Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: MicroStrategy, Coinbase, Tether release their results, Canary Capital files for a spot Solana ETF, Paxos released a Singapore compliance stablecoin.

Institutional Corner: Eastern Europe becomes the 4th largest crypto market.

Charts of the Week: Update on cost to produce one Bitcoin, USDT volume increased, Bitcoin correlation with the dollar stays negative.

Top Jobs in Crypto: Featuring Crypto.com, Semoto, Bullish, Glassnode, Blockchain.com, BLKBOX.ai

Macro Update

This is where we connect the dots between macro and crypto.

Vote Bitcoin

Well, Uptober lived up to its meme, with Bitcoin closing the month up over 15% 🚀

As we head into election week, the rising odds of a Trump victory have certainly played their part in pushing Bitcoin higher, although as we’ve been outlining, the macro dynamic is a powerful tailwind which, whatever the outcome of the Presidential election, we believe will keep driving Bitcoin and broader risk assets higher well into 2025.

Part of that dynamic is liquidity and this week, the US Treasury released its quarterly refunding plans. Whilst there were no major surprises, the Q4 borrowing requirement of a relatively benign $546bn, $19bn less than expected back in July, reaffirmed expectations that US liquidity will remain supportive into Q4 and beyond. In part, with an expected TGA (Treasury General Account which is the cash account the Treasury holds at the Fed) of $700bn at year end, compared to the current $886bn level, provides room for $186bn run down of that cash, which is positive for markets, all things equal. The Treasury also announced plans to conduct weekly “liquidity support” buybacks of up to $4bn per operation and expects to buy up to $30bn of “off-the run” or older securities across the curve over the remainder of Q4. Just don’t call it yield curve control 😳

Borrowing forecasts into Q1 2025 are expected to surge to $823bn yet that assumes a raising/suspension of the debt ceiling (current debt ceiling suspension expires 31st Dec) which we think unlikely given the transition of power to a new President. In which case, without the ability to raise new debt, the Treasury will have to run down that 700bn TGA balance throughout Q1 which is a huge cash injection to start 2025. Of course, assuming the debt ceiling gets lifted by Q2, things will then get trickier as the Treasury issues new debt and rebuilds the TGA which will drain liquidity.

TLDR: Risk can party on until April 🕺🏾

On the data front this week, the labor market dominated releases and continued to reinforce our view that the market has gotten ahead of itself in pricing the “reflation” trade. Firstly, the JOLTS survey on Tuesday reported that the number of job openings fell to 7.44mio in September, its lowest level since 2021. The number of quits, often seen as a more reliable measure of labor market strength, was also steady at 3.07mio. This underlying softness was backed up by Friday’s NFP which showed only 12k jobs were added in September (Vs 113k exp) the lowest level since Dec 2020. Private sector jobs actually declined by 28k. There was also net 112k of downward revisions to the prior reports. Now these numbers will have been impacted by recent hurricanes, but clearly there are scant signs of underlying strength in the labor market, and given the Fed’s focus currently is to get ahead of labor market risks, little in the data this week will prevent the Fed cutting 25bps next week with a view to cutting another 25bps in December. Rates markets have gone too far in pricing out cuts and will need to recalibrate.

Death, taxes and debt…

Despite the softer data, bond markets continued to trade heavy and US 10yr yields took out the 4.30% level which we thought may cap yields. We’re a little perplexed at what’s driving this sell off. Clearly there’s the “Trump trade” impact. We’ve also had to digest a lot of Treasury supply and there’s a decent amount of issuance next week, with $125bn being issued across the 3, 10 and 30yr maturities, so maybe some front running of that. In the UK, Labour’s “tax and spend” budget is set to ramp up the debt burden even more and did little to help the broader bond complex. Death, taxes and perpetually increasing debt in fiat driven economies are the three certainties in life! We continue to be bullish bonds however as the market re-prices this renewed “reflation” narrative. Oil’s recent sell off perhaps leading the way for yields to “catch down.”

