Sorry for the short delay in the usual Sunday night posting, we’re dealing with a new baby and a bit of illness between the two of us!

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Low vol, range bound markets persist in crypto, short term frustration remains but we think the big picture theme continues to play out.

Crypto Educator: Anton Golub.

Crypto Native News: Revolut moving away from crypto in the US, 6 Ethereum ETF applications.

Institutional News: KPMG release a report titled “Bitcoins Role in the ESG imperative”, India as head of the G20 calls for rules for crypto and Hong Kong regulators give 2 crypto exchanges licenses for retail investors.

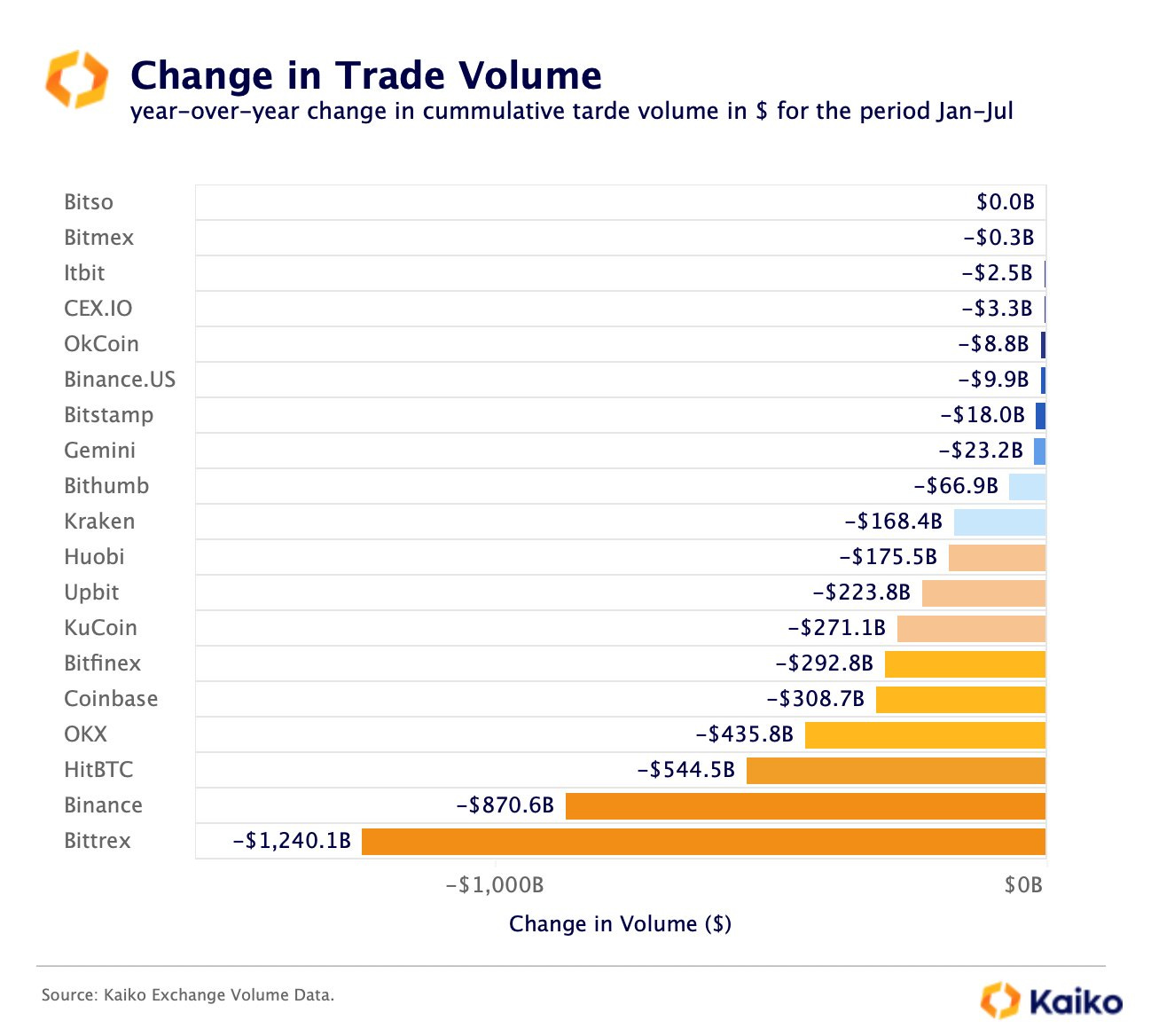

Chart of the Week: Change in crypto exchange trade volumes this year.

