Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

If you think someone will benefit from reading this newsletter, we’d be really grateful if you could share it with them. Thanks!

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Beginning of a rate cutting cycle and the end of balance sheet reduction remains on track. Banking stress comes to the fore!

Crypto Native News: Tether releases its lates financial attestation, Solana based Jupiter Exchange executes a huge airdrop, Coinbase hires former UK Chancellor and FTX says it plans to repay its customers.

Institutional News: BlackRock spot ETF volumes continue to grow.

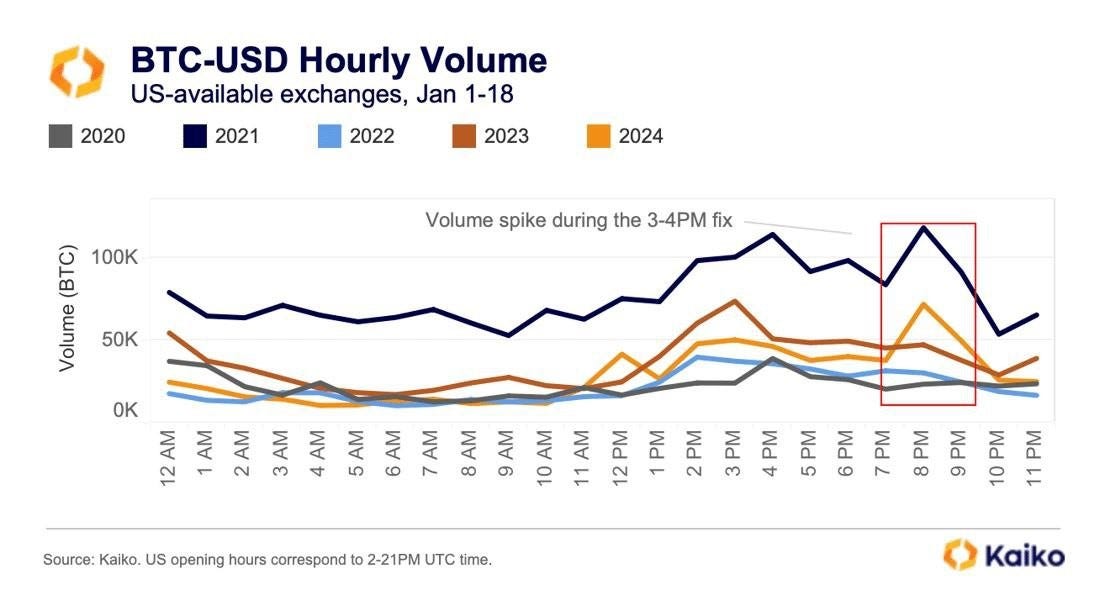

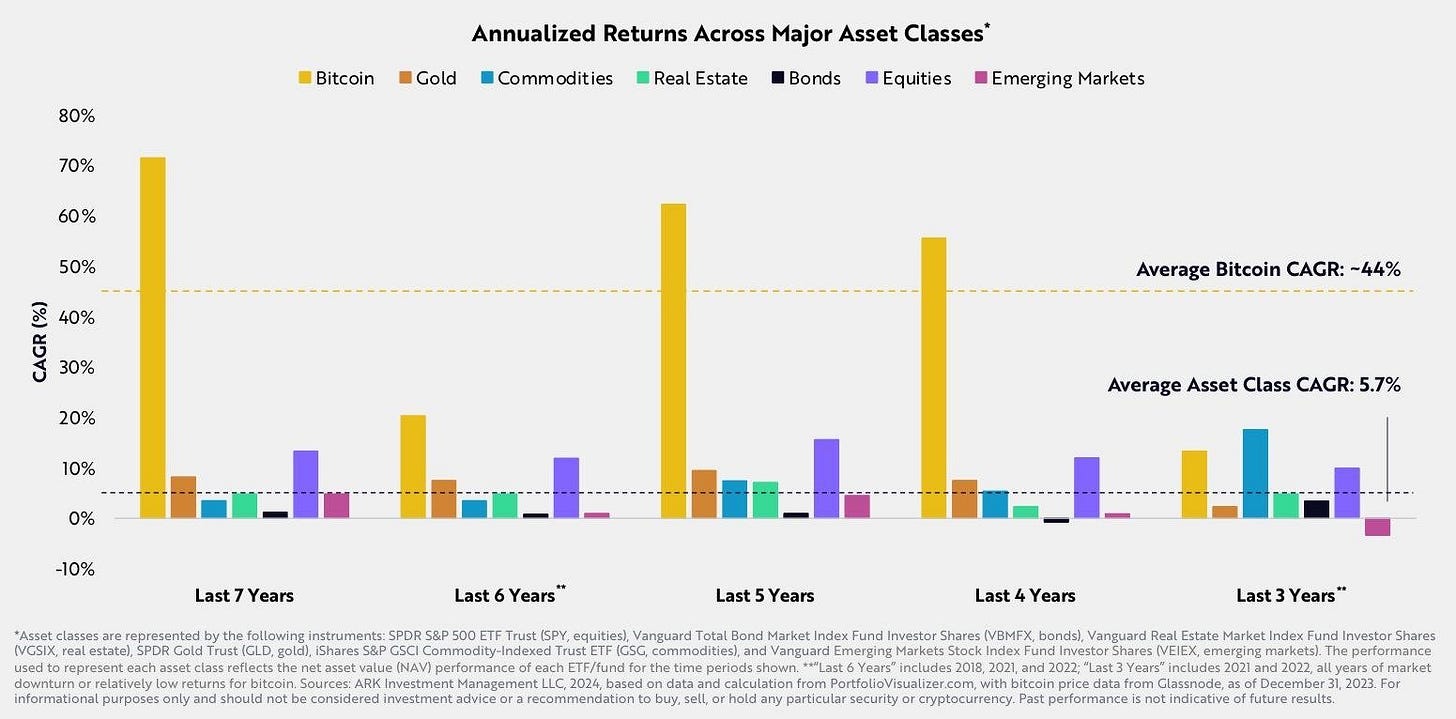

Charts of the Week: Bitcoin volumes increase in the 3-4pm window, naira experiences a sharp decline, Truflation much lower that the official data and bitcoins annualised return beats other assets.

Top Jobs in Crypto: Featuring Options Group Recruiters, CryptoNewsZ, Paysafe, Hudson River Trading, Crypto Recruit Recruiters, Revolut and Uphold.

Macro Update

This is where we connect the dots between macro and crypto.

Canary in the Coal Mine

Big week for macro with the FOMC and Non Farm Payrolls employment report the data highlights, although renewed banking concerns made for an interesting sub plot.

The Fed, holding rates as expected at 5.25-5.5%, was initially deemed “hawkish” after JPow poured cold water on the idea of the first cut being delivered in March, saying that was “not likely.” They have however pivoted to an explicit easing bias and despite the resilience of the data, suggested that a continuation of current trends, particularly with inflation, would justify the beginning of a rate cutting cycle. The Fed just wants to see another few months of inflation remaining, at what Powell described, as on target by recent measures.

On Quantitative Tightening (QT) the Fed had some discussions but “in-depth discussions” on the taper of QT will begin at the next meeting in March. Expect then the tapering process to commence early in Q2.