Which brings us into the election. Clearly there’s a binary knee jerk reaction to a Trump or Kamala win. As we write, the Selzer poll which now has Kamala winning in Iowa has taken BTC towards 68k. A Kamala win we expect can take us back towards 60k and possibly test the $58/59k zone. A Trump win likely propels us to new record highs and the beginning of the move to 100k. In the unlikely event that Kamala secures a “Blue Sweep” then we can reasonably expect a broader risk sell off. Assuming however a Kamala win, with a split congress (to prevent her implementing some of her more extreme policies such as unrealized capital gains tax) or a more risk positive Trump win, net we see little lasting impact outside of the short term volatility.

Vote Bitcoin…

Both candidates are set to run huge deficits which will reinforce the cycle of currency debasement over time. Shorter term, the Fed will continue to respond to the lagged data flow which, whoever wins on Tuesday, will not be impacted for several months. That data flow will continue to show a slowing, not collapsing growth dynamic set against a disinflationary economy. Meanwhile, with a global slow down under way, led by China, major central banks cutting rates and China firing the big stimulus bazooka (China are reported to announce a 10trn Yuan stimulus package next week, with potential for this to be bigger if Trump wins) an easier rates and liquidity environment will see risk and Bitcoin continue to rally hard into year end and as we mention above, likely throughout Q1 2025.

In the unpredictable world of politics, where the fate of our wealth, of our freedoms, are determined on the whims of a few narcissistic, self serving politicians, Bitcoin with its permissionless, non-Sovereign, non-partisan, transparent, predictable monetary network provides reassuring stability and hope of a better future. Bitcoin will be here much longer than whichever candidate triumphs on Tuesday. The only vote you need to make to secure your future is Bitcoin.

Native News

Key news from the crypto native space this week.

MicroStrategy announced its third quarter 2024 results this week. Some of the key highlights from the release are Year-to-date 2024, the Company’s BTC Yield is 17.8%. The Company is revising its long-term target to achieve an annual BTC Yield of 6% to 10% between 2025 and 2027. As of September 30, 2024, the carrying value of the Company’s digital assets (comprised of approximately 252,220 bitcoins) was $6.851 billion. As of September 30, 2024, the original cost basis and market value of the Company’s bitcoin were $9.904 billion and $16.007 billion, respectively, which reflects an average cost per bitcoin of approximately $39,266 and a market price per bitcoin of $63,463, respectively. Total revenues were $116.1 million, a 10.3% decrease year-over-year. Phong Le, President and Chief Executive Officer, MicroStrategy said in a statement “Our focus remains to increase value generated to our shareholders by leveraging the digital transformation of capital. Today, we are announcing a strategic goal of raising $42 billion of capital over the next 3 years, comprised of $21 billion of equity and $21 billion of fixed income securities, which we refer to as our “21/21 Plan.” As a Bitcoin Treasury Company, we plan to use the additional capital to buy more bitcoin as a treasury reserve asset in a manner that will allow us to achieve higher BTC Yield”

Coinbase also released its Q3 earnings this week. The key news was that it’s board of directors has authorised a $1 billion share repurchase program. "In October 2024, our board of directors authorised and approved a share repurchase program, which provides for the repurchase of up to $1 billion of our outstanding Class A common stock without expiration," Coinbase said. "The timing and amount of any repurchases will depend on market conditions." Coinbase said its balance sheet is "strong" as the company ended the third quarter with $8.2 billion in USD resources, an increase of $417 million from the previous quarter. Across the board Coinbase's net revenue, net income and Adjusted EBITDA were all up year on year as crypto prices traded at lower levels in 2023. But when compared to the previous quarter only the company's net income improved to $75 million in this most recent quarter versus $36 million in the second quarter. Coinbase registered a net revenue of $1.13 billion in the third quarter, down from the previous quarter's $1.38 billion. Adjusted EBITDA for the third quarter came in at $449 million as compared to last quarter's $596 million.

Tether Holdings Limited (BVI), the issuer of the stablecoin USDT, announced strong Q3 2024 financial results this week. For the quarter ending 30 September 2024, Tether reported $2.4 billion in net profits. The primary drivers of these earnings were gains from its substantial holdings in U.S. Treasuries and gold, which accounted for a combined $2.4 billion. U.S. Treasuries alone contributed around $1.3 billion, while Tether’s gold holdings added approximately $1.1 billion to the profit line. Read the full report from Tether HERE.

