Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Deribit trade volume rose nearly 100% in 2024, total stablecoin supply on Solana reached an all time high.

Institutional Corner: SAB121 rescinded, Standard Chartered say BTC and ETH could reach $200k and $10k respectively and the ECB says European banks need a digital euro.

Charts of the Week: The top 50 altcoin trading volume dominance climbed to 71%, Solana daily REV reached an all time high, Solana DEX volumes rise.

Top Jobs in Crypto: Featuring Coinbase, Re7 Capital, Crypto.com, OpenPayd, Coincall and Fidelity.

Macro Update

This is where we connect the dots between macro and crypto.

Don't Over Complicate This

The macro took somewhat of a backseat this week as Trump’s inauguration and subsequent policy announcements dominated the headlines, yet the positive risk outlook we outlined last week continued to unfold, with both the S&P 500 and Bitcoin notching new record highs 💪

Our key take away from the policy announcements in regard to macro, was that Trump was far more measured in relation to tariffs, not imposing them on day one as many had feared, instead calling on Federal agencies to conduct a review of US trade policies to determine the impact of future tariffs. He did however pledge to impose 25% tariffs on Canada and Mexico as soon as February, although in a continued softening of stance towards China, said he’d “rather not have to use tariffs.” This builds on the “very good call” with President Xi the previous week.

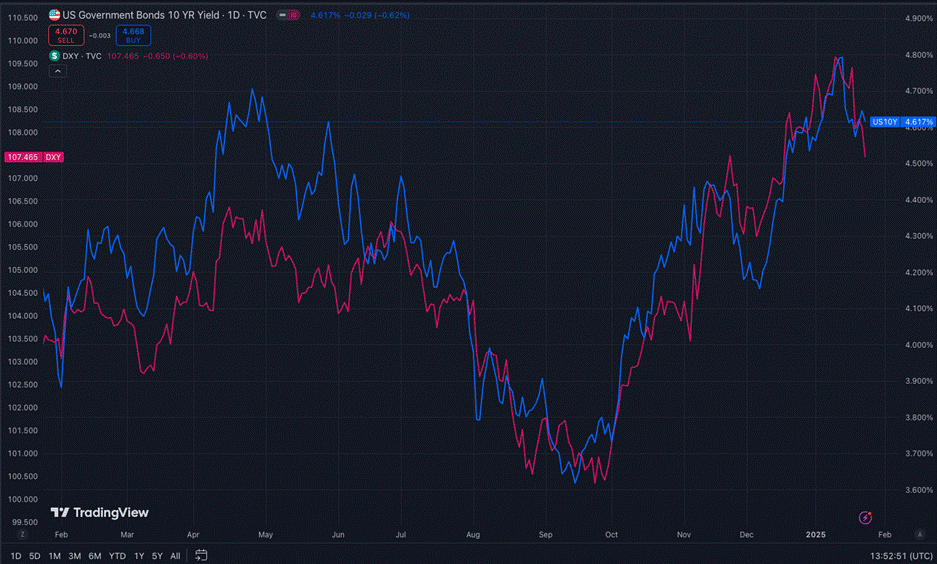

The impact of the softer trade stance saw the dollar record one of its worst weeks in more than a year, down circa 1.8%, led by USDCNH which fell from around 7.34 to close the week at 7.2395. This has been a major headwind to Bitcoin, especially as China’s intervention efforts to “smooth” the currency weakness are negative for liquidity as they sell down their FX reserves, whilst the dollar wrecking ball acts to strangle global liquidity, tightening broader financial conditions. The tariff fears have also been a driver of the early year run up in yields which are also rolling over along with the dollar, 10yr yields now sit some 20bps lower than when we called for the peak.

Supportive risk backdrop…

Bitcoin has made record highs in the face of these headwinds, driven by early year liquidity flowing into the market, plus the powerful demand/supply dynamic post the election. Macro headwinds turning to tailwinds reinforce our bullish Q1 view for both Bitcoin and broader risk.

US dollar and 10yr yields rolling over - macro headwinds becoming tailwinds

Elsewhere, the Bank of Japan hiked rates 25bps to 0.5% as expected, with the hike accompanied by upward revisions to inflation forecasts for 2025. Investors expect an additional hike in the second half of 2025. We highlighted this meeting as a macro risk, but also dispelled the “macro doomer” chat that this could spark a renewed carry trade unwind. Reaction post the anticipated outcome was consequently muted. 10yr JGB yields up 3bps to 1.23% having little impact on global bonds which continue to be dominated by US treasuries.

Indeed, whilst the Fed is expected to hold rates steady (despite Trump saying he wants the Fed to start cutting!) the ECB’s Largarde, speaking at Davos, reinforced expectations for a 5th rate cut this week, with Villeroy, the head of the French central bank, suggesting rates could fall “very quickly” as confidence grows in reaching the 2% inflation target. In the UK, soft employment data, with unemployment jumping to 4.4%, accompanied by the sharpest fall in payrolls since Nov 2020 and a further fall in job openings, reinforces growing expectations for BoE cuts.

