Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “I love how it covers a multitude of topics but concise enough to read in one sitting. It has everything I need to know in crypto!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: The macro dynamic continues to head towards a powerful tailwind for Bitcoin. Watching for ETF inflows this week.

Crypto Native News: All time high for Bitcoin futures open interest, Celcius aiming to recover $2bn.

Institutional News: Blackrock unveils its first tokenised fund, the FCA to deliver a market abuse regime for crypto, a number of Ethereum ETF approvals delayed, WisdomTree granted a trust company charter.

Charts of the Week: Average bitcoin trade size rising, Bitcoin market depth surpassed pre-FTX average.

Top Jobs in Crypto: Featuring LondonLink, Chckout.com, Revolut, Tech Alchemy, Uphold, Quadra Trade and Blockchain.com

Macro Chart of the Week - The more debt out there, the more pressure there is to keep yields artificially low. The total debt-to-GDP (not just government debt) of the world’s largest economies on the x-axis and the 10-year yields in these economies on the y-axis. Higher debt comes with a lower yield. Hat tip to Jerome Blokland for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

The Macro Sands are Shifting

Bitcoin and the broad crypto space remained under pressure this past week after the reversal off of new record highs that we highlighted in last week’s letter, gathered a little momentum. At the core of the correction has been a shift in the positive demand/supply dynamic, as net inflows into the ETF’s have turned negative, with $887bn of net outflows over the past week.

Those net outflows however, have been solely driven by continued large outflows from Grayscale. Net inflows into the “nine’s” remain positive, so nothing here to materially change the big picture, positive demand shock story emanating from the ETF’s. Indeed, Grayscale outflows will naturally slow to a trickle, especially when bankruptcy related selling has run its course.

When Doves Cry…

A massive week on the macro kicked off with the Bank of Japan (BoJ) exiting its negative interest rate policy, setting a policy rate target of 0-0.1% up from the prior -0.1%. They also ended the Yield Curve Control (YCC) programme, but said it remained committed to buying the same quantity of JGB’s while being flexible on rates and “in the case of a rapid rise in long term interest rates, the bank will make nimble responses, such as increasing JGB purchases”

Nimble responses to higher yields, sounds very much the same as YCC to us and whilst the macro doomers were growling for their big risk off moment, in all, this was little other than tweaking around the edges. A 0.1% hike in rates does little to change the relative domestic yield profile to spark a large sell off in global bonds and equities for Japanese investors to repatriate home. Meanwhile, with the BoJ still doing QE in all but name, the BoJ remains a large Central Bank adding printed liquidity to the system, a dynamic they are unlikely to ever escape given a debt/GDP ratio in excess of 260% and a BoJ owning over 50% of that debt. Combined with a dovish press conference, the JPY and Japanese yields both fell lower and what had been deemed a pivotal risk for unrelenting equity markets, came and went with a whimper.

On to the Fed where many were expecting a more hawkish Powell following recent stronger inflation prints. In the event, there was little change to the Fed outlook, keeping rates unchanged at 5.25-5.5% and the median of the “dot plot” still projecting 3 rate cuts this year. Powell displayed little concern on the recent stronger inflation prints, describing them effectively as seasonal noise. The bar appears very high to deter the Fed from cutting rates. As we have argued, the Fed’s concerns perhaps are now focused on the US debt spiral alongside rising global instability resulting from higher US rates. Inflation needs to materially accelerate to stop them cutting. Implicit to this view, the Fed is now willing to tolerate higher levels of inflation, which of course in itself will help reduce the real debt burden. We may be witnessing the slow shift to a “range target” on inflation, with the Fed seemingly comfortable at 2-3%.

Gold certainly got the message, hitting new record highs on Thursday whilst the S&P 500 index took the invite to party, closing yet again at new record highs. 2yr US yields falling circa 14bps on the week, alleviating some of the macro headwinds that had additionally been weighing on Bitcoin.

