Guest write number 2 features this week. James Straten is a Research and Crypto Analyst at CryptoSlate and provides daily Twitter updates on on-chain analysis. Today James shares his top 5 crypto charts.

Since many of you are new here, we should remind you who your authors are. Chris and Dave both worked for 18 years each at central and investment banks on trading desks. We have spent the last year or so working in institutional crypto trading. So we think were well placed to bring you good quality content based on our 2 pillars, integrity and experience.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Quiet week last, ahead of a busy week next week. Will the Fed light the fuse on BTC ? Still keep a close eye on China.

BONUS SECTION - Top 5 crypto charts by James Straten.

Crypto Native News: Vitalik Buterin speaks at EthCC, Ripple applies for FCA registration and Fidelity issues its Q2 Signals Report.

Institutional News: Soc Gen Forge granted French regulatory license, the FCA spoke on crypto at the TSC and announces its permanent Digital Sandbox, investment into bitcoin ETF’s hits record pace, Kuwait’s regulator prohibits the use of crypto payments and Nasdaq pauses the launch of its digital asset custodian business.

Chart of the Week: Bitcoin miner stocks having a good year.

Top Jobs in Crypto: Featuring Blockchain.com, Coinbase, Fireblocks, Prop Trading Firm, QCP Capital and FCA

Want to be a guest writer for London Crypto Club ?

To help educate our readers further, were looking for people to write a guest slot on specific topics. If you have an idea and you would like to be featured in an upcoming episode of this newsletter, please reply to this email with your suggestion. I’m thinking crypto market microstructure, data analytics, DeFi, etc but totally open to suggestions. Thanks.

Macro Update

This is where we connect the dots between macro and crypto.

Waiting for Godot

Relatively quiet week on the macro front ahead of the upcoming Fed meeting. US data continues to paint a mixed picture with activity continuing to slow - softer retail sales, weak industrial production - yet jobless claims coming in lower than expectations as the lagging labour market remains resilient.

The Conference Board’s Lead Economic Indicators however showed an accelerating contraction which increasingly points to recession, printing the lowest reading since July 2020 and the 15th consecutive monthly decline. Recession or not, US economic activity is set to decline sharply in the months ahead.

Meanwhile, China’s economy lost significant steam in Q2, with QoQ growth of just 0.8%, down from 2.2% and taking the low base yearly comparison to just 6.3% against expectations of 7.3%. Highlighting the consumer woes, retail sales slowed sharply from 12.7% in May to just 3.1% in June.

Perhaps an even bigger concern as it relates to social unrest, youth unemployment is now at a record 21.3%. Underpinning the slowdown is a deepening property crisis, underscored by China’s Evergrande reporting a $81bn loss for the last two years.

A failing property sector, dissatisfied youth, expectations of more liquidity. Got BTC?

With the currency under pressure and complicating efforts to ease, Chinese State Banks were seen selling USDCNH in the week as it appears a line has been drawn under the extent of acceptable currency weakness. Talk also that perhaps China has been sitting on BTC to maintain the veil of stability and warn off potential capital flight. It certainly feels like there’s a “flow” out there which leans into any attempt for BTC to break higher.

Overall, cross-asset trading in a range in the past week, with the dollar a touch stronger, yields recovering higher as positions adjust into the Fed. Volatility continues to get crushed as we await a new catalyst which likely comes from the hard data “truing up” to the softer forward data.

Patience required yet the macro tailwinds for Crypto, however continue to build and support a breakout to the topside. Will Wednesday’s Fed finally light the fuse?

Bonus Section - Top 5 Crypto Charts by James Straten

James is a Research and Data Analyst at CryptoSlate. Here are his top 5 charts using on chain analytics. Check out his daily on chain analysis on Twitter HERE.