We remain then in a global rate cutting cycle (ex-Japan) which alongside rising liquidity, provides a supportive backdrop for risk ✅

Another supportive driver of markets is the continued fading of the US reflation narrative and fears of a resurgence in inflation. Trump pulling out of the Paris Climate accord aligns with his desire to get energy prices lower and his promise to “drill baby drill” will keep pressure on oil. Oil fell over 3% on the week and we expect continued falls to have a gravitational pull on 10yr US yields. A renewed disinflationary pulse accompanied by lower yields again providing for a very supportive risk backdrop🕺🏽

A paradigm shift…

For crypto specifically, we also got the crypto focused executive order titled “Strengthening American Leadership in Digital Financial Technology” which described digital assets as playing a “crucial role in innovation and economic development” in the US. Below we list the key points of this order, courtesy of the excellent team at FRNT Financial:

● Protects the rights of individuals to use blockchain, develop software, mine, transact and self-custody digital assets;

● Support the sovereignty of the US dollar via stablecoins;

● Ensure access to banking for crypto firms;

● Provide regulation support a ‘vibrant and inclusive digital economy and innovation in digital assets;’

● Take ‘measures to protect Americans from the risks of’ CBDCs;

● Revoking Biden’s 2022 executive order on crypto;

● Establishment of the President‘s Working Group on Digital Asset Markets;

● 'The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.

Bitcoin expressed some disappointment at the lack of a more definitive announcement of a Strategic Bitcoin Reserve and more so by the inclusion of “crypto” in the stockpile. However, whilst we agree that only Bitcoin should be part of a US reserve, the establishment of a working group, headed by David Sacks is a credible and sensible step towards establishing what is possibly the most important economic development in the US since Nixon took the dollar off the gold standard.

Perhaps a more significant, positive event for Bitcoin was also the SEC’s repeal of SAB 121. SAB 121 required companies that hold custody of crypto-assets on behalf of users to account for those crypto assets as liabilities on their balance sheets. Since its issuance in March 2022, the effect of SAB 121 has been to largely prevent banks and other financial services businesses regulated by the SEC from custodying crypto assets for customers (given the high cost of capital from marking customer assets as a liability) and, by extension, limited the crypto-asset services these businesses could provide.

Banks will now be able to viably come into the space which will further supercharge institutional adoption and consequent Bitcoin demand. The CEO’s of Bank of America and Morgan Stanley were quick to express their readiness to integrate crypto into their traditional businesses provided regulatory conditions allow.

This is a paradigm shift in the regulatory landscape which markets are yet to fully appreciate. Previously, it was considered career risk for tradfi firms to position themselves in and build digital asset businesses. Now the career risk will be NOT having a digital asset strategy. We are set to unleash a torrent of capital into this space creating a seismic demand shock 🌊

Don’t overcomplicate this…

The lack of follow through on price action is giving cause for concern for those suffering from 2022 bear market PTSD. Yet with lots of information to digest amidst a growing, more dominant institutional sector, we continue to expect real flows over the coming weeks to flow in and drive a powerful demand/supply dynamic to rip us to new highs.

Some reasons for caution this week into month end, which has negative liquidity connotations, as well as big central bank meetings headlined by the Fed and the big MAG7 earnings results. Expect some choppy price action as positions adjust.

Yet our message after a monumental week for crypto is don’t over complicate this. Bitcoin and broader crypto are set to reprice significantly higher 🚀

Native News

Key news from the crypto native space this week.

Total trading volume in Deribit's product suite, which comprises crypto options, perpetual futures, volatility futures, and spot market, rose 95% in 2024, from $608 billion in 2023 to $1.185 trillion. Options alone registered a trading volume of $743 billion, a 99% year-on-year growth, accounting for a large share of the total exchange activity. Deribit's Chief Commercial Officer Luuk Strijers said “Deribit saw an increase in activity throughout the year, particularly in Q4 as institutional investors demonstrated heightened optimism around the U.S. presidential election, as well as the $100k Bitcoin bull run that followed.” He added "The rise in total platform volume and across our offered products indicates that Deribit continues to be the go-to derivatives exchange, particularly as more professional traders enter the space."

This week the total stablecoin supply on Solana reached new all-time highs, exceeding $10 billion for the first time. According to DeFiLlama data, the value of stablecoins on the Solana network has rose by nearly 110% since the beginning of January, climbing from $5.1 billion to $10.8 billion. In comparison, Ethereum currently holds $115 billion in stablecoins, BNB Chain has $7 billion, Base contains $3.8 billion, and Arbitrum holds $3.1 billion. This growth has been dominated by the issuance of Circle's USDC (USD Coin) on the network. On-chain data shows that Circle has minted roughly $3.5 billion worth of USDC on Solana over the past week. According to The Block's data dashboard, nearly 80% of Solana's stablecoin supply (about $8 billion) consists of USDC, which has nearly doubled since the start of this month, going from $4.2 billion to $8.2 billion. Tether’s USDT makes up $1.96 billion of stablecoins on the network.

