Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: New crypto report from Consynsus, MicroStrategy included in Nasdaq-100, Crypto.com announces partnership with Crypto.com, Avalanche raises $250m.

Institutional Corner: Vancouver passes a crypto motion, Hong Kong to speed up licensing processes for crypto trading platforms.

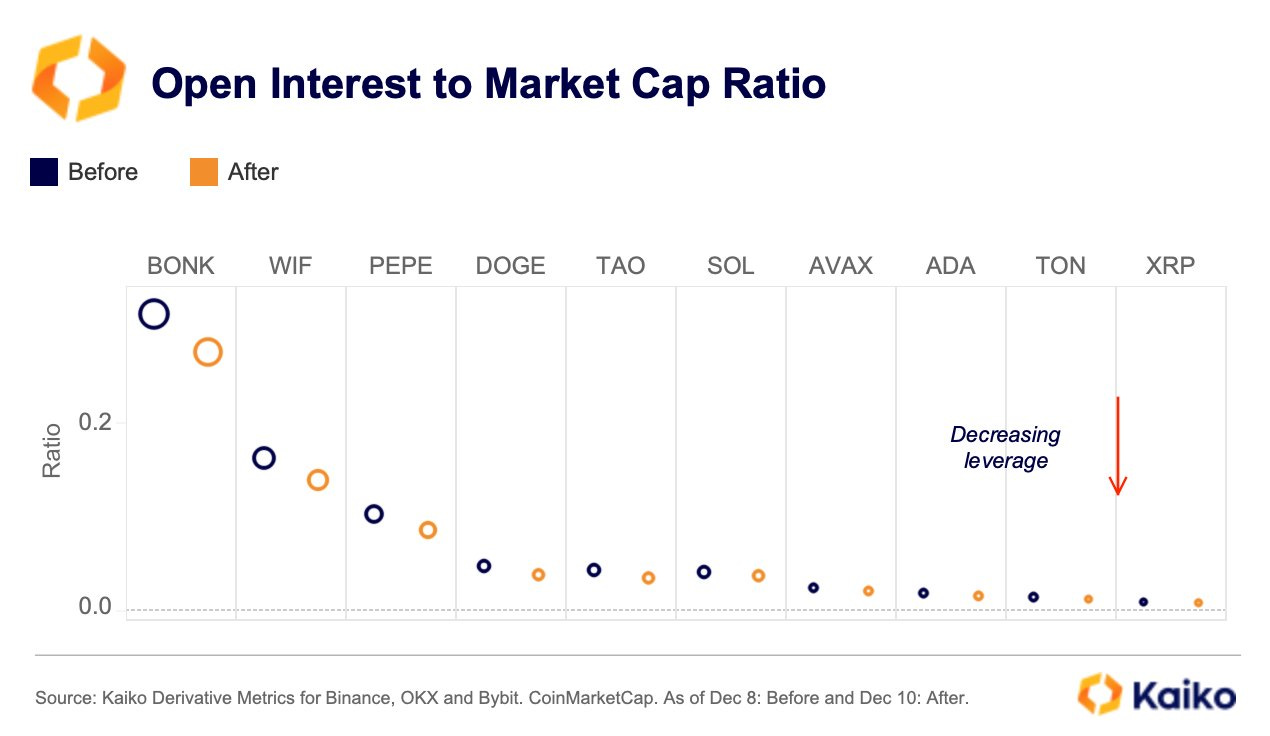

Charts of the Week: ETH CME futures cross 1m ETH open interest, USDT on Ethereum overtakes USDT on TRON, OI to market cap dropped for many alts.

Top Jobs in Crypto: Featuring DRW, Koinly, Nansen, KeyRock, AssetPass and Laser Digital.

Macro Update

This is where we connect the dots between macro and crypto.

Central Banks Spreading Holiday Cheer

A re-newed sell off in US Treasuries failed to stop the Nasdaq hitting new record highs as the global rate cutting cycle, which we expect to continue to propel risk and crypto, continued unabated.

The Swiss National Bank cut rates 50bps, the biggest cut in almost a decade in response to weaker than expected inflation and growing global uncertainty. The Bank of Canada cut 50bps for the second time this cycle in response to a slowing economy, although indicated cuts going forward would be more gradual. Meanwhile the ECB cut rates 25bps for the 4th time this cycle and considered a 50bp reduction as growth forecasts were revised lower. The ECB also dropped its commitment to “keep policy rates sufficiently restrictive for as long as necessary” adopting a more explicitly dovish policy stance in response to “increasing downside risks to growth.”

Big Bazooka Part II…

Underscoring the global risks to growth, data out of China continued to highlight a weak economy mired in deflation, with inflation at -0.6% MoM and a tepid 0.2% YoY. Producer prices also fell 2.5% YoY marking the 26th straight month of decline.