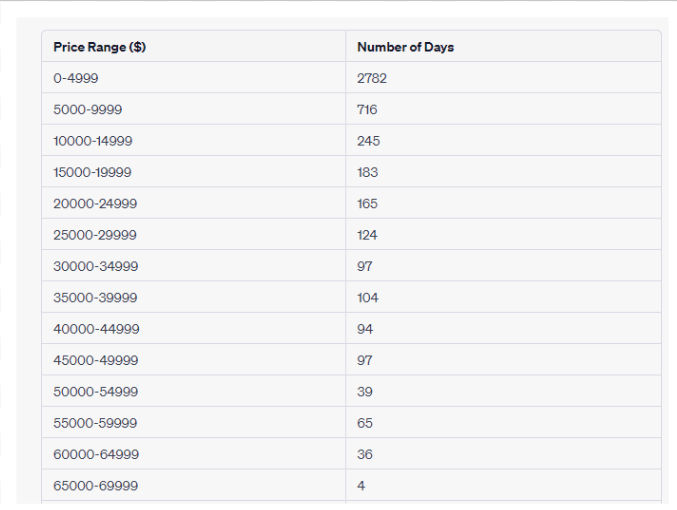

A fascinating aspect of Bitcoin’s performance is the number of days the asset has spent within various price ranges. For instance, the cryptocurrency lingered between $0 and just under $5,000 for an extended period of 2,782 days. However, as the price brackets increased by $5,000 increments, the number of days Bitcoin spent within these ranges has progressively diminished. This suggests a rapid ascension in Bitcoin’s price over the years.

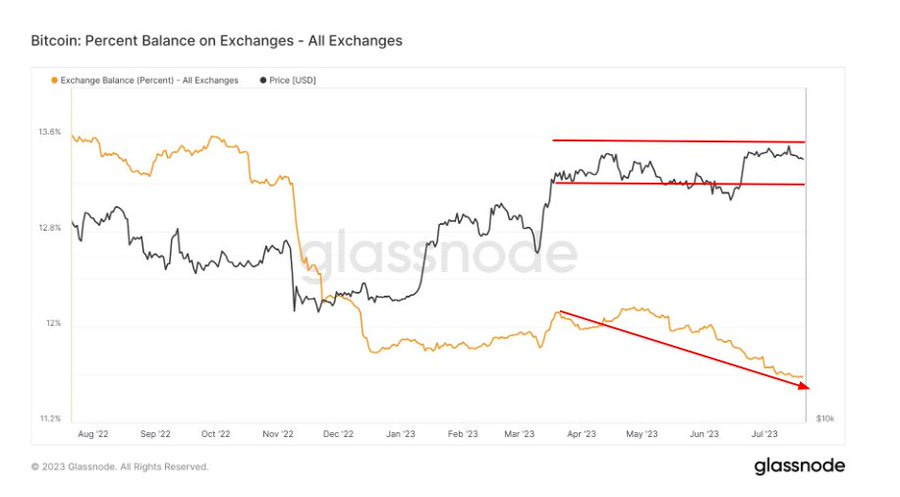

Bitcoin has effectively been trading in the same range since SVB collapse since end of March, but 0.5% of the supply has left exchanges.