Digital asset manager Canary Capital filed for a spot Solana ETF this week, joining the likes of VanEck and 21Shares filing. The firm had already filed for XRP and Litecoin ETFs and added its Solana application this week. Canary said in its statement “Despite the hyper-competitive L1 and EVM landscape, Solana has emerged as a battle-tested front-runner for decentralised applications. Solana's robust DeFi ecosystem has led to strong sustained on-chain analytics as measured by transactions per day, active addresses, and new addresses, while maintaining a low fee environment for all consumers. Future growth in native on-chain stablecoin deployment will also likely further accelerate the commanding lead Solana maintains over its peers.”

Regulated blockchain infrastructure company Paxos introduced Global Dollar (USDG), a Singapore-compliant stablecoin whose United States dollar backings are reserved and managed by DBS Bank. On Thursday, Paxos announced the launch of its second localised stablecoin offering, USDG, in Singapore five months after establishing the United Arab Emirates-regulated interest-bearing Lift Dollar (USDL) stablecoin. According to Paxos, USDG complies with MAS’ upcoming stablecoin framework established in August 2023. As a result, USDG is currently available on the Ethereum blockchain and will be made available on other chains as regulations evolve. The company plans to partner with global crypto exchanges, wallets and trading platforms to make USDG available to individuals and institutions.

Institutional Corner

Top stories from the big institutions

According to a Chainalysis report, Eastern Europe has become the fourth-largest cryptocurrency market in the world, accounting for over 11% of the total crypto value received worldwide. (See chart below). Eastern Europe received over $499 billion worth of cryptocurrency between July 2023 and June 2024. Decentralised finance (DeFi) activity accounted for a third of the region’s crypto value flow, totalling more than $165 billion. Despite growing DeFi activity, centralised cryptocurrency exchanges (CEXs) remain the main beneficiaries, receiving over $324 billion of those digital asset transactions. Read the full report HERE.

Charts of the Week

Because charts are just as important as macro.