Top Jobs in Crypto: Featuring Galaxy, QubeRT, Time Reaearch, Blockchain.com, Crypto.com and Wintermute.

Want to be a guest writer for London Crypto Club ?

To help educate our readers further, were looking for people to write a guest slot on specific topics. If you have an idea and you would like to be featured in an upcoming episode of this newsletter, please reply to this email with your suggestion. I’m thinking crypto market microstructure, data analytics, DeFi, etc but totally open to suggestions. Thanks.

Macro Update

This is where we connect the dots between macro and crypto.

Unsustainable

Low vol, range bound markets persist in crypto, despite rising volatility in tradfi markets.

At the center of that volatility continues to be the bond market post the Bank of Japan’s (BoJ) “tweak” to its Yield Curve Control policy, which has spilled over to wider bond markets on fears that Japan, the largest foreign holder of US bonds will sell their foreign assets to repatriate back home.

Adding to the bond volatility, Fitch also downgraded the US from the highest level AAA rating to AA+ citing “governance and medium term fiscal challenges.” Whilst we do not think this is a significant event (the US will remain the cleanest shirt in the laundry and the benchmark “risk free” rate) it was yet another reason for the bond vigilantes to hit the sell button, especially with the US announcing an increase in its bond issuance to fund its spiralling deficits.

10yr US yields hit highs around 4.20%, reversing, perhaps significantly, ahead of the key 4.25%, on a softer Non Farm payrolls print which came in at 187K in July, with downward revisions to prior releases. Average hourly earnings did tick up to 4.4% from 4.2% although that was partly a function of falling weekly hours.

With the JOLTS survey also showing job openings falling to the lowest levels in 2 years, at 9.58mio in June, the labor market continues to slowly soften and likely gives the Fed enough comfort to pause in Sep, all else equal. But the data resilience continues to keep us in this “macro purgatory” whereby markets can’t fully embrace the end of a hike cycle and we go back to watching the next data print.

Urggh, this is frustrating!

The macro dynamic then with higher US yields, the dollar rebounding and cross asset volatility picking up, acting as a head wind for crypto.

However, the big picture themes continue to play out.

The BoJ is in an impossible situation with inflation rising, yet an artificially inflated bond market, with suppressed yields that they can’t step away from.

Case in point, the BoJ conducted two emergency bond buying programmes last week to slow the bond sell off. The currency is consequently weakening as the “tightening” of policy is contradicted by increasing liquidity and forced balance sheet expansion.

Meanwhile, in the US, with deficits spiralling out of control, all roads eventually lead to debt monetisation. China also continues to ramp up fiscal efforts to resuscitate a weakening economy.

Bitcoin then remains caught between the short term, negative macro dynamics, whilst the longer term drivers, as major economies struggle to manage unsustainable debt levels, grow stronger.

Indeed, volatility curves in crypto continue to steepen aggressively. Markets are preparing for an explosion in future volatility and are positioning for that volatility to be to the upside. London Crypto Club agree.

This is a good time to remind you of our bigger picture view. If you haven’t read it before, check out Episode 1 of Connecting the Dots where we set out our long term macro/crypto view.

At London Crypto Club, were here to help you on your crypto journey and highlight good quality educators. I recently connected with Anton Golub and recommend you check out his daily content on LinkedIn and Substack. Anton is a 3 times founder in crypto since 2013. Anton posted an interesting article this week on Restarting FTX, read it HERE.

Native News

Key news from the crypto native space this week.

