Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: IBIT passes 700,000 BTC in AUM, Bit Digital converts BTC treasury to ETH, Circle partners with OKX, Bit Mining announces strategic shift to Solana.

Institutional Corner: Emirates signs a MOU with Crypto.com, Bank of Korea Governor says allowing multiple non-banking institutions to issue local stablecoins could lead to currency chaos.

Charts of the Week: Summary of VC deals in June, momentum in the BTC breakout.

Top Jobs in Crypto: Featuring Blockchain.com, Keyrock, Alpaca, Fidelity, Kraken, Blockchain121.

Macro Update

This is where we connect the dots between macro and crypto.

It’s Go Time

We concluded last week that “with the sanguine macro backdrop, the US running insane deficits, all with the stimulative impact of a weaker dollar amidst rising global liquidity,” that Bitcoin was set to break into new range highs and indeed, we finally got the breakout we were looking for.

Clearly, despite the the supportive risk environment that’s taken equities to new record highs, Bitcoin was digesting a lot of profit taking into the $110k zone which once absorbed, with a still incredibly powerful demand dynamic at play, driven both by the ETF inflows and proliferation of Bitcoin Treasury company purchases creating a relentless bid, we finally broke the 110k-112k resistance zone to print new record highs above $118k 🎉

Equities on the other hand had a relatively muted, directionless week, consolidating around the highs, with little in terms of top tier economic data to provide fresh impetus. Although worth noting, as we continue to see crypto and tech as the asset classes that will outperform everything over the next decade, AI bellwether NVIDIA hit the $4trn market cap threshold for the first time 🤯

Disinflationary pulse…

The most important data release for us this week came out of China which continued to show persistent deflation. The producer price index fell 3.6% in June YoY, marking the biggest drop in producer prices for nearly 2 years according to Bloomberg. CPI did rise 0.1% YoY although declined 0.1% MoM. With little sign of the deflationary spiral stabilising, expectations continue to rise for more stimulus out of China 🌊

With China the world’s manufacturing hub in persistent deflation, we continue to think this will push a disinflationary pulse across global markets and keep inflation in check, adding to the benign macro environment.

This is worth keeping in mind ahead of Tuesday’s CPI print which is expected to rise from 2.4% to 2.6% YoY on headline and core inflation to 3% from 2.8%, with some of the tariff impact perhaps coming into play.

Fed minutes this week continued to show caution on the potential tariff impact, despite expectations that rate cuts will come later this year (and two members calling for a July cut.) Quite interesting also to see Truflation showing a renewed disinflation trend in July, with “real time” inflation now dropping back below 2% to 1.74% having peaked at 2.7% at the end of June.

Truflation: Real time disinflationary trends re-emerging after the June peak

We therefore think Tuesday’s CPI data will have little impact on this bull market in both equities and Bitcoin as we remain in a “goldilocks” macro environment of slowing, not collapsing US growth with little signs of accelerating inflation that would shift the direction of travel for the Fed from cuts to hikes.

Meanwhile, the drivers of risk are currently coming from a weaker dollar which continues to feed into easier global financial conditions and is facilitating the expansion in global money supply. The 180 from Trump/Bessent on deficit reduction also means we’re back running the “fiscal dominance” playbook, which puts less impetus on the Fed and rate cuts, to sustain the positive risk dynamic.

Additionally, with geopolitical fears in the rear-view mirror, risk premium continues to leak out of these markets which we still view as underpositioned risk and needing to chase performance. On-going tariff headlines are also having an increasingly muted impact as deadlines are continuously extended and deals negotiated.

Banana Zone…

Little then to change the bullish view here at London Crypto Club.

With the CLARITY Act (establishes a regulatory framework for crypto, clarifying roles for the SEC and CFTC in overseeing digital assets) GENIUS Act (setting rules for the issuance and operation of stablecoins) and Anti CBDC Surveillance State Act (prohibiting the Fed from issuing a CBDC) all scheduled for consideration in Congress this week, we also continue to see the hugely positive, idiosyncratic drivers unfold.

Interesting too, Bitcoin dominance is showing signs of having peaked and breaking lower. It feels then like alt season may finally be arriving and we are entering the next stage of the fabled “banana zone” 🍌🍌🍌

It’s go time 🚀

Native News

Key news from the crypto native space this week.

