Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “The most succinct, easy to digest macro summary I have read in all crypto newsletters!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: In the US, fiscal dominance has replaced monetary dominance and is the source of cash flowing into markets, dumbfounding the Macro bears incessantly calling for the top. Yellen’s visit to China is key to watch. Bitcoins consolidation off of record highs looks to be complete.

Crypto Native News: Deribit wins conditions VASP license in Dubai, Hut8 says banks want to buy their bitcoin, Tether buys more bitcoin, and Ripple announces plans to launch a stablecoin and trading volumes in spot, futures and options all rise.

Institutional News: Singapore announces plans to expand the scope of regulated payment services, Brevan Howard invests in a crypto accelerator fund and Monochrome Asset Management transfer its bitcoin ETF to CBOE Australia.

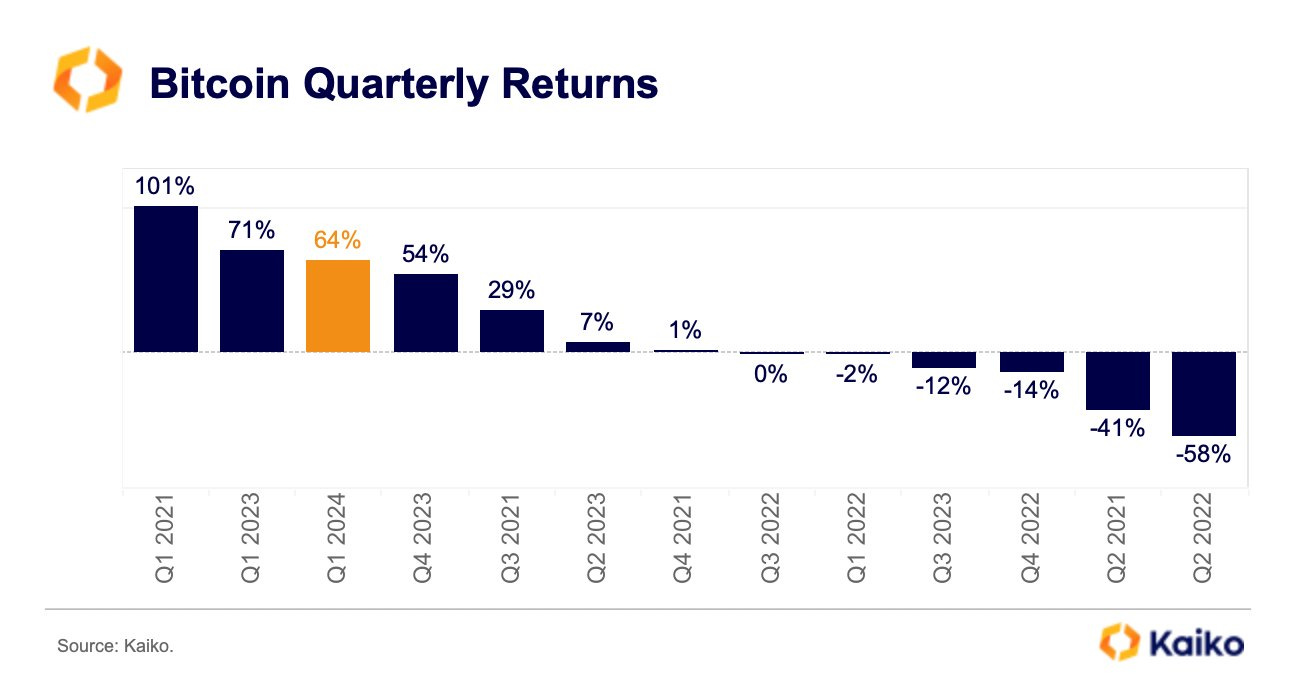

Charts of the Week: Bitcoin quarterly returns.

Top Jobs in Crypto: Featuring Kraken, Ripple, fscom, GFO-X, XBTO and Drip

Macro Chart of the Week - Foreign central banks reducing holdings of US treasuries and increasing holdings of gold.

Macro Update

This is where we connect the dots between macro and crypto.