Institutional Corner

Top stories from the big institutions

As Trump took office in the US, the key announcement came from the U.S. Securities and Exchange Commission who published a new Staff Accounting Bulletin on Thursday withdrawing its controversial SAB 121. SAB 121 directed banks and other public companies that they had to mark any customers' crypto assets on their own balance sheets. SAB 122 "rescinds the interpretive guidance" and instead directs firms to use Financial Accounting Standards Board rules or International Accounting Standard provisions. SAB 121, published in 2022, required SEC registrants to record an obligation to safeguard the crypto assets that they hold at the fair value of the related assets. The American Bankers Association had urged the commission to rescind the bulletin, saying it curbed the ability of the association’s member banks to develop and bring to market at scale certain digital asset products and services. The bulletin said "The staff reminds entities that they should continue to consider existing requirements to provide disclosures that allow investors to understand an entity’s obligation to safeguard crypto-assets held for others.” Read the full bulletin HERE.

In a note this week, Standard Chartered Global Head of Digital Assets Research Geoff Kendrick said "The dominance of institutional inflows to ETFs is likely to support bitcoin and ether performance; we see their prices reaching the $200,000 and $10,000 levels by end-2025, respectively. Kendrick added "We expect institutional flows into bitcoin in 2025 to exceed 2024 levels, with fresh capital likely to come from long-only funds classified as ‘pension funds.'" He argues that because if this capital might flow into altcoins but it could be weaker than normal saying “An altcoin light season will begin, and I say light because institutional flows will drive bitcoin and ether, partly offsetting rotation into alts”.

Speaking at a policy meeting in Frankfurt on Friday, European Central Bank (ECB) board member Piero Cipollone said that Eurozone banks need a digital euro to counter United States President Donald Trump's efforts to promote worldwide U.S.-backed stablecoins. At the Institute for Law and Finance’s 13th Conference on the Future of the Financial Sector, Cipollone cautioned that the Trump administration move could further attract customers away from traditional banks, amplifying the need for the ECB to accelerate its digital currency plans. "I guess the key word here in Trump's executive order is worldwide." He added that “This solution, you all know, further disintermediates banks as they lose fees, they lose clients...That's why we need a digital euro."

Charts of the Week

Because charts are just as important as macro.

Altcoins showed resilience during $BTC's latest rally to all-time high's on Monday. The top 50 altcoin trading volume dominance climbed to 71%, matching levels last seen in early November.

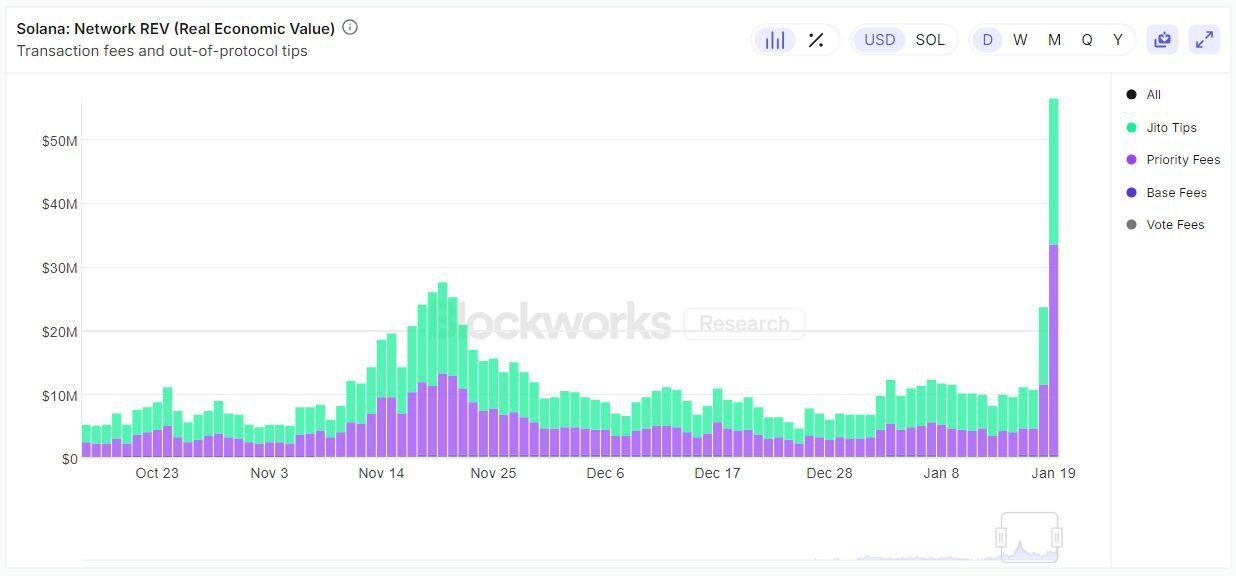

Solana daily REV sets new all time high at $56.5M, more than double the previous high of $27.2 set back in November.

Solana DEX volumes saw a huge increase at the start of the week.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Associate, Prime Trading Execution Services at Coinbase

Investment Analyst (Liquid Token) at Re7 Capital

Business Development Manager, VIP Partnerships at Crypto.com

Sales and Trading Associate at OpenPayd

Senior Institutional Business Development Manager, Crypto Options at Coincall

Quant Developer at Fidelity Investments

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.