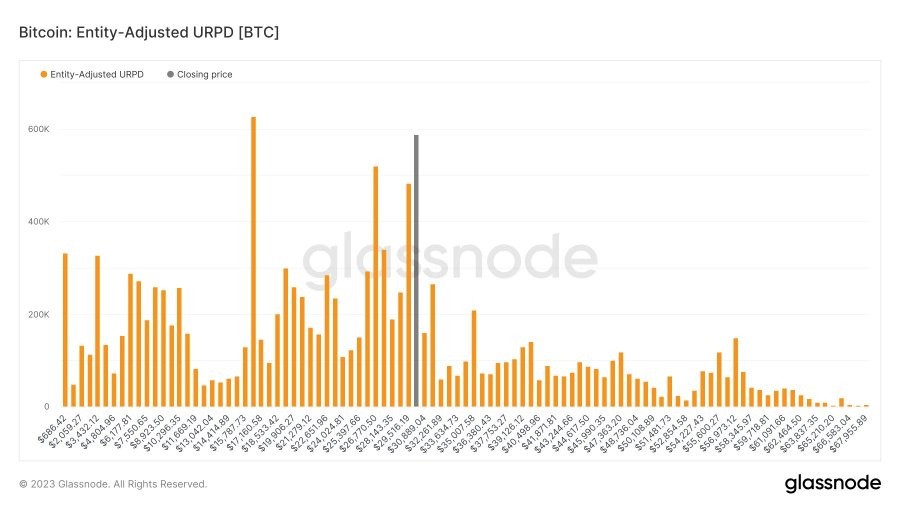

Unspent Transaction Output (UTXO) Realized Price Distribution (URPD) shows at which prices the current set of bitcoin UTXOs were created. Quite remarkable how long bitcoin has been at 30k. Roughly 3.42% of the supply against $16,500, 3.64% of the supply. Very strong consolidation!

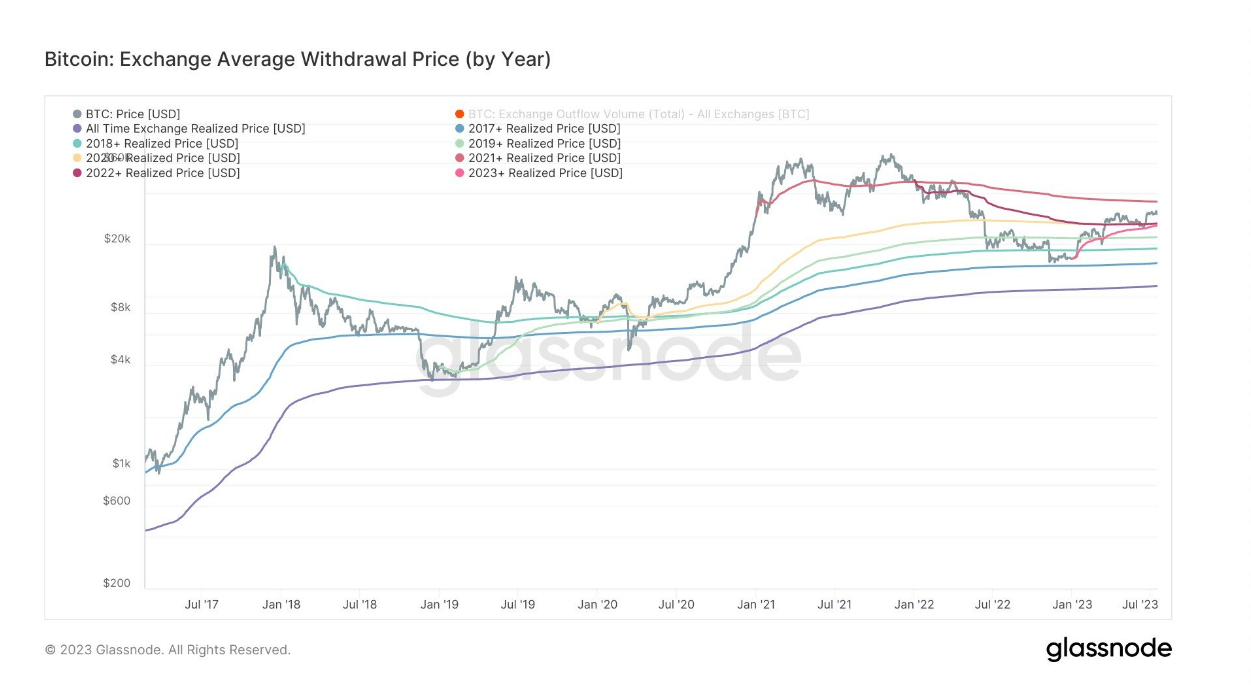

Investors who entered the market in 2021 faced a high-cost basis of $48,000. However, after two and a half years of consistent buying, these investors have managed to reduce their cost basis down to $35,500. While all other cohorts are currently in profit.

