Welcome to the new subscribers that have joined us over the last week.

The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

As always, our only ask is that you share this with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: Liquidity conditions still favourable for risk/crypto and our take on the “dollar demise.”

Crypto Native News: Binance and CZ sued, Bittrex to close US operations, OKX to set up Hong Kong entity and CryptoCompare release their monthly Stablecoin/CBDC report.

Institutional News: Check out the Cryptocurrency Regulation tracker tool I found, Members of European Parliament approve new anti-money laundering rules, SEC’s Gensler speaks on cryptocurrencies and the National Futures Association sets its standards for members that deal in digital-assets commodities.

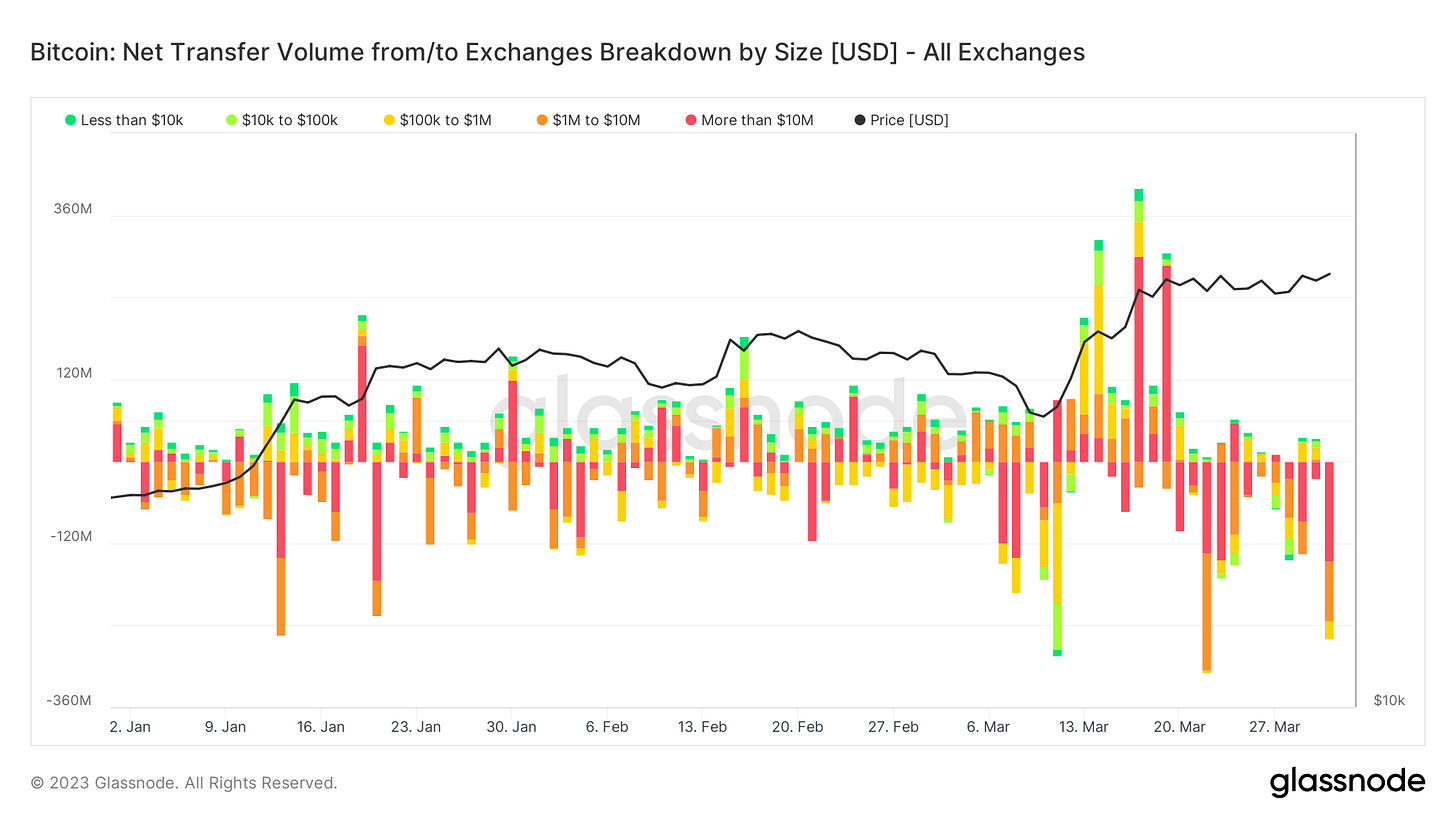

Chart of the Week: 3rd highest BTC outflows this year.

