Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: VanEck files for a new exchange-traded fund targeting companies building infrastructure for digital assets, Sygnum raises $58m, Phantom Wallet raises $150m, Jio Platforms partners with Polygon.

Institutional Corner: Intesa Sanpaolo buys 11 BTC, BlackRock Asset Management launches its first Canadian Bitcoin ETF.

Charts of the Week: Bitcoin correlations with major asset classes increased in Q4, NFT market participation increases, Bitcoin ETF AUM and management fees.

Top Jobs in Crypto: Featuring Legend Digital, Blockdaemon, Wintermute, ValleyDAO, Galaxy, OpenPayd and Revolut.

Macro Update

This is where we connect the dots between macro and crypto.

Things are About to Get Wild

All change!

In last week’s Connecting the Dots, we focused on how the resurgent inflation fears were overblown and the broad US “reflation” narrative looked stretched, signalling a top for US yields and the dollar. This week, the data supported that thesis and indeed, we saw US yields between 10 to 20bps lower across the curve and the dollar cooling, alleviating the macro headwinds blowing against the strong underlying liquidity backdrop that underpins our bullish Q1 outlook.

US CPI was the key data highlight of the week and whilst headline CPI rose from 2.7% to 2.9%, core inflation came in softer, slowing from 3.3% to 3.2%. Little to change the current stance of the Fed, but for a market that was pricing barely 1 cut in 2025, it was sufficient to price back another 25bps of easing and drive a sharp rally in equities and Bitcoin 🚀

The softer inflation pulse was also reflected in the UK, where headline inflation unexpectedly slowed from 2.6% to 2.5% and encouragingly, saw services inflation, a key focus for the BoE, drop sharply to a 3 year low of 4.4% from 5%. Core inflation similarly dropped from 3.5% to 3.2%. A Feb rate cut from the BoE is now a lock 🤜🤛

Fading inflation….

One of our biggest non consensus views is that for 2025/2026, disinflation, if not outright deflation, will be the biggest problem for Western central banks. Extremes of Covid may have distorted economic cycles, but fundamentally they haven’t changed and we remain in a disinflationary world, driven by debt, technology and an ageing population. The explosion of AI is set to accelerate the disinflationary force from tech.

The world's second largest economy and largest exporter is currently stuck in a deflationary spiral which it will export to the rest of the world. Global growth is falling (UK GDP this week came in at 0% for the final quarter, just 1% YoY, whilst German GDP, Europe’s largest economy, declined 0.2% in 2024 following a 0.3% decline in 2023) meanwhile, the “resilient” US economy comes as at the cost of running insane, war time level deficits over 7%.

We’re witnessing the “bumpy phase” of disinflation, after sharp falls from circa 10% to 3% in the US, but without some global supply shock, the fall in global demand makes it difficult for us to see where a resurgence in inflation comes from. If disinflation starts to take hold below central banks 2% targets, there will be a panicked response. Yet given the transmission of monetary policy is 12-18 months, rate cuts will initially appear ineffective and before long, we’ll see policy makers reaching back into the QE toolkit.

Lowflation, or outright deflation is a MUCH bigger problem than inflation for these debt bloated economies and if real economy inflation can’t reduce the real debt debt burden, they will pump the asset side of the balance sheet. Disinflation in the real economy will be offset by rapid asset price inflation.

Consequently, we believe this rate cutting cycle will be extended which in turn has the potential to extend the typical 4 year Bitcoin cycle. Putting aside the paradigm shift from a supportive US administration, an extended macro cycle likely means Bitcoin outperforms many of the topside targets. $500k Bitcoin peak this cycle is not a silly outcome in our view 👀

Debt ceiling & liquidity…

Set to add some downward momentum to US yields, Yellen said late Friday that the US Treasury will start taking "extraordinary measures” from next week as the debt ceiling has hit and to avoid the risk of default on government debt. Extraordinary measures essentially involve suspending/delaying certain non essential payments and investments. Importantly it means there will be no new net Treasury issuance which is positive for bonds given the reduced supply hitting the market. Ultimately, once these measures quickly exhaust, the Treasury will have to use the cash they already have sitting in the Treasury General Account (TGA) which sits at just over $600bn (they’ve already tapped circa $100bn in Jan.) That’s a big cash injection into our markets which will drive liquidity over the coming weeks and keep Bitcoin and risk trading higher.

