Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

We’d like to ask a small favour…

If you find any part of this newsletter useful, could you share it with just 1 person you think might benefit from receiving it. Thank you !

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: The global slowdown remains in tact, volatility in US treasury markets continue to reinforce Bitcoin’s newly acquired “flight to quality” characteristics. Institutional adoption is gaining traction.

Crypto Native News: Two Prime note recent growth in crypto borrowing and lending, Robinhood to launch operations in the EU and UK.

Institutional News: HSBC announces digital asset custody for tokenised securities, the head of the BIS speaks on CBDC’s.

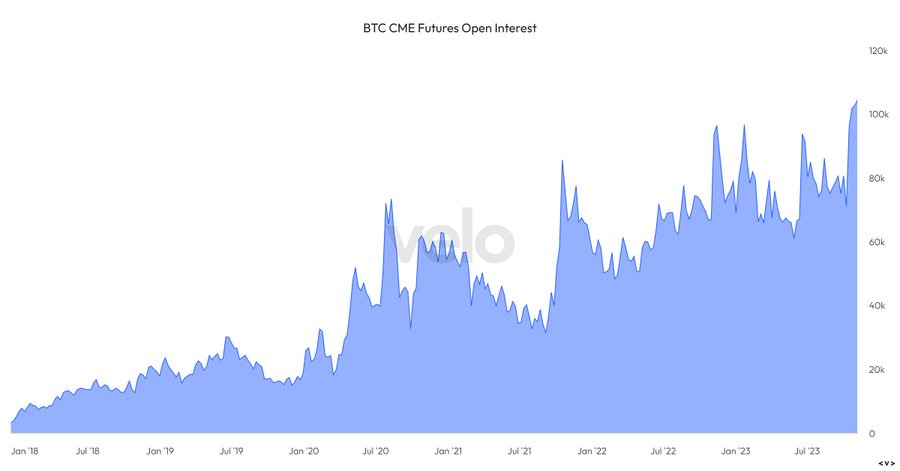

Chart of the Week: CME bitcoin futures open interest at all time highs.

Top Jobs in Crypto: Featuring Revolut, Coincharted, Priority Crypto Recruiters, Paypal and Robert Walters.

Macro Update

This is where we connect the dots between macro and crypto.

Stars Aligning

A quieter week on the macro saw rates markets temper expectations of rate cuts, as JPow pushed back on the dovish FOMC interpretation, refusing to rule out another rate hike and saying the Fed were not yet confident rates were restrictive enough to get inflation back to 2%.

The dollar subsequently recovered higher on the week and 2yr yields moved back above 5% although the market continues to price rates at 4.25-4.50% by the end of 2024.

Despite the recent easing in financial market conditions, credit conditions in the “real economy” continue to tighten as reflected in the latest Senior Loan Officer Opinion Survey (SLOOS) from the Federal reserve. This painted a picture of tightening lending standards and weaker credit demand and continues to support our view of a much weaker growth and inflation backdrop throughout Q4 and beyond.

Indeed, soft China exports alongside weak German industrial production data this past week serves as a reminder of the global slowdown that is under way. China’s YoY inflation rate is also clocking in at a deflationary -0.2% and this disinflationary impulse will be felt globally. Oil’s recent move lower despite geopolitical instability and on-going OPEC output cuts is also worth noting. The great “reflation trade” is dying.

Little then, to dissuade our view that the rate hike cycle from major central banks, including the Fed, is done and will be an important tailwind for crypto over the coming months.

Perhaps the biggest “macro” event however, was continued volatility in the US bond market. A weak 30yr bond auction on Thursday (weakest demand in 2 years) saw 30 year yields make the biggest daily jump since March 2020 and underscored the deterioration in treasury market liquidity. This volatility in the fiat systems “risk-free” security highlights the fragilities in the fiat financial system. Under-scoring that fragility, a ransomware attack on the Industrial and Commercial Bank of China, also disrupted the US treasury market as ICBC were prevented from settling trades on behalf of other market participants.

Narratives are important drivers of macro and crypto trends and these treasury market vulnerabilities are acting to reinforce Bitcoin’s newly acquired “flight to quality” characteristics. It’s hard to understate how significant this shifting psychology towards Bitcoin is and will be an important driver of the “institutional adoption” story that looks set to be a key driver of crypto to new highs in 2024.

