memecoin liquidity at a record, BlackRocks BUIDL has accumulated over $$60m in assets.

Top Jobs in Crypto: Featuring Chainlink Labs, Quant Capital, Coinbase, CoinMarketCap, BitGo and Cumberland.

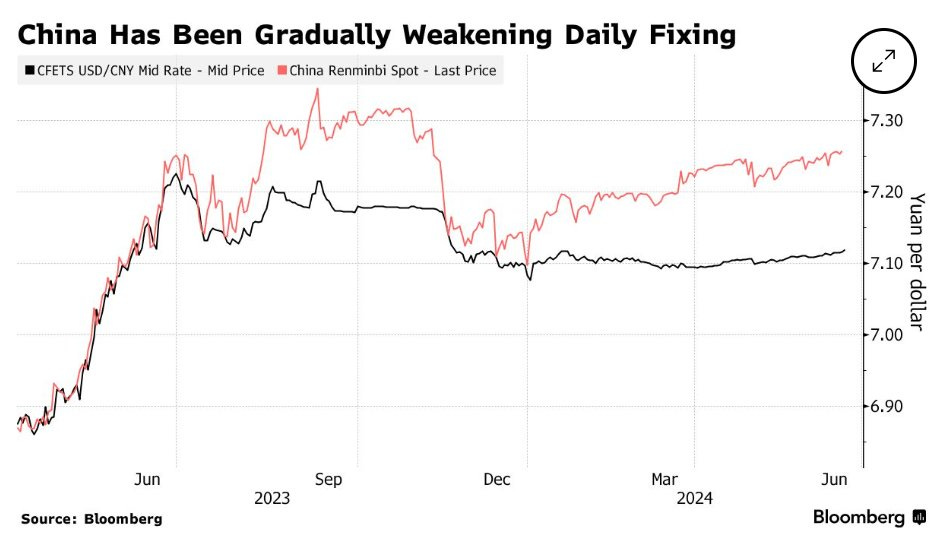

Macro Chart of the Week - A crawling peg for China’s daily CNY fixing. The weaker fixings each day signalling a willingness to allow a weaker CNY will encourage a greater pace of capital flight out of China. Hat tip to Brad Setser for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

Stack Sats and Chill

A holiday shortened week in the US provided little new in terms of momentum for Bitcoin, which traded heavy but within this sideways consolidation range, despite stocks continuing to make fresh record highs. US yields closed broadly just a few bps higher, despite a heavy corporate bond issuance week which we would typically expect to weigh on treasuries (buyers of the corporate bonds short treasuries to hedge out the interest rate risk.) We still therefore feel confident in the view that a slowing growth outlook in the US will continue to see yields break lower and provide a tailwind for Bitcoin.

On the data, US retail sales pointed to a weakening consumer, rising just 0.1% in May after falling a downwardly revised 0.2% in April. Sales at bars and restaurants fell 0.4% suggesting discretionary spending is being curtailed. As has been the typical, frustrating pattern in US data however, Friday’s S&P PMI’s posted a solid 54.6% on the composite, suggesting robust business activity, with services strong at 55.1. Encouragingly, as it relates to the Fed, selling price pressures were shown to be at the weakest levels since the start of the pandemic. However, the mixed data picture continues to keep us in this “macro purgatory” unable to fully embrace the US rate cutting cycle.

Elsewhere, the Swiss National Bank surprised markets with another 25bp rate cut as inflation pressures continue to weaken. The Bank of England remained on hold as expected but with some members saying the decision was finely balanced, expectations for an August cut increased. Inflation back at target at 2% perhaps providing some comfort to get the cutting cycle under way. Overall, major central banks remain on course to begin, or have begun the rate cutting cycle. This will continue to support risk markets, especially with a more supportive liquidity backdrop.

One headwind however has been a re-strengthening in the dollar, with the DXY pushing back towards 106. The mixed data in the US contrasting to the more consistent, softer data pulse elsewhere and the relative policy divergence implications keeping the dollar stronger. We expect that trend to reverse as the Fed starts to lay the ground for the first rate cut amidst a continued softening in the labor market. Until then, US exceptionalism remains supreme and a stronger dollar puts the squeeze on BTC.

No more is the relative dollar strength more important than in China. On Thursday, China set the Yuan’s daily reference rate at its weakest level since November in a sign that they’re losing their grip on the currency. The off-shore CNH consequently fell to its lowest levels of the year, with USDCNH rallying above 7.2900. Not an outright devaluation, but a “crawling peg”. With the tacit signal that the PBOC is willing to allow the currency to weaken, maybe to keep pace with the JPY which is trading back above 159 against the dollar, a greater pace of capital flight will be encouraged making efforts to support the Yuan even more difficult. As China tries to maintain some control, Bitcoin will likely struggle to rally as China remains incentivised to keep a lid on BTC and discourage capital outflows. Yet the pressure continues to build and as another major central bank battles with the impossible trinity of trying to maintain low rates, without a weakening of the currency or capital outflows, all roads will eventually lead to Bitcoin!

Also reinforcing the longer term bullish case for Bitcoin, the CBO increased the 2024 US budget deficit estimate from $1.5trn to $1.9trn 🤯 For those who try to suggest the US economy can handle higher rates, remember that the lunatics running government continue to run emergency level deficits. The picture would look very different without this level of fiscal support which will of course eventually undermine the dollar.