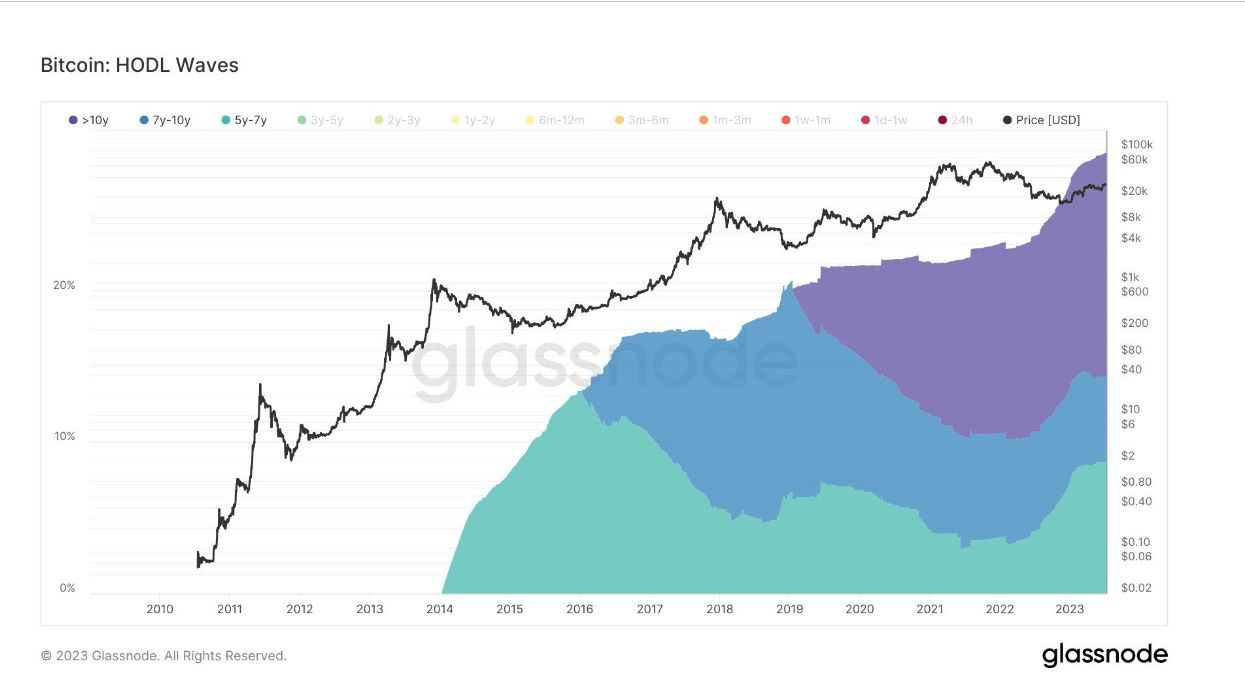

HODL Waves. In summary, approximately 30% of the total Bitcoin supply is held by holders who have owned their Bitcoin for 5 years or longer.

More than 10 years: 14.8% of the total Bitcoin supply is held by individuals or entities who have owned their Bitcoin for over 10 years.

Between 7 and 10 years: 5.6% of the total Bitcoin supply is held by individuals or entities who have owned their Bitcoin for a duration falling between 7 and 10 years.

Between 5 and 7 years: 8.7% of the total Bitcoin supply is held by individuals or entities who have owned their Bitcoin for a duration falling between 5 and 7 years.

Native News

Key news from the crypto native space this week.

Vitalik Buterin, the Co-Founder of the Ethereum Network spoke at the annual EthCC conference this week. The speech focused on Ethereum’s ongoing developments and its long-term vision. Buterin delved into key concepts, including the transition to Proof of Stake (PoS), sharding, Verkle trees, state expiry, and Ethereum Improvement Proposals (EIPs), signalling the platform’s commitment to scalability, security, and decentralisation. He also unveiled Ethereum’s plans to solidify its position as a powerful, robust, secure, and decentralized blockchain ecosystem. The transition to PoS stands out as a pivotal development for Ethereum. By moving away from the energy-intensive Proof of Work (PoW) consensus algorithm, Ethereum aims to reduce its environmental impact while improving scalability and security. This transition is expected to reduce the annual issuance of Ether, the native cryptocurrency of Ethereum, and introduce a new security model known as weak subjectivity. With these changes, Ethereum’s monetary policy is set to become more predictable, fostering trust and stability among users.

