Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

If you think someone will benefit from reading this newsletter, we’d be really grateful if you could share it with them. Thanks!

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: US rate cuts back to the fore, US yields have continued to fall but particularly interesting has been the fall in the dollar. What does this all mean for crypto?

Crypto Native News: Figment and Apex Group launch ETH and SOL ETP staking products, Revolut announces a partnership with MataMask, Banxx raises £20m in a series A funding and BlockFi reached a settlement with FTX/Alameda.

Institutional News: Van Eck expects half of its AUM to come from crypto, BRICS to create a new payment system.

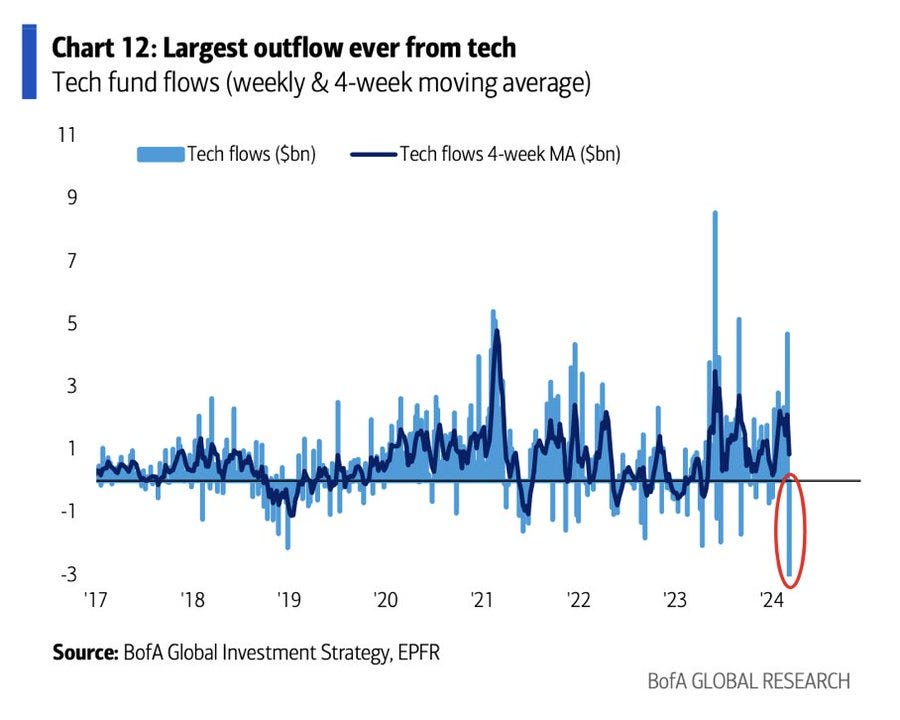

Charts of the Week: Bitcoin ETF flows increasing, Tech funds see outflows and Coinbase volumes rise.

Top Jobs in Crypto: Featuring Bondex, Wintrado Academy, London Link, WorldPay, LMAX Digital.

Macro Update

This is where we connect the dots between macro and crypto.

The Curious Case of the Weakening Dollar

A big week on the macro front provided a supportive tailwind to the unrelenting ETF flows to take BTC to yet another record high against the dollar 🎉

For a market that had moved too far in pricing out rate cuts, a softer pulse to the recent data flow, plus a less hawkish Powell, saw a dovish re-pricing in rates, pricing back 4 rate cuts from 3 and dragging yields and the dollar lower.

In testimony to Congress, Powell stated that policy makers were “not far” from having the confidence that inflation’s downtrend would be sustained and described interest rates as being “well into restrictive territory” and “far from neutral now.” June increasingly looks like a lock for the beginning of the rate cut cycle. Meanwhile, the data continues to calm some recent fears of a re-accelerating, reflationary economy that would force the Fed to hike further.

The highlight of course being US Non Farm payrolls, which, whilst beating on headline with a solid 275k jobs added in Feb, saw a significant revision to Jan’s 353k print, down to 229k. Unemployment also jumped from 3.7% to 3.9%, the highest level in over 2 years and average hourly earnings also came in at a soft 0.1% MoM with yearly earnings ticking lower to 4.3%.