The Bank of England meanwhile made its own dovish pivot, keeping rates unchanged, but with the two previous hawkish members dropping their vote to hike and another backing an immediate cut. With CPI data coming in at 3.4% in Feb, down from 4% in Jan, an upbeat BoE governor later claimed that rate cuts “were in play” at future meetings. June looks set to see the Fed, BoE and ECB all get their respective cutting cycles under way 🚀

Currency Devaluation..

Firing the starting gun on the global rate cutting cycle was the Swiss National Bank (SNB) who surprised markets with a surprise 25bp cut to 1.5%, aiming to address falling inflationary pressures and the negative effects from a strong currency. As major economies outside of the US battle recessionary levels of growth, we may well be pivoting towards currency wars, whereby weaker currencies are desired to remain competitive in a slowing global economy.

Interestingly, the PBOC appeared to signal comfort with a weaker currency, setting a higher USDCNY fix on Friday and seemingly giving up defending the 7.20 level. Whilst currency interventions were seen to slow the move higher, with broad Asia currency weakness (particularly the main competitor, JPY) and an economy still battling a deflationary spiral, China is perhaps willing to also join the devaluation game. Off-shore USDCNH closing Friday at 7.2770.

This gives us reason for some short term caution on Bitcoin. Currency weakness will encourage further capital outflows and with capital controls in place, Bitcoin is an attractive conduit for capital to leave China. China is therefore incentivised to keep Bitcoin heavy to discourage those outflows. Yet if fears sufficiently grow that China is willing to devalue the currency, there could be a flood of Chinese capital looking to flow into Bitcoin which China will find difficult to prevent. We witnessed this in 2015 when China devalued the currency and Bitcoin rallied 3x in the space of a few months 😳

In summary…

The macro dynamic continues to be heading towards providing an increasingly powerful tailwind for Bitcoin and the broader crypto space as the global monetary policy dial turns to easy mode. Despite recent inflation stickiness, the Fed’s willingness to “run it hot” and tolerate higher inflation potentially marks a significant shift in Fed policy that ultimately drives real rates lower. Of course, in a highly indebted economy, negative real rates and financial repression are a necessary condition to keep the system running and fiat currency debasement remains the escape valve. Gold continues to signal that the macro sands are shifting. Should net ETF inflows turn positive this week, don’t be surprised if Bitcoin catches the macro winds and accelerates to new highs 🚀

Native News

Key news from the crypto native space this week.

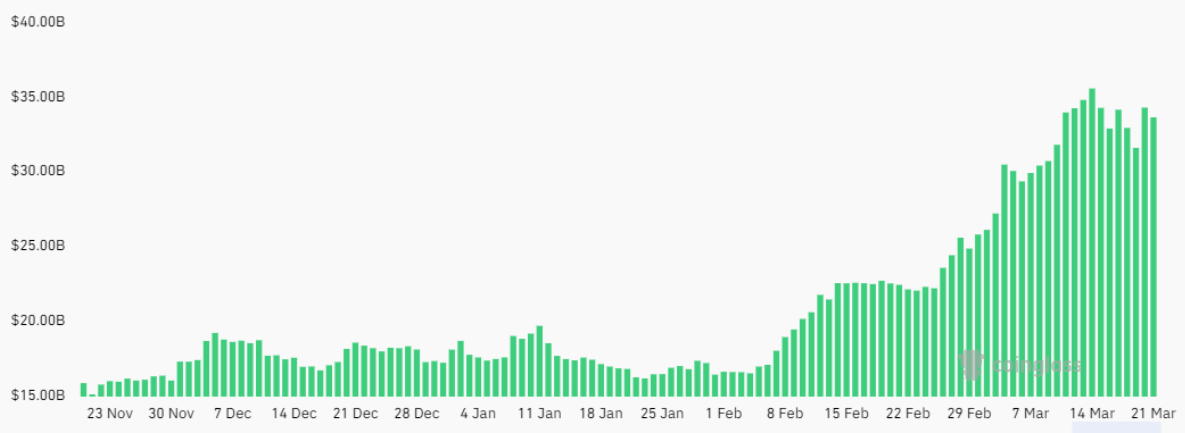

The aggregate Bitcoin futures open interest reached a $36 billion all-time high on March 21, up from $30 billion two weeks prior. Moreover, the market leader, the Chicago Mercantile Exchange (CME), achieved an $11.9 billion open interest

Bitcoin Open Interest, chart by Coinglass.