Non Farm Payrolls, meanwhile, came in with a blow out, expectations beating headline print of 353k jobs added, with the past 2 months numbers revised higher by 126k. Unemployment also ticked down to 3.7% and average hourly earnings rose to 4.5% from 4.3%, although that was in large part due to reduced weekly hours worked. Indeed, average weekly hours at 34.1 is the lowest since the depths of the Covid crisis and raises question marks on the validity of the strength of the headline number. Further weakness under the hood was revealed in the household employment survey which showed a LOSS of 31k jobs. Full time jobs also declined 63K, with part time jobs surging 96K.

Hmmm, colour us skeptical. Nonetheless, this headline report will do little to hurry the Fed to kick off the rate cutting process.

Overall however, we continue to track our main theme which we deem bullish for broad risk and crypto. Namely, the beginning of a rate cutting cycle and the end of balance sheet reduction, supporting an improving liquidity backdrop. We are however looking wrong on our expectation for that first rate cut to occur in March, although as we’ve frequently highlighted, the timing is much less important than the direction of travel.

Closer to home, the Bank of England held rates steady but also pivoted to an easing bias, dropping reference to the risk of further tightening and keeping “under review” how long to keep rates at 5.25%. BoE forecasts see inflation falling to 1.4% in 2 years at constant rates and so now it is about when, not if, they cut. Another tick to the “peak rates” box ✅

Perhaps the most noteworthy event which reinforces our bullish view on Bitcoin, was renewed banking stress. Shares of New York Community Bancorp (NYCB) plunged on Wednesday after cutting its dividend and reporting a surprise Q4 loss of $260m. NYCB bought the failed Signature Bank in last year's regional bank crisis and blamed a rise in expected losses from commercial real estate (CRE) loans. This dragged the broad regional bank’s index lower. Adding to the CRE concern, Japan’s Aozora bank went limit down on Thursday after also warning of large losses on their holdings of US office loans.

With close to $1trn of CRE loans to roll this year, it’s estimated that there are circa $1.2trn of CRE losses which are perhaps about to rear their head. NYCB is a huge canary in the coal mine. Add to this the estimated $500bn losses banks are sitting on with their underwater Treasury holdings, there’s close to $2trn of losses hiding in the banking sector.

