Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “The most succinct, easy to digest macro summary I have read in all crypto newsletters!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: We were waiting for a spark to take us out of the range bound lethargy and generally heavy price action for Bitcoin, we may have got it this week.

Crypto Native News: Coinbase to support the lightening network, Coinbase reports Q1 earnings, Tether announces all time high profits and crypto VC investments rise.

Institutional News: Vodafone wants to integrate cryptocurrency wallets with SIM cards and the CFTC speaks on AI and DeFi.

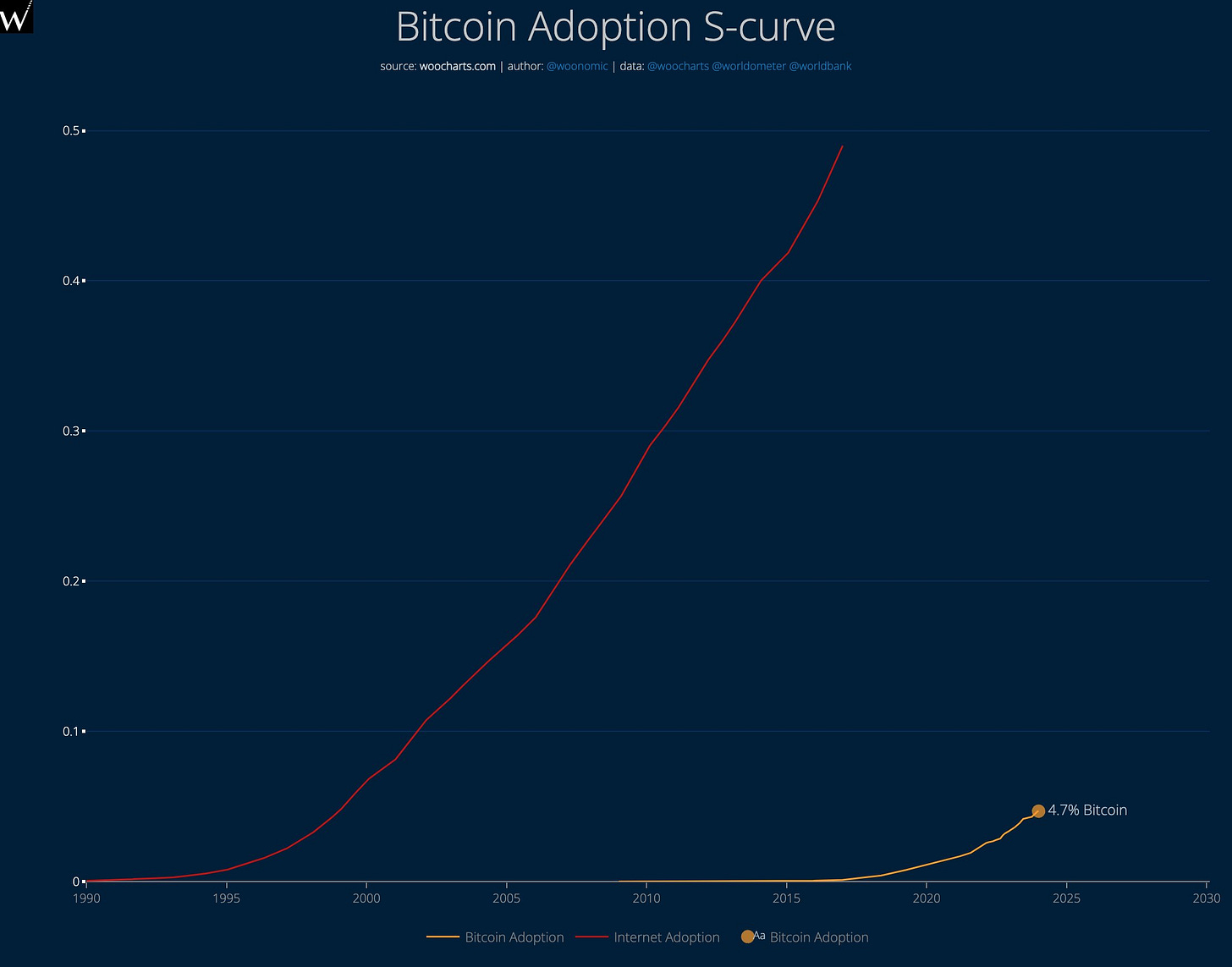

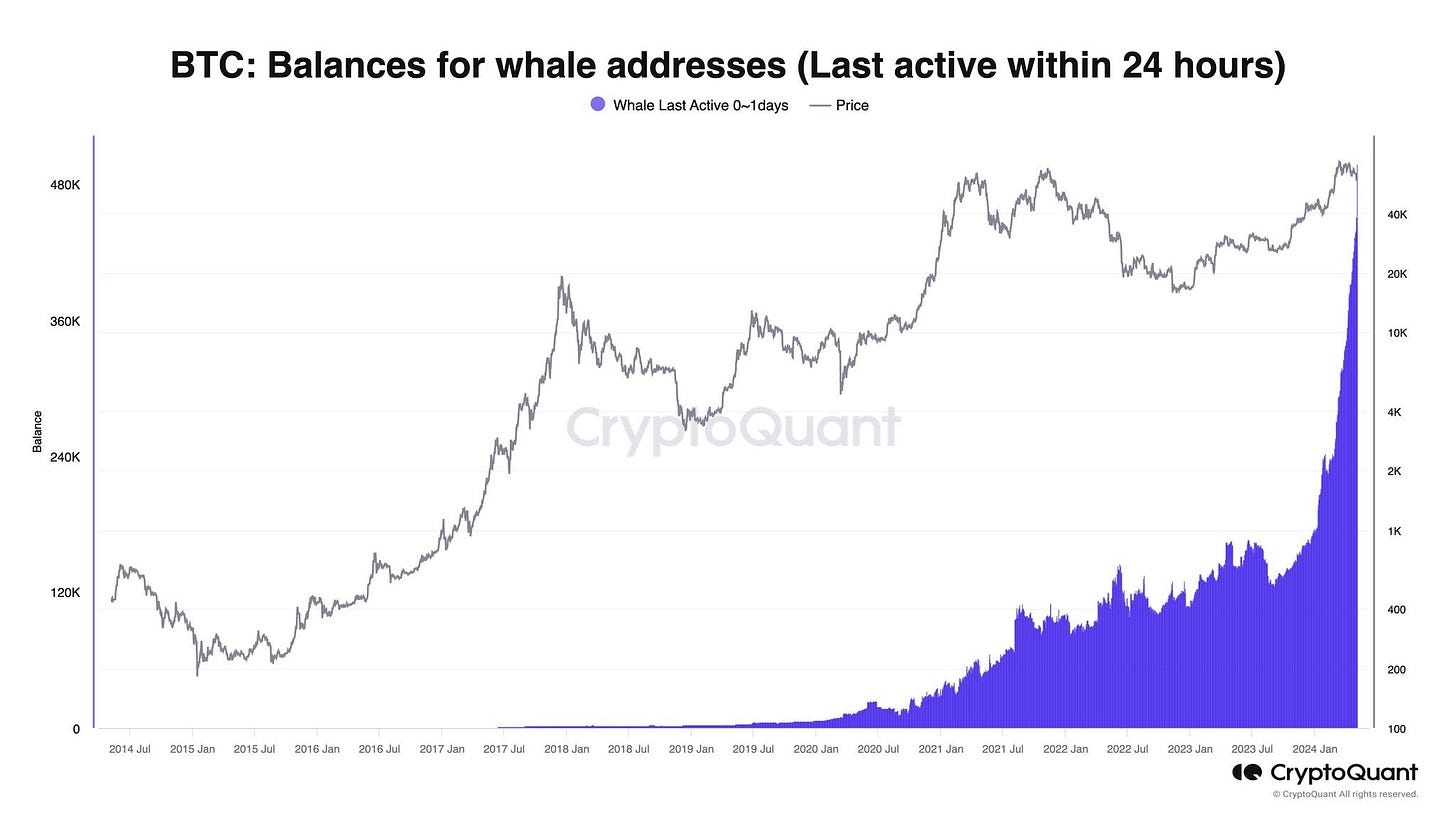

Charts of the Week: Bitcoin at 4.7% world adoption, whales accumulated $3bn BTC on one day this week.