Earlier in the week, JOLTS data showed the “quit rate” fell to 2.1%, its lowest level since August 2020, suggesting workers do not have confidence in their ability to find another job. Job openings fell to the lowest level in 3 months. In the Fed’s Beige Book survey of regional economic conditions, the Fed said the labor market continued to soften, with wages rising at a slower pace and expectations of future pay hikes in line with historical norms.

All in, the labor market continues to show signs of softening, with little inflationary wage pressures. Nothing to derail the Fed from cutting rates, game on.

Elsewhere, the ECB left rates unchanged as expected but also signalled June for the first rate cut, as they revised lower growth and inflation forecasts. Juxtaposed to the global rate cutting cycle however, expectations for the BoJ to move away from negative interest rate policy continue to grow. BoJ board member Nakagawa saying that “prospects for the economy to achieve a positive cycle of rising inflation and wages are in sight.” The remarks came as Japan’s largest trade union group said that average wage hike demand hit 5.85% for this year, the first time it stood above 5% for 30 years. Markets now anticipate the move away from negative 0.1% to occur in April, with some looking for March.

We at London Crypto Club continue to err on the dovish side when it comes to the BoJ. The window of opportunity looks largely to have been missed as inflation has “normalised,” whilst the economy unexpectedly fell into recession at the end of last year. If there is a move (we’re not convinced there will be) it may well be a “one and done” which would limit the potential impact on global markets.

As a reminder, Japan as the largest creditor economy and holder of foreign assets poses a huge risk to global bond and equity markets. Higher domestic rates have the potential to see foreign assets sold and the proceeds repatriated home. This especially risks destabilising the US treasury market.

It was interesting then that whilst USDJPY moved lower as Japanese yields rose, US 10yr yields continued to fall some 10bps on the week. In part, soothing fears, BoJ governor Ueda said that even if they end negative rate policy and yield curve control, they will continue to buy enough long term bonds to avoid an abrupt spike in yields. Ironically, a BoJ move away from negative rates, putting upward pressure on yields may have the impact of driving more liquidity into markets as the BoJ are forced to simultaneously implement continued quantitative easing.

Last week’s comments from the Fed’s Waller about re-balancing the Fed’s treasury holdings towards shorter dated securities, continues to play on our minds. As we described, this “operation twist” would have QE like characteristics and allow the continued funding of this spiralling debt dynamic. Gold spiked around the headlines and continued to push new highs this week. US yields have continued to fall but particularly interesting has been the fall in the dollar. This comes despite Europe also looking to cut rates and on the brink of recession. Japan in recession. China battling a slowing, deflationary economy. It almost feels like there’s some degree of coordinated policy where the US is needing to play its part by getting rates down along with the dollar. Hmmm 🤔

Either way, the macro, which had previously been a headwind, is now acting as a tailwind for BTC with a supportive lower rates, lower dollar dynamic. Macro doomers continue to call for the top in equities (NVIDIA’s 10% drop from its highs on Friday feeding the bears some scraps) yet there continues to be a flood of liquidity able to power this market. The gold move for us is less a sign of impending doom, but impending shifts in monetary policy which will keep supplying liquidity to our markets.

The previous macro headwinds were insufficient to overpower this demand/supply dynamic in Bitcoin. Now we have macro tailwinds, it’s really difficult to see what stops the Bitcoin train continuing higher. Mean reversion doesn’t work in an exponential trend. 100k pre halving doesn’t look silly here.

Native News

Key news from the crypto native space this week.