Cross-assets ended the week painting a somewhat contradictory picture. Odds for a March rate cut falling sub 20%, yet 2yr yields closed the week flat, 10yr yields lower some 12bps as renewed bank concerns weighed (Treasury quarterly borrowing forecasts were also lowered by $55bn with a continued skew to front end T-bills giving bonds additional support.) The dollar finished the week stronger, yet gold closed 1% higher. Stocks continue to make record highs, driven by the MAG7, aided by strong earnings. Oil heavy, despite geopolitical tensions, as global growth fears weigh. China stocks under renewed pressure on growth and property concerns.

The macro cross-currents then, failing to provide a clear path to give Bitcoin momentum. We continue to feel China is a big headwind, as they are incentivised to keep a lid on Bitcoin to maintain the “veil of stability” and discourage capital outflows. Watch for signs of stability there, as they continue to try and artificially inflate domestic assets, as a trigger for Bitcoin to break higher.

Meanwhile, renewed banking stress is a huge potential bullish catalyst for Bitcoin, the ultimate hedge against the failure of the fiat system. Rates are simply too high for this debt bloated system to handle. The Fed, with inflation under control, will need to get rates lower sooner, rather than later or else be forced into more extreme, emergency measures. Ultimately, these underwater assets will, like in China, need to be artificially inflated with the Fed forced to flood the system with liquidity. It’s a case of when, not if, and this week may have brought that moment closer.

Check out our Friday thread on the Bitcoin ETF’s HERE.

Everything you need to know from the first 3 weeks of trading.

Stats, charts, facts and opinions!

Native News

Key news from the crypto native space this week.

Stablecoin issuer Tether released its latest set of financials this week. According to the post, Tether reported a "record-breaking" $2.85 billion of profits last quarter as its flagship token USDT neared a $100 billion market capitalisation. The latest quarterly attestation showed some $1 billion of the profit came from the interest earned on the company's vast U.S. Treasury, reverse repo and money market fund investments, which are held to back the USDT stablecoin. Through last year, the company booked $6.2 billion in net operating profits, with some $4 billion from interest earned on the Treasury holdings as the Fed increased interest rates. Read the full report from Tether HERE.

Jupiter Exchange, a Solana-based decentralised exchange, this week executed one of the largest token airdrops in history, distributing approximately $700M worth of its JUP token to nearly a million wallets. The airdrop, which took place without major issues on the Solana blockchain, saw the JUP token price rise from an initial $0.41 to $0.72, achieving a fully diluted market cap of over $6B. However, the price has since dropped to $0.60. The airdrop took place with no notable issues aside from some RPC nodes, the go between for wallets and the network, struggled to keep up with user demand in the first 30 mins of the airdrop.

Coinbase announced this week that they have hired former UK Chancellor George Osborne for its advisory council. Coinbase has staffed its advisory council with people ranging from security experts to former congressmen, a testament to the various legal and regulatory issues crypto companies must deal with. The announcement from Coinbase said that it has hired the former chancellor and would be “relying on his insights and experiences as we grow Coinbase around the world”.

At a court hearing this week, FTX said that it fully expects to repay its customers. However, the full recovery of assets is based on the point of FTX’s actual bankruptcy, when the markets were in turmoil and bitcoins price was around $20,500. The repayment process under consideration in the US bankruptcy court would require claimants to submit proof they had, and subsequently lost assets on FTX.

Institutional Corner

Top stories from the big institutions

On Thursday, trading volumes for BlackRocks spot bitcoin ETF eclipsed those of Grayscale investments, the first time since the funds began trading on 11 January. at the time of writing, the Grayscale GBTC product had accounted for nearly half of the trading volume, roughly $14.4bn of the $29.3bn total. On Thursday, Grayscale trading volumes were 292m vs BlackRocks $302m.

Charts of the Week

Because charts are just as important as macro.

Bitcoin trading volumes on exchanges has increased between the 3-4pm window. Hat tip to Kaiko Data for the chart.

Stats like this don’t always hit the headlines but they serve as a reminder of the case for bitcoin. The Nigerian naira is experiencing rapid currency debasement. Hat tip to Javier Blas for the chart.

US Truflation data showing at 1.44%, vs the Feds backward looking 3.4%.

During the last 7 years, Bitcoins annualised return has averaged around 44%. Hat tip to Ark Invest for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Options Market Making PM via Options Group Recruiters

Crypto Journalist at CryptoNewsZ

Senior Sales Manager for Paysafe

Crypto Trading Support Engineer at Hudson River Trading

Algo Trader at Crypto Trading Firm via CryptoRecruit Recruiters

Business Compliance Manager at Revolut

Performance Marketing Manager at Uphold

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.