Bankrupt crypto lender Celsius is reportedly aiming to recover $2 billion from major customers who withdrew from the platform just before its bankruptcy in July 2022. According to a recent report, a Celsius bankruptcy oversight committee has begun contacting customers who withdrew more than $100,000 prior to its downfall, with the goal of using potential returned funds to pay back customers who did not withdraw from the platform in time. The committee will offer clawback-affected customers a “favourable rate” if they decide to settle, with the threat of litigation if funds are not returned.

Institutional Corner

Top stories from the big institutions

This week, BlackRock unveiled its first tokenised fund issued on a public blockchain, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). BUIDL will provide qualified investors with the opportunity to earn U.S. dollar yields by subscribing to the Fund through Securitise Markets, LLC. Through the tokenisation of the Fund, BUIDL will offer investors important benefits by enabling the issuance and trading of ownership on a blockchain, expanding investor access to on-chain offerings, providing instantaneous and transparent settlement, and allowing for transfers across platforms. BNY Mellon will enable interoperability for the Fund between digital and traditional markets. Robert Mitchnick, BlackRock’s Head of Digital Assets said “This is the latest progression of our digital assets strategy,” “We are focused on developing solutions in the digital assets space that help solve real problems for our clients, and we are excited to work with Securitise.”

The U.K.’s Financial Conduct Authority (FCA) intends to deliver a market abuse regime for crypto this year. The business plan set out an agenda to protect consumers, ensure market integrity and facilitate international competitiveness. Last year, the government issued a consultation that included plans for a market abuse regime for crypto assets. “The market abuse offenses would apply to all persons committing market abuse on a crypto asset that is admitted (or requested to be admitted) to trading on a U.K. crypto asset trading venue," the government said in its crypto consultation response in October. "This would apply regardless of where the person is based or where the trading takes place." The proposed regime would, for example, require crypto exchanges to detect and disrupt market abuse behaviours. Read the full business plan HERE.

A number of spot Ethereum ETF approvals were delayed by the SEC this week. VanEck, Hashdex Nasdaq and the ARK 21Shares Ethereum ETF’s were all delay. In the latest delayed ETF for VanEck on Wednesday, the agency said it would take until May 23, 2024 to make a decision on the ETF and asked the public for comments. The SEC said "The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change, as modified by Amendment No. 1, and the issues raised therein," Read the full release from the SEC HERE.

WisdomTree Funds was granted a trust company charter by the New York Department of Financial Services (NYDFS). The Trust Charter authorises WisdomTree to perform fiduciary custody of digital assets, including digital wallet services, to issue and and exchange DFS-approved stablecoins and manage stablecoin reserves under the newly formed entity the WisdomTree Digital Trust Company LLC. There are only a few other digital asset trust companies with this charter.

Charts of the Week

Because charts are just as important as macro.