Top Jobs in Crypto: Featuring CoinDesk, XBTO, Bybit, Status, State Street, OKX and Copper.

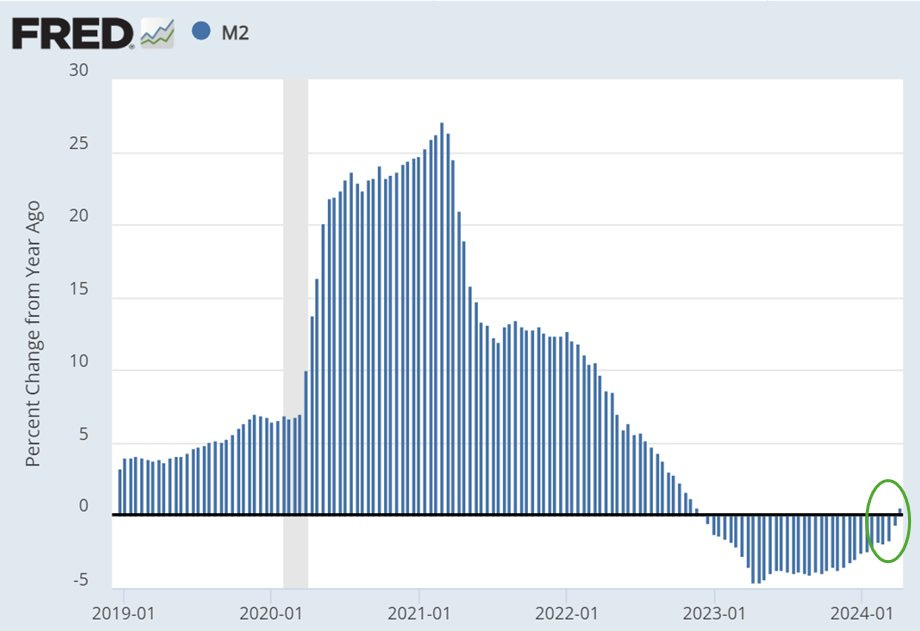

Macro Chart of the Week - M2 money supply turns positive for first time since late 2022. Hat tip to BitcoinNews for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

Bull Market Reignited

All change ⚠️

We concluded our newsletter last week with the following:

“Either JPow and the Fed flip dovish and sacrifice the dollar, or China and Japan get pushed to breakpoint. Bitcoin as both a risk-on asset and a flight to safety captures both tails of the risk distribution. Depending on the Fed, it feels like we’re going to get pushed to one of those tail end scenarios.”

In the event, a more dovish JPow took some steam out of the market, effectively killing the overly hawkish talk that they might hike rates, something JPow said was “unlikely.” He also said “there are paths to not cutting, and paths to cutting, it will depend on the data.” Crucially, current Fed thinking does not include a path to hiking, with current policy deemed “sufficiently restrictive.” - JPow is pushing the market to the right, risk on tail!

Whilst rates were kept on hold as expected, another dovish element was in the announcement of the taper of Quantitative Tightening, slashing the monthly roll off of US Treasuries from $60bn to $25bn. That’s a material $35bn of reinvestment back into the bond market, helping to ease liquidity conditions.

Particularly significant for markets and liquidity, the announcement of the taper came shortly after the Quarterly Refinancing Announcement (QRA) from the Treasury and Yellen additionally announcing the Treasury buyback programme👇

Yield Curve Control…

The QRA where the Treasury announced their funding needs for the quarter as well as the planned treasury issuance was, in our view, a bullish development for markets. Whilst Q2 borrowing needs increased by $41bn for Q1 to $243bn, Q3 first estimate at $847bn was lower than some market expectations of $1trn plus (of course this likely gets revised higher!) Importantly, there were no increases to nominal coupon auction sizes (essentially longer dated bond issuance unchanged) with the increase in funding needs coming from an increase to 4, 6 and 8 week bill auctions.