BlackRock's IBIT spot Bitcoin exchange-traded fund surpassed 700,000 ($76 billion) in assets under management on Monday, 18 months after its launch in January 2024. IBIT accumulated 698,919 BTC by July 3, according to its fund page, with around 1,510 BTC in net inflows on July 7, taking it over the milestone after the Independence Day holiday in the U.S. "New milestone… iShares Bitcoin ETF now holds over 700,000 BTC," Nate Geraci, president of NovaDius Wealth Management (formerly The ETF Store), said. "*700,000* in 18 months. Ridiculous." IBIT is now the 3rd highest revenue-generating ETF for BlackRock out of 1,197 funds and is only $9 billion away from being the first, Bloomberg Senior ETF Analyst Eric Balchunas previously highlighted.

Crypto-mining and staking firm Bit Digital said Monday it has completed the conversion of its entire corporate treasury from bitcoin to ether in a move to become one of the largest holders among publicly traded companies. The Nasdaq-listed company (ticker BTBT) said it liquidated roughly 280 BTC — currently worth over $30 million — and used the proceeds, along with $173 million in gross proceeds from its share offering, to purchase more ETH. Bit Digital says it now holds approximately 100,603 ETH following its crypto treasury shift, up from 24,434 ETH held at the end of the first quarter of 2025. The pivot is incentivised by Ethereum’s programmable blockchain design, growing adoption, and staking model, Bit Digital CEO Sam Tabar said on Monday. “We believe Ethereum has the ability to rewrite the entire financial system,” he said, adding that the firm intends to leverage Ethereum’s long-term potential. “We are starting with exposure to over 100K ETH for now, but we intend to aggressively add more so we become the preeminent ETH holding company in the world.”

Stablecoin issuer Circle announced on Wednesday that it has partnered with crypto exchange OKX to make USDC easier to buy, trade, and transfer across blockchains. The agreement provides OKX’s more than 60 million global users with a one-to-one on and off-ramp between U.S. dollars and USDC. Customers will be able to convert dollars to the fully reserved stablecoin and redeem in the other direction through OKX's buy-and-sell portal. The partnership intends to simplify global access to digital dollars and further integrate Circle's stablecoin into cryptocurrency platforms. “Demand for USDC continues from businesses and individuals eager to adopt this new form of high-utility and internet-based money," Circle co-founder and CEO Jeremy Allaire said in a statement. As part of the deal, the two companies will also run joint educational campaigns on stablecoins, targeting developers, traders, and everyday users. Read the full statement from Circle HERE.

NYSE-listed crypto mining company BIT Mining announced a "strategic shift" into the Solana ecosystem this week. The firm said it has plans to raise between $200 million and $300 million to accumulate SOL in phases, based on market conditions and capital availability. Bit Mining said in a statement "This transition positions BIT Mining to capture emerging opportunities across the broader blockchain value chain, while also establishing itself as a publicly traded vehicle for investors seeking exposure to the Solana ecosystem. By entering the Solana ecosystem, the company aims to leverage its high-performance infrastructure and dynamic developer community to drive innovation, enhance ecosystem integration, and create sustainable shareholder value." To kick off its new strategy, BIT Mining said it will convert all of its existing crypto holdings into SOL and adopt a "long-term holding strategy." The company also plans to expand its role in the Solana ecosystem further by running validator nodes to help maintain network decentralisation and security while earning onchain staking rewards.

Institutional Corner

Top stories from the big institutions

Dubai-based airline Emirates has signed a memorandum of understanding (MoU) with Crypto.com to explore integrating the exchange’s crypto payments functionality into the airliner’s payment systems. Details on the types of goods or services Emirates would accept crypto payments for, or which crypto tokens would be accepted, were not detailed. According to the official announcement, the official integration of the feature is expected to take place next year. Emirates Deputy President and Chief Commercial Officer Adnan Kazim said in a statement “Partnering with Crypto.com to integrate cryptocurrency into our digital payments system reflects Emirates’ commitment to meeting evolving customer preferences, in addition to tapping into younger, tech-savvy customer segments who prefer digital currencies.”

Bank of Korea Governor Lee Chang-Yong said on Thursday that allowing multiple non-banking institutions to issue local stablecoins could lead to currency chaos reminiscent of the 19th century. Lee's comment comes amid South Korea's ongoing efforts to promote the issuance and usage of Korean won-based stablecoins, which is one of President Lee Jae Myung's election promises. Lee said "Allowing won stablecoins irresponsibly could conflict with foreign currency exchange policies, and delegating payment and settlement services to non-banks will disrupt the profit model of existing banks." Lee added that the central bank cannot determine the policies around KRW stablecoins, and said it will discuss and establish a direction once it becomes clear which relevant government departments will participate.

Charts of the Week

Because charts are just as important as macro.