Further supporting bonds, as we outlined last week, we expect Trump to be far more moderate when it comes to tariffs than his bluster and rhetoric which is a tactic to bring relevant parties to the table. On Friday, Trump held a call with China’s Xi of which he said on his Truth Social media platform:

“I just spoke to Chairman Xi Jinping of China. The call was a very good one for both China and the U.S.A. We discussed balancing Trade, Fentanyl, TikTok, and many other subjects. President Xi and I will do everything possible to make the World more peaceful and safe!”

These signs of cooperation and moderation in the language will be well received by the market and reduce some of the more extreme fears which we believe has been behind the recent bond sell off.

Trump Pump…

Heading into the inauguration then, the macro looks good for broader risk and bitcoin to trade to new highs. The big macro headwinds of rising yields and a stronger dollar fading whilst the liquidity pulse from the RRP drawdown (another $60bn drawn down last week) alongside the coming TGA flood makes for a “buy everything” environment.

One risk perhaps being the Bank of Japan which is expected to raise rates on Friday 25bps to 0.5%. Macro doomers continue to fret on the potential for a renewed “carry trade unwind” with Japanese investors, the world's largest foreign creditors, selling foreign assets to repatriate home to receive the higher domestic yields.

However, as we said back in August, that event was less a “carry” or funding unwind, but a highly correlated momentum trade (short JPY, long stocks) blowing up. Rates still remain far too low in Japan both on an absolute and relative basis to spark an unwind of the funding trade, which is borrowing in a lower yielding currency, to invest in higher yielders.

Further, the big Japanese pension and lifer funds that hold the chunk of foreign assets as a part of this funding trade are typically slow to change allocations and certainly aren’t receiving sufficient yield back home to warrant a portfolio shift. More likely, they will simply increase hedge ratios (as hedge costs will fall) which will weigh on USDJPY and subsequently the broader dollar, which net is positive liquidity and risk. We don’t therefore view Friday as being a risk to a renewed global bond sell off, particularly as the BoJ remains cautious of the potential to unsettle markets.

Meanwhile, whilst the macro cycle itself continues to point to record highs for Bitcoin, Trump is also expected to sign a series of crypto related Executive Orders declaring digital assets a “national imperative or priority.” Potential also remains for the establishment of a bitcoin “stockpile” to be part of that executive order, instructing the Treasury not to sell any more Bitcoin as a pre-cursor to establish Bitcoin as a strategic reserve asset.

The market is not “priced” for this paradigm shift in the regulatory outlook for crypto or for the potential for Bitcoin to be established as a strategic reserve asset. In fact, you can’t price a real demand shock and real flows that are set to flood into crypto. Just buy, HODL and let the demand/supply dynamic play out. Things are set to get wild 🤪

Native News

Key news from the crypto native space this week.

Asset management firm VanEck filed for a new exchange-traded fund (ETF) on Wednesday, targeting companies building infrastructure for digital assets. The fund's structure avoids direct crypto exposure, but maintains exposure to the digital asset markets it compiles. According to the filing this week the Onchain Economy ETF seeks to allocate at least 80% of its assets to "Digital Transformation Companies" and digital asset instruments. The companies may include crypto exchanges, payment gateways, mining operations, and firms providing infrastructure services. It also seeks to invest in firms providing the core technology, infrastructure, and data centre capacities that support digital asset operations. See the full filing HERE.

Switzerland and Singapore-based crypto bank Sygnum announced this week that it has raised $58 million in an oversubscribed strategic growth round. Sygnum achieved unicorn status with a post-money valuation of more than $1 billion. Fulgur Ventures, a venture capital firm specialising in Bitcoin technologies, was the cornerstone investor in the final close of the round. Tuesday’s announcement comes less than a year after Sygnum confirmed it had secured over $40 million in an interim close of a strategic funding round last January, led by Milan-based asset manager Azimut Holding, at a $900 million valuation. In its previous Series B funding round, which closed in January 2022, the crypto bank secured $90 million with participation from several Asia-based investors, including Sun Hung Kai & Co., Animoca Brands and SBI Holdings. The fresh capital will be used to expand its product portfolio with a focus on Bitcoin technology, broaden its institutional infrastructure, strengthen its compliance teams and explore strategic acquisition opportunities.

