Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Just as the macro tailwinds are whipping up, the negative flow drivers are abating. This is perhaps the most comfortable we’ve felt during a bull market drawdown. Find out why below….

Crypto Native News: Large decrease in stablecoin volumes, number of staked ETH continues to rise.

Institutional Corner: Goldman Sachs to release 3 new tokenisation products, CFTC chair says he needs more power and money to police spot crypto, Partior closes a series B round including JP Morgan and Standard Chartered and the Australian stock exchanges launched a new spot bitcoin ETF.

Charts of the Week: Crypto VC summary and TON open interest rises to highs.

Top Jobs in Crypto: Featuring DRW Cumberland, Token Metrics, Revolut, XTX Markets, Bitpace and Binance.

Macro Chart of the Week - Powell's preferred metric for the real fed funds rate (based on 1y inflation breakeven) now sitting at its highest since last October. Hat tip to Michael Brown for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

The Tide is Turning

Rinse repeat for Bitcoin this week as a continuation of the bullish macro dynamic leaned into the negative flow driven storm, dominated by the German Government selling down their seized Bitcoin.

We suggested the flush out on Friday 5th July had the hallmarks of a local low and Bitcoin recovered in a choppy week of trading and is now some 9% off the lows. Meanwhile, major US indices continue to smell the macro coffee, once again tagging new record highs. Despite a sharp, post CPI “sell the news” correction as the MAG7 came under pressure in a mini unwind of the growth/value trade, SPX ended the week circa 1% higher, Nasdaq just 0.5% lower.

On the data, the all important June CPI confirmed the disinflation trend and reinforces our view that a September rate cut is a lock. The data was softer across the board, with the headline at 3% down from 3.3% and Core coming in at 3.3% down from 3.4% and the lowest in 3 years.

Headline CPI on the month actually fell 0.1%. On a 3 month annualised basis, core inflation fell to 2.1%, the lowest level since the pandemic. Partly driving the softness is the lagging “owners equivalent rent” which, acting typically with an 18 month lag, is catching down to real rents and will continue to pull inflation (as measured by the Fed) lower over the next few quarters. The Fed will gain increasing confidence that inflation is under control and can turn focus to a labor market which is starting to crack.

Markets quickly moved to price more fully the September cut, with odds even for a July cut and 3 cuts in 2024 rising. 7 cuts are now priced by the end of 2025. Our risk positive, peak rates narrative remains very much on track ✅

2yr yields subsequently reacting to price an easier Fed, dropping to 4.45%, the lowest levels since mid-March when, coincidentally, Bitcoin was making its all time highs 👀 10yr yields also closing sub 4.20% at 4.18% and we think this move will gain momentum as the market embraces the rate cutting cycle amidst a slowing US economy. This is go time!

China stimmy…

The dollar sell off also gained momentum, with the Bank of Japan taking the opportunity to lean on an open door and “intervene” selling USDJPY for maximum impact. USDJPY falling from 161.80 to sub 158. Importantly, the dollar and yield move easing pressure on CNH ahead of the upcoming Third Plenum (a 3 day meeting of the Chinese Communist Party to outline key economic policies for the next few years.)

China we expect will ramp up stimulus post this gathering and with the Fed set to begin cutting rates, will provide cover for China to ease further without destabilising the currency. This would be a hugely positive scenario for Bitcoin, especially as current intervention efforts, reducing FX reserves, has been a form of liquidity tightening in China.

Indeed, the latest credit and money supply data perhaps sheds light on Bitcoin’s lackluster performance over the past couple of months. China’s M1 money supply growth at a negative 5% Y/Y. Despite stimulus efforts, credit growth has also been relatively muted although encouragingly, Total Social Financing rose in June from CNY 2trn to 3.3trn. The economy meanwhile continues to battle deflation. June CPI at -0.2% MoM and a tepid 0.2% YoY. The weakness of consumption evident in an unexpected 2.3% fall in imports in June.

Tide is Turning…

China is emitting a huge disinflationary pulse across the world which reinforces our view that global liquidity is set to turn significantly higher in an attempt to reflate the global economy. The Fed getting the rate cutting cycle under way will provide the cover, especially for the likes of China battling to maintain currency stability. This is an insanely bullish backdrop for Bitcoin.

Just as the macro tailwinds are whipping up, the negative flow drivers are abating. Germany has now emptied their wallet. Mt Gox remains an overhanging risk, although we continue to think much of this risk will have been hedged and the other Mt Gox hodlers will continue to hodl 💪. Tentative signs too that the hash rate is turning higher, suggesting the miner capitulation sell flows could soon dry up.

Further, we’ve seen some sizable inflows into the Bitcoin ETF’s, with a total of 20,600 BTC worth $1.19bn in the past 6 trading days. Contrary to what some commentators have suggested, the BTC ETF investors are not degen gamblers, but buy the dip HODLERS. With the ETH ETF’s set to go live, we also have a catalyst for renewed capital flows into crypto.

Overall then, the set up for the next leg higher for Bitcoin looks compelling. This is perhaps the most comfortable we’ve felt during a bull market drawdown. Whilst we hold out little hope for the weather in the UK, crypto summer looks close to getting under way 😎

Native News

Key news from the crypto native space this week.

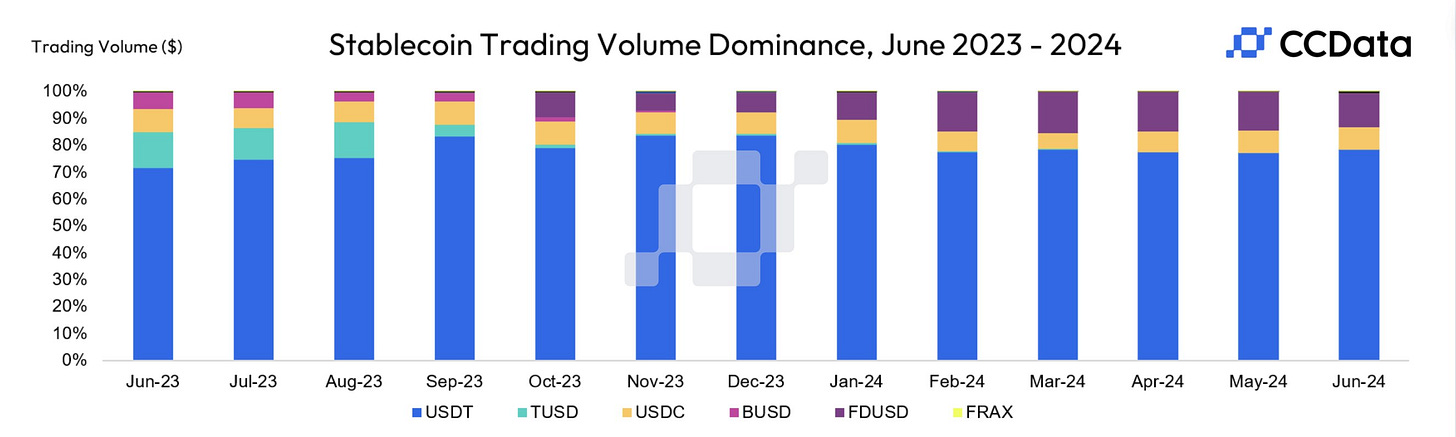

According to CCData’s latest stablecoin and CBDC report there has been a significant decrease in stablecoin trading volumes. In June, the figure fell by 18% to $97 billion. However, the total market capitalisation of stablecoins rose for the ninth consecutive month during the reporting period. The report reveals that the global stablecoin market capitalisation increased by 0.53% month-on-month to $161 billion. The figure is the highest stablecoin market capitalisation since April 2022, but the growth rate has slowed since May. The report also notes that the market share of stablecoins increased from 6.22% in May to 6.83% in June. Tether USD (USDT), the leading stablecoin by market capitalisation, maintained its dominance in June. USDT’s market capitalisation increased by 0.97% compared to May. Read the full report from CCData HERE.

According to report from CryptoQuant this week "“The total number of staked ETH has continued to increase and sits near its all-time high as it stands at 33.3 million ETH or 27.7% of the total supply." The report added that ETH supply is growing again, although slowly. But the narrative of ultra-sound money has ended. The total supply is at its highest level since December 11, 2023. The report also said that spot trading volume data shows ether could be as liquid as BTC, with ETH spot trading volume being 80%-90% of that of bitcoin in the last few weeks.

Institutional Corner

Top stories from the big institutions

Mathew McDermott, Goldman Sachs global head of digital assets said the bank is preparing to launch three new tokenisation products later this year in the United States and Europe, following “a major uptick in interest from clients” in crypto. Speaking in Fortune magazine, McDermott declined to specify details but did say that Goldman Sachs plans to create marketplaces for tokenised real-world assets (RWAs) and would focus on the “fund complex” in the United States and European debt markets. McDermott reportedly added that the investment bank plans to target financial institutions, rather than retail investors, with its new products and will rely exclusively on permissioned blockchains. He said the RWA marketplace would differentiate itself with the speed of execution and by expanding the types of assets that can be used as collateral.

CFTC Chair Rostin Behnam spoke at the Senate Agricultural committee this week and said that the US derivatives watchdog needs more power and money to police spot crypto markets and keep investors safe. Rostin said that in the tax year ending in April, about 50% of enforcement actions brought by the Commodity Futures Trading Commission were against crypto businesses. He added that it is “a staggering statistic for an agency that oversees trillion-dollar markets — to have to allocate half of its resources to a market it doesn’t regulate and does not get appropriated funds for.” The CFTC, as the derivatives regulator, has limited authority over crypto spot market but Behnam told lawmakers that if the government decided to change that, and give it full jurisdiction over crypto, the CFTC would need more budget for personnel and cybersecurity. He suggested that If Congress passes legislation, the CFTC would need an extra $60 million for year one and around $35 million more in year two, while it waited for new income from crypto registrants to kick in.

Global blockchain payment fintech Partior announced the close of a more than $60 million Series B round led by Peak XV Partners (formerly Sequoia Capital India & SEA). New investors Valor Capital and Jump Trading also participated in the round, further supported by existing shareholders JPMorgan, Standard Chartered and Temasek. Peak XV Managing Director Shailendra Singh said “Partior is an extremely ambitious attempt to transform global money transfer and settlement amongst banks. It’s a unique approach where multiple banks have come together to catalyse change in this industry.” The new funding will be used to help the firm continue to develop its ledger-based interbank rails for real-time clearing and settlement, including new features such as intraday FX swaps, the integration of additional currencies and just-in-time multi-bank payments. Read the full release from Partior HERE.

On July 9th, the Australia Stock Exchange (ASX) gave the green light to digital asset manager DigitalX to launch a spot Bitcoin ETF. The new ETF began trading on July 12th under the ticker BTXX. This comes just weeks after the ASX approved its first Bitcoin ETF in June when it listed the VanEck Bitcoin ETF. Australia has been building momentum in Bitcoin ETFs over the past year. The country's first spot Bitcoin ETF, the 21Shares Bitcoin ETF (EBTC), launched in April 2022 and trades on the Cboe Australia exchange. Most recently, in June, the Monochrome Bitcoin ETF (IBTC) also began trading on the Cboe. Now, ASX is following suit by approving its second Bitcoin ETF after VanEck's product became the first last month.

Charts of the Week

Because charts are just as important as macro.

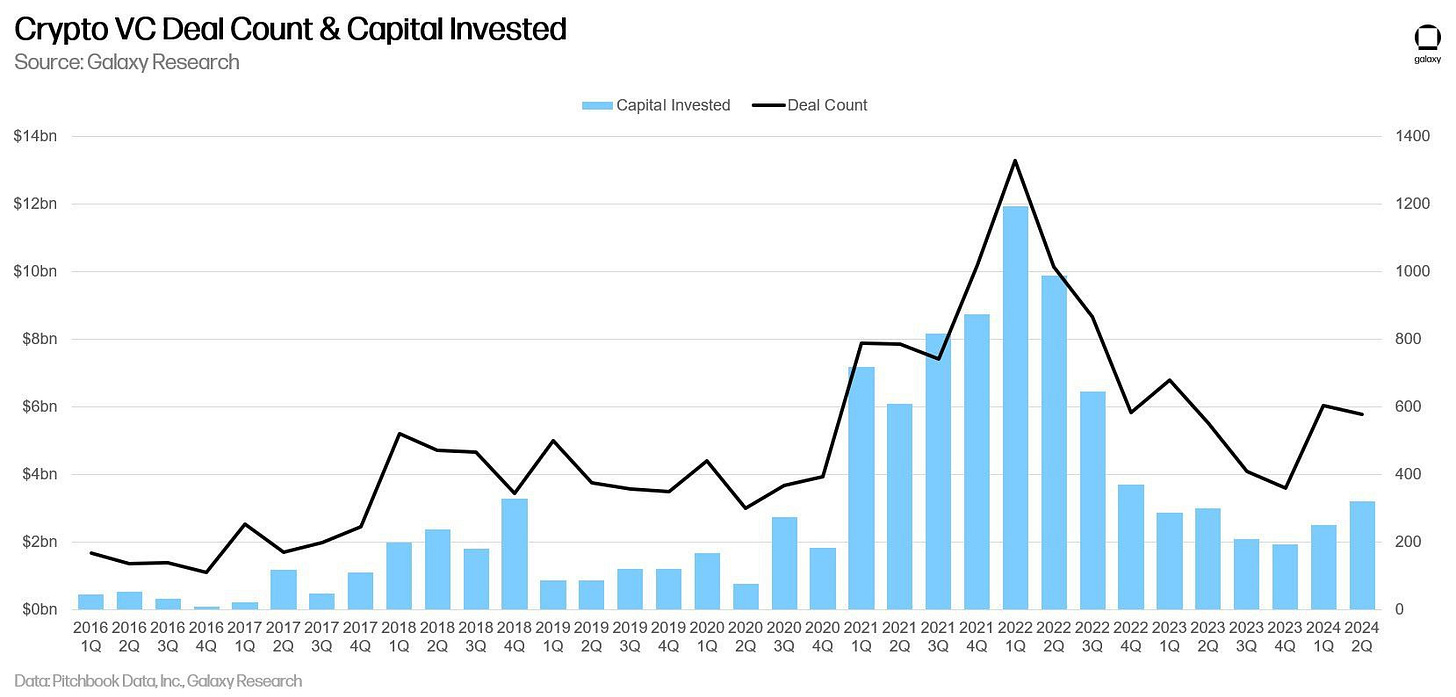

According to Galaxy Research, in Q2 2024, venture capitalists invested $3.194bn (+28% QoQ) into crypto and blockchain focused companies across 577 deals (-4% QoQ).

Open Interest for TON perps reached all time highs earlier this summer as price soared. Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Wallet Operations at DRW Cumberland

Crypto Business Development Intern at Token Metrics

FinCrime Manager Crypto at Revolut

Trading Operations Specialist at XTX Markets

Head of Customer Success at Bitpace

Community Coordinator at Binance

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.