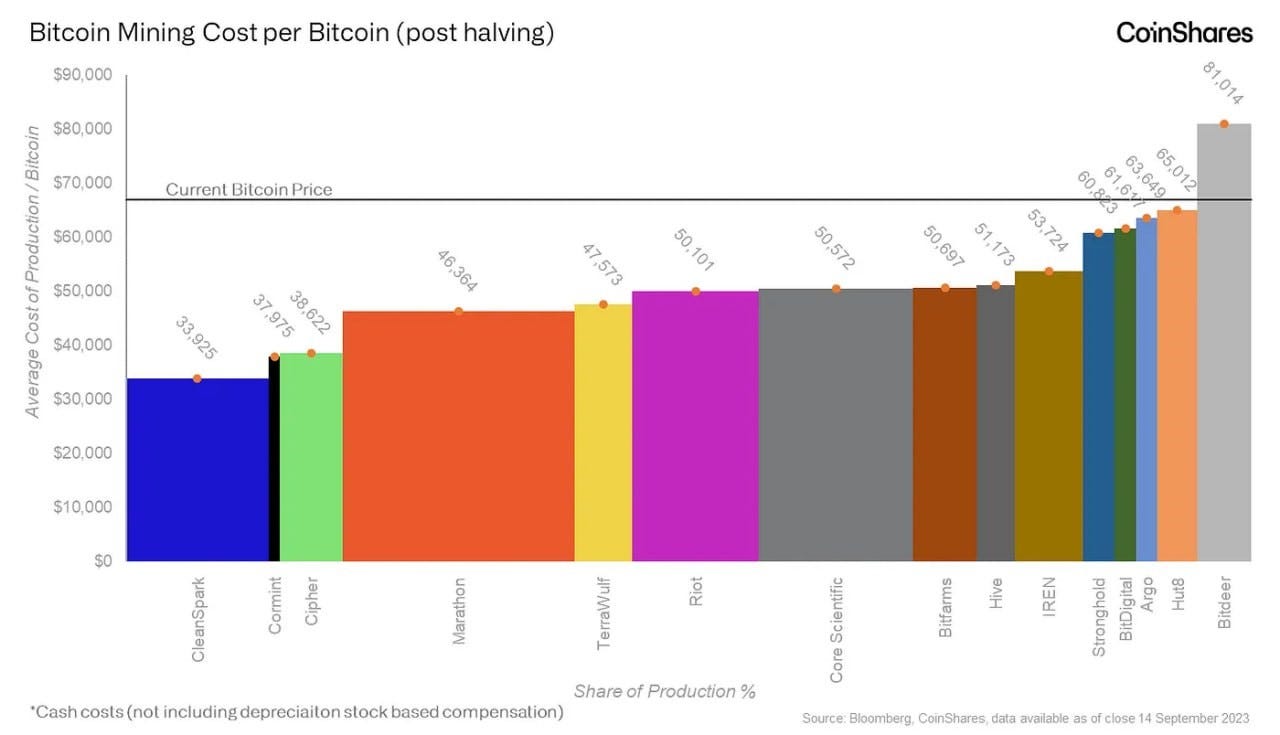

The average cost to produce one Bitcoin across all listed miners is now $49,500 based on Q2 data, compared to $47,200 in Q1.

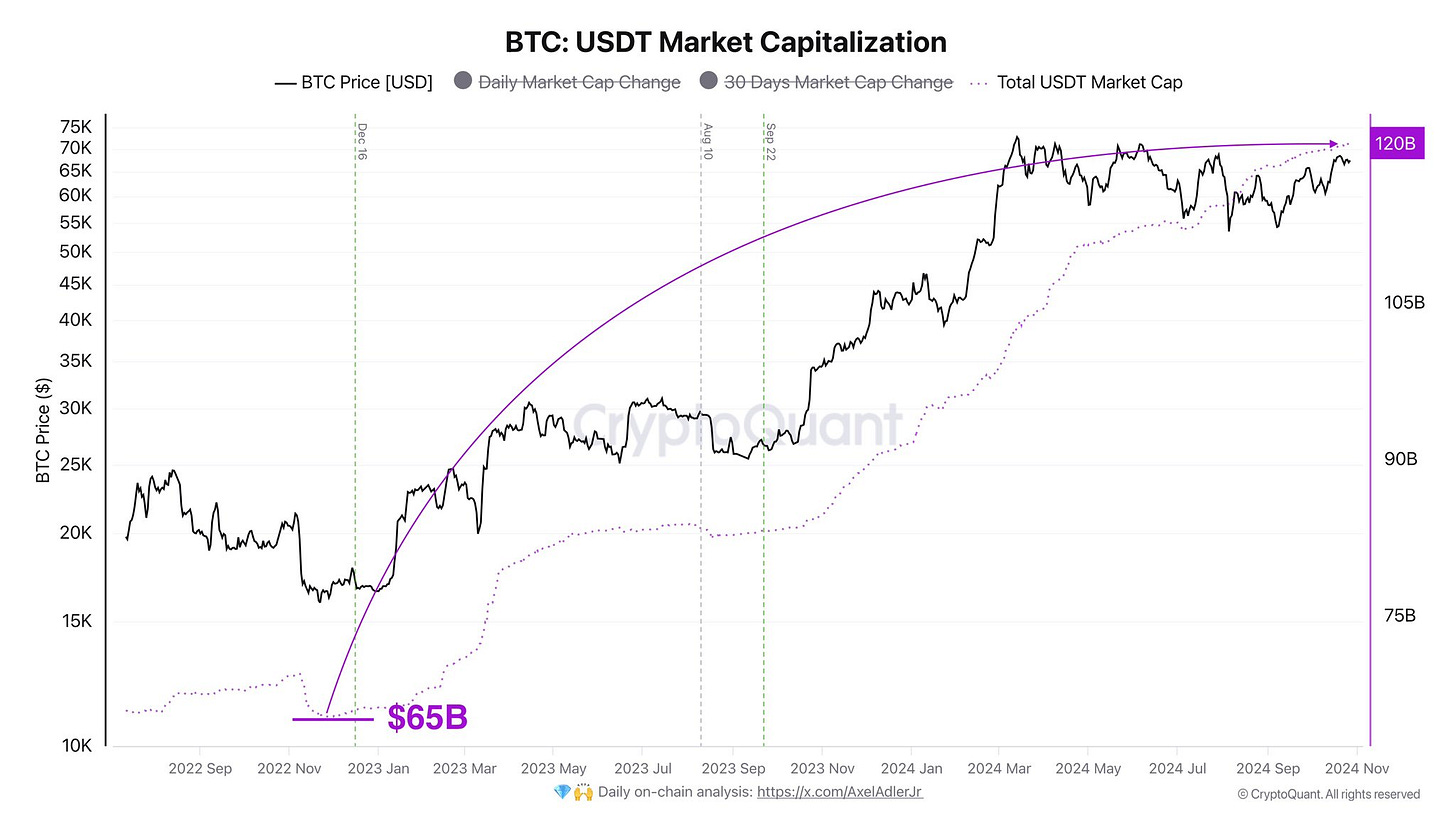

Since the beginning of the bull cycle, the volume of USDT has increased by 84%, from $65B to $120B.

