Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Circle debuts on the NYSE, Ripple’s RLUSD token gains regulatory approval in the DIFC, Dubai.

Institutional Corner: UK FCA to allow retail investors to trade crypto ETN’s, Investment advisors the biggest holder of the bitcoin ETF’s, JP Morgan to expand some of its crypto offerings for trading and wealth-management clients, Uber exploring plans to use stablecoins.

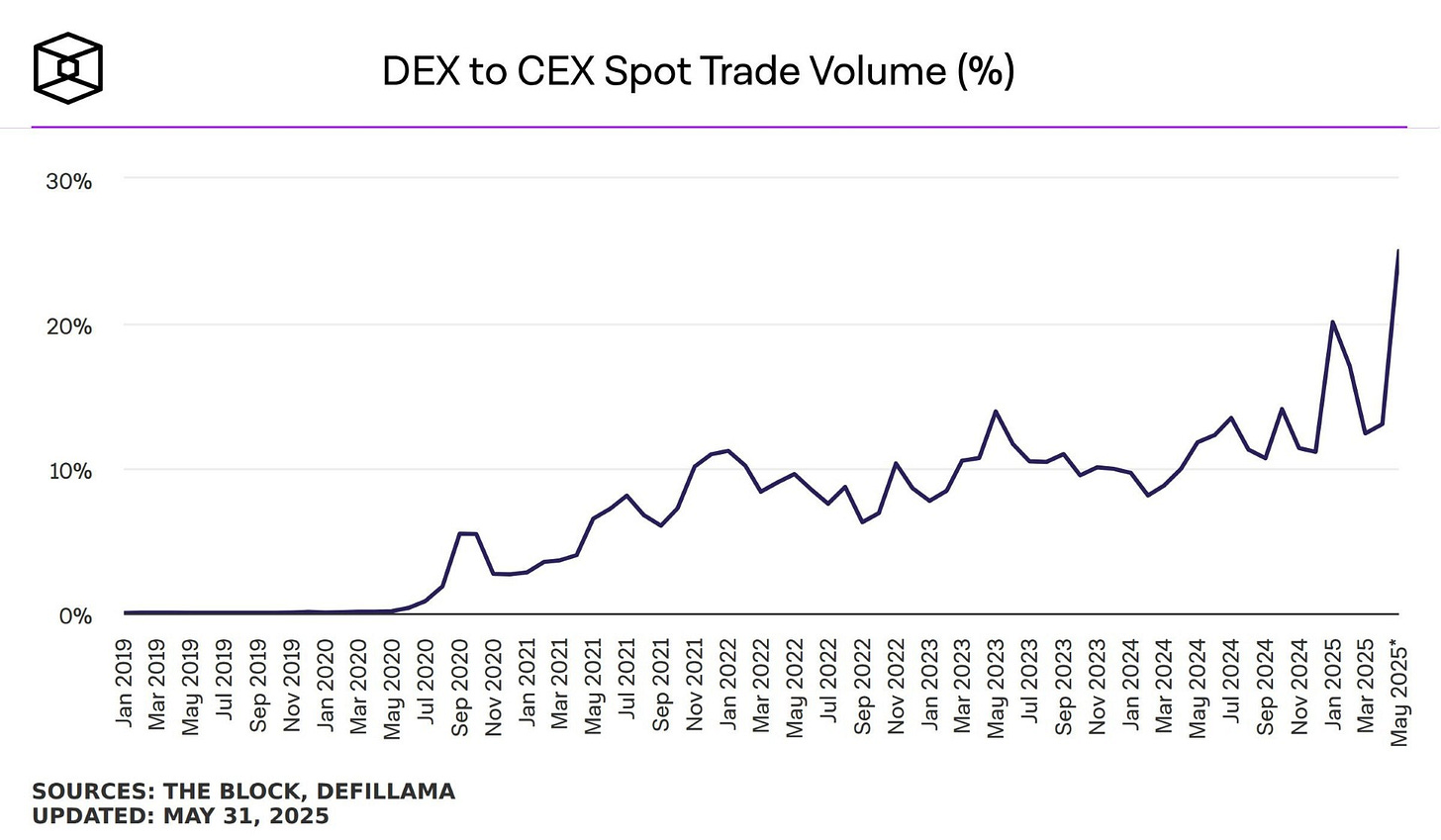

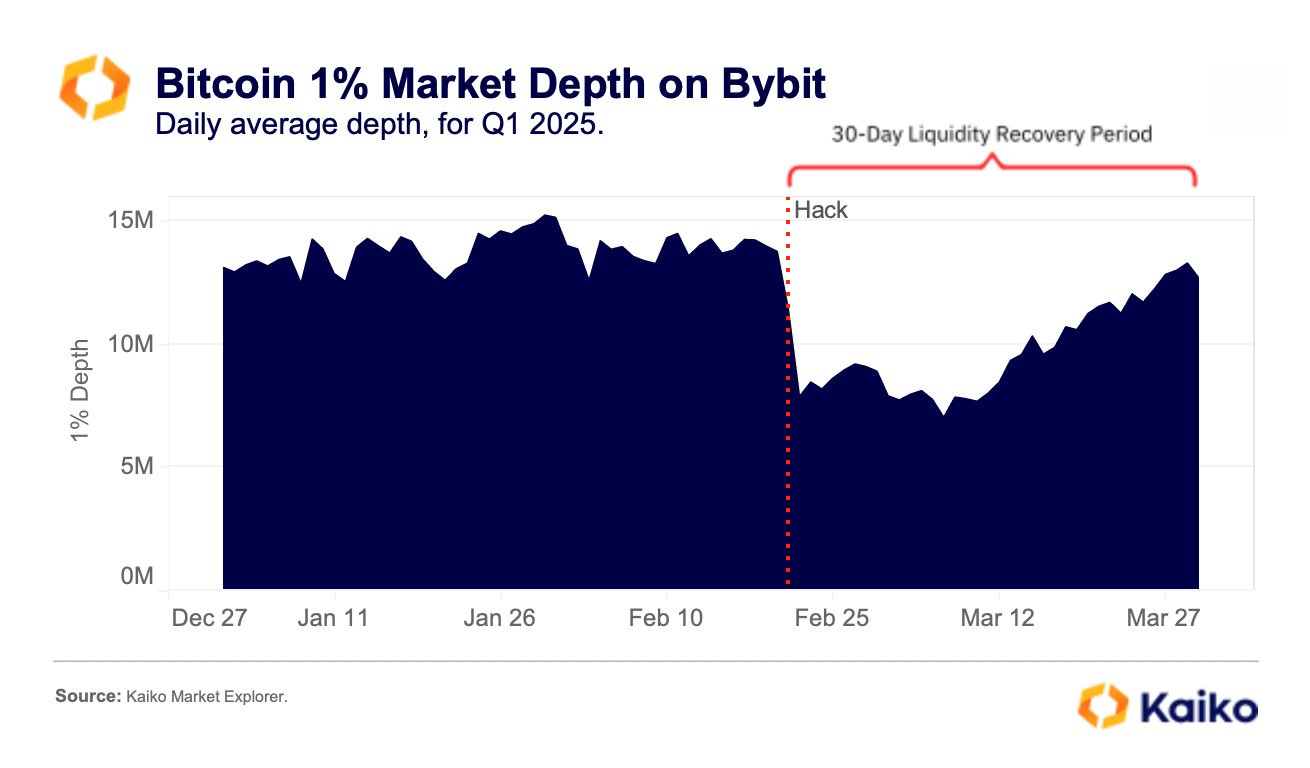

Charts of the Week: Ethereum engagement hits weekly high, DEX to CEX volume hits a high, Bybit market depth recovered post hack.

Top Jobs in Crypto: Featuring Fasanara, Revolut, Kokomo Games, Bitget, Koinly, Trireme.

Macro Update

This is where we connect the dots between macro and crypto.