Effectively, Yellen continues to weight the debt issuance to front end T-bills which can continue to be funded by teasing out the cash parked at the RRP and have a positive effect on liquidity.

More importantly, the Treasury also announced the Treasury buyback schedule, the first buyback operation since 2002. This program is aimed at “supporting market liquidity” and starting 29th May through to July, the US Treasury will conduct weekly “Liquidity Support Buybacks” of up to $2bn per operation.

Combined with the re-weighting of issuance to the front end of the curve (via shorter dated T-bills) alongside the announced QT taper, this looks and feels very much like yield curve control 😳.

Whilst no doubt the great and good of Wall Street will argue over the significance of this, as the brilliant Lyn Alden highlighted:

“the fact the Treasury has to provide liquidity for what is supposed to be the most deep and liquid market in the world, and that serves as the world reserve asset, is notable”

TLDR; Between the Fed and US Treasury, we effectively have YCC and liquidity conditions in Q2 will be significantly easier keeping a lid on yields and the dollar, reversing what was becoming a stronger headwind to both Bitcoin and broader risk.

We think given this shift, Bitcoin can begin its next leg higher, starting the ascent to 100k. Expect major US stock indices to also reclaim record highs. The market is positioned far too hawkishly and is underweight risk. That hawkish positioning will need to be unwound over the coming weeks and will provide a powerful tailwind to our markets.

Bad news is good news….

Further boosting markets, Friday’s Non Farm Payrolls came in weak across the board with a weaker than expected 175k jobs added last month, the weakest since November. Wage growth also slowed to 0.2% from 0.3% prior with the YoY wage growth at 3.9%, the slowest in 2 years and the unemployment rate ticked higher to 3.9%. That followed signs of labor market weakness in the JOLTS survey, where job openings fell 25k to 8.488mio, the lowest number since February 2021. Hire rates dropped to 3.5%, matching the post pandemic low and quits fell to 2.1%, the lowest since August 2020 suggesting employers reluctant to hire and employees reluctant to quit and find a new job.

This is important as there’s an asymmetry to Fed decision making currently. Strong data just means higher for longer with rates on hold. Weaker data will quickly bring the Fed into rate cutting mode and especially ahead of the election, the Fed will be quick to respond to signs of labor market weakness.

Bad news is good news for a market dependent on rates and liquidity and as we’ve suggested, the market moved too far in pricing out Fed rate cuts. As that pricing recalibrates, we expect the bond rally which started on Friday to have legs and the dollar to continue to weaken, alleviating the pressure on JPY and CNH.

As we’ve also discussed, as China battled to keep a lid on USDCNH, to maintain the “veil of stability” in an effort to discourage capital outflows, we believe they also try to keep a lid on Bitcoin. With that pressure relieved, Bitcoin will face less resistance to move higher from here.

Bull market back on…

We were waiting for a spark to take us out of the range bound lethargy and generally heavy price action for Bitcoin. Between the Fed and US Treasury, that spark has been ignited and liquidity conditions in Q2 look set to be significantly easier. Added to this, after some lumpy ETF outflows, Friday saw net inflows of 378mio, including the first inflow into Grayscale. That would provide a significant sentiment and narrative shift to these markets should that sustain. Bull market back on, lets go 🚀

Native News

Key news from the crypto native space this week.

This week, Coinbase rolled out support for the lightening network, the layer 2 protocol built on top of the Bitcoin blockchain. Previously, bitcoin transfers on Coinbase were processed on-chain, meaning transactions could take between 10 minutes and two hours, incurring high fees during periods of network congestion. Coinbase’s protocol specialist and Lightning integration lead Viktor Bunin said “Growing Bitcoin adoption increases economic freedom in the world. I’m thrilled that our Lightning integration is live to make Bitcoin more useful and accessible worldwide,” “Offering faster and cheaper BTC payments through our partnership with Lightspark is another huge milestone for the ecosystem.”