June VC Deals: there were 66 crypto VC funding deals, representing a 3.1% increase month-over-month but a 37.1% decrease year-over-year. The total funding amount reached $2.846 billion, down 27.9% compared to the previous month.

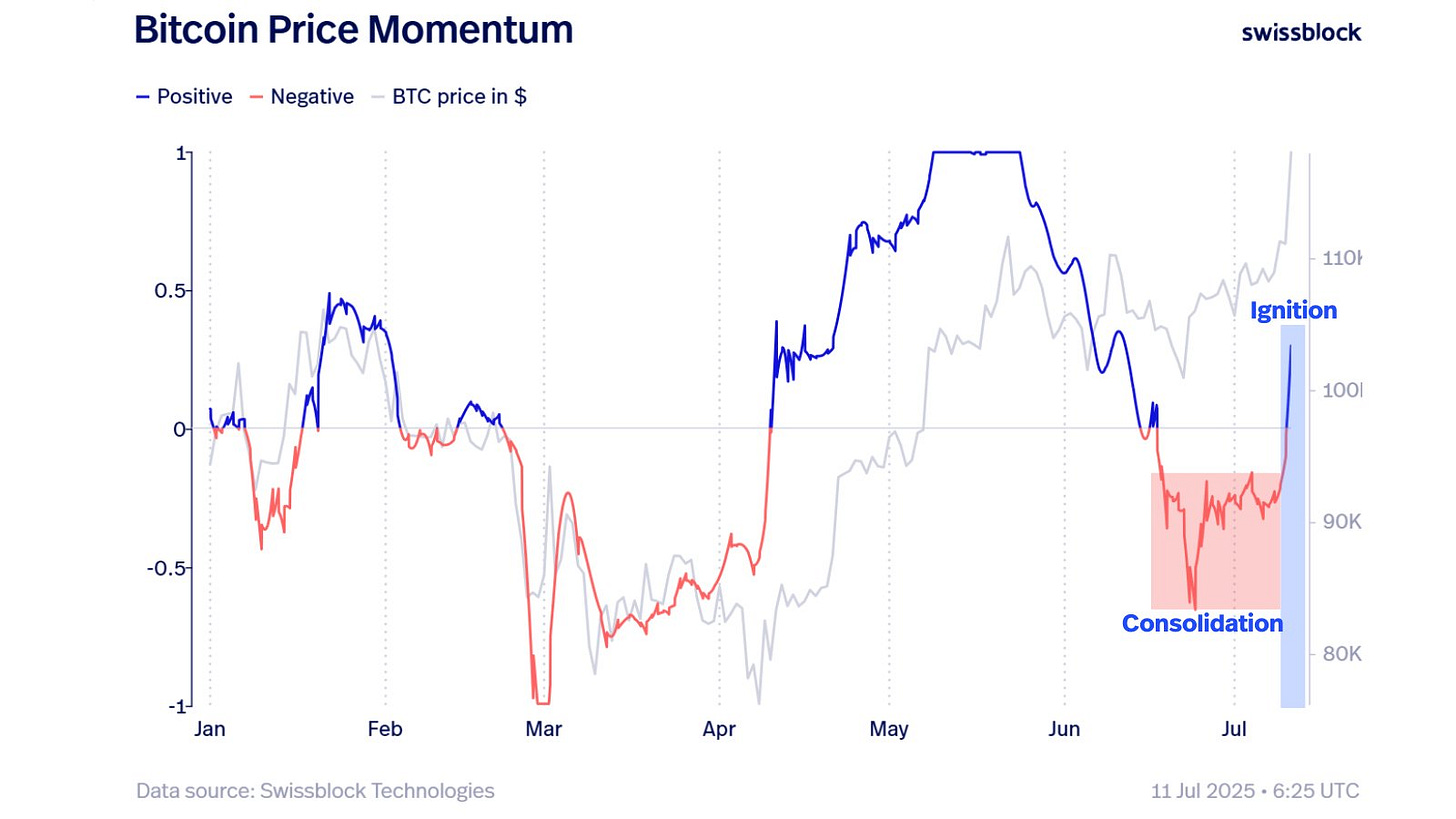

Nice chart from Swissblock showing momentum confirming the breakout for Bitcoin. See more from Swissblock HERE.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

OTC Crypto Trader at Blockchain.com

Digital Assets Trader - ECN and eTrading at Keyrock

Crypto Operations Associate at Alpaca

Head of International Sales at Fidelity International

Senior Product Manager, Exchange Custody at Kraken

Finance Operations - Crypto at Blockchain 121

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.

This is a really great newsletter merging Macro & Crypto. Thanks