Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: A pivotal week for macro, read our full summary below.

Crypto Native News: Tether to launch a UAE dirham stablecoin, Binance to expand the number of staff, Bitwise acquires ETC Group.

Institutional Corner: Sony launching its own blockchain, State Street partners with Taurus, JP Morgan releases the latest edition of its crypto report, nearly half of the US election donations come from crypto firms.

Charts of the Week: Institutional ownership of the spot bitcoin ETF’s growing, bitcoin dominance has surged, FDUSD mark share growing.

Top Jobs in Crypto: Featuring Re7 Capital, Coinbase, XBTO, Backbase and Checkout.com.

Macro Update

This is where we connect the dots between macro and crypto.

The Time has Come

A quiet week in terms of volumes amidst light summer trading was rounded off with a landmark event which likely sets the macro tone into Q4 and beyond. It was of course the Fed’s annual retreat at Jackson Hole which historically has been used to signal a significant shift in the direction of monetary policy.

Indeed, whilst not unexpected, JPow officially ordained the end of the rate hike cycle and the start of the rate cutting cycle. As summarised by the “Fed Whisperer” Nick Timiraos, “the Powell pivot is complete.”

The key headline from the event to hit our screens was the unequivocal line:

“The time has come for policy to adjust.”

The comments across the board were dovish, with strong confidence expressed that inflation is on a sustainable path back to 2% with the “unmistakable” cooling of the labor market the Fed’s primary concern. The strength of the language around the labor market certainly gave the sense of a “Fed pivot” relative to a previously more balanced JPow, who firmly expressed that they “do not seek further cooling in labor market conditions” and that they “will do everything we can to support a strong labor market”

We’ve been writing for several months that markets were stuck in “macro purgatory,” unable to embrace the rate cutting cycle as resilient data created uncertainty around the timing of rate cuts. Indeed, some market participants over recent months speculated that the next move might even be a hike. Yet the softening of the labor market, which we’ve highlighted frequently here, has reached an inflection point and with a sustained disinflationary path, to paraphrase Powell, the direction of travel is now clear. Markets are now able to cross over into macro heaven 😇

Perhaps underscoring the soft labor market undertone, earlier in the week, the highly anticipated BLS revisions to US payrolls for the 12 months to March showed the largest downward revisions in over a decade, with 818,000 fewer jobs created in that period than originally calculated. To visualize that, in 2023, the previously assumed 230k monthly payroll increases was only 130k. This is often a problem in slowdowns. Payroll data tends to be over-estimated given false assumptions on the death/birth business rates in an assumed more robust economy (likewise payrolls get underestimated when the economy is in an accelerated growth phase).

Aren’t rate cuts historically negative for stocks?

We remain then in a “goldilocks” environment with a disinflationary, slowing but not collapsing economy with a Fed having plenty of room to cut rates and global liquidity is rising. We would push back too on the lazy narratives that Fed rate cuts have historically been negative for stocks. Firstly, we believe post 2008 (when central banks and governments made the irrevocable decision to artificially inflate the assets that are the collateral underpinning the financial system) financial markets are now simply a function of rates and liquidity and not a reflection of the real economy. We still have a short term, knee-jerk negative reaction to recession fears, yet that quickly reverses once central banks reassure markets that the “central bank put” remains firmly in place (as the BoJ were quick to remind markets in the recent carry unwind wobble) Hence in 2020 amidst a global pandemic and the deepest recession since WWII, stocks recorded new record highs once the rate cuts and liquidity started flowing. Additionally, past rate cuts, back when the economy mattered, typically came too late and were very reactionary to a more stressed situation. Now, the Fed is cutting into a slowing economy, with a softening labor market, yet we remain far from a stressed situation. Risk looks good from our viewpoint.

Reverse dollar wrecking ball…

Adding to the positive risk tailwinds is the continued breakdown of the dollar as the economic divergence story that drove the dollar in the first half of the year, unwinds with the US “catching down” to the economic softness seen elsewhere. The dollar is now at its weakest levels since the end of December. This is the reverse of the dollar wrecking ball which was suffocating the global economy and strangling global financial conditions. The dollar softness is becoming a lubricant that can help reflate global trade and contribute to an easing liquidity backdrop for markets.

US yields are also breaking down and we think have much further to go as the rate cutting cycle gets under way. A sustained break of 3.80% for the 10yr will open up for a move to 3.20%. This peak rates thematic has underpinned a lot of our bullish thesis and looks set to accelerate. With long duration trades performing, the high beta long duration proxies of Nasdaq and Bitcoin should outperform everything. Bitcoin, with no cash flow being the longest duration asset to once again be the best performing asset in 2024 🚀

Politics is also having a short term impact. Perhaps another bullish development this past week was to see Kamala’s odds on Polymarket peak into the DNC and Donald Trump go back into poll position. RFK’s endorsement of Trump is potentially significant too. This might be an important chart to keep an eye on short term 👇

Peak Kamala - Trump’s rising odds back into poll position coinciding with BTC recovery

Tentatively, Bitcoin has broken out of the recent 58k-62k range yet we still have a supply overhang to digest that will challenge a climb back to new record highs. We need real demand to come back into the market and off-set the negative supply dynamic, which may have to wait for the end of summer. However, Bitcoin is currently lagging behind the cross-asset macro which is forming a powerful tailwind. As the time has come for Fed policy to adjust, maybe the time has come for Bitcoin to re-establish bull market momentum.

Native News

Key news from the crypto native space this week.

Tether said this week it plans to launch a new stablecoin pegged to the United Arab Emirates dirham in collaboration with Phoenix Group and Green Acorn Investments. According to a press release, the token will "lead the way in seeking licensing under the UAE Central Bank's recently announced Payment Token Services Regulation." Tether CEO Paolo Ardoino said "The United Arab Emirates is becoming a significant global economic hub, and we believe our users will find our Dirham-pegged token to be a valuable and versatile addition," he added, claiming: "Tether's Dirham-pegged stablecoin is set to become an essential tool for businesses and individuals looking for a secure and efficient means of transacting in the United Arab Emirates Dirham whether for cross-border payments, trading or comply diversifying one's digital assets.

Binance CEO Richard Teng said in an interview this week, that the firm will be hiring 1,000 new staff this year. He added that Binance plans to have a 700 strong compliance workforce by the end of 2024, up from around 500 currently. Teng said that Binance fields a number of requests from law enforcement agencies around the world and the number of requests has reached 63,000 so far this year up from 58,000 in 2023.

Bitwise Asset Management announced the acquisition of ETC Group, the London based ETP issuer with over $1bn in AUM. The news marks Bitwise’s expansion into Europe and adds nine European-listed crypto ETPs to Bitwise’s broad suite of ETPs, hedge fund solutions, and separately managed accounts. ETC Group’s ETP suite includes the largest and most heavily traded physical Bitcoin ETP (BTCE), Ethereum with staking (ET32), Solana (ESOL), XRP (GXRP), and the MSCI Digital Assets Select 20 (DA20). All of ETC Group’s products are physically backed and will be renamed with the Bitwise brand in the coming months. Hunter Horsley, Bitwise’s CEO said “Bitwise is building a global crypto asset manager for investors and financial advisors who want a best-in-class partner specialized in this fast-growing asset class,” “This acquisition allows us to serve European investors, to offer clients global insight, and to expand the product suite with innovative ETPs. We’re proud of the reputation we have built over the last six years with advisors, institutions, and investors as a sophisticated asset manager in crypto markets, and look forward to bringing this expertise to European investors.”

Institutional Corner

Top stories from the big institutions

Sony Group has announced the launch of its Ethereum layer-2 blockchain developed in partnership with Web3 infrastructure provider Startale, called Soneium. Driven by a joint venture between Sony and Startale—known as Sony Block Solutions Labs—Soneium marks the company's initial steps towards developing a fully realised blockchain. The networkis due to launch in the coming weeks and will initially operate on a testnet in collaboration with Astar Network, a blockchain platform known for its multi-chain capabilities. The collaboration will integrate Astar's zkEVM assets and infrastructure with Soneium, providing initial liquidity and a range of fungible and non-fungible digital assets.

State Street said this week that it will partner with Swiss firm Taurus for custody, tokenisation and node-management solutions to automate the issuance and servicing of digital assets, including digital securities and fund management vehicles. The partnership will see State Street leverage three of Taurus’ products including custody solution Taurus-PROTECT and Taurus-CAPITAL, which streamlines the process of creating and managing tokenized assets throughout their lifecycle. State Street will also use Taurus-EXPLORER, which provides blockchain connectivity to multiple different blockchain protocols. The partnership will allow State Street to hold clients' crypto assets and help them create tokenized assets, such as funds and other securities.

JP Morgan say in their latest crypto report that at the current bitcoin prices, the value of the remaining 1.3 million tokens left to be mined is about $74 billion. The bank reduced its price targets for some of the miners it covers to reflect second-quarter results and changes in both the price of bitcoin and the network hashrate. As a reminder the Hashrate refers to the total combined computational power used to mine and process transactions on a proof-of-work blockchain. JPMorgan cut its CleanSpark (CLSK) price target to $10.50 from $12.50 while maintaining its neutral rating on the shares. It reduced the Iren (IREN) price target to $9.50 from $11 and kept its overweight rating. Underweight-rated Marathon Digital's (MARA) price objective was lowered to $12 from $14, and overweight-rated Riot Platforms' (RIOT) price objective was trimmed to $9.50 from $12.

According to a report in the US this week, nearly half of all the corporate money flowing into the election has come from the crypto industry. Crypto corporations are by far the dominant corporate political spenders in 2024 as nearly half (48%) of all corporate money contributed during this year’s elections ($248 million so far) came from crypto firms. The sum, approximately $119 million, was raised from a mix of contributors, with Coinbase and Ripple accounting for more than 80% of the donations. Most of the money is going to super PACs that are backing pro-crypto candidates running for office this year. Read the full report HERE.

Charts of the Week

Because charts are just as important as macro.

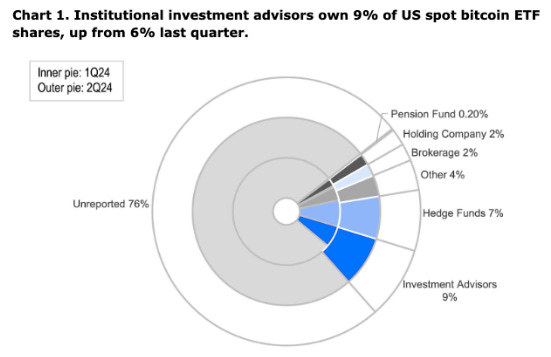

Institutional investment advisors own 9% of the spot bitcoin ETF, up from 6% last quarter. Hat tip to Coinbase for the chart.

Bitcoin Dominance has surged from 38% in Nov 2022 to 56% this week. Meanwhile, Ethereum, the second-largest asset, saw its dominance decline by 1.5%, remaining relatively stable over the past two years. Hat tip to Glassnode for the chart.

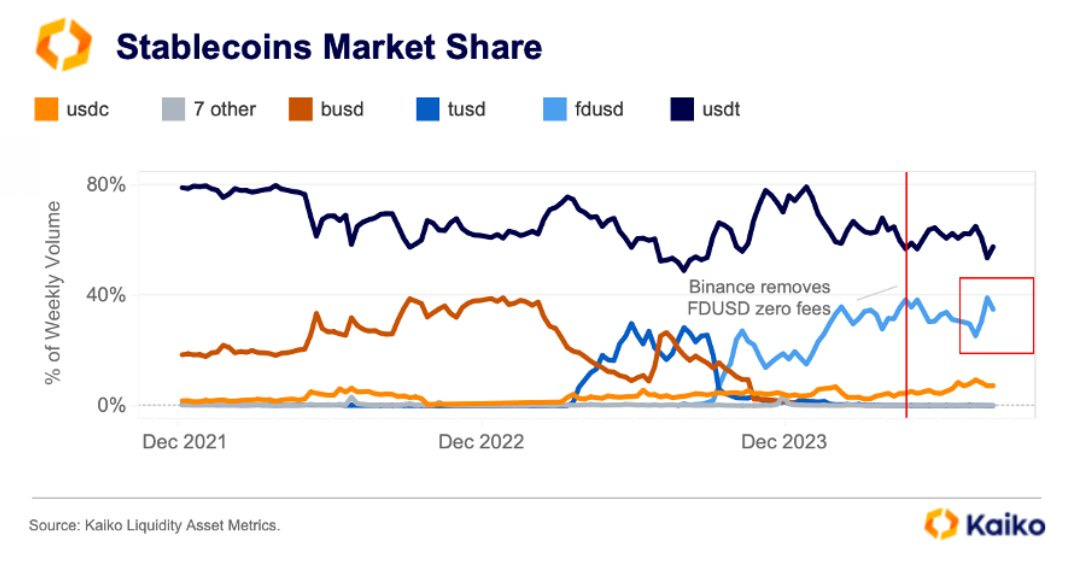

Stablecoin $FDUSD's market share on Binance hit a record high of 39% in July, reversing a three month downward trend. Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Venture Investor, SocialFi at Re7 Capital

Execution Services Trader at Coinbase

Middle Office and Trading Assistant at XBTO

Marketing Manager UK at Coinbase

Sales Manager Crypto at Checkout.com

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.