Nothing Stops This Train

Markets extended their rebound this week, with small caps joining the rally as the risk-on rotation broadens. All major indices are now back into positive YTD territory 🥳

The AI thematic continues to be in vogue, with upbeat earnings and Meta's 20-year energy deal for AI ops fuelling sentiment across the space. We suspect this will underpin Nasdaq’s move to new record highs over the next couple of weeks.

Meanwhile the data flow continues to support our “Goldilocks” view of the world, with another resilient, albeit slowing non farm payrolls print of 139k, down from a downwardly revised 147k. The unemployment rate held steady at 4.2% and average earrings YoY remained at 3.9%. Signs of underlying weakness remain and we continue to expect the labour market to soften over the coming months, yet there is little sign of a sharp slowdown that would be more of an impediment to risk.

ISM manufacturing and services PMIs also both slipped below 50 for the first time together since mid-2023, marking outright contraction in both sectors. Services PMI at 49.9 contracting for the first time since June last year, led by a sharp drop in new orders.

Positive risk indicators…

This is a slowing, not collapsing economy, which we expect will continue to anchor inflation, despite the tariff uncertainty. This sanguine macro backdrop is now reflected by the VIX which has dropped below 17, having been as high as 52 back in April. This augurs for further gains in the S&P 500 as the likes of Risk Parity funds (who allocate and leverage across assets according to volatility - lower volatility, leading to increased weight and leverage to that asset class) scale up.

More broadly, as we’ve outlined previously, this market remains underweight risk and we suspect there will be some forced performance chasing into the quarter end. Pain remains higher!

Also quite interesting, despite 10yr US yields spiking back above 4.50% post the NFP release, the MOVE index (a measure of US bond volatility) fell to its lowest levels since February. This is important as it relates to liquidity, given the role of treasuries as collateral for borrowing and leverage. Lower volatility requiring less collateral facilitating greater leverage.

We highlight the above as everything right now looks super supportive for risk. It will take more than the Trump/Musk bromance ending to put a significant dent in the positive risk dynamic.

Nothing stops this train…

Nonetheless, the public spat between Trump and Musk did hit Bitcoin quite hard, falling to lows around $100,370. The move made little sense to us. If anything, when the President of the United States is arguing with the richest man in the world, we find the decentralised, non-sovereign qualities of Bitcoin even more appealing!

However, having reached new record highs a couple of weeks ago and then settling into a consolidatory range, perhaps this was the flush needed to shake out some stale longs.

Indeed, liquidations such as these tend to mark local lows and with $100k forming solid support, we believe this can now help Bitcoin build renewed momentum for a more decisive break higher, assisted by the broader positive risk tailwinds.

Perhaps more importantly, is the reason WHY Trump and Musk were arguing and it centres around Trump’s “Big Beautiful Bill” which Musk described as a “disgusting abomination.”

The Bill is set to add circa $3trn to the Federal deficit over the next decade and runs counter to the early promises of Trump and Bessent to reign in deficits and get spending under control. Musk has been a very vocal advocate of the need to reduce the deficit and the risks it poses, unchecked, for the future.

Yet, as we dismissed the likely impact of DOGE which was always unlikely to make a dent, no President is incentivised to reduce the deficit as there is little way of doing so without a big hit to growth. Especially as the debt intensity of growth is rising (it requires more units of debt for each unit of growth.) Fiat, credit based economies rely on ever more debt to grow and no one wants to be the President that took responsible action at the cost of sharply falling growth under their watch. Hence no matter whether Republican or Democrat, the deficit keeps rising. Nothing stops this train 🚂

It’s also why we think the US economy is set to slow, but not fall into a deep recession when the US is still running deficits north of 6%.

The current macro backdrop then is the US, alongside Canada, EU, China are all running large fiscal deficits. Bonds will remain under pressure, but financial repression and yield curve control will be necessarily used to keep a lid on them. Global M2 and liquidity continues to expand and fiat currency continues to be debased.

Risk consequently will continue to perform well with equities reaching ever new highs (in fiat terms.)

Bitcoin will continue to outperform everything 🚀

Don’t over complicate it 😉

Native News

Key news from the crypto native space this week.