Coinbase earnings were also released this week. The company posted first-quarter revenue of $1.6 billion, a 72% increase quarter on quarter. Reported net income for Coinbase was $1.18 billion (or $4.40 per share) and was fuelled by a boost in transactions. Consumer transaction revenue doubled from the previous quarter, reaching $935.2 million, and volume was up over 93%, to $56 billion. Meanwhile, institutional trading saw even greater increases, with revenue up 133% from the previous quarter, to $85.4 million, and more than doubling in volume to $256 billion. Bitcoin made up a third of both consumer and institutional transactions.

Stablecoin issuer Tether announced an all-time high net profit of $4.52 billion in the Q1, according to an attestation report by auditing firm BDO. Tether’s first quarter net operating profits of $1 billion were driven by its US Treasury holdings, and “other profits” stemmed from mark-to-market gains in its bitcoin and gold positions. The $4.52 billion total beats the former record of $2.85 billion in net profit gathered during the last three months of 2023.

According to a report from Galaxy Digital, crypto companies raised almost $2.5 billion in venture capital investment in the first quarter of this year, representing a 29% increase in dollar value and a 68% higher deal count on a quarter-on-quarter basis. The report said “After 3 consecutive quarters of declining deal count and capital invested, both rose in Q1.” The number of deals rose to 603 and the amount of capital invested gained 29%. The report noted some caution saying “Higher interest rates will continue to pose a challenge to venture funds seeking to raise capital and, therefore, start-ups seeking investment from those funds.” Read the full report from Galaxy Digital HERE.

Institutional Corner

Top stories from the big institutions

Vodafone, the UK-based telecommunications provider, hopes to bring blockchain technology to smartphone users by integrating cryptocurrency wallets with subscriber identity module (SIM) cards. Vodafone Blockchain Lead David Palmer discussed the company’s plans to integrate blockchain technology into smartphone sim cards and said “By 2030 we’re expecting more than 20 billion mobile phones to be in operation, many of those being smartphones. […] So we’ve focused on linking the sim card to digital identity, linking the sim card to blockchains, and using the cryptography we have in those sim cards for that integration.” Palmer elaborated on the figures he presented, stating that he expected there to be some eight billion smartphones in use by 2030 and predicting a surge in crypto wallets to 5.6 billion in the same time frame — enough to account for nearly 70 percent of all people on Earth.

In a speech this week, the CFTC’s Kristin Johnson proposed recommendations such as heightened penalties to address artificial intelligence in financial markets, including decentralised finance. In the speech delivered at the Sidley Austin and Rutgers Law School Fintech and Blockchain Symposium, Commissioner Johnson outlined her concerns about AI and how that applies to DeFi saying "Deploying AI in ecosystems running on blockchain technology raises novel issues for supervision, risk management, and compliance, as well as enforcement." Johnson said one issue with DeFi is that there is no central party, which separates it from traditional markets. She added "As an initial matter, traditional financial laws and regulations often assume specific organisational or market structures," "Decentralised autonomous organisations and the use of non-intermediated market structures by blockchain-based platforms may depart from these assumptions in important ways. The deployment of AI in DeFi systems may muddy the regulatory waters, particularly with respect to supervisory responsibilities and accountability for compliance with longstanding and critical regulations such as the Bank Secrecy Act, which aims to address the threats of money laundering and illicit finance in our financial system."

Charts of the Week

Because charts are just as important as macro.

Bitcoin is at is at 4.7% world adoption, this is the same as Jan 1999 for Internet Adoption. Hat tip to Willy Woo for the chart.

On Thursday through Friday this week whales accumulated nearly $3bn BTC over 24 hours. Hat tip to Vivek4real for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Index Sales and Relationship Management at CoinDesk

Crypto Content Writer - Dubai based for Bybit

Digital Services Product Manager at State Street

Senior Token Research Analyst at OKX

Product Marketing Lead at Copper

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.