Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Read out latest view on the current macro environment.

Crypto Native News: OKX to debut a mobile app in the US, a judge dismissed the case for Consensys against the SEC, crypto travel company Travala partners with Solana.

Institutional Corner: SEC approves options trading on BlackRock ETF, German suthorities shut down 47 crypto exchanges, Cruto Finance and Commerzbank partner to offer crypto services.

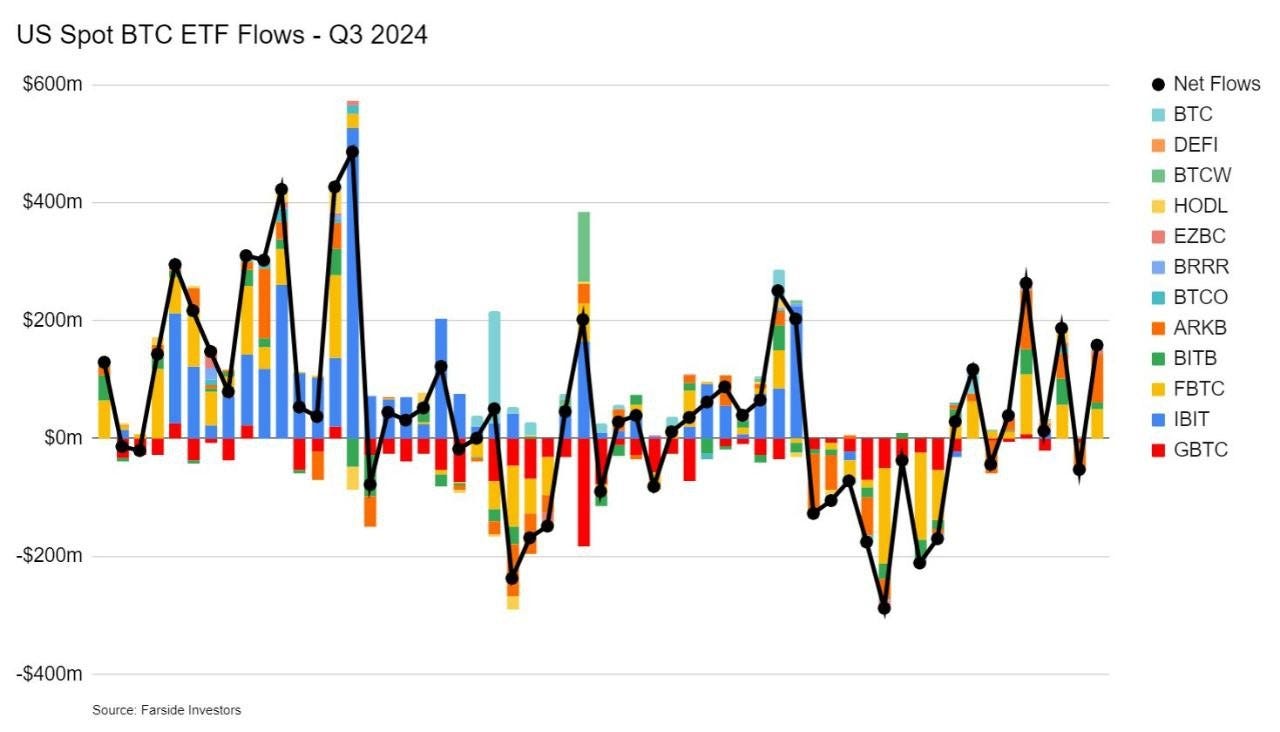

Charts of the Week: 42 tokens have outperformed BTC year to date, decent inflows to the spot bitcoin ETFs the last week.

Top Jobs in Crypto: Featuring Onchain Bureau, BNB Chain, Indelible, Revolut, Trust Wallet and WorldPay.

Macro Update

This is where we connect the dots between macro and crypto.

Recalibrating

The Fed dominated markets this week by kicking off the rate cutting cycle with a 50bp cut which had been somewhat telegraphed by the “Fed Whisperer” Nick Timiraos prior. Markets were better priced for 50bps into the event, although it was expected to be a close call between that and 25bps.

Interesting and adding a dovish element, was the median of the dot plots which see an additional 50bps of cuts in 2024, with 25 coming in Nov, followed by another 25 in Dec. Meanwhile, JPow confirmed the Fed have “begun the rate cutting cycle” albeit tempering expectations for the pace of cuts going forward describing the larger 50bps cut to kick things off as “risk management” and spun it as not being behind the curve already, but “a commitment to not get behind.” Adding to the positive risk vibes, JPow framed the cuts as coming to maintain both economic and labor market strength, rather than a reaction to a material weakening.