Following its win against the SEC last week, Ripple said its aiming to expand in the UK and Europe. Sendi Young Ripples European Managing Director, said that the company had applied for registration as a cryptoasset firm at the Financial Conduct Authority (FCA) and a payment institution license in Ireland. Young said “These are massive investments with a view that we continue to grow exponentially in this region”.

Fidelity Digital Assets released a report this week titled “Q2 2023 Signals Report”. The report suggested that Ether’s outlook for the next year and the long term is positive. The report highlights some positive technical analysis indicators, but beyond that, the rationale behind Fidelity’s bullish outlook for Ether is the network’s higher burn rate versus coin issuance, the “new address momentum” and a growth in the number of network validators. According to the Fidelity report, the net issuance since the Merge in September 2022 resulted in a net supply decrease of more than 700,000 Ether. Additionally, the analysts claim that Glassnode data showing an increasing number of Ethereum addresses that transacted for the first time ever proves healthy network adoption. The report also points to a 15% increase in the number of active Ethereum validators in the second quarter. Read the full report HERE.

Institutional Corner

Top stories from the big institutions.

This week, SG Forge, Societe Generale’s digital asset subsidiary, was the first to gain a full, regulatory licence from the national regulator. The license allows the bank’s crypto division to trade “digital assets against other digital assets,” as well as receive and transmit “third-party orders.” This comes on top of its already-approved activities of custody, and trading digital assets. Jean-Marc Stenger, SG Forge CEO, said in a statement “This step will allow us to continue supporting our institutional clients wishing to benefit from services on digital assets that meet the highest standards of compliance and banking security.” The full update from the French regulator, the AMF, can be found HERE.

The Financial Conduct Authority CEO, Nikhil Rathi, spoke at the Treasury Select Committee this week. He noted that the FCA is not swayed by the size of firms when granting regulatory approval. The FCA is in charge of registering and overseeing crypto companies that wish to operate in the country under existing anti-money laundering requirements. The financial regulator has received over 300 applications from crypto firms since opening its register two years ago but only 42 firms have managed to register with the regulator so far. Watch the hearing from TSC HERE.

On Thursday, the FCA said it plans to provide access to a permanent Digital Sandbox from 1 August 2023. The sandbox provides a secure setting where developers can test and evaluate their products in the knowledge that any unintended side effects will be isolated from a live environment. The FCA say the Digital Sandbox works to foster innovation and growth. Participants can apply to join the sandbox from 1 August and this will give them permanent access to the following:

High quality datasets and API’s

Robust data security protection.

A collaborative platform

and observation deck.

Read full details from the FCA HERE.

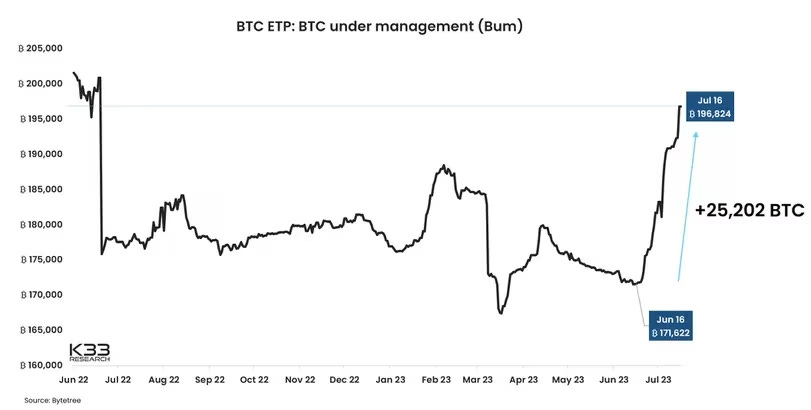

Since BlackRock filed for its spot bitcoin ETF on 15 June, investment into bitcoin exchange traded products has increased at record pace. Data from K33 Research shows the BTC-equivalent exposure of ETPs listed worldwide increased by 25,202 BTC ($757 million) to 196,824 BTC in the four weeks to July 16. That's the second-highest monthly net inflow, surpassed only by inflows seen following the launch of ProShares’ futures-based ETF and other futures-based ETFs in October 2021, according to K33 Research’s Vetle Lunde

Its not all unicorns and fairies in crypto. This week Kuwait regulator prohibited the use of crypto for payments or investment to try and combat money laundering. The Kuwait Capital Markets Authority also placed an absolute ban on digital asset mining, prohibited the recognition of crypto as decentralised currency and also warned the public that companies are not allowed to provide any type of crypto related services.