In what could be quite significant for global markets, China’s Politburo vowed to embrace a “moderately loose” monetary policy in 2025 (from previously prudent) and a more “proactive” fiscal response to address the slowing economy. Whilst specifics were again lacking, China last changed the wording to “moderately loose” in 2008 before enacting massive fiscal policy, which helped pull the global economy out of the growth nadir post financial crisis. The Chinese “big bazooka” has gotten off to a few false starts but we increasingly feel it is set to arrive and flood our markets with yet more liquidity and be a significant driver for the blow-off top phase of crypto in this cycle.

In a juxtaposition, the US economy continues to outperform the rest-of-world, with CPI data this week still proving sticky, ticking higher to 2.7% on a YoY basis with core inflation stuck at 3.3%. Lagging shelter costs (expected to come down) continue to be responsible for nearly 40% of the price increases but under the hood, inflation looks benign, with core services prices rising at their slowest pace since early 2022, whilst core goods prices are still deflating year over year. Little in this report to stop the Fed cutting rates next week, which the market is now 97% priced for.

A surprise jump in weekly jobless claims to a two month high of 242k which follows last week’s tick higher in unemployment will also continue to keep the Fed more focused on downside risks to the labour market, with policy deemed still as being restrictive. Whilst we expect a “cautious” cut from the Fed, signalling a slower pace of cuts going forward given recent strength in the data, we remain of the view that the pre-election spend sugar high will start to dissipate, keeping inflation and growth muted and causing the Fed to cut more than is currently priced by markets. Especially given the slowing global growth backdrop which the US will not be forever immune to.

US debt sustainability fears…

Indeed, the US growth outperformance is being driven by an ever increasing fiscal deficit which once again is causing concern amongst investors in terms of sustainability. With US debt now north of $36trn, the asset management bond giant, Pimco, announced this week that it is cutting exposure to long-dated US debt because of the “deteriorating deficit dynamics” whilst Ray Dalio, founder of the world’s largest hedge fund, Bridgewater, said he would invest in “hard money” like gold and Bitcoin whilst avoiding debt assets, as most major economies face rising indebtedness problems 🫡

Rising US yields is typically a headwind for Bitcoin, however when yields are rising because of debt sustainability fears, Bitcoin, as the world’s hardest asset, is the ultimate hedge against the failure of fiat, debt based economies. Even stocks become a TINA trade (there is no alternative) as deficits run unchecked, pumping nominal growth, debasing the currency. Whilst we’d be reluctant to underestimate Elon Musk, the Department of Government Efficiency is unlikely to change this dynamic. Sure, they can reduce wasted government spending, but for growth to sustain, the economy will continue to require increased deficit spending and debt expansion. Nothing stops this train.

Into the final, full trading week of 2024 then, all focus on the Fed. Yet, whilst lots of ink will be spilled on the pace of cuts going forward, little detracts from the supportive macro dynamic of a global central bank rate cutting cycle and rising global liquidity, set to be propelled by China.

Rising US yields are a slight concern, yet for Bitcoin, the idiosyncratic bull narrative is growing stronger week by week. Microstrategy’s addition to the Nasdaq 100 the latest milestone ✅

The Bitcoin Santa Rally looks set to spread more Christmas cheer 🍻

Native News

Key news from the crypto native space this week.

According to a survey from blockchain firm Consensys, cryptocurrency ownership around the world is climbing, although market volatility and scams are still barriers to newcomers. Crypto ownership has increased in many countries around the world with emerging markets leading. Mexico saw an 85 jump in crypto ownership, +7% in the Philippines and South Africa, +5% in Germany and +4% in Japan. At least half of respondents in Nigeria (84%), South Africa (66%), Vietnam (60%), the Philippines (54%) and India (50%) reported owing a crypto wallet in 2024. Turkey and the United States also rank highly, with 44% and 43% of respondents indicating wallet ownership, respectively. According to the survey, about 40% of respondents currently own or have previously purchased cryptocurrencies. As for purchase intentions, a higher proportion of respondents in Asia and Africa express intentions to invest in crypto assets within the next 12 months. However, ownership rates are notably lower in countries like Japan, Argentina, Canada, France, Italy, and the UK, where less than one-third of respondents have ever bought digital assets.

