Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Kraken sees large revenue growth, Tether publishes its Q1 attestation report.

Institutional Corner: CME sees large jump in derivatives trading, Arizona vetoes a bill to allow digital asset as part of its official reserves, new blockchain and digital assets hub in the Maldives.

Charts of the Week: 7 day BTC volatility at 563 day low, long term BTC holder analysis.

Top Jobs in Crypto: Featuring Revolut, FreedX, Chainlink Labs, Crypto.com and MoonPay.

Macro Update

This is where we connect the dots between macro and crypto.

Pain is Higher

As London Crypto Club were enjoying schmoozing with the crypto world in Dubai this week, U.S. equities were busy extending their rally with the S&P 500 marking a second consecutive week of gains and closing Friday with its 9th straight session in positive territory. The Nasdaq also ripping 3.4% higher, powered by tech earnings that broadly beat expectations.

At the core of the move was renewed confidence that trade tensions are easing, with Trump rolling back auto tariffs and his team teeing up a near-term deal, with Lutnick saying a trade deal with an unnamed country was “done, done, done done”.

As we said last week, with Trump front loading the “bad news,” there’s a lot of risk premia to leak out of these under positioned markets as the move towards negotiation and compromise lends to softer, more market friendly headlines 📈

Macro Goldilocks…

On the macro, mixed jobs data gave markets a bit of a rollercoaster, with ADP and JOLTS pointing to cracks in the labour market, before Friday’s payrolls snapped back with a stronger-than-expected 177k jobs print. Wage growth remained tame, and the unemployment rate held steady giving a “goldilocks” feel to the data to drive further risk gains into the weekend.

Although the recession doomers were rewarded earlier in the week with a 0.3% negative GDP print for Q1 - the first in three years - markets mostly looked through it, chalking it up to front-loaded import activity and tariff front-running. Consumer spending however, still looks healthy, whilst inflation pressures continue to fade with the Fed's preferred inflation gauge, core PCE, flat on the month and falling to 2.6% YoY, down from 3%.

Whilst Trump tariffs cloud the outlook with uncertainty, the data flow continues to support our sanguine characterisation of the US macro backdrop as a slowing, not collapsing, disinflationary economy.

Alongside rising global liquidity, the reflexively stimulative impact of the recent dollar weakening and lower oil, make for a fertile risk environment and pain will continue to be higher for a market that had priced Covid level stress and uncertainty.

Bitcoin Traversing…

Bitcoin meanwhile is relatively muted, running into resistance ahead of $98k.

We explained last week how Bitcoin captures both the left and right tail of the risk distribution. In recent weeks, Bitcoin’s relative outperformance came as we moved closer to the left tail of that distribution, with markets questioning US debt sustainability and the credibility of the dollar.

Those fears have subsided somewhat, with the dollar and US yields stabilising, as Trump has softened the tariff rhetoric and eased off talking about firing JPow - the strike on the “Treasury bond put” got hit!

Bitcoin is consequently traversing back towards the “risk-on right tail” and we suspect will gain momentum as the aforesaid risk premium continues to leak out of these markets.

Additionally, it’s worth noting, both the RRP and TGA have built substantially since mid April by a combined circa $400bn (TGA rebuilt on the April tax repayments, RRP into month end) and so we expect a positive liquidity pulse over the next weeks as those flows reverse and come back into the market. Clearly wood to chop into $100k, but the supportive tailwinds are building.

The mood at Token 2049 in Dubai was a bullish one. The macro here doing little to dent that optimism 🚀

Native News

Key news from the crypto native space this week.

According to a report released on Thursday, Kraken saw revenue jump to $472 million in the first quarter of 2025. This represents 19% growth year-over-year, largely driven by a surge in volatility in the first quarter, during the first 100 days of President Trump’s second term. The firm’s adjusted earnings before interest, taxes, depreciation, and amortisation (EBITA) also rose 17% to $187.4 million year over year, while total exchange trading volume grew 29% in the same period. This follows the $1.5 billion in revenue generated in 2024. The company said in a blog “While Q1 revenue declined 7% sequentially due to overall market softness, adjusted EBITDA rose 1% sequentially – highlighting Kraken’s resilience amid seasonality.” The company also noted there was a “slowdown in overall market trading activity” following an unusually busy Q4 in 2024 during the U.S. election season.

Tether published its Q1 attestation report this week. The report confirms the accuracy of Tether’s Financials Figures and Reserves Report (FFRR) and offers a transparent breakdown of the assets backing Fiat Denominated stablecoins as of March 31, 2025. The company reached an all-time high of total exposure in U.S. Treasuries approaching $120 billion, including Treasuries indirect exposures from Money Market Funds and reverse repo agreements. Tether also reported over $1 billion in operating profit from traditional investments during the quarter, driven by solid performance in its U.S. Treasury portfolio, while the performance of Gold has almost offset the volatility in crypto markets. Circulating supply of USD₮ grew by approximately $7 billion in Q1, with a 46 million increase in user wallets. Read the full report HERE.

Institutional Corner

Top stories from the big institutions

CME Group’s cryptocurrency derivatives market posted a steep increase in trading activity in April, reaching a new average daily volume (ADV) of 183,000 contracts worth $8.9 billion in notional terms. That marks a 129% jump compared to the same month last year, suggesting growing institutional interest in crypto markets. CME’s ether futures ADV surged 239% to 14,000 contracts, while micro ether futures climbed 165% to 63,000. Micro bitcoin futures followed with a 115% increase to 78,000 contracts. Read the full release from the CME HERE.