According to a statement this week, Phantom Wallet has raised $150 million and secured a $3 billion valuation. Venture capital firms Sequoia Capital and Paradigm led the Series C funding round, which also included a16z and Variant. Co-founder and CEO Brandon Millman said, "The wallet’s rise in popularity shows that there’s a 'broader trend' in which more people are buying crypto directly with their digital wallets instead of using Coinbase Global Inc.’s exchange and other centralised platforms." The company said it has 15 million monthly active users and $25 billion in self-custody assets. In November, the crypto wallet app placed ninth among the top free iPhone apps. Solana added "With these new resources, we plan on making bigger bets to accelerate crypto adoption and become the world’s biggest and most-trusted consumer finance platform," and noted that Phantom Wallet "has become the most dominant crypto wallet in the world, thanks in large part to Solana." See the full press release from Phantom HERE.

Indian telecom and technology company Jio Platforms is taking significant steps to enhance the digital experience for its more than 450 million users. Jio Platforms is a wholly-owned subsidiary of energy giant Reliance Industries. Reliance is led by one of Asia's richest man, Mukesh Ambani, and his family. Jio has partnered with with Polygon Labs, the development team behind Polygon Protocols, to launch its Web3 and blockchain services in India. This collaboration will leverage Polygon's advanced blockchain technology to add innovative Web3 capabilities to some of Jio Platform's existing applications and services. Polygon's co-founder, Sandeep Nailwal, said on the partnership "This is a significant step forward for Web3 adoption in India. We look forward to collaborating with Jio as they introduce Web3 to millions of customers."

Institutional Corner

Top stories from the big institutions

Intesa Sanpaolo, Italy's largest banking group, become the first Italian bank to make a direct investment in the crypto this week as it purchased 11 Bitcoins for roughly 1 million euros (US$1 million). The confirmation came from Intesa Sanpaolo’s press office, following speculation that emerged earlier in the day after an internal email from the group was leaked. While the purchase was confirmed, the banking group declined to elaborate on its motivations or potential future strategies involving Bitcoin.

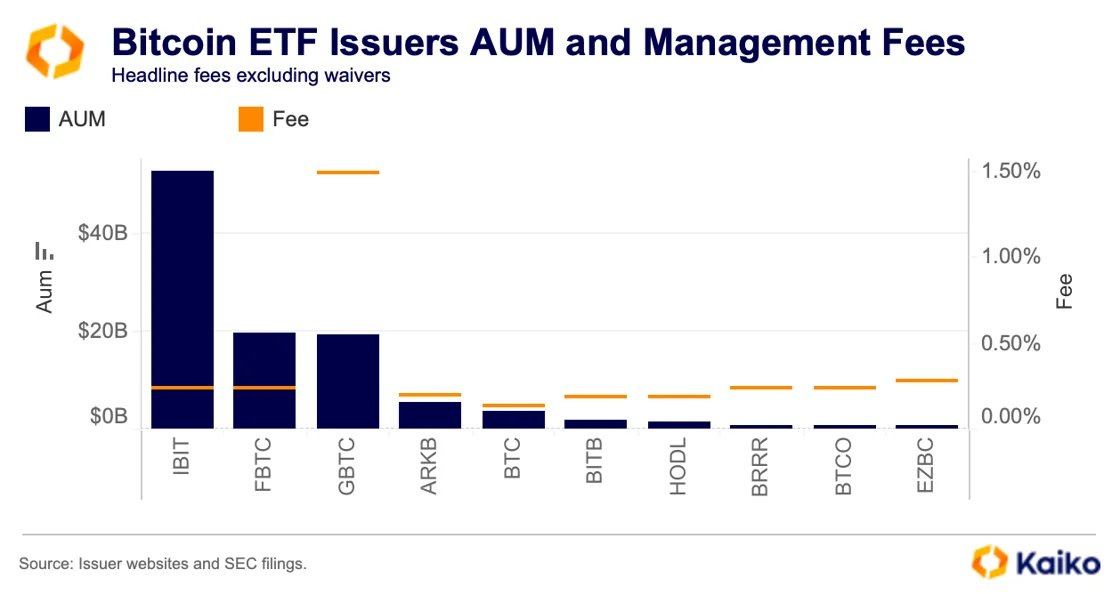

BlackRock Asset Management launched its first Canadian Bitcoin ETF on Cboe Canada. The iShares Bitcoin ETF (iShares Fund) has begun trading under the IBIT ticker in Canadian dollars and IBIT.U in U.S. dollars, targeting investors seeking Bitcoin exposure without the usual complexities of direct crypto ownership. The iShares Bitcoin ETF (iShares Fund) has begun trading under the IBIT ticker in Canadian dollars and IBIT.U in U.S. dollars, targeting investors seeking Bitcoin exposure without the usual complexities of direct crypto ownership. Read the full statement HERE.