The report highlights the top barriers to entering the crypto space:

At the close on Friday, it was announced that MicroStrategy will be included in the Nasdaq-100 Index. The change comes into effect prior to market open on 23 December. The Nasdaq-100 Index tracks the 100 largest non-financial companies listed on the Nasdaq exchange and includes some large names like Apple, Nvidia, Microsoft, Amazon, Meta, Tesla and Costco. On 29 November, the day when the Nasdaq took a market snapshot in preparation for the index's annual rebalancing, MicroStrategy had a market cap of roughly $92 billion. That would rank the company as the 40th largest in the Nasdaq 100 and a likely weighting in the index of 0.47%

Crypto.com has announced a strategic partnership with Deutsche Bank. Under this collaboration, Deutsche Bank will provide corporate banking services for Crypto.com in Singapore, Australia, and Hong Kong, with plans for expanded support in the future. Crypto.com say the partnership will allow the firm to offer seamless corporate banking capabilities, improving operational efficiency, and establishing a robust banking foundation in the Asia-Pacific region. Karl Mohan, General Manager APAC and MEA and Global Head of Banking Partnerships for Crypto.com said “This is a momentous relationship for us and further highlights our commitment to security and compliance. Teaming up with one of the world’s leading financial services providers further cements our, already strong, presence globally and we are excited to build on this with the support of Deutsche Bank.” Kriti Jain, Head of New Economy Corporate Coverage for APAC and Cash Sales for APAC & MEA for Deutsche Bank said “We are delighted to support Crypto.com’s strategic businesses in Asia Pacific. Our strong track record with serving global new economy clients, combined with our commitment to innovation and broad global network position us strongly to help Crypto.com with its long-term growth ambitions.”

Layer 1 blockchain project Avalanche announced a raise of $250 million via a locked token sale led by Galaxy Digital, Dragonfly and ParaFi Capital this week. The announcement indicated that the tokens sold have certain vesting or lock-up periods. SkyBridge, SCB Limited, Hivemind, Big Brain Holdings, Hypersphere, Lvna Capital, Republic Capital, Morgan Creek Digital, FinTech Collective, CMCC Global, Superscrypt, Cadenza, Chorus One and Tané Labs also participated, among others. The investment will support the Avalanche9000 upgrade, which launched on testnet in November with over $40 million in retroactive rewards for developers building on the network. Avalanche9000 is designed to drive scalable, purpose-built Layer 1s, reducing blockchain deployment costs by 99.9% and transaction costs by 25 times.

Institutional Corner

Top stories from the big institutions

Vancouver, British Columbia's city council has passed a motion to explore the possibility of accepting bitcoin for payment of taxes and fees as well as establishing a bitcoin reserve. The motion, prepared by Mayor Ken Sim, calls for "diversifying the City of Vancouver's financial reserves and payment options to include bitcoin." The motion adds "It would be irresponsible for the City of Vancouver to not look at the merits of adding bitcoin to the City’s strategic assets to preserve the City’s financial stability.” The motion calls for City staff to report back to the Council on the feasibility of a "bitcoin-friendly city" strategy by the end of the first quarter of 2025. This motion marks a significant change in City policy towards BTC, as Vancouver's prior Mayor, Kennedy Stewart tried to outright ban bitcoin ATMs within city limits in 2019 (Vancouver was home to the world's first bitcoin ATM).

Hong Kong has pledged to speed up the licensing process for crypto trading platforms as the region continues its drive to become a cryptocurrency hub. Joseph Chan, Acting Secretary for Financial Services and the Treasury (FSTB), said at the parliament this week that the Securities and Futures Commission will facilitate a “swift licensing process” and establish a “consultative panel” that’s expected to commence early next year for licensed trading platforms. In June 2023, it officially started a crypto licensing regime for crypto trading platforms, allowing licensed exchanges to offer retail trading services. The regulator has granted licenses to OSL Exchange, HashKey Exchange and HKVAX so far. In addition to crypto trading, the government is also prepared to regulate stablecoins, having released consultation documents for fiat-referenced stablecoin issuers. FSTB plans to introduce a relevant legislative bill to the Legislative Council “within this month,” Chan said in response to questions from Johnny Ng, a Hong Kong lawmaker. According to the consultation, the proposal would require all FRS issuers to obtain a license from the HKMA. The authorities are also focusing on crypto custody services. Chan said regulators will introduce a proposal to license crypto custodians next year.

Charts of the Week

Because charts are just as important as macro.

ETH Futures on CME just crossed 1M ETH open interest for the first time.

USDT on Ethereum overtook USDT on TRON this week. The USDT supply on Ethereum grew by ~$20 billion in the last month.

Open Interest to Market Cap ratio dropped for most altcoins this week, indicating lower leverage. Meme tokens like BONK, WIF, PEPE, and DOGE saw the biggest declines.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Quant Trader - Cryptoassets at DRW

Product Analyst for Crypto at Koinly

Affiliate Manager for EMEA at Nansen

Digital Assets / Crypto Research Analyst at Keyrock

Trading Operations Specialist at Laser Digital

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.