Global Fragilities

A bearish undertone kept risk and BTC heavy to start April, although we ended the week on the front foot, with signs that this BTC correction off the highs has run its course. We think the lows are in.

Whilst net ETF inflows have once again turned positive (reports on Friday too that Genesis has finished selling $2.1bn of its Grayscale BTC ETF holding) the macro headwinds blew strong as resilient data and cautious Fed speak cast doubt over the timing and depth of rate cuts. June cuts are now being pushed to September. Meanwhile, geopolitical tensions continue to percolate, keeping a bid under oil as Israeli officials warned that Iran may be preparing missile attacks.

Mixed data and a mixed Fed….

On the data, a stronger manufacturing ISM (creeping into expansion territory for the first time in 16 months), with a strong prices paid index (jumping to 55.8 from 52.5) earlier in the week, sparked a renewed bond sell off which saw 10yr yields breach the 4.40% level, a pivotal level to watch. This however was later off-set with the services ISM (remember, services is 70% of the US economy) which came in at a weaker 51.4 Vs 52.6 prior and also saw prices paid plunge to 53.4 from 58.6, marking the biggest two-month plunge in prices for the series since 2008. The US dollar and yields promptly reversing, coinciding with BTC marking its lows sub $65k.

Whilst the plethora of Fed speak was mixed and often contradictory, JPow trod a more dovish line, stating that “it is too soon to say whether the most recent (inflation) readings represent more than just a bump" and reiterating that it will “likely be appropriate as some point this year” to cut rates and he does not believe “inflation is reversing higher.”

As we’ve repeated often, it’s the direction of travel that matters, more than the timing. The Fed remains on course to cut rates, which remains a supportive backdrop for our markets.

Friday’s non-farm payrolls meanwhile will do little to alter the debate. A beat on headline of 303K (200k expected) but earnings continuing to move lower on a YoY basis, at 4.1% Vs 4.3% prior, gave a somewhat goldilocks feel to the data that sent risk higher into the weekend. Under the hood however, there continues to be signs of weakness with public sector hiring forming the bulk of hires, whilst the household survey showed full time jobs growth falling to a 3 year low, as part time jobs growth soared to a near 3 year high.

Fiscal dominance…

The dominance of public sector workers in the “resilient” labor market underscores what’s driving the broad resilience in the US economy. Namely a government that is printing $1trn of deficits every quarter 🤯

Fiscal dominance has replaced monetary dominance and is the source of cash flowing into markets, dumbfounding the Macro bears incessantly calling for the top. Yet the top won’t come whilst the US Government is running this level of money creation, unchecked. Meanwhile the Fed appears willing to tolerate a higher inflation range to keep real rates artificially low. All of this is combining to devalue the dollar.

However, FX is a relative game, so the dollar looks relatively strong as the higher nominal rates that the US is running are causing problems to other major central banks, such as the PBOC in China and BoJ in Japan who are still needing to run easy monetary policy and engaged effectively still in the monetary dominance game of QE.

These economies are now battling to maintain relative currency stability versus the dollar. This is particularly true in Japan, where USDJPY is testing the 152 line in the sand, prompting a barrage of verbal interventions with Prime Minister Fumio Kishida on Friday committing to using “all available means” to deal with excessive JPY falls. China meanwhile needing to remain competitive with Japan have allowed a mini devaluation but continue to sell dollars to slow the move higher in USDCNY.

Whilst the US dollar may however look strong (just don’t look at Gold or Bitcoin!) the US Treasury market is looking vulnerable.

The interconnected fiat system….

No doubt, these dynamics will be high on the agenda with Yellen currently in China. Indeed, it was notable as 10yr US yields breached 4.40% (this appears to be a US line in the sand) Biden put a phone call in to President Xi to discuss “areas of cooperation and areas of differences.” The US Treasury also conducted its first Treasury buyback operation. Just a small $200mio operation to test the pipes.

Recall, Yellen announced last year that they would look to launch a treasury buyback programme in 2024 to make the US treasury market more “liquid and resilient” and to smooth the volatility of bill issuance. Can read about it here 👇

https://www.ft.com/content/808f8b31-61ac-4f8b-aec1-744ea9b4b6b3

In short, to help provide liquidity (support) to the long end of the Treasury market, they will buy the longer dated bonds but off-set that with shorter dated bill issuance. Effectively, it’s a form of Yield Curve Control!! Bond markets back under pressure are clearly making the US administration nervous.