Stablecoin issuer Circle Internet's shares more than doubled in their debut on the New York Stock Exchange on Thursday. The New York-based company's stock opened for trading at $69 apiece, valuing the stablecoin issuer at nearly $18 billion, on a fully-diluted basis. The stock rose as much as $103.75 and was halted multiple times for volatility amid frenetic trading. The shares closed at $83.23, up roughly 168% from their IPO offer price.

The Dubai Financial Services Authority (DFSA) approved Ripple’s RLUSD token for use within the Dubai International Financial Centre (DIFC), making it the third stablecoin to gain regulatory approval under the DIFC’s cryptocurrency regime. RLUSD’s certification comes after Ripple itself received approval (in March) to offer blockchain payment services within the DIFC. These two approvals mean that Ripple can integrate RLUSD into the global payment services it’s offering in Dubai and the UAE, while other DFSA-licensed firms in the area can also include the stablecoin in the solutions they offer their own clients.

Institutional Corner

Top stories from the big institutions

This week, the UK Financial Conduct Authority (FCA) said it was proposing to allow retail investors to access crypto exchange-traded notes (ETNs). Like stocks and shares, crypto ETNs can be bought and sold and work by tracking the performance of cryptoassets such as Bitcoin and Ethereum. It means people are exposed to its changing value without needing to hold the asset themselves. Currently, just professional investors are allowed to buy and sell the investment product after the FCA granted access last year. At the time, the regulator said it still believed crypto ETNs to be “ill-suited for retail consumers due to the harm they pose”. On Friday, David Geale, the FCA’s executive director of payments and digital assets, said the proposals reflect its “commitment to supporting the growth and competitiveness of the UK’s crypto industry”. He added “We want to rebalance our approach to risk and lifting the ban would allow people to make the choice on whether such a high-risk investment is right for them given they could lose all their money.”

According to recent SEC filings Investment advisers now hold over $10.28 billion in spot bitcoin ETF assets, representing 124,753 BTC. Investment advisers hold nearly half of the total crypto assets declared by the various funds. Hedge fund managers are second, holding $6.9 billion worth of BTC ETF, or nearly 83,934 BTC, followed by brokerages and holding companies. There is a similar trend with ether. Advisers lead with $582 million in exposure, representing 320,089 ETH, while hedge funds hold $244 million, or 134,469 ETH. The total institutional ETH ETF exposure now stands at over $1.06 billion, or 587,348 ETH. Though smaller than bitcoin’s footprint, it signals rising interest in diversified crypto exposure.

JPMorgan & Chase plans to expand some of its crypto offerings for trading and wealth-management clients. The bank intends to let its clients use cryptocurrency assets as loan collateral for certain cryptocurrency exchange-traded funds (ETFs), including BlackRock's iShares Bitcoin Trust (IBIT). Previously, clients could only do so on a case-by-case basis. JPMorgan will also include a wealth-management client's crypto holdings when assessing their total net worth and liquid assets when determining the amount a client can borrow against their assets.

This week, Uber Chief Executive Officer Dara Khosrowshahi said that the company is in the “study phase” of using stablecoins as a way to transfer money globally. Speaking at the Bloomberg Tech Conference in San Francisco this Khosrowshahi said “Stablecoins appear to have “a practical benefit other than crypto’s historic value,” It’s “quite promising especially for global companies” as it can help reduce costs of moving money around among different countries, he added.

Charts of the Week

Because charts are just as important as macro.

Ethereum weekly engagement hits a new all-time high. Over 17 million addresses engaged with the Ethereum ecosystem last week. Up 16.95% from the week before.

DEX to CEX spot trading volume has reached a high of 25%. Hat tip to The Block for the chart.

Following February’s $1.5B hack, Bybit’s BTC 1% market depth fully recovered in just 30 days. Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Head of Front Office Technology at Fasanara

Business Development Manager (Institutional Crypto Partnerships) at Revolut

Web3 Growth Manager at Kokomo Games

Business Development Manager at Bitget

Social Media Manager at Koinly

Web3 Senior Associate at Trireme

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.