Top Jobs in Crypto: Featuring DRW, FCA, Paysafe, Options Group, Mastercard and Copper.

Macro Update

We’re macro at heart, this is where we try to connect the dots between the macro and crypto.

Fiat Demise

A quieter week for markets as banking sector stress simmered and month/quarter end considerations dominated. The positive momentum continued however, with tech stocks leading a 1.5% rally on Friday as the Nasdaq capped its best quarterly performance since Q2 2020.

US PCE inflation data was one of the few data highlights and came in a touch softer than expectations, adding a tailwind for risk.

The Fed’s preferred core PCE measure came in at 0.3% on the month (down from 0.5%) and 4.6% on the year (Vs 4.7% exp) the smallest increase since October 2021. Inflation excluding housing and energy which JPow has identified as important to monitor, also moderated to 0.3% in Feb and at 4.6% YoY was the smallest increase since last July.

Whilst the Fed will want to see further progress on the pace of disinflation, the data will calm fears that took hold in February of a “re-acceleration”. Indeed, Feb’s data increasingly looks like a blip and the peak inflation narrative that formed part of our positive view in Jan looks to be in-tact.

Liquidity also continues to flow. Although the Fed balance sheet contracted this past week circa 28bn, it expanded some 366bn in March as the Fed responded to the banking crisis. China also pumped an additional net CNY 850bn ($125bn) in just the past week as they manage quarter end liquidity and look to cushion volatility from a still struggling domestic economy. This is a tidal wave of liquidity which will continue to propel risk assets and crypto.

Also gaining a lot of attention this week has been the customary “dollar demise” pieces that typically accompanies a dollar sell off (USD is down circa 2% over the month.) Fanning the flames was news that Brazil and China have reached a deal to trade bilaterally using their own currencies, replacing the dollar. China also settled its first LNG trade in Yuan and the BRICS nations (Brazil, Russia, India, China, South Africa) are reportedly discussing a new gold backed unified currency for the bloc.

We could write a whole newsletter to debunk the de-dollarization FUD but will simply say here, that dollar dominance in settling global trade is so large, that any de-dollarization would take decades to play out. Indeed, with over $17trn in debt issued outside of the US, a fall in USD based trade would reduce the velocity and availability of dollars and would actually see dollar stronger on the demand/supply imbalance.

With no real alternative, the dollar then remains the cleanest shirt in the fiat laundry. However, we remain bearish fiat currencies as a whole and the “dollar demise” pieces continue to support the “digital gold” narrative for BTC as the conversation highlights a fiat system that is failing and in search of alternatives. This is what brought us to crypto.

Native News

Key news from the crypto native space.

At the start of the week the U.S. Commodity Futures Trading Commission (CFTC) sued crypto exchange Binance and founder Changpeng Zhao Monday on allegations the company knowingly offered unregistered crypto derivatives products in the U.S. against federal law. It was alleged that Binance operated a derivatives trading operation in the U.S., offering trades for cryptocurrencies including bitcoin (BTC), ether (ETH), litecoin (LTC), tether (USDT) and Binance USD (BUSD), which the suit referred to as commodities. The CFTC is charging Binance with violating laws around offering futures transactions, “illegal off-exchange commodity options,” failing to register as a futures commissions merchant, designated contract market or swap execution facility, poorly supervising its business, not implementing know-your-customer or anti-money laundering processes and having a poor anti-evasion program. Binance Founder CZ responded to the claims and rejecting the allegations, arguing that the crypto exchange “does not trade for profit or 'manipulate' the market under any circumstances.” He said the CFTC filing was both “unexpected and disappointing,” as it had been working cooperatively with the regulator for over two years. He went further to state that employees are restricted from buying or selling coins where they’ve obtained “private information” about them. “I observe these policies myself strictly. I also never participated in Binance Launchpad, Earn, Margin, or Futures. I know the best use of my time is to build a solid platform that services our users” Read the full CFTC filing HERE.