Our take…

This is the “goldilocks” scenario for risk which we have been writing about for several weeks into the start of the cutting cycle. Current real rates are far too high and with a disinflationary economy, real rates are getting tighter each month.

With comfort that inflation is now under control, but clear signs of emerging slack in the labor market, the Fed is able to move towards neutral and to paraphrase a past quote from JPow, we’re currently a long way from neutral.

Meanwhile, despite comparisons doomers have made to the reaction of equities to past 50bp cuts, this rate cut is not reacting to sudden market or economic stress. Instead, as nicely characterised by JPow, this is merely a “recalibration” of the policy rate which was moved into overly restrictive levels to strangle the threat of inflation.

Further supporting our bullish interpretation, a report from JP Morgan highlighted that the Fed has cut rates 12 times when the S&P 500 was just 1% off its all time high. The S&P was higher one year later all 12 times with a median return of 15%.

This is not a risk rally to fade and not one to over complicate. We have all the ingredients for stocks and Bitcoin to rip into the end of 2024:

✅ Disinflation

✅ Slowing not collapsing economy

✅ Fed with a lot of rate cut bullets to fire

✅ Global liquidity rising

✅ A US government running 6% deficits

✅ A sh*t ton of liquidity in the market ($6trn alone parked in money market funds about to earn a lot less interest)

Carry on…

The other big meeting with a potential to move markets this week was the Bank of Japan, who held rates steady as expected at around 0.25%. Whilst in its assessment, inflation expectations have risen moderately and the economy was expected to grow above its potential growth rate, there were dovish overtones with BoJ governor Ueda saying that uncertainty over the US economic outlook was partially off-setting optimism on inflation. He also noted the recent strengthening of the Yen had reduced the risks of an inflation overshoot and “as such, we have some time to decide on policy”

The more dovish BoJ (as we have been forewarning) saw USDJPY move from 142 to briefly trading above 144, closing the week at 143.85.

We’ve debunked the idea of the carry trade unwind in previous episodes and if bears were pinning hopes of a risk sell off on the BoJ, this meeting will have come as a great disappointment.

In China meanwhile, data continued to underscore the slowing momentum in the economy which cast doubt on China hitting its growth target this year. Industrial production, retail sales and fixed asset investment all weaker and lower in August, whilst urban unemployment hit a 6 month high at 5.3%. Chinese equities rose on the week however as expectations continue to grow for more stimulus (remember, markets are a function of rates and liquidity!) and the bigger 50bp rate cut from the Fed provides cover for China to bring out its big bazooka.

We’ll wrap it up there this week so as not to over complicate it ourselves! This is a goldilocks environment and “go time” for risk and Bitcoin. Whilst the US election may cast a cloud of uncertainty, we don’t believe the outcome is particularly significant for markets either way. Trump is obviously the more bullish outcome, but for all the fears around Kamala taxing unrealised capital gains, the likelihood is, she won’t get this through congress. Both candidates will however continue to run huge deficits, debase currency and inflate all assets.

In summary, the Fed has begun their rate cutting cycle and global liquidity is starting to ramp. The market is under positioned risk and will be forced to chase performance. We’ve expressed the need for patience over recent weeks, but as Q4 approaches that patience looks set to be rewarded. Bitcoin is primed for the next leg higher 🚀.

Native News

Key news from the crypto native space this week.

OKX’s U.S.-based sister crypto exchange—once called OKCoin—is aiming to debut a new mobile application this fall as part of the exchange’s broader relaunch, OKX Chief Marketing Officer Haider Rafique said on Thursday. OKX, one of the largest crypto exchanges in the world by volume, expects to launch the new app for U.S. users in the next couple of months. The company is reportedly still working on onboarding “a few” U.S. banks ahead of launch. The new OKX app will be available to users in 41 states, just like its predecessor app, OKCoin. The new app will “not be the OKCoin app rebranded”, but a “brand new product.” OKCoin app users will be migrated to the new U.S. “OKX” app when it launches, according to Rafique. Some users, who have been notified of the upcoming migration via email, have already begun transferring their crypto in preparation for the migration. The team behind the new app is also aiming to launch it with automated clearing house (ACH) transfers, which some traders have had trouble with on the OKCoin app. ACH transfers, though typically slower than wire transfers, are generally more cost effective and provide other benefits for users. “We don’t want to just launch with wire, we want to launch with ACH,” Rafique said. “[With] wire I don’t think people are gonna be really excited, and it's also inconvenient.”