Overall, little to change the bullish medium/long term picture as we move into an easier rate and liquidity environment. The stronger dollar creates a headwind and there appears to still be some strong sell flows, with Bitcoin miners having sold more than $2bn worth of bitcoin since June as weaker miners post halving are forced to sell. ETF flows over the past week also a net negative. The patience that we called for last week will likely be required a little longer, especially with little in terms of top tier data ahead of Friday’s US PCE data. Month/quarter end considerations also make for a choppy trading environment. Nonetheless, with funding rates quite flat, there appears to be little long leverage to drive a deeper, downward liquidity cascade. This period of consolidation is healthy. Stack sats and chill 😎

Native News

Key news from the crypto native space this week.

Leading Ethereum developer Consensys announced that the U.S. Securities and Exchange Commission is “closing its investigation” into the cryptocurrency, saying “Today we’re happy to announce a major win for Ethereum developers, technology providers, and industry participants: the Enforcement Division of the SEC has notified us that it is closing its investigation into Ethereum 2.0. This means that the SEC will not bring charges alleging that sales of ETH are securities transactions.” After the SEC approved Ethereum spot ETFs last month, Consensys said it sent a letter to the SEC noting that the funds “were premised on ETH being a commodity,” asking how the decision would affect the agency's investigation. Consensys attorney Laura Brookover said “Things have changed remarkably fast since we filed our lawsuit against the SEC in late April, culminating in today’s development,” “After more than a year, the Ethereum investigation is finally over with no charges against anyone.” Read the full announcement from Consensys HERE.

Bitwise updated its S-1 registration form for its spot Ethereum ETF, including language about a $2.5m seed investment. Bitwise said "Bitwise Investment Manager, LLC, an affiliate of the Sponsor, is expected to purchase the initial Baskets of Shares for $2,500,000, at a per-Share price of $25 for these 100,000 Shares (the 'Seed Baskets')." Bitwise also said Pantera Capital Management LP is interested in buying up to $100 million of shares. "However, because indications of interest are not binding agreements or commitments to purchase, these potential purchasers could determine to purchase more, fewer or no Shares.”

According to data tracked by Tagus Capital, stablecoin issuers now cumulatively hold more than $120 billion in U.S. Treasury notes. That makes them the world's 18th largest holders of U.S. debt, ahead of major current account surplus nations like Germany and South Korea (see chart below). Tether Ltd, the issuer of tether (USDT), the world's leading dollar-pegged cryptocurrency by market value, alone holds around $91 billion in Treasuries and Circle, the issuer of USDC, holds short-dated U.S. debt, including repos, worth $29 billion, according to Tagus Capital.

Tether Holdings Ltd., has created a new synthetic dollar that is backed by gold, the company announced Monday. The token was created on the company’s new Alloy by Tether platform and will trade as aUSDT via smart contracts on the Ethereum Mainnet blockchain, where users can mint it through over-collateralisation by depositing another Tether token that tracks the value of gold. The new offering highlights Tether’s ambitions to expand beyond its USDT stablecoin, a token with a market capitalisation of $112.5 billion that tracks the value of the US dollar and is backed by reserves of US Treasury bills and other securities and investments.

Institutional Corner

Top stories from the big institutions

Zodia Custody, the digital asset custodian backed by Standard Chartered Bank announced an investment from NAB Ventures this week. NAB Ventures are the venture arm of National Australia Bank (NAB). Amanda Angelini, Managing Director of NAB Ventures, highlights NAB's commitment to secure financial services saying "As a trusted financial institution, NAB is focused on ensuring the finance sector continues to provide simple, safe and secure services for Australians. This is particularly important in newer fields where technology continues to evolve quickly. NAB Venture’s investment in Zodia was based on a range of factors including their innovative approach, institution-grade safety and strong work with regulators. We look forward to seeing Zodia Custody drive further innovation in the digital assets space.” Julian Sawyer, CEO Zodia Custody said "We are extremely grateful to NAB Ventures for their support in our vision to build a better institutional digital asset infrastructure. It’s a true vote of confidence. Australia is set to enter an unprecedented period of innovation and adoption. We are here and ready to support institutions on that journey."

The Chamber of Digital Commerce, a leading trade association in the blockchain industry, has submitted its feedback on the United States Internal Revenue Service’s (IRS) proposed Form 1099-DA, which is intended for reporting digital asset transactions. The chamber’s detailed response highlights the need to simplify the form, making it more straightforward for brokers dealing with digital assets such as cryptocurrencies to use. It also highlights privacy concerns, including requesting only the necessary information for reporting digital asset transactions by taxpayers. The chamber criticised the draft form for requesting excessive information. It suggests that the final form only requires information necessary for basic tax reporting, while brokers should retain additional details for use during specific IRS examinations. Read the full report from the Digital Chamber HERE.

Charts of the Week

Because charts are just as important as macro.

Monthly stablecoin transfer volumes have 10x’d over the past 4 years, from $100bn to $1Tn per month. Hat tip to TokenTerminal for the chart.

Memecoin liquidity measured by 1% market depth, has surged to record highs. The combined figure for DOGE, SHIB, PEPE, WIF, BONK, GROK, BABYDOGE, FLOKI, MEME, HarryPotterObamaSonic10Inu and HarryPotterObamaSonic, recently rose to $128 million.

BlackRocks BUIDL has accumulated over $460mn in investments since launching in March.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Journalist at Crypto

Treasury Associate at Chainlink Labs

Crypto Quant Trader at Quant Capital

Senior Counsel, UK Legal at Coinbase

Global Management Trainee, Social Media at CoinMarketCap

Sales Development Representative at BitGo

eCrypto Relationship Manager at Cumberland

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.