Fintech firm Revolut will no longer provide crypto services to United States users, citing a challenging regulatory environment in the country. As of 2 September, Revolut's U.S. customers won't be able to place buy orders for cryptocurrencies Users will still be able to place sell orders until 2 October and from 3 October, the venue will be fully closed, meaning users won't be able to buy, sell or hold any cryptocurrencies. A Revolut spokesperson said "As a result of the evolving regulatory environment and the uncertainties around the crypto market in the U.S., we've taken the difficult decision, together with our U.S. banking partner, to suspend access to cryptocurrencies through Revolut in the U.S.” The decision does not affect Revolut users outside of the U.S. and impacts less than 1% of Revolut's crypto customers globally.

This week, Volatility Shares, Bitwise, VanEck, Roundhill, ProShares and Grayscale have filed applications with the SEC for Ether ETFs. Historically, the SEC has never approved any ETF applications tracking Ethereum futures contracts, though nearly 10 have been filed previously, a person familiar with the process told CoinDesk. If the SEC doesn't deny the applications, the Ether ETFs will launch 75 days from the filing date and Volatility Shares would be the first on 12 October, with the others to follow.

Institutional Corner

Top stories from the big institutions

KPMG released a report this week titled Bitcoins Role in the ESG Imperative. The report was co-authored by KPMG principal of technology risk Brian Consolvo and director of ESG Kirk Caron. Bitcoin is sometimes criticised that it has a mostly negative environmental and societal impact because of its high energy use and popularity among cybercriminals. However, the authors dispute this, suggesting that the the process of using powerful computers to solve the complex equations needed to validate transactions on the network — can help incentivise clean energy production, bolster financial inclusion, and even reduce greenhouse gas emissions from industrial activities. A quote from the report says “Despite Bitcoin’s increased adoption, it continues to often be a misunderstood technology and asset class". Interestingly, the report also suggests that Bitcoin uses about the same amount of electricity as tumble dryers globally. You can read the full report HERE.

India is currently the head of the G20. This week it submitted a G20 presidency input note proposing a path for the development of globally coordinated rules for crypto assets. A section of the note said “There is still need for coordination in consistent implementation of crypto asset regulations and guidance put in place by different jurisdictions. We hope this will help prioritise areas of work essential to achieving a comprehensive, cohesive and coordinated global policy and regulatory framework.” The note concurs with Financial Stability Board (FSB) and the International Monetary Fund (IMF) guidelines which are set to be published in September. The coming IMF/FSB paper will outline a regulatory and supervisory approach towards unbacked crypto assets, stablecoins and decentralized finance (DeFi). However, India has expanded on the framework with a range of action points addressed to the two international organisations. India wants the IMF and FSB to examine regulatory arbitrage, the corporate practice of opting for jurisdictions with favourable laws. Other action points include calls for the IMF to assess macro-financial risks associated with emerging market and developing economies. Outreach initiatives are suggested to raise awareness of risks, focusing on jurisdictions with high crypto adoption. Read the full input note HERE.

This week in Hong Kong, 2 cryptocurrency exchanges HashKey Group and OSL, received approval from regulators to operate as Hong Kong's first licensed cryptocurrency exchanges for retail investors. HashKey and OSL were already the only two local exchanges licensed by the Securities Futures Commission (SFC) to provide certain digital asset trading services to professional investors. Gary Tiu, head of regulatory affairs at OSL said "This is a monumental moment not only for OSL but for the broader crypto market”

Chart of the Week

Because charts are just as important as macro.

Change in trade volumes on crypto exchanges between Jan and July. Binance saw the largest trade volume dip this year, second only to Bittrex (which is under Chapter 11).

Hit tip to Kaiko Data for the chart.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

European Product Specialist at Galaxy

Trade Desk Support & Operations Analyst at Qube RT

Portfolio Manager at Time Research

Senior Product Manager, Growth at Blockchain.com

Java Developer (Exchange/Trading Platform) at Crypto.com

Graduate Trading Assistant at Wintermute

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.