Arizona Governor Katie Hobbs vetoed a bill on Friday that would have allowed the state to hold the digital asset as part of its official reserves. The legislation, known as Senate Bill 1025, proposed using seized funds to invest in BTC and create a digital assets reserve managed by the state. After passing the state House in a narrow 31–25 vote, the bill reached Hobbs' desk, where it was swiftly struck down. Hobbs said in a statement “The Arizona State Retirement System is one of the strongest in the nation because it makes sound and informed investments. Arizonans' retirement funds are not the place for the state to try untested investments like virtual currencу.”

A Dubai-based family office has announced plans to invest $8.8bn to build a “blockchain and digital assets” financial hub in the Maldives. Debt coming due in the next two years was “the biggest challenge that we have”, Zameer told the Financial Times in a video interview this week, adding that the deal was “something we see as a potential contributor to bring us out of certain difficulties that we are in”. MBS, which says it manages assets worth approximately $14bn, is the family office of a Qatari, Sheikh Nayef bin Eid Al Thani. It plans to finance the Maldives investment by tapping its network of family offices and high net worth individuals to form a consortium. MBS’s chief executive Nadeem Hussain said the phased project could be funded through equity and debt and that firm commitments “north of” $4bn-$5bn had already been secured.

Charts of the Week

Because charts are just as important as macro.

Bitcoin 7-day volatility hit a 563 day low this week.

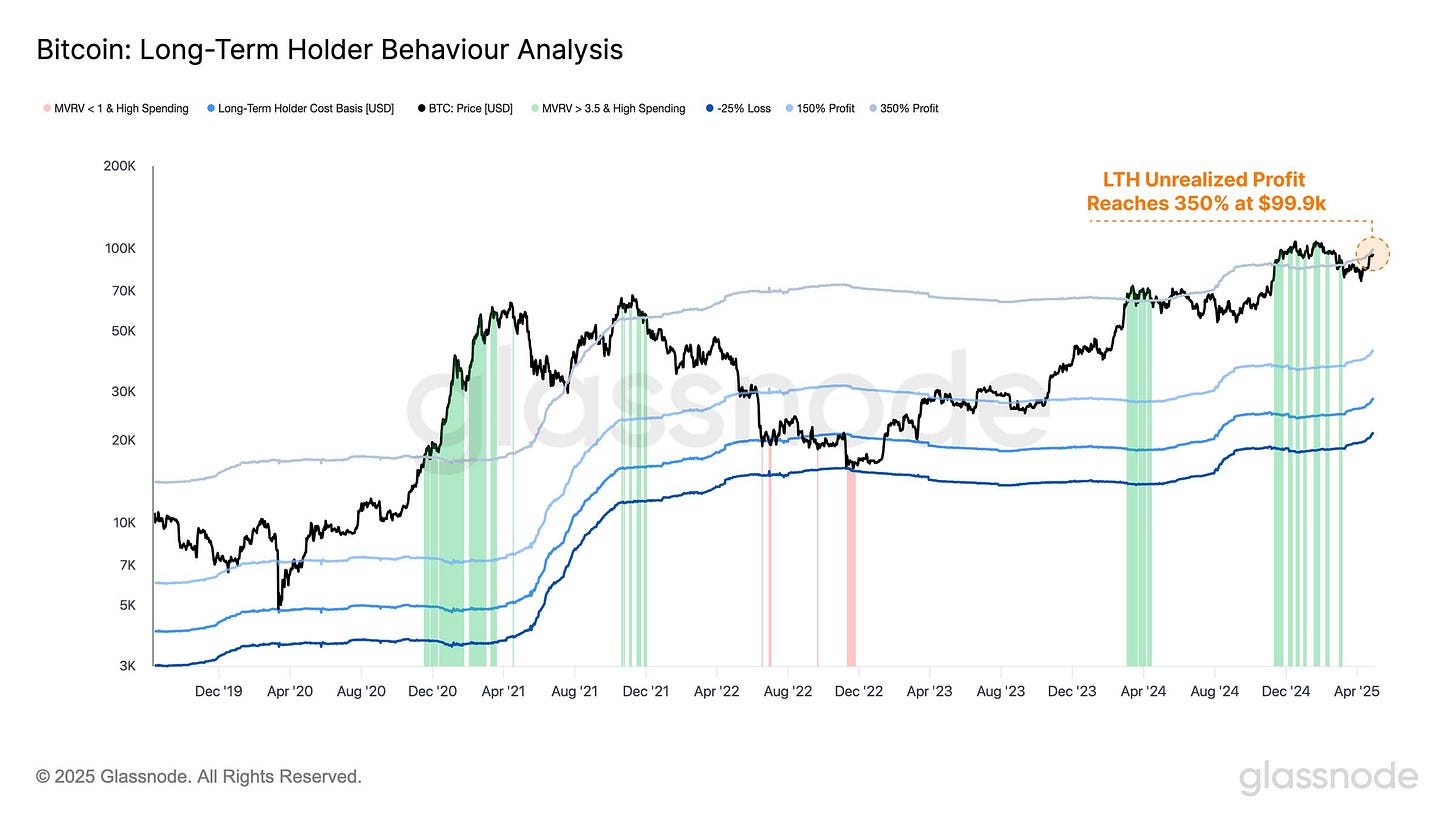

Historically, LTHs begin distributing more aggressively around a 350% unrealised profit margin, which aligns with a BTC price of ~$99.9k. As the market nears this level, increased sell-side pressure is likely, requiring strong demand to absorb it. Hat tip to Glassnode for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Product Owner UX - Crypto at Revolut

Product Manager Crypto Exchange at FreedX

Blockchain and Product Partnerships Manager at Chainlink Labs

Director Organic Growth Crypto at Crypto.com

Senior Product Manager for Crypto at MoonPay

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.