Institutional staking services provider Figment Europe and Apex Group are set to launch Ethereum and Solana staking exchange-traded products on the SIX Swiss Exchange. The products, the Figment Ethereum Plus Staking Rewards (ETHF) and Figment Solana Plus Staking Rewards (SOLF) will go live on 12 March. The products are designed to offer institutions convenient access to staking rewards through traditional brokers or banks under a familiar ETP wrapper. Figment CEO Lorien Gabel said in a statement “We have worked hard to be in a position to support the launch of the first Ethereum and Solana staked ETPs by Issuance .Swiss AG on a regulated trading venue here in Switzerland,” “Our objective is now near complete and marks an important step towards the introduction of staking products in conventional ETP form for the still-nascent crypto market.”

Revolut announced a partnership with MetaMask this week. The new feature called Revolut Ramp will allow user to buy and deposit crypto into their MetaMask wallets. Lorenzo Santos, senior product manager at Consensys, the company behind MetaMask said “This partnership is really about giving our users what they want — more control over their crypto, in a straightforward way” “This partnership is really about giving our users what they want — more control over their crypto, in a straightforward way”. Revolut has 40 million customers and MetaMask 30 million.

U.K. Financial Conduct Authority-authorised crypto payments firm Baanx has raised $20 million in a Series A funding round led by Ledger, Tezos, Chiron and British Business Bank. Ledger is a crypto hardware wallet manufacturer that offers a Baanx-powered pre-paid crypto debit card. This funding round is reportedly being dedicated to introducing services on the United States and Latin America. The Baanx's token, BXX, rose 8% in the 24 hours after the announcement.

Bankrupt cryptocurrency lender BlockFi has reached a $874.5 million in-principle settlement with FTX and Alameda Research estates, according to a bankruptcy filing this week. BlockFi — which was hit by the collapse of FTX in 2022 and filed for Chapter 11 bankruptcy soon after — will receive a customer claim against FTX worth $185.2 million and a claim of $689.3 million from FTX’s sister trading firm Alameda Research. The filing said BlockFi customers are expected to receive the claims at full value, as long as FTX meets its distribution goals. Out of the $874.5 million, $250 million will be a secured claim, for which there is collateral to prioritise the payment to BlockFi after FTX’s reorganisation plan is approved by creditors. “BlockFi ensures that it will receive that $250 million shortly after the FTX plan is confirmed and goes effective – likely allowing a second interim distribution in the near term.”

Institutional Corner

Top stories from the big institutions

VanEck Europe, the European division of the global asset manager said it expects half of its assets under management to come from crypto in the future. Martijn Rozemuller, the CEO of VanEck Europe, said crypto will become more important and that he sees more potential for growth in that area than in others. As a reminder, VanEck Europe is the issuer of the VanEck Crypto and Blockchain Innovators UCITS ETF which holds Coinbase, Block, and MicroStrategy, among others. Rozemuller said in an interview “Today, roughly 10% of the business' assets under management come from crypto products and 90% derive from conventional investing through ETFs,” “I think that balance will shift,” “Crypto will become more important … and it will be closer to 50/50.”

According to Russian new agency TASS, the five-nation BRICS group comprising Brazil, Russia, India, China and South Africa will work on creating a payment system based on blockchain and digital technologies. “We believe that creating an independent BRICS payment system is an important goal for the future, which would be based on state-of-the-art tools such as digital technologies and blockchain. The main thing is to make sure it is convenient for governments, common people and businesses, as well as cost-effective and free of politics” the initiative is reportedly part of the efforts to increase the role of BRICS in the international monetary system and reduce the reliance on the US dollar. It was added “Work will continue to develop the Contingent Reserve Arrangement, primarily regarding the use of currencies different from the US dollar"

Charts of the Week

Because charts are just as important as macro.

Chart showing the growing inflows into the spot Bitcoin ETF’s, plus Grayscale outflows. Hat tip to James Butterfill for the chart.

Tech funds saw the largest outflows ever. Hat tip to Barchart for the chart.

Large spike in Coinbase volumes on Friday. Hat tip to Will Clemente for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Lecturer for Crypto at Wintrado Academy

OTC Crypto Sales Manager at LondonLink

Senior Director, Crypto and Web3 Vertical Growth at WorldPay

Broker Operations Analyst at LMAX Digital

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.