Now here’s the rub. China and Japan are the two biggest foreign buyers of US Treasuries. Yellen needs China (and Japan) to keep buying the debt which is spiralling out of control. China and Japan need the US to keep rates lower and the dollar weaker so they can maintain control of their domestic currencies. We suspect a mutually beneficial deal can be done here 🤝

We’re watching closely then this coming week, how the dollar and US yields behave, particularly as 10yr closed right on the 4.40% level which appears pivotal. We expect both to move lower. The move higher in oil, largely as a result of escalating geopolitics, is also fanning inflationary concerns, complicating the Fed’s efforts to get rates lower. It’s also making Biden very unpopular back home. Signs this weekend that China may also be willing to broker a peace deal between Russia and Ukraine are worth watching.

Overall, it feels like we’re at a major pivot point. The US Treasury market is under strain as they continue to run spiralling deficits. Asian currencies are under huge pressure, complicating efforts to run necessarily easy monetary policy. A global interconnected fiat driven financial system dependent on debt, simply can’t handle these high real rates and some form of intervention/cooperation will be required to stop the fiat system imploding. All roads lead to financial repression and currency debasement.

Bitcoins consolidation off record highs looks to be complete. With the underlying global fragilities seemingly coming to a head, net ETF inflows back to positive, all with the halving ahead, Bitcoin looks set accelerate the next leg higher 🚀

Native News

Key news from the crypto native space this week.

Crypto options exchange Deribit, said on Tuesday that its Dubai-based unit, Deribit FZE, has won a conditional virtual asset provider (VASP) license from the local regulator. The license allowing FZE to operate as a virtual asset exchange for spot and derivatives trading remains non-operational until Deribit satisfies all remaining conditions and local requirements of Dubai’s Virtual Asset Regulatory Authority (VARA). Once the license is operational it will allow Deribit to serve institutional and qualified investors while continuing to serve retail investors through its Panama-based broker affiliate.

Interesting comments from Asher Genoot the CEO of Bitcoin Miner Hut8 this week. In an interview he said “We’ve had banks reach out to us to try to buy our Bitcoin because of the supply shortages on these different exchanges.” Hut 8 is one of the largest publicly traded Bitcoin mining operations in the world. Its market capitalisation stands at almost $1.2 billion. Hut 8 holds almost $600 million in Bitcoin, which makes it the fourth-biggest holder of Bitcoin among publicly traded companies. The size of its holdings is topped only by software developer MicroStrategy, rival mining company Marathon Digital, and car manufacturer Tesla. Whilst Genoot refused to name any of the institutions, he said they were “the largest banks you can think of.”

Stablecoin issuer Tether purchased another $627 million worth of bitcoins in the first quarter of 2024, bringing its total holdings to about 75,354 BTC, worth over $5.2 billion. This marks the first time Tether's bitcoin holdings have surpassed the $5 billion mark. With the latest Q1 purchase, Tether has now become the seventh-largest holder of bitcoin from its previous rank of 11 earlier this year. Tether first disclosed its bitcoin holdings in May 2023 as part of its first-quarter attestation report for that year. At the time, the company said it would purchase bitcoins with up to 15% of its profits every quarter as it shifts its stablecoin reserves toward crypto and away from U.S. government debt. See the list of largest BTC wallet holders HERE.

Ripple announced this week that it plans to launch its own stablecoin linked to the US dollar, across the Ethereum and XRP blockchains. The stablecoin doesn’t have a name yet but will be fully backed by US dollars , short term US government bonds and “other cash equivalents”. Ripple says it will provide monthly attestations of its holdings that back the stablecoin, which will be audited by a third-party accounting firm. Ripple Chief Technology Officer David Schwartz said they expect the stablecoin market to explode in the coming years saying “We think we're uniquely positioned to have a competitive entry in that market,” he said. “We have our presence both on the institutional side with our payments product, and on the XRP Ledger side, we have some entry into the DeFi section of the space. Those are kind of the two big buckets in which stablecoins are being used today.”