Speaking of Institutional adoption, CME bitcoin futures open interest surpassed Binance in the number 1 spot last week (regulated institutions typically are unable to trade on unregulated crypto native exchanges and so CME activity Vs crypto native exchanges can be used as a barometer of relative institutional dominance.) On the anniversary of the FTX collapse which many said would set institutional crypto adoption back years, the institutional participation in these markets is stronger than ever 💪

Overall, the confluence of positive crypto drivers continues to percolate nicely. The end of the global rate hike cycle alongside on-going US debt sustainability fears and the fragility of the fiat systems “risk free” asset. Expectations of imminent approval of a spot BTC ETF and now Blackrock filing for an ETH spot ETF, fuelling the institutional adoption narrative. Price action looks constructive as pull backs are shallow and as we’ve highlighted previously, this market remains under positioned and forced to chase performance helping maintain an underlying bid to these markets. The broadening of the Bitcoin move to seeing altcoin outperformance is also reflective of liquidity returning back to crypto. Despite the recent gains, it really feels early in this bull run. It won’t be a straight line higher but both the macro and crypto stars are aligning 👀

Native News

Key news from the crypto native space this week.

The need for institutional borrowing and lending facilities comes up in many of the conversations I have with crypto market participants and that market is starting to grow again. Alexander Blume, Managing Partner at SEC-registered investment advisor Two Prime said this week “Since the soft launch of our lending offering on 13 September, we’ve been surprised by how much demand there is for crypto-secured loans”. Blume added “We have seen about $2 billion in demand for bitcoin-secured loans since we started offering them in September” For those of you new to this world, Crypto-collateralised lending is an arrangement where a borrower pledges bitcoin, ether, or other digital assets as security and primarily draws the loan in the form of fiat currencies. In case a debt goes bad, the lender usually, as the contractual authority, liquidates the pledged crypto asset to recover the amount loaned. Crypto loans are typically over collateralised, meaning the value of the collateral is far greater than the loan’s value. It ensures the lender has some cushion to protect against losses from a potential decline in the value of the collateral asset.

Robinhood, the popular trading platform, released its third quarter earnings report this week. In it, it said that its crypto-related revenue for the third quarter fell 55% to $23 million from the same quarter one year earlier. The report also highlighted plans to start EU crypto trading and U.K. brokerage operations in the coming weeks. Quotes from the report said "With an experienced team in place, we will soon launch brokerage operations in the U.K.," "As another step in global expansion, we are also planning to launch crypto trading in the EU following our U.K. launch"

Institutional Corner

Top stories from the big institutions

HSBC continue their foray in digital assets. This week the bank said it plans to start a digital-assets custody service for institutional clients focusing on tokenised securities in conjunction with Swiss crypto safekeeping specialist Metaco. In 2022, HSBC launched a HSBC Orion, a platform for issuing digital assets and recently introduced an offering for tokenised digital gold on that platform. HSBC said the custody plans for now involve “tokenised securities issued on third-party platforms, e.g., private and/ or public blockchain compatible tokenised bonds or tokenised structured products (not for custody of cryptocurrencies or stablecoins).”

The head of the Bank for International Settlements (BIS) Agustin Carstens spoke at a conference this week. His speech was titled "Securing the future monetary system: cyber security for central bank digital currencies”. "Whether in wholesale form – as a type of digital central bank reserve – or retail form – as a digital banknote – it is increasingly clear, at least to me, that these new forms of money will sit at the core of the future financial system". Under the group's recommendation, central banks around the world are exploring issuing digital versions of sovereign currencies. But monetary authorities will have only a limited role to play in the issuance of CBDCs compared with the private sector. He added "Most customer-facing services will remain in the private sector's remit," Carstens said. "Cyber resilience among these institutions will also be crucial to maintaining trust in the system as a whole ... And this activity does not need to be done by individual organizations in isolation – we can share knowledge. In fact, collaboration between the private and public sectors is key to manage existing and emerging cyber threats". Read the full speech HERE.

Chart of the Week

Because charts are just as important as macro.

This week, CME bitcoin futures open interest surpassed 100k for the first time.

Hat tip to Will Clemente for the chart

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Business Development Manager at Revolut

Head of Product Crypto Exchange at Revolut

Technical Analyst Expert Crypto at Coincharted

Lead Generation Executive via Priority Crypto Recruiters

UK Crypto MLRO Manager at PayPal

Digital Assets Crypto Operations Analyst via Robert Walters

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.