A U.S. district judge has dismissed a case brought against the Securities and Exchange Commission by blockchain and web3 development company Consensys Software Inc. Judge Reed O'Connor in the U.S. District Court for the Northern District of Texas in the Fort Worth Division dismissed Consensys' claims and sided with the SEC on Thursday. The dismissal follows a long back and forth between the SEC and Consensys over the past year. As a recap, Consensys sued the SEC in April, in part over how the agency categorised ether as a security. The firm also noted in the complaint that SEC staff sent Consensys a Wells Notice in April, meaning a formal notice that the agency plans to bring an enforcement action against them. However, later in June, Consensys said it was notified that the SEC was closing its investigation into Ethereum, which at the time was described as a "major win" for the industry. Consensys said it still planned to continue the lawsuit because it was also looking for a "declaration that offering the user interface software MetaMask Swaps and Staking does not violate the securities laws." Then, in July, the SEC sued Consensys over its failure to register as a broker through its Metamask swaps service. That lawsuit was filed in the U.S. District Court for the Eastern District of New York. Consensys said it would "keep fighting for the rights of blockchain developers" in its case with the SEC in New York.

The crypto-native travel bookings platform Travala has integrated with Solana , the fourth-largest blockchain by market cap, expanding support to its third network beyond Ethereum and BNB Chain. Travala CEO Juan Otero announced the news during a panel discussion at Solana Breakpoint in Singapore on Saturday. The integration will allow users to book flights, hotels and accommodation with Solana-based assets, including SOL, USDT and USDC, among others. Users will also be able to receive up to 10% of their bookings' value back in SOL travel rewards through its loyalty program, alongside BTC and Travala’s native token, AVA. Otero said “The Solana network has become one of the most-used blockchains due to its cost-effectiveness and scalability. The technologies that can be harnessed on the Solana network open significant avenues to build the next phase of travel.” Following a community vote, AVA is also being deployed on Solana in addition to the Ethereum and BNB Chain versions of Travala's token.

Institutional Corner

Top stories from the big institutions

The U.S. Securities and Exchange Commission has approved BlackRock's proposal to list and trade options for its spot bitcoin exchange-traded fund. The SEC said it was approving the world's largest asset manager on an "accelerated basis" to list those options for the iShares Bitcoin Trust, in a filing posted on Friday. Nasdaq ISE, LLC would be listing and trading those options. The SEC said “The Commission is publishing this notice to solicit comments on Amendment Nos. 4 and 5 from interested persons, and is approving the proposed rule change, as modified by Amendment Nos. 1, 4, and 5, on an accelerated basis.” Read the full filing HERE.

The German Attorney General's Office Frankfurt am Main (Generalstaatsanwaltschaft) and the country’s Federal Criminal Police Office (BKA) have shut down 47 crypto exchanges allegedly tied to criminal activities including money laundering. The press release says the exchanges purposefully failed to comply with their obligation to carry out certain identity and background checks on their customers, also known as “know your customer” (KYC) requirements. They added, some customer and transaction data was seized by the government in the process of the investigation. Given that the people behind those activities often reside in other countries outside of Germany, where criminal activities like this are “tolerated or even protected,” the authorities noted it may be nearly impossible for German government officials to prosecute them. Instead, the authorities will focus on “weakening” the underlying infrastructure that allowed for those illegal activities, according to the statement. Earlier this year, the BKA seized 49,857 bitcoin , worth $2.1 billion at the time, from the operators of a privacy website called Movie2k.to, which was shut down in 2013 for violating the Copyright Act. Read the full report from BKA HERE.

Crypto Finance, a subsidiary of Germany's largest stock exchange operator, signed a deal with Commerzbank (CBK) to offer trading services to the lender's corporate clients in Germany. Gernot Kleckner, head of capital markets for corporate clients at Commerzbank said "Our offering in digital assets, enables our corporate clients to seize the opportunities presented by bitcoin and ether for for the first time. Our joint solution represents the highest level of security in the trading and custody of crypto assets, which is also a standard we also share with the Deutsche Boerse Group." Commerzbank obtained a crypto custody license in Germany in November 2023, allowing the financial services firm to offer a wide range of services related to digital assets.

Charts of the Week

Because charts are just as important as macro.

Only 42 tokens among the Top 300 on CoinMarketCap have outperformed BTC in 2024 Year-to-Date. 11 of the top 15 tokens are MEME. 20 tokens were listed on Binance last year or earlier, and 5 tokens listed on Binance in 2024. Hat tip to MustStopMurad for the chart.

Bitcoin ETF flows for Q3. Decent inflows over the last week, following a week of outflows.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Digital Asset Management Deal Closer and Business Development at Onchain Bureau

Senior Growth Hacking Manager at BNB Chain

Fintech Growth Marketer at Indelible Inc

FinCrime Manager for Crypto at Revolut

Product Manager DeFi/Earn at Trust Wallet

Embedded Finance Partnerships Manager at WorldPay

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.