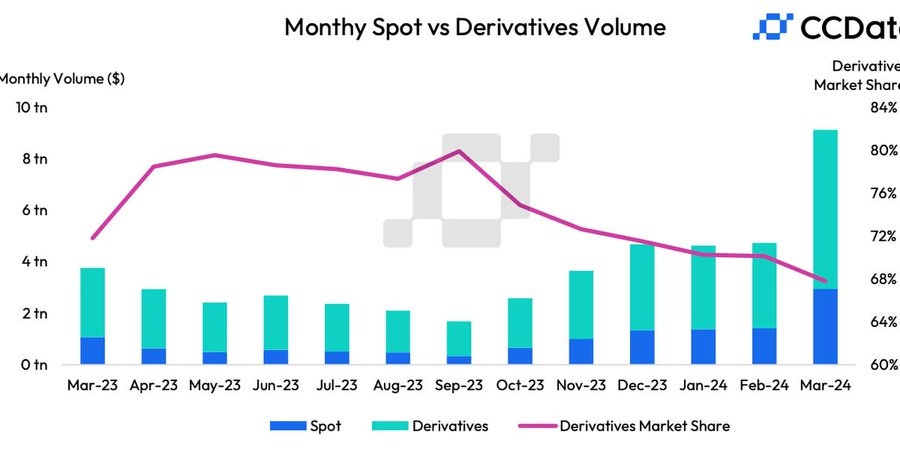

According to CCData, trading volume in futures and options tied to cryptocurrencies on centralised exchanges rose 86.5% to a record high of $6.16 trillion, translating to three times the total market cap of all cryptocurrencies. Still, the market dominance of derivatives slipped to 67.8%, the lowest since December 2022 as traders flocked to the spot market, where cryptocurrencies are exchanged for immediate delivery. Spot trading volume jumped 108% to $2.94 trillion, the highest monthly volume since May 2021. The combined spot and derivatives trading volume increased 92.9% to a record $9.12 trillion. Great visual from the report below.

Institutional Corner

Top stories from the big institutions

The Monetary Authority of Singapore announced on Tuesday that it is expanding the scope of regulated payment services by introducing amendments to the Payment Services Act and its subsidiary legislation. Singapore is introducing regulations that appear to be more stringent for companies engaging in cryptocurrency services or digital payment token (DPT) services. According to the statement, the amendments are expected to take effect from 4th April in stages. Specifically, the MAS noted that the new rules would cover custodial services for DPTs, facilitation of the transmission of DPTs, and facilitation of cross-border money transfers between countries “even where moneys are not accepted or received in Singapore.” The MAS also said “The amendments will empower MAS to impose requirements relating to anti-money laundering and countering the financing of terrorism, user protection and financial stability on DPT service providers.” Read the full press release from MAS HERE.

Brevan Howard Digital and Galaxy Digital have both invested in crypto accelerator Alliance's third fund. The Alliance Fund III had its first close in February, getting commitments from Brevan Howard Digital and Galaxy Digital worth $20 million. According to new reports, Fund III is looking to raise an additional $80 million by July, capping it at $100 million. It is expected to invest $500,000 per start-up.

Monochrome Asset Management, an investment management firm based in Australia, announced on April 5 that it had transferred its application for its flagship bitcoin exchange-traded fund (ETF) to Cboe Australia. The firm views this move as a testament to its “commitment to providing investors with secure, accessible, and innovative investment products.” Jeff Yew, CEO of Monochrome said “We are proud to work with Cboe Australia to bring Monochrome’s new bitcoin ETF to market, expanding the investment universe for Australian Investors. As leaders in digital assets globally, their established track record and commitment to innovation and safe market accessibility aligns with Monochrome’s strategic objectives

Charts of the Week

Because charts are just as important as macro.

Bitcoin closed Q1 up 64%, its third best quarter over the past three years.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Software Engineer - Blockchain Platform - Crypto and On-chain at Kraken

Business Development Associate at Ripple

Head of Digital Assets at fscom

Digital Assets Risk Back Office Software at XBTO

Head of Business Development at Drip

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.