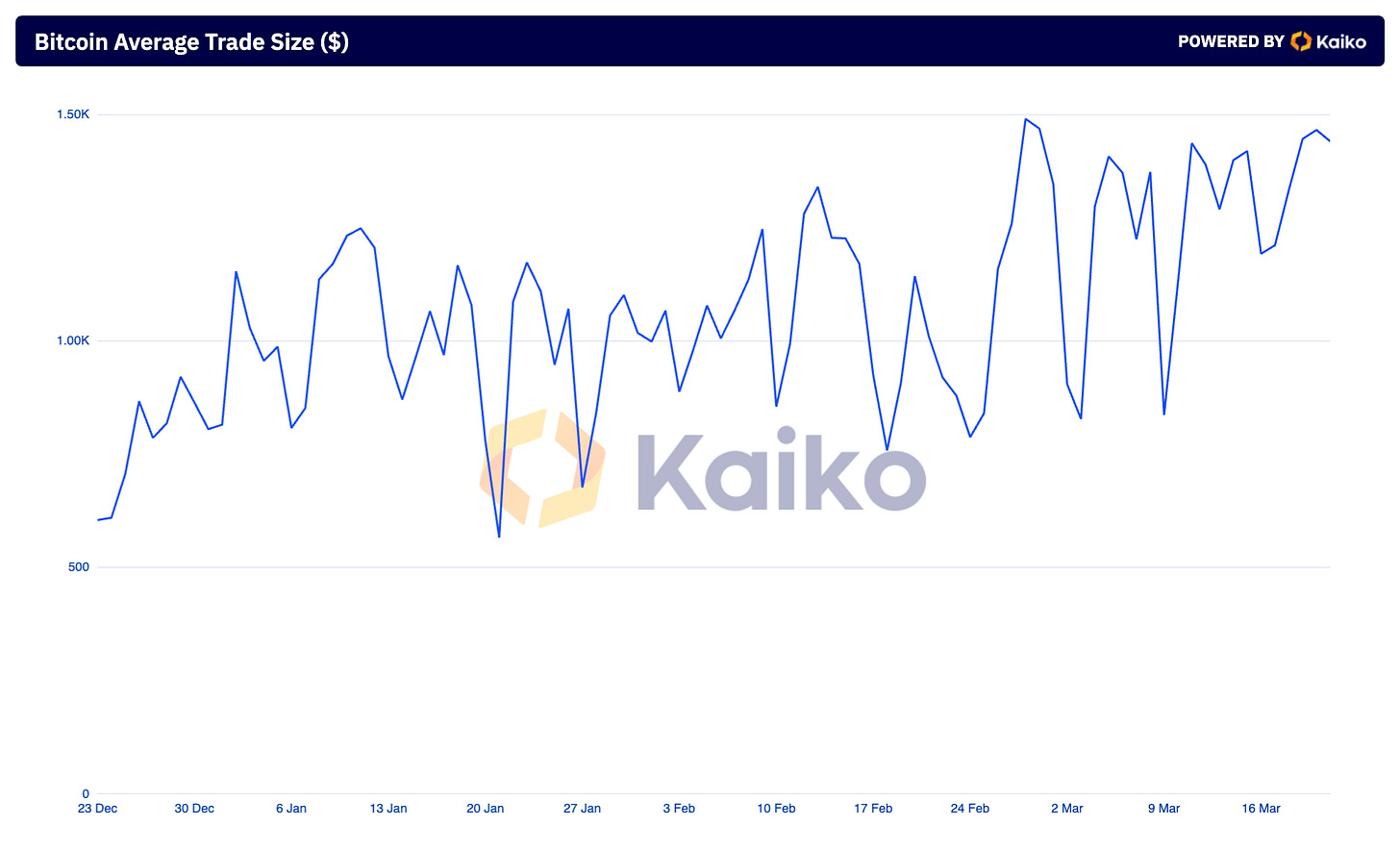

Average bitcoin trade size on centralised exchanges continues to rise, now just under $1.5k. Hat tip to Kaiko Data for the chart.

Bitcoin 2% market depth briefly surpassed its pre-FTX average of $470mn.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Account Manager, Crypto and Gaming at Checkout.com

FinCrime Manager for Crypto at Revolut

CRM Manager, Crypto Wallet at Tech Alchemy

Senior DeFi Engineer at Uphold

Quantitative Engineer at Quadra Trade

Risk Manager at Blockchain.com

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.