Charts of the Week

Because charts are just as important as macro.

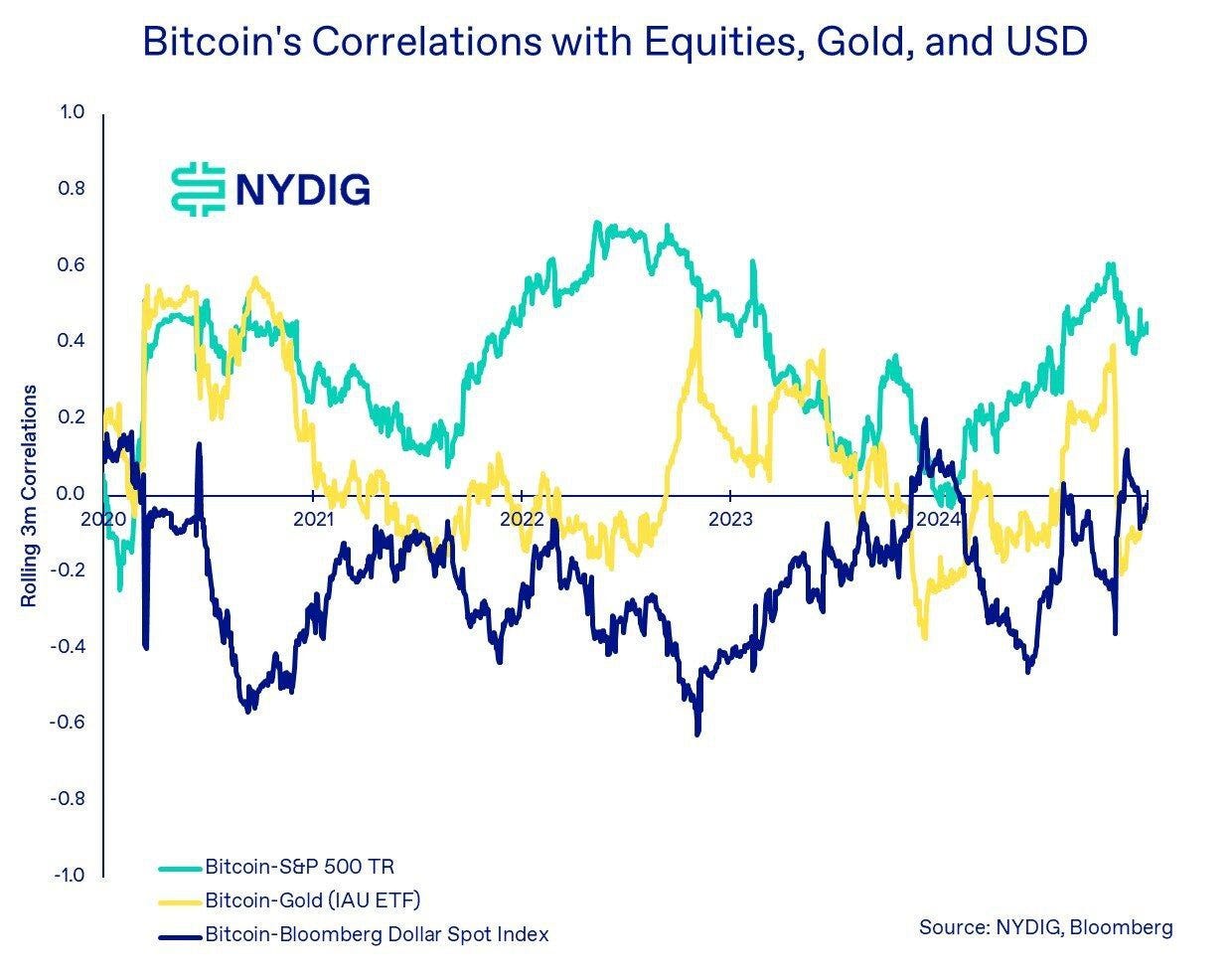

Bitcoin's correlations with major asset classes, including US equities, gold, and the US dollar index, decreased (in absolute terms) during Q4 2024, largely due to the election.

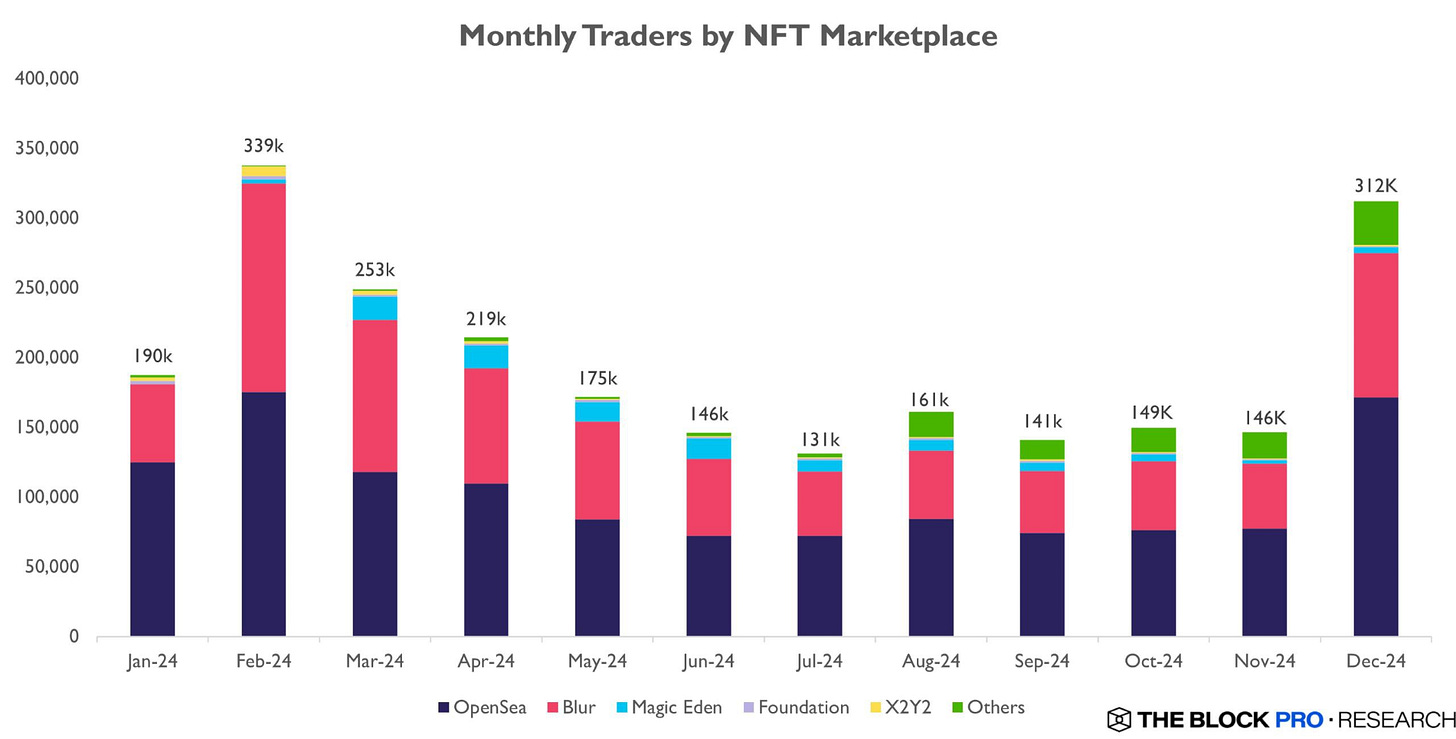

NFT market participation sees a large increase. NFT trader count surged by 166K in Dec 2024, a 113.7% MoM increase.

One year on and Bitcoin ETFs saw $36bn of net inflows with over $100bn in assets under management across the 10 funds.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Futures Crypto Trader at Legend Digital

Ethereum Ecosystem Lead at Blockdaemon

DeFi Trader/Developer at Wintermute

Head of Marketing at ValleyDAO

Sales Support Analyst - Liquidity Provisioning/Market Making at Galaxy

Sales and Trading Associate at OpenPayd

Strategy and Operations Manager - Derivatives at Revolut

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.