Nasdaq has decided to pause the launch of its U.S. digital assets custodian business and the pursuit of relevant licenses. The decision stems from concerns regarding the shifting business and regulatory environment in the U.S., as CEO Adena Freidman explained during an earnings call. The exchange operator had been awaiting approval from the New York Department of Financial Services by the end of June to offer custody services to clients. The intention to enter the crypto custody space was initially announced last July following the collapse of Three Arrows Capital. Despite halting the custody service, Freidman emphasized Nasdaq's ongoing commitment to support the digital assets ecosystem and engage with regulators. The company intends to establish itself as a leading digital assets software solutions provider. Additionally, Nasdaq's partnership with BlackRock for a spot bitcoin ETF is currently awaiting approval from the Securities and Exchange Commission.

Chart of the Week

Because charts are just as important as macro.

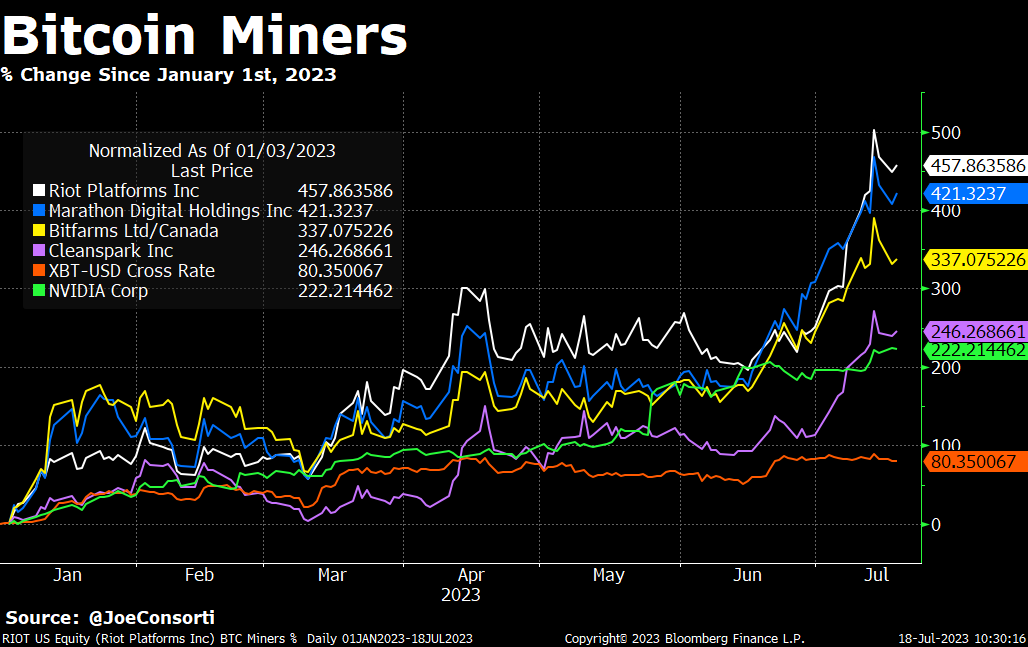

Bitcoin miner stocks having a good year.

RIOT is up 457% MARA is up 421% BITF is up 337% CLSK is up 246%

Both Bitcoin and Nvidia rose by less than public miners this year — 80% and 222% respectively.

Hat tip to Joe Consorti for the chart.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

OTC Crypto Sales Trader at Blockchain.com

Senior Blockchain Researcher at Coinbase

Fireblocks Network Business Lead at Fireblocks

Senior Quant Researcher at Prop Trading Firm

Wholesale Cryptoasset Policy Manager at the FCA

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.