Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: SEC dismissed its lawsuit against Binance, Bybit obtains a MiCA license, GameStop buys over $500m worth of bitcoin, PSG confirm it holds Bitcoin in its treasury.

Institutional Corner: The SEC issues new guidance on staking, Cantor Fitzgerald launched a new bitcoin fund with downside protection based on the price of gold, New York Mayor encourages crypto firms to come to the Big Apple.

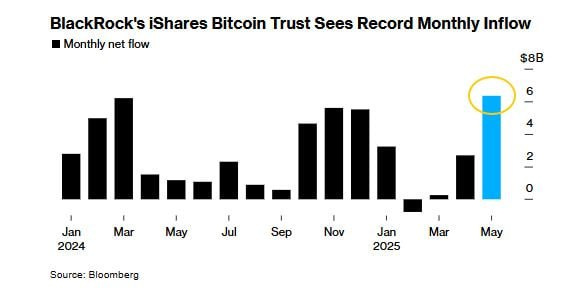

Charts of the Week: Record monthly inflows to BlackRocks bitcoin ETF, Base transaction activity rebounds.

Top Jobs in Crypto: Featuring Kraken, Capital.com, DV Trading, State Street

Macro Update

This is where we connect the dots between macro and crypto.

Riding the Exponential Trends

US equities staged a solid rebound over the holiday shortened week, with the Nasdaq (+2.00%) leading broader markets, helped in part by solid earnings results from AI bellwether NVIDIA, which saw revenue surging 69% from a year ago to $44.1bn 🤯

NVIDIA is the central player to an exponential AI trend and for us has parallels to crypto, where tradfi analysts continuously look for mean reversion yet fail to grasp the significance of a secular, exponential trend. AI is also the perfect compliment to crypto and we remain of the view that AI based tech and crypto will out perform every asset class over the next decade. There really is little else to be focused on right now from an investment perspective 🧐

The initial catalyst for market gains however, was a weekend surprise from President Trump, who walked back a fresh 50% tariff on EU imports just two days after announcing it. The delay, now set for July 9, came alongside promises to “fast-track” negotiations. Then, on Wednesday, the U.S. Court of International Trade ruled Trump lacked authority for most of the global tariffs imposed since his second term began. Stocks ripped higher Thursday morning before reversing as the administration immediately appealed, and by evening, a federal court had temporarily blocked the ruling. Negative comments from Treasury Sec Bessent suggesting China trade talks were “a bit stalled” further soured the mood.

Tariff headlines will continue to make for short term volatility, yet it's clear that the worst case scenarios are behind us and markets still need to re-risk for the 180 turn we’ve seen both on tariffs AND deficit reduction.

Macro Goldilocks…

On the macro meanwhile, the “goldilocks” scenario we have been trying to highlight was further strengthened by a constructive inflation report. Core PCE—a key Fed gauge—eased to 2.5% YoY in April, its softest pace since 2021 whilst headline PCE inflation eased to 2.1%, basically at target. Supercore inflation (services inflation excluding housing) is now NEGATIVE for the first time since covid.

Whilst tariffs cast an uncertain cloud, this remains a risk friendly, disinflationary economy. Alongside a still robust labour market and slowing, not collapsing growth, this is a goldilocks backdrop to a market still under positioned risk.

China meanwhile continues to inject liquidity into our markets, injecting net 247bn Yuan ($35bn) via 7 day reverse repos on Monday, which came on the back of last Friday’s 500bn Yuan one year medium-term lending facility (MLF) operation.

Interestingly, whilst China continues to pump liquidity and ease policy, CNH also strengthened to its stronger levels since Nov 8, 2024 at 7.17. Increasingly, it feels like the dollar has been part of the discussions with China for a trade deal with a weaker dollar suiting both parties. It provides cover for China to ease policy and inject liquidity to stimulate domestic demand which in turn increases Chinese demand for US goods helping to reduce the deficit. A broadly weaker dollar also helps to strengthen global growth and China's other export markets.

This is all MASSIVELY stimulative for risk markets and of course Bitcoin 💪

Bitcoin however this week somewhat under performed, fading off the previous week's record highs. Part of this appears to be in line with a move lower in US bond yields which softened on reduced expectations for tariffs and the weaker inflation print. Bitcoin is oscillating between its role as a hedge against the failure of the US financial system as it continues to run unsustainable deficits, thus putting pressure on the bond market, to its high beta, risk on proxy as real rates come lower and liquidity gets pumped into the system. It’s remarkable how Bitcoin in recent weeks has become positively correlated to US yields, but that’s because US yields have been rising on debt sustainability concerns, rather than a material change to the growth and inflation expectations which would require tighter monetary policy.

It’s also worth remembering that this week was month end, which is typically negative liquidity (the RRP rose $161bn this week as banks window-dress balance sheets - that's cash being taken out of the market.) Month end also creates noisy, erratic trading as positions adjust and portfolios rebalance. We therefore read little into these moves and continue to track the bullish macro undercurrents which we suspect will take us back to the highs this coming week. There’s a lot of performance chasing required into quarter end in June. Stay locked in.