After 9 years of operation, cryptocurrency exchange Bittrex will shut down its US exchange on 30 April. Bittrex co-founder and CEO Ritchie Lai in the statement “It’s just not economically viable for us to continue to operate in the current U.S. regulatory and economic environment,” “Regulatory requirements are often unclear and enforced without appropriate discussion or input, resulting in an uneven competitive landscape” “Operating in the U.S. is no longer feasible.” The closure does not affect Bittrex Global, which operates in Europe, Canada and South America, plus other locations.

Cryptocurrency exchange OKX announced it has set up a Hong Kong entity for launching virtual asset services in Hong Kong, and intends to apply for the virtual asset service provider (VASP) licence under the Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance 2022 which is scheduled to take effect on 1 June 2023.

CryptoCompare released their monthly Stablecoin and CBDC report for March. Below are some of the key takeaways from the report. Read the full report HERE.

In March, the total market capitalisation of stablecoins fell 1.34% to $133bn (data up to 20th March). This is the lowest stablecoins market cap since September 2021 and the twelfth consecutive month of decline.

On March 10, USDC started depegging following the collapse of its partner bank, Silicon Valley Bank, which held $3.3bn of its stablecoins reserves. The stablecoin fell as low as $0.877 on the 11th of March.

On March 14, stablecoins trading volume reached $51.9bn as USDC and other stablecoins recovered their peg. This was the highest daily volume recorded since November 10 (during FTX’s collapse).

With rival stablecoins BUSD having stopped minting new tokens, and USDC facing uncertainty following the collapse of its partner bank, USDT continues to strengthen its stablecoin dominance. The market dominance of USDT now stands at 57.5%, the highest market share since 20th June 2021.

Institutional Corner

Top stories from the big institutions.

If you want to learn more about Cryptocurrency regulation, I stumbled across a neat tool this week from Atlantic Council, their Cryptocurrency Regulation Tracker. They analyse how 45 countries have regulated cryptocurrencies in the jurisdictions. Cryptocurrency Regulation Tracker - Atlantic Council

This week, Members of European Parliament (MEPs) approved stricter rules to close existing gaps in combating money laundering, terrorist financing and evasion of sanctions in the EU. MEPs from the Economic and Monetary Affairs and Civil Liberties, Justice and Home Affairs committees adopted their position on three pieces of draft legislation on the financing provisions of EU Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) policy. Looking at the crypto specifics, the new draft legislation is imposing a 1,000 euro ($1,083) cap on anonymous crypto transfers to combat money laundering and terrorist financing. The newly adopted text indicates that introducing the bill will require greater transparency and compliance, particularly from crypto asset managers. It noted “Entities, such as banks, assets and crypto assets managers, real and virtual estate agents and high-level professional football clubs, will be required to verify their customers’ identity, what they own and who controls the company.”

Speaking at the House Appropriations Subcommittee on Financial Services and General Government Wednesday, SEC Chair Gary Gensler said that rules for the cryptocurrency market already exist—but that the industry is still “rife with noncompliance.” Congressman Sanford Bishop asked the chairman if the SEC has “any plans to issue a rule to clarify how securities laws apply to digital assets.” In usual fashion, Gensler replied that “The regulations actually already exist, sir. They’re called the securities regulation, and so there are disclosure regulations for when somebody tries to raise money from the public,” Gensler has repeatedly said in the past that most digital assets—but not the biggest and oldest Bitcoin—fall under the securities definition.

The National Futures Association is setting up standards for its members that deal in digital-assets commodities. The NFA is a self-regulatory organisation occupies a space between the federal government and industry and has more than 100 members involved in Digital Assets. The Compliance rule, which is due to go live on 31 May, is limited to involvement with bitcoin (BTC) and ether (ETH) but gives the NFA “the ability to discipline a member or take other action to protect the public if a member commits fraud or similar misconduct with respect to its spot digital asset commodity activities.” The rule requires members to supervise their activity closely and says that members involved in spot crypto commodity activity “must adopt and implement appropriate supervisory policies and procedures over these activities.” You can read the full press release HERE.

Chart of the Week

Because charts are just as important as macro.

31 March saw the 3rd largest exchange outflow of the year in Bitcoin. The three largest outflows in the chart below all occurred after the collapse of Silicon Valley Bank.

Hat Tip James Straten for the chart. Data from Glassnode.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Lead Associate Financial Promotions & Enforcement Taskforce Crypto at the FCA

Senior Sales Manager for Crypto at Paysafe

Director of Product, Digital Assets OTC at Options Group

Director Crypto Consulting at Mastercard

Accounts Receivable Analyst at Copper

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.