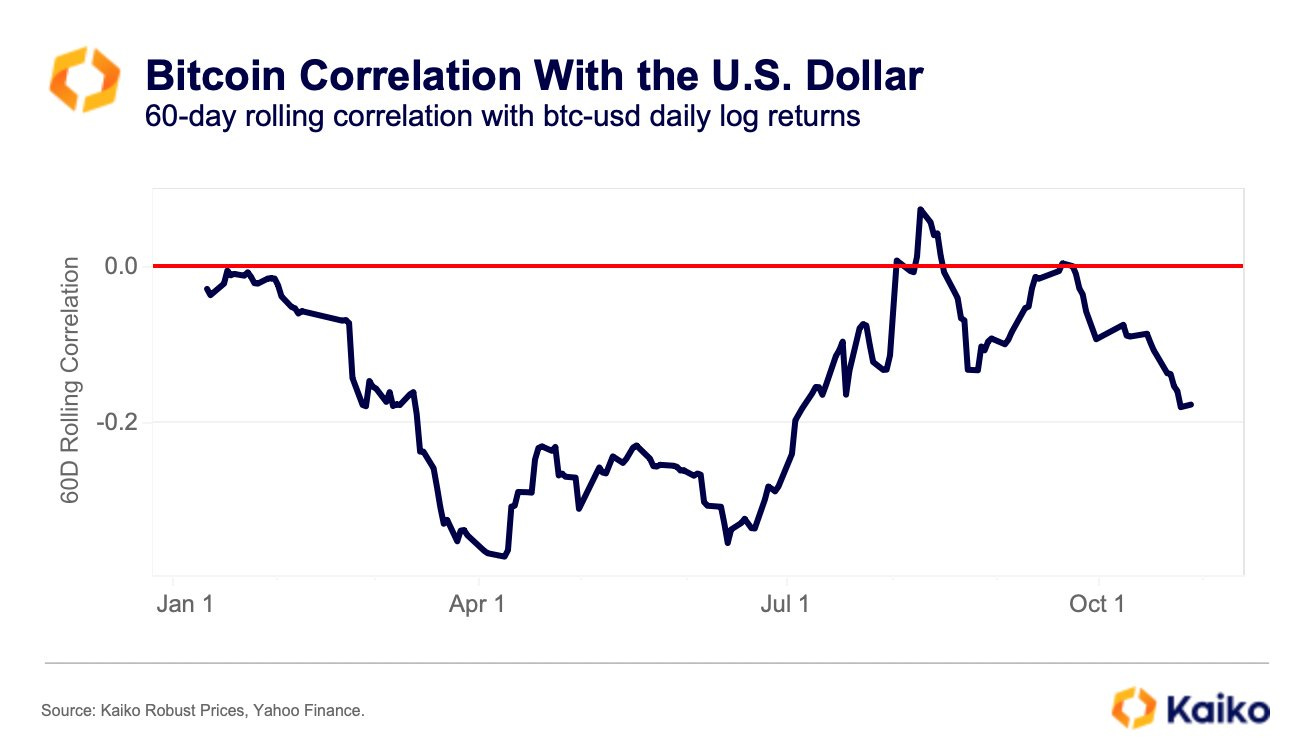

Bitcoin’s 60-day correlation with the USD has stayed mostly negative in 2024, averaging -0.2, despite a brief positive flip in August.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Business Development Manager, VIP Partnerships at Crypto.com

Manager Trading Technology at Bullish

Macro Analyst - Blockchain / Digital Assets at Glassnode

Senior Product Manager, Institutional at Blockchain.com

Sales Development Representative at BLKBOX.ai

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.