Native News

Key news from the crypto native space this week.

According toa court filing on Thursday, The U.S. SEC is seeking to dismiss its lawsuit against Binance. The agency and lawyers representing the SEC, Binance, and former Binance CEO Changpeng Zhao filed a "joint stipulation" in the U.S. District Court for the District of Columbia. The filing said "Whereas, in light of the foregoing, and in the exercise of its discretion and as a policy matter, the Commission believes the dismissal of this Litigation is appropriate.” Binance reportedly said "The dismissal of the SEC’s case against Binance is a landmark moment. We’re deeply grateful to Chairman Paul Atkins and the Trump administration for recognising that innovation can’t thrive under regulation by enforcement."

This week, crypto exchange Bybit obtained a Markets in Crypto-Assets Regulation (MiCA) license from Austria’s Financial Market Authority (FMA), allowing the exchange to expand into the European market. The approval allows Bybit EU to operate as a regulated crypto asset service provider (CASP) and extend its services across all 29 European Economic Area member states. As part of its expansion, Bybit has officially established its European headquarters in Vienna, Austria.

On Wednesday, GameStop, the video game retailer announced that it has taken its first steps in cryptocurrency by purchasing 4,710 bitcoins at a price of approx. $108,800 costing approx. $512.6m. The company had shared its plans in March, when its board agreed to use some of its money to invest in bitcoin. CEO Ryan Cohen shared the reason behind the move in a video at the Bitcoin 2025 Conference in Las Vegas. He said the Bitcoin investment could help safeguard the company from financial risks. "Bitcoin has certain unique advantages compared to gold, the portability aspect of it," Cohen said. "It's instantly transferable across the globe. It's instantly verified via the blockchain... there's the scarcity element of it as well."

French football club Paris Saint Germain became the first major sports club to publicly confirm holding bitcoin in its treasury. Pär Helgosson, head of PSG Labs, said at the Bitcoin 2025 conference in Las Vegas on Thursday “We took our fiat reserves and we actually allocated Bitcoin. We still have it in our books. And as one of the largest clubs in the world, we’re the largest player in the sports ecosystem to do that.” He added “More than 80% of our fan base is actually under 34 years old. It means that we're about what's next, just like Bitcoin.”

Institutional Corner

Top stories from the big institutions

On Thursday the U.S. SEC issued new guidance on crypto staking saying that that most of the common staking activities aren't subject to federal securities regulations, as long as specific conditions are met. The report shares its views on certain activities known as “staking” on networks that use proof-of-stake (“PoS”) as a consensus mechanism (“PoS Networks”). The report addresses the staking of crypto assets that are intrinsically linked to the programmatic functioning of a public, permissionless network, and are used to participate in and/or earned for participating in such network’s consensus mechanism or otherwise used to maintain and/or earned for maintaining the technological operation and security of such network. Read the full release from the SEC HERE.

Cantor Fitzgerald announced on Thursday that it has launched a new Bitcoin-focused fund with downside protection based on the price of gold. Cantor CEO Brandon Lutnick said at the Bitcoin Las Vegas conference that by balancing Bitcoin's volatility with the precious metal's relative stability, the fund would address investors fearful of the cryptocurrency’s frequent dramatic price drops. Lutnick said "We are launching a gold-backed Bitcoin fund with the idea that there are still people on the earth that are scared of Bitcoin, and we want to bring them into this ecosystem. We are going to provide them upside while giving them downside protection secured by physical gold." A statement from the firm said the fund "aims to deliver uncapped upside participation in Bitcoin, while providing 1-to-1 downside protection based on the price of gold." It will be available to investors in the coming weeks, the firm said but did not specify a date.

Speaking at the Bitcoin 2025 conference, New York Mayor Eric Adams continued his push to shepherd the crypto community to New York, calling for the creation of a Bitcoin Bond in the city and the removal of its controversial BitLicense requirements. He said “You have a mayor who is the crypto mayor, is the Bitcoin mayor, and I want you back in the city of New York, where you won't be attacked and criminalized. Let's get rid of the Bitcoin license and allow us to have the free flow of Bitcoin in our city." The speech comes a week after Adams hosted the inaugural New York Crypto Summit, where he announced the development of a digital assets advisory council designed to help bring jobs and investment to New York City.

Charts of the Week

Because charts are just as important as macro.

BlackRock Bitcoin ETF has seen record inflows in May. Hat tip to Bloomberg for the chart.

Base transaction activity has rebounded to approximately 10 million daily transactions after a brief dip to around 7 million in recent weeks. Hat tip to The Block for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Trading Desk Lead , Kraken Prime

Product Director Digital Assets at Capital.com

Head of Digital Asset Strategy at State Street Global Advisors

Product